Average car insurance in Florida can vary significantly depending on factors like your age, driving history, and the type of vehicle you drive. The Sunshine State’s unique demographics, driving conditions, and insurance regulations all contribute to its distinct car insurance market.

Understanding these factors can help you navigate the complexities of Florida’s insurance landscape and find the best coverage at a price that fits your budget. This guide will explore the average car insurance premiums in Florida, key factors influencing costs, and strategies for saving money on your policy.

Factors Influencing Car Insurance Costs in Florida

Car insurance premiums in Florida are influenced by a complex interplay of factors, reflecting the state’s unique demographics, driving conditions, and regulatory landscape. Understanding these factors is crucial for drivers seeking to navigate the Florida car insurance market effectively.

Florida’s Unique Demographics and Driving Conditions

Florida’s demographics and driving conditions significantly impact car insurance costs. The state’s large population, including a substantial elderly population, contributes to a higher risk of accidents. Additionally, Florida’s warm climate and high tourist influx lead to increased traffic congestion, which can raise the likelihood of accidents.

Impact of Insurance Company Practices and Regulations

Insurance company practices and regulations play a pivotal role in shaping Florida’s car insurance market. The state’s no-fault insurance system, which requires drivers to cover their own medical expenses regardless of fault, has contributed to higher insurance costs. Additionally, Florida’s strict regulations regarding insurance rates and coverage can limit competition and potentially increase premiums.

Key Factors Determining Car Insurance Premiums

- Driving Record: Drivers with a history of accidents, traffic violations, or DUI convictions face higher premiums. Insurance companies view these factors as indicators of higher risk.

- Vehicle Type and Age: The type and age of a vehicle can significantly influence insurance premiums. Newer, more expensive vehicles often carry higher insurance costs due to their greater repair costs and potential for theft.

- Coverage Levels: The level of coverage chosen, such as liability, collision, and comprehensive, directly affects premiums. Higher coverage levels generally lead to higher premiums.

- Credit Score: In Florida, credit score is a factor in determining car insurance premiums. Individuals with lower credit scores may face higher premiums, as they are perceived as higher-risk borrowers.

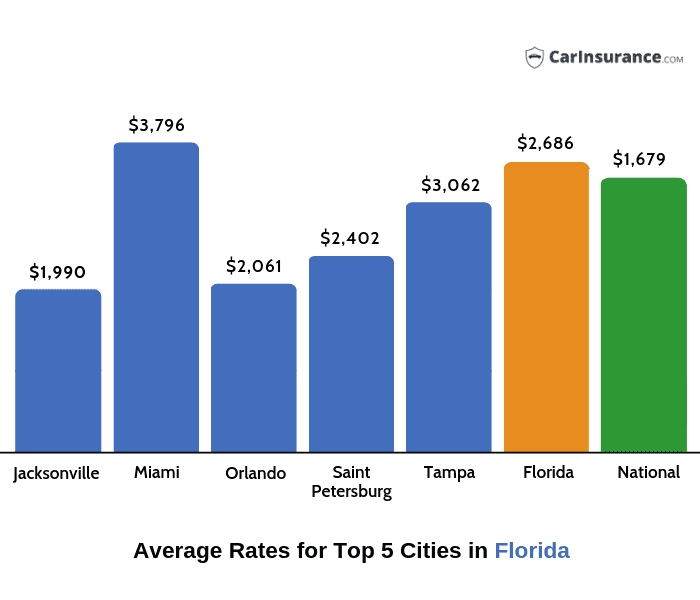

- Location: Car insurance premiums can vary based on location. Areas with higher crime rates or accident frequencies may have higher premiums.

