State Farm car insurance in Florida is a popular choice for drivers seeking reliable coverage and competitive rates. With a long history in the state, State Farm has established itself as a trusted provider, offering a range of insurance options tailored to meet the needs of Florida residents. From comprehensive coverage to affordable premiums, State Farm’s commitment to customer satisfaction has earned it a loyal following among Floridians.

This guide delves into the intricacies of State Farm car insurance in Florida, providing valuable insights into coverage options, pricing, discounts, and the claims process. We’ll explore the unique aspects of Florida’s driving environment and how they impact State Farm’s offerings. Whether you’re a new driver or a seasoned motorist, this comprehensive overview will equip you with the knowledge to make informed decisions about your car insurance needs.

State Farm Car Insurance in Florida

State Farm is a prominent and well-established insurance provider in Florida, boasting a substantial presence and a strong reputation. The company has been serving Floridians for decades, earning their trust and becoming a household name in the state’s insurance market.

State Farm’s Market Share and Reputation in Florida

State Farm holds a significant market share in Florida’s car insurance market, consistently ranking among the top providers. This dominance can be attributed to various factors, including its extensive network of agents, competitive pricing, and customer-centric approach. State Farm’s commitment to providing exceptional customer service and reliable insurance solutions has earned it a positive reputation among Floridians.

Key Features of State Farm Car Insurance in Florida

State Farm offers a comprehensive range of car insurance coverage options in Florida, designed to meet the diverse needs of its policyholders. These options include:

