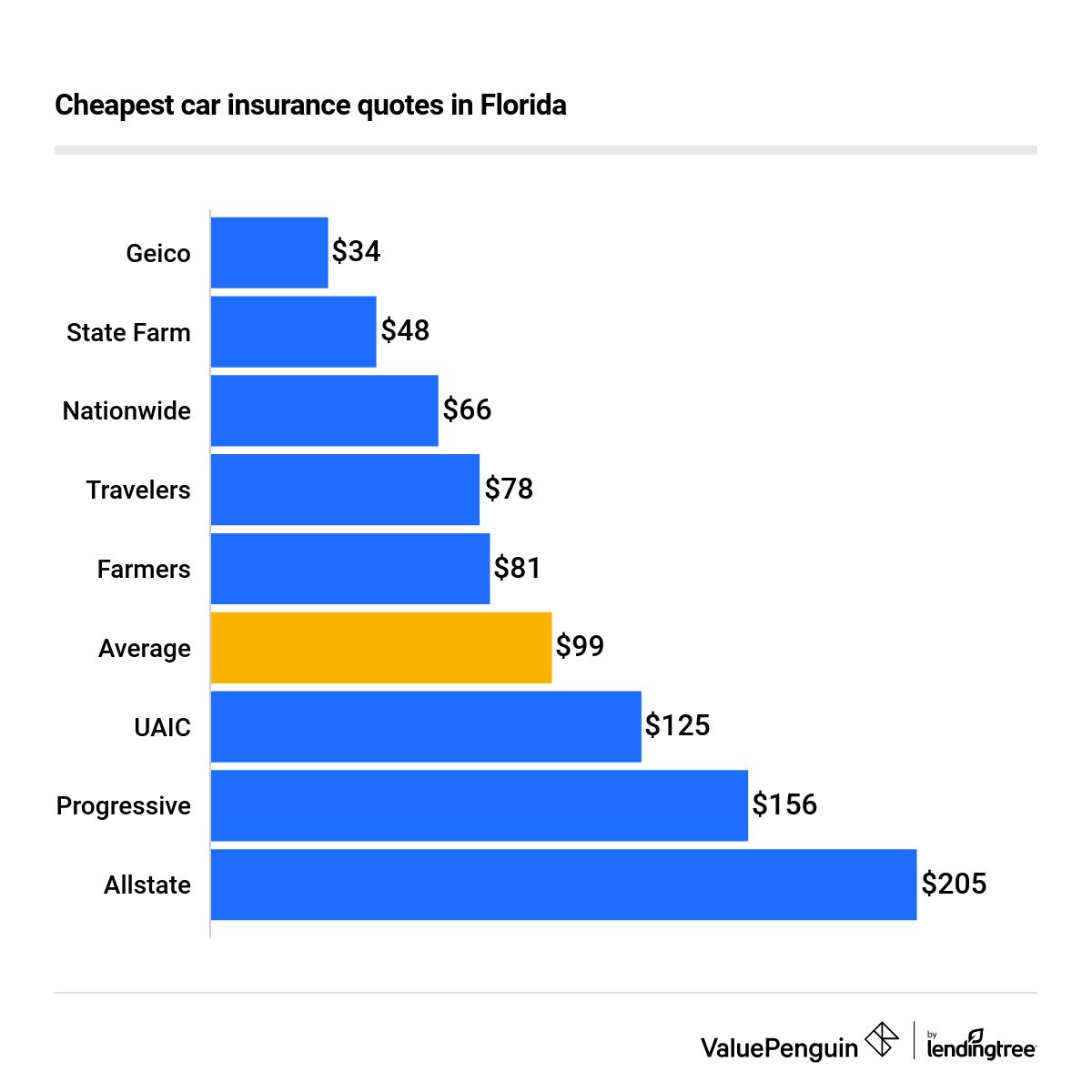

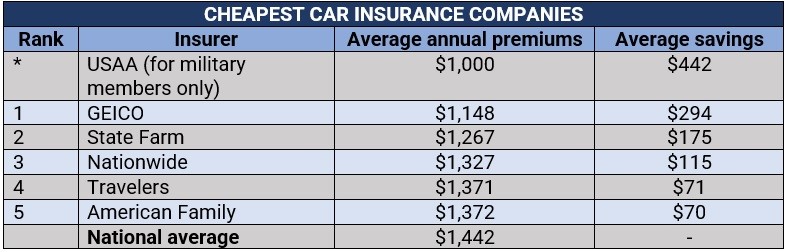

Lowest car insurance Florida is a common search term, and for good reason. Florida’s unique driving environment, including high population density, frequent storms, and a litigious climate, can make car insurance premiums significantly higher than in other states. Understanding the factors that influence your car insurance rates is crucial for finding the best deal.

From understanding your driving history and credit score to exploring coverage options and comparing quotes, this guide will equip you with the knowledge to navigate the Florida car insurance market and secure the most affordable coverage.

Understanding Florida’s Car Insurance Landscape

Florida’s car insurance landscape is unique and complex, influenced by a combination of factors that drive costs higher than in many other states. Understanding these factors is crucial for drivers seeking the best coverage at the most affordable price.

Factors Influencing Florida’s Car Insurance Costs

Several factors contribute to the high cost of car insurance in Florida. These include:

- Weather Patterns: Florida’s frequent hurricanes and severe storms result in significant damage to vehicles, leading to higher claims and insurance premiums.

- High Population Density: With a large and growing population, Florida’s roads are congested, increasing the risk of accidents and insurance claims.

- Litigation Rates: Florida has a reputation for a high volume of lawsuits related to car accidents, which contributes to higher insurance costs as insurers must cover legal expenses and settlements.