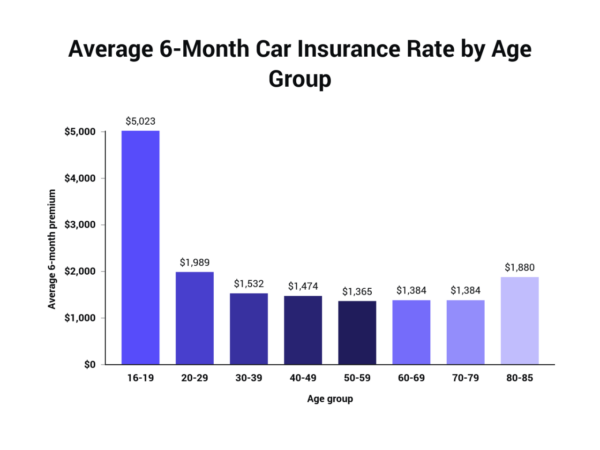

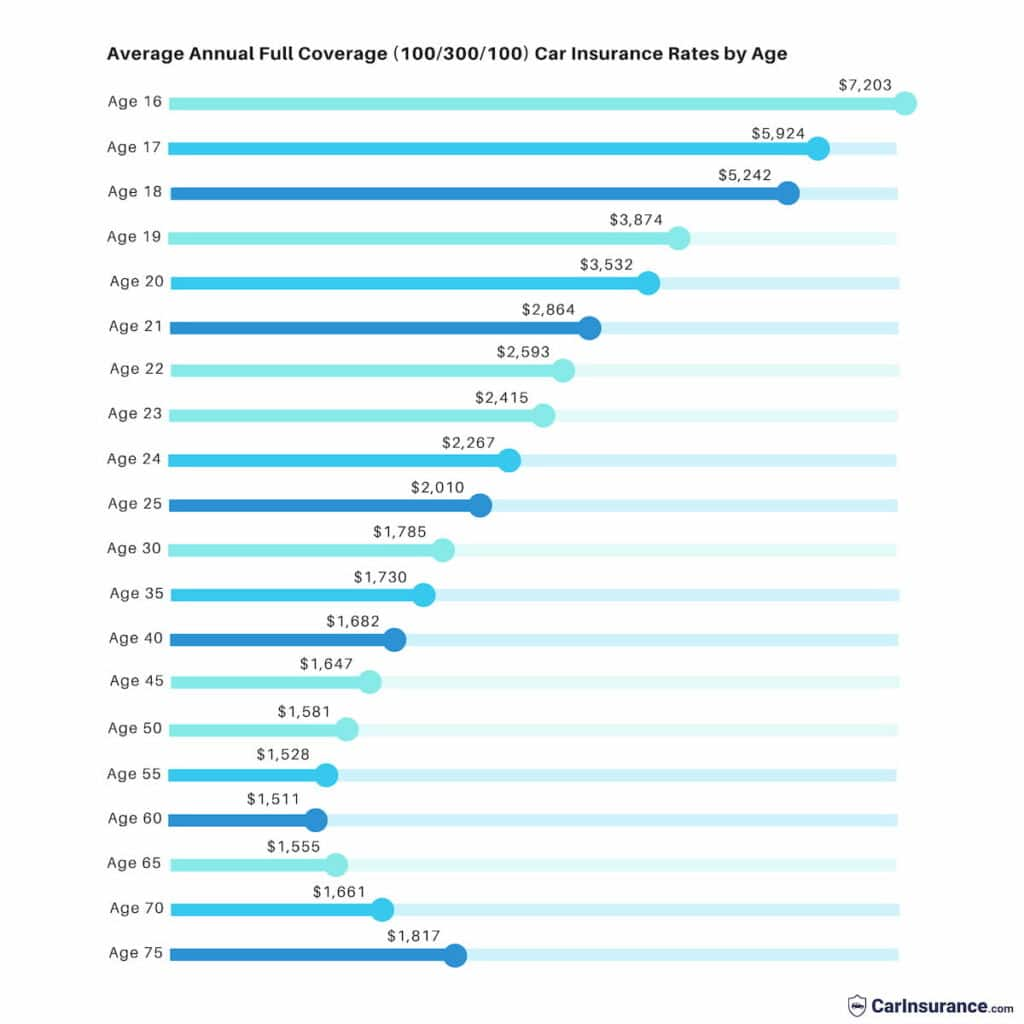

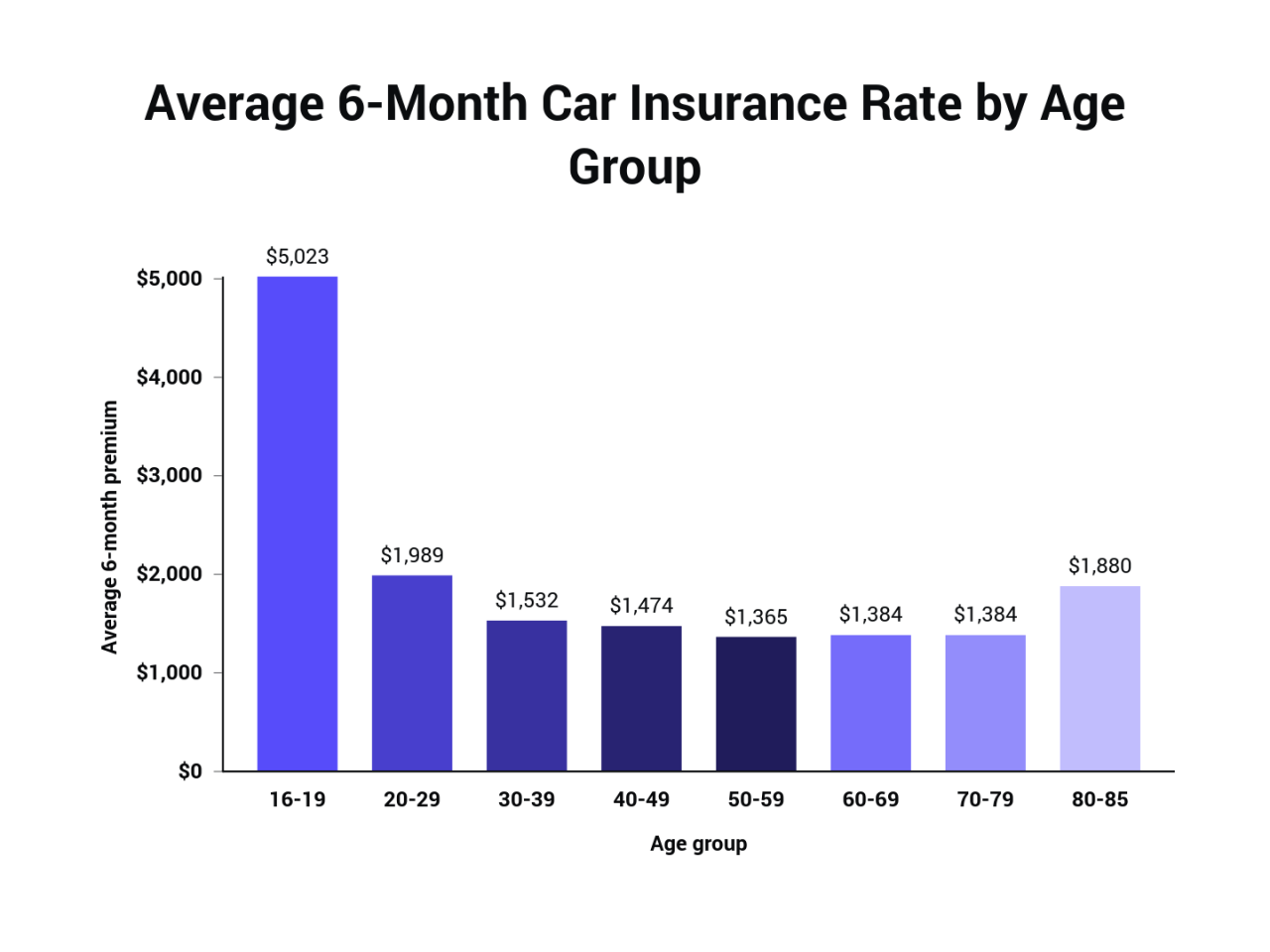

- Age and Gender: Younger drivers, particularly those under 25, generally face higher premiums due to their higher risk of accidents. Gender can also play a role, with men typically paying higher premiums than women.

Average Car Insurance Premiums in Florida

Florida is known for its warm weather, beautiful beaches, and unfortunately, high car insurance premiums. Several factors contribute to this trend, including a high volume of car accidents, a significant number of uninsured drivers, and a large population of senior citizens. This section explores the average car insurance premiums in Florida, providing insights into how these premiums are determined and how they compare to national averages.

Average Car Insurance Premiums by Factor

Average car insurance premiums in Florida can vary significantly based on several factors.

- Age: Younger drivers typically pay higher premiums due to their lack of experience and higher risk of accidents. As drivers gain experience and age, their premiums tend to decrease.