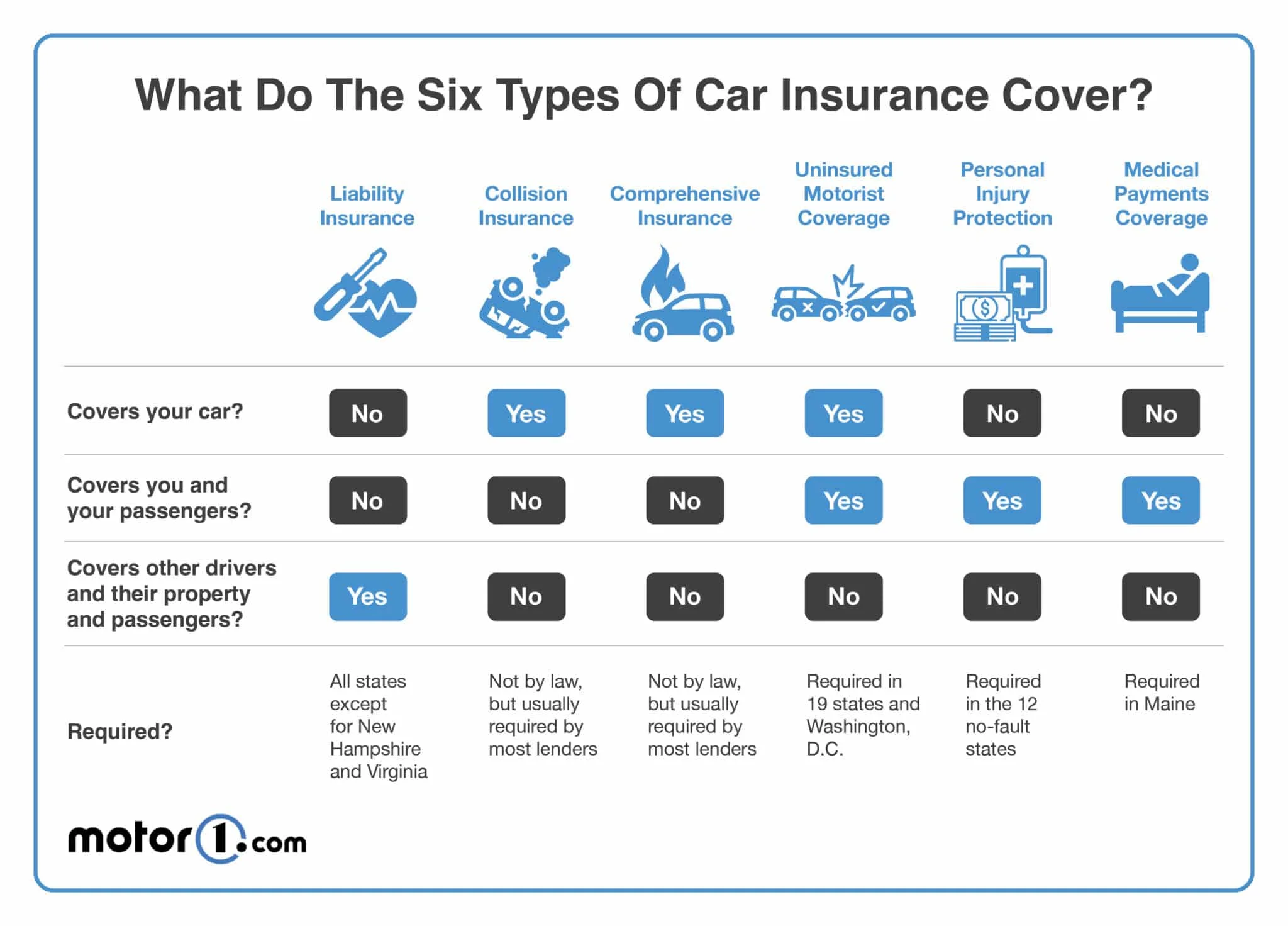

- Liability Coverage: This essential coverage protects you financially if you are at fault in an accident that causes injury or damage to others.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of fault.

- Comprehensive Coverage: This coverage protects your vehicle against damage from non-accident events, such as theft, vandalism, or natural disasters.

- Personal Injury Protection (PIP): Florida requires all drivers to have PIP coverage, which covers medical expenses and lost wages for you and your passengers in case of an accident.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): This coverage provides protection if you are involved in an accident with a driver who is uninsured or underinsured.

In addition to these standard coverage options, State Farm also offers various policy features and discounts that can help you save money on your premiums. These features may include:

- Safe Driving Discounts: State Farm rewards safe drivers with discounts on their premiums.

- Good Student Discounts: Students with good grades may qualify for discounts on their car insurance.

- Multi-Policy Discounts: Bundle your car insurance with other State Farm insurance policies, such as homeowners or renters insurance, to receive a discount on your premiums.

Coverage Options and Features

State Farm offers a comprehensive range of car insurance coverage options in Florida, designed to cater to diverse needs and driving situations. Understanding the various coverage types and their features is crucial for choosing the right policy that provides adequate protection while staying within your budget.

Liability Coverage

Liability coverage is a fundamental component of car insurance in Florida, legally mandated to protect you financially in case you cause an accident that results in injury or damage to others. This coverage pays for the following:

- Bodily Injury Liability: This covers medical expenses, lost wages, and pain and suffering for the other driver and passengers involved in an accident if you are at fault.

- Property Damage Liability: This covers repairs or replacement costs for the other driver’s vehicle and any other damaged property, such as fences or buildings, if you are at fault.

Florida requires all drivers to carry a minimum liability coverage of $10,000 per person and $20,000 per accident for bodily injury, and $10,000 for property damage. However, it’s advisable to consider higher limits, especially in a state like Florida with high traffic volume and potential for severe accidents. Higher limits provide greater financial protection in case of a serious accident.

Personal Injury Protection (PIP)

PIP coverage, also known as “no-fault” insurance, is mandatory in Florida and covers medical expenses, lost wages, and other related costs for you and your passengers, regardless of who is at fault in an accident.

- Medical Expenses: Covers medical bills for treatment of injuries sustained in an accident, including doctor’s visits, hospital stays, and rehabilitation.

- Lost Wages: Covers income lost due to injuries sustained in an accident, up to a certain limit.

- Other Expenses: Covers other expenses related to the accident, such as funeral costs, childcare, and household services.

The minimum PIP coverage required in Florida is $10,000, but you can choose higher limits for greater protection.