- Fraudulent Claims: Unfortunately, Florida has a higher rate of fraudulent car insurance claims, which insurers must factor into their pricing to protect themselves from losses.

The Role of the Florida Department of Financial Services

The Florida Department of Financial Services (DFS) plays a vital role in regulating the state’s car insurance industry. The DFS:

- Ensures Financial Stability: The DFS oversees the financial health of insurance companies to protect policyholders from insolvency.

- Protects Consumers: The DFS investigates complaints against insurance companies and helps resolve disputes between consumers and insurers.

- Regulates Rates: The DFS has the authority to review and approve insurance rates, ensuring they are fair and reasonable.

Essential Elements of a Standard Florida Car Insurance Policy

A standard Florida car insurance policy typically includes the following essential coverages:

- Liability Coverage: This coverage protects you financially if you cause an accident that results in injuries or property damage to others. It covers the other driver’s medical expenses, lost wages, and property repairs up to the limits of your policy.

- Personal Injury Protection (PIP): This coverage, also known as “no-fault” insurance, pays for your medical expenses and lost wages, regardless of who caused the accident. It’s mandatory in Florida, with a minimum coverage limit of $10,000.

- Property Damage Liability (PDL): This coverage pays for damage to the other driver’s vehicle or property if you cause an accident.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of who is at fault. It’s optional but recommended if you have a loan or lease on your vehicle.

- Comprehensive Coverage: This coverage pays for repairs or replacement of your vehicle if it’s damaged by events other than a collision, such as theft, vandalism, or natural disasters. It’s also optional but recommended if you have a loan or lease on your vehicle.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): This coverage protects you if you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have enough insurance to cover your losses.

Identifying Factors Affecting Car Insurance Premiums

Your car insurance premium is not a fixed amount. Instead, it’s calculated based on various factors that assess your risk as a driver. Understanding these factors can help you make informed decisions to potentially lower your premium.

Driving History

Your driving history is a major factor influencing your insurance rates. Insurance companies assess your past driving record, looking for incidents like accidents, traffic violations, and driving under the influence (DUI) convictions.

- A clean driving record with no accidents or violations usually translates to lower premiums.

- Accidents, especially those deemed your fault, can significantly increase your rates, as they indicate a higher risk of future incidents.

- Traffic violations like speeding tickets, running red lights, or reckless driving can also lead to higher premiums.

- DUI convictions carry the most severe impact, often resulting in significantly higher premiums or even denial of coverage.

Age

Age is another crucial factor. Younger drivers, especially those under 25, tend to have higher premiums due to their statistically higher risk of accidents.

- As drivers gain experience and age, their risk profile generally decreases, leading to lower premiums.

- Older drivers, particularly those above 65, may face higher premiums due to factors like age-related health conditions or reduced reaction times.

Credit Score

Surprisingly, your credit score can impact your car insurance rates in Florida. Insurance companies believe that those with good credit are more responsible and less likely to file claims.

- A higher credit score often translates to lower premiums, while a lower credit score can lead to higher rates.

- It’s important to note that this practice is not universal across all states and is subject to regulations.

Vehicle Type, Lowest car insurance florida

The type of vehicle you drive significantly impacts your insurance premiums.

- Luxury cars, high-performance vehicles, and expensive SUVs are generally associated with higher repair costs, leading to higher insurance rates.

- Older vehicles, while less expensive to buy, might have outdated safety features, potentially resulting in higher premiums.

- Vehicles with advanced safety features like anti-lock brakes, airbags, and stability control often qualify for discounts, leading to lower premiums.

Coverage Choices

The type of coverage you choose directly impacts your premium.

- Comprehensive and collision coverage provide protection against damage to your vehicle, but they come at a higher cost.

- Liability coverage, which covers damages to other vehicles or property, is typically mandatory in Florida and can be more affordable than comprehensive and collision coverage.

- Uninsured/underinsured motorist coverage provides protection when you’re involved in an accident with a driver who lacks sufficient insurance.

Deductibles

Your deductible is the amount you pay out-of-pocket before your insurance coverage kicks in.

- A higher deductible generally means lower premiums, as you agree to bear more of the financial burden in case of an accident.

- A lower deductible means higher premiums, as your insurance company assumes more financial responsibility.

Discounts

Insurance companies offer various discounts to incentivize safe driving practices and customer loyalty.

- Good Driver Discount: This discount is awarded to drivers with a clean driving record and no accidents or violations.

- Safe Driver Discount: This discount is offered to drivers who complete defensive driving courses, demonstrating their commitment to safe driving practices.

- Multi-Car Discount: If you insure multiple vehicles with the same insurance company, you may qualify for a discount.

- Other Discounts: Many other discounts are available, such as discounts for good students, homeowners, and military personnel.

Conclusive Thoughts: Lowest Car Insurance Florida

Navigating the complexities of Florida car insurance doesn’t have to be overwhelming. By understanding the factors that influence your premiums, exploring coverage options, and comparing quotes, you can find the lowest car insurance in Florida that meets your specific needs. Remember, a little research and proactive planning can go a long way in saving you money on your car insurance.

FAQ Insights

How do I compare car insurance quotes in Florida?

Use online comparison tools or contact multiple insurance companies directly to get personalized quotes. Be sure to provide accurate information about your driving history, vehicle, and desired coverage.

What are the penalties for driving without car insurance in Florida?

Driving without car insurance in Florida is illegal and can result in fines, license suspension, and even jail time. Additionally, you may be held personally liable for any damages or injuries caused in an accident.

Can I get car insurance discounts in Florida?

Yes, many insurance companies offer discounts for good driving records, safe driving courses, multi-car policies, and other factors. Be sure to inquire about available discounts when getting quotes.