- Gender: In some states, women tend to pay lower premiums than men. However, this difference is often minimal, and in Florida, there’s little to no difference.

- Driving History: Drivers with a clean driving record, without accidents or traffic violations, generally pay lower premiums. Conversely, those with a history of accidents or violations can expect to pay significantly more.

- Vehicle Type: The type of vehicle you drive is a major factor in determining your insurance premium. High-performance cars, SUVs, and luxury vehicles are often more expensive to insure due to their higher repair costs and potential for greater damage in accidents.

- Coverage Levels: The amount of coverage you choose will significantly impact your premium. Higher coverage levels, such as comprehensive and collision coverage, provide greater protection but also come with higher premiums.

- Location: Car insurance premiums can vary within Florida based on the specific location. Areas with higher traffic density and accident rates generally have higher premiums.

- Credit Score: In some states, insurance companies may use your credit score to determine your premium. While this practice is not as prevalent in Florida, it’s still a factor that could influence your rates.

Comparison with National Averages and Other States

Florida’s average car insurance premiums are typically higher than the national average. According to the National Association of Insurance Commissioners (NAIC), the average annual premium for car insurance in the United States was $1,771 in 2022. In contrast, the average annual premium in Florida was $2,100, about 18.6% higher than the national average.

- Higher Than Average: Several states have higher average car insurance premiums than Florida, including Michigan, Louisiana, and New Jersey. These states often have a higher density of uninsured drivers, a higher number of accidents, and more complex legal systems, all contributing to higher premiums.

- Lower Than Average: States with lower average premiums than Florida include Idaho, Maine, and North Dakota. These states generally have lower population densities, fewer accidents, and less complex legal systems, leading to lower insurance costs.

Average Car Insurance Premiums in Florida by Coverage Level

The following table provides a general overview of average car insurance premiums in Florida for different coverage levels:

| Coverage Level | Average Annual Premium |

|---|---|

| Liability Only | $1,200 |

| Liability + Comprehensive | $1,600 |

| Liability + Collision | $1,800 |

| Full Coverage | $2,100 |

Note: These premiums are estimates and may vary based on the factors discussed earlier. It’s essential to obtain quotes from multiple insurance companies to find the best rates for your specific situation.

Understanding Florida’s Insurance Market

Florida’s car insurance market is unique and complex, influenced by a combination of factors such as high population density, a large number of tourists, and a history of severe weather events. Understanding the dynamics of this market is crucial for consumers seeking the best insurance coverage.

Major Car Insurance Providers in Florida, Average car insurance in florida

Several major insurance providers operate in Florida, offering a wide range of coverage options and pricing structures. Here’s a list of some of the leading players:

- State Farm: One of the largest insurance companies in the US, State Farm offers a comprehensive range of insurance products, including car insurance, in Florida.

- GEICO: Known for its competitive pricing and extensive advertising, GEICO is another major player in the Florida car insurance market.

- Progressive: Progressive is a well-known provider offering a variety of insurance options, including personalized coverage and flexible payment plans.

- Allstate: Allstate offers a range of car insurance products, including accident forgiveness and roadside assistance.

- USAA: USAA primarily serves military personnel and their families, providing competitive rates and excellent customer service.

- Florida Peninsula Insurance Company: A Florida-based insurer, Florida Peninsula specializes in providing coverage to drivers who may have difficulty finding insurance elsewhere.

Types of Car Insurance Policies in Florida

Florida law mandates that all drivers carry at least the minimum required liability coverage, known as the “Financial Responsibility Law.” This coverage protects other drivers and their property in case of an accident caused by the insured driver. However, drivers can choose to purchase additional coverage to protect themselves and their vehicles further.

- Liability Coverage: This is the most basic type of coverage, covering damages to other vehicles and injuries to other people in case of an accident caused by the insured driver.

- Personal Injury Protection (PIP): PIP coverage pays for medical expenses and lost wages for the insured driver and passengers in case of an accident, regardless of fault.

- Property Damage Liability: This coverage pays for damages to other people’s property, such as their vehicles or buildings, in case of an accident caused by the insured driver.

- Collision Coverage: Collision coverage pays for repairs to the insured vehicle in case of an accident, regardless of fault.

- Comprehensive Coverage: Comprehensive coverage protects against