Collision Coverage

Collision coverage pays for repairs or replacement costs for your vehicle if it’s damaged in an accident, regardless of fault. This coverage is optional in Florida, but it’s highly recommended if you have a financed or leased vehicle.

- Deductible: This is the amount you pay out of pocket for repairs before your insurance kicks in. Higher deductibles typically result in lower premiums.

- Limits: The maximum amount your insurance will pay for repairs or replacement costs, usually based on the actual cash value (ACV) or the vehicle’s replacement cost.

Comprehensive Coverage

Comprehensive coverage pays for repairs or replacement costs for your vehicle if it’s damaged by something other than an accident, such as theft, vandalism, fire, hail, or flood. This coverage is optional in Florida, but it’s beneficial for protecting your investment in your vehicle.

- Deductible: The amount you pay out of pocket for repairs before your insurance kicks in. Higher deductibles typically result in lower premiums.

- Limits: The maximum amount your insurance will pay for repairs or replacement costs, usually based on the actual cash value (ACV) or the vehicle’s replacement cost.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist (UM/UIM) coverage protects you and your passengers if you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have enough insurance to cover your losses.

- Uninsured Motorist (UM): Covers your injuries and property damage if you’re hit by a driver without insurance.

- Underinsured Motorist (UIM): Covers the difference between the other driver’s insurance limits and your actual losses if you’re hit by a driver with insufficient insurance.

UM/UIM coverage is optional in Florida, but it’s strongly recommended, as it provides crucial protection in situations where the other driver is uninsured or underinsured.

Optional Add-ons

State Farm offers several optional add-ons to enhance your car insurance policy, including:

- Rental Reimbursement: Covers the cost of a rental car while your vehicle is being repaired after an accident.

- Roadside Assistance: Provides services such as towing, flat tire changes, and jump starts.

- Gap Coverage: Pays the difference between your vehicle’s actual cash value and the outstanding loan balance if your vehicle is totaled.

- Custom Equipment Coverage: Covers the cost of repairs or replacement for aftermarket accessories, such as custom wheels, sound systems, or performance parts.

Pricing and Discounts

State Farm car insurance premiums in Florida are influenced by several factors, including your driving history, vehicle type, location, and coverage options. Understanding these factors can help you make informed decisions about your insurance needs and potentially save money on your premiums.

Factors Influencing Premiums

The cost of car insurance in Florida can vary significantly depending on a range of factors. State Farm, like other insurance providers, considers these factors when determining your premium:

- Driving History: Your driving record, including accidents, traffic violations, and DUI convictions, significantly impacts your premium. Drivers with a clean record generally enjoy lower rates than those with a history of incidents.

- Vehicle Type: The make, model, and year of your car influence your premium. Newer, more expensive vehicles typically have higher insurance costs due to their higher repair and replacement costs.

- Location: The area where you live plays a crucial role in determining your premium. Areas with higher crime rates, traffic congestion, and accident frequency often have higher insurance costs.

- Coverage Options: The type and amount of coverage you choose directly affect your premium. Comprehensive and collision coverage provide more protection but come at a higher cost. You can save money by choosing lower coverage limits or opting out of certain types of coverage if you feel comfortable with the risk.

- Age and Gender: Younger and inexperienced drivers generally have higher premiums than older drivers with more experience. Gender also plays a role, with males typically paying higher rates than females due to their higher risk of accidents.

- Credit Score: In some states, including Florida, insurers may use your credit score to assess your risk. Individuals with good credit scores may qualify for lower premiums.

Discounts Available

State Farm offers various discounts to help Florida drivers save money on their car insurance. These discounts can significantly reduce your premium, making it more affordable to protect yourself and your vehicle:

- Safe Driving Discount: Drivers with a clean driving record and no accidents or violations for a specified period can qualify for a safe driving discount. This discount rewards responsible drivers for their safe driving habits.

- Good Student Discount: Students who maintain good grades in school can often qualify for a good student discount. This discount recognizes the positive correlation between academic achievement and responsible driving behavior.

- Multi-Policy Discount: State Farm offers discounts for bundling multiple insurance policies, such as home, renters, or life insurance, with your car insurance. This discount rewards customers for their loyalty and provides them with a more comprehensive insurance package.

- Defensive Driving Course Discount: Completing a defensive driving course can earn you a discount on your car insurance. These courses teach safe driving techniques and can help you become a more responsible driver.

- Anti-theft Device Discount: Installing anti-theft devices, such as alarms or tracking systems, can make your car less attractive to thieves and qualify you for a discount.

- Paperless Discount: Choosing to receive your insurance documents electronically can earn you a discount. This option helps State Farm reduce its paper consumption and administrative costs.

Comparison with Other Providers

To determine if State Farm offers the best rates for your specific needs, it’s essential to compare its prices with other major car insurance providers in Florida.

- Progressive: Known for its personalized discounts and flexible coverage options, Progressive often offers competitive rates in Florida. You can use their online tools to get a quick quote and compare it with State Farm’s offer.

- Geico: Another popular insurer in Florida, Geico emphasizes its commitment to affordable rates and excellent customer service. Comparing Geico’s quotes with State Farm’s can help you find the best value for your money.

- Allstate: Allstate offers a wide range of coverage options and discounts, making it a strong contender in the Florida car insurance market. Comparing Allstate’s rates with State Farm’s can help you identify the most favorable option for your needs.

Claims Process and Customer Service

State Farm is known for its comprehensive claims process and customer-centric approach. When you file a claim, you can expect a smooth and efficient experience.

Claims Filing Process

Filing a claim with State Farm in Florida is straightforward. You can do it online, over the phone, or through the State Farm mobile app.

- Report the Accident: Immediately after an accident, contact State Farm to report the incident. You will need to provide details such as the date, time, location, and parties involved.

- Gather Information: Collect as much information as possible, including contact details of the other driver(s), witness statements, and photos of the damage.

- File a Claim: Once you have gathered the necessary information, you can file a claim online, over the phone, or through the State Farm mobile app.

- Claim Review: State Farm will review your claim and request any additional information needed.

- Claim Processing: Once the claim is approved, State Farm will process the claim and handle repairs or replacement costs.

Customer Service Standards

State Farm prioritizes customer satisfaction and strives to provide exceptional customer service. The company has a dedicated team of claims adjusters and customer service representatives who are available to assist you throughout the claims process.

- 24/7 Customer Support: State Farm offers 24/7 customer support through phone, email, and online chat.

- Dedicated Claims Adjusters: Assigned claims adjusters work directly with policyholders to manage the claims process, providing updates and guidance.

- Transparency and Communication: State Farm maintains open communication with policyholders, keeping them informed about the status of their claim.

- Fast and Efficient Claim Resolution: State Farm aims to process claims quickly and efficiently, minimizing any inconvenience for policyholders.

Customer Support Channels

State Farm provides multiple customer support channels to ensure accessibility for policyholders in Florida.

- Phone: Policyholders can reach State Farm’s customer service team 24/7 by phone.

- Mobile App: The State Farm mobile app allows policyholders to file claims, track the status of their claim, and access other services.

- Website: The State Farm website provides access to online resources, including FAQs, claim filing forms, and contact information.

- Local Agents: State Farm has a network of local agents throughout Florida who can provide personalized support and assistance.

Florida-Specific Considerations

Florida presents unique challenges and opportunities for car insurance providers like State Farm due to its distinct legal landscape and driving environment. Understanding these factors is crucial for policyholders to make informed decisions about their coverage.

Impact of Florida’s Driving Laws and Regulations, State farm car insurance in florida

Florida’s driving laws and regulations have a significant impact on car insurance policies, particularly in terms of coverage requirements and potential liabilities. Here’s a breakdown of key factors:

- No-Fault Insurance System: Florida operates under a no-fault insurance system, where drivers are primarily responsible for covering their own medical expenses after an accident, regardless of fault. This system aims to streamline claims processing and reduce litigation. State Farm’s policies in Florida comply with these regulations, offering Personal Injury Protection (PIP) coverage to cover medical expenses and lost wages.

- Mandatory Coverage: Florida requires all drivers to carry a minimum level of liability insurance, known as “Financial Responsibility.” This mandatory coverage includes bodily injury liability, property damage liability, and Personal Injury Protection (PIP). State Farm’s policies in Florida meet these minimum requirements and offer additional coverage options to enhance protection.

- High Traffic Density: Florida’s high population density and tourist influx contribute to a higher volume of traffic and accidents. This increased risk translates into potentially higher insurance premiums for policyholders.

- Hurricane Risk: Florida is prone to hurricanes, which can cause significant damage to vehicles. State Farm offers comprehensive coverage that includes protection against natural disasters like hurricanes, ensuring policyholders are adequately covered in case of damage.

Implications of Florida’s No-Fault Insurance System

Florida’s no-fault insurance system has several implications for State Farm’s coverage offerings and policyholders:

- Limited Liability Coverage: Under the no-fault system, drivers primarily focus on recovering their own losses through PIP coverage, limiting the need for extensive liability coverage. State Farm’s policies in Florida reflect this by offering a range of liability coverage options, allowing policyholders to choose the level of protection that aligns with their risk tolerance and budget.

- Emphasis on PIP Coverage: Florida’s no-fault system emphasizes the importance of Personal Injury Protection (PIP) coverage. State Farm’s policies in Florida provide comprehensive PIP coverage, ensuring policyholders have access to medical expenses and lost wage benefits in case of an accident.

- Potential for Disputes: While the no-fault system aims to reduce litigation, disputes can still arise, particularly when determining fault or the extent of damages. State Farm’s experienced claims adjusters and legal team are available to assist policyholders in navigating these complexities.

Benefits and Challenges for State Farm Policyholders in Florida

State Farm car insurance policyholders in Florida benefit from the company’s extensive network of agents, comprehensive coverage options, and competitive pricing. However, they also face certain challenges:

- High Premiums: Florida’s high accident rates and hurricane risk can lead to higher premiums for car insurance. However, State Farm offers various discounts to help mitigate costs, such as safe driving discounts, multi-policy discounts, and good student discounts.

- Limited Coverage Options: While State Farm offers comprehensive coverage options, Florida’s no-fault system may limit the extent of liability coverage available. Policyholders should carefully review their coverage options to ensure they have adequate protection for their specific needs.

- Claims Processing Delays: Florida’s high volume of claims can lead to delays in processing. State Farm’s commitment to efficient claims handling and its extensive network of repair facilities aim to minimize these delays.

Last Recap: State Farm Car Insurance In Florida

Navigating the world of car insurance can be overwhelming, especially in a state as diverse as Florida. By understanding the intricacies of State Farm’s offerings and the unique considerations specific to Florida, you can make confident choices that ensure your financial protection on the road. State Farm’s commitment to customer service and its comprehensive range of coverage options make it a strong contender for Florida drivers seeking peace of mind and affordability. Remember to carefully review your policy details, explore available discounts, and contact State Farm directly for personalized advice and guidance.

User Queries

What types of car insurance coverage does State Farm offer in Florida?

State Farm offers a comprehensive range of car insurance coverage options in Florida, including liability, collision, comprehensive, personal injury protection (PIP), and uninsured/underinsured motorist (UM/UIM) coverage. You can customize your policy to meet your specific needs and budget.

How can I get a car insurance quote from State Farm in Florida?

You can obtain a car insurance quote from State Farm in Florida by visiting their website, calling their customer service line, or contacting a local State Farm agent. Be prepared to provide information about your vehicle, driving history, and desired coverage options.

Does State Farm offer any discounts for car insurance in Florida?

Yes, State Farm offers a variety of discounts for car insurance in Florida, including safe driver discounts, good student discounts, multi-policy discounts, and more. Contact your local State Farm agent to learn about the discounts you may qualify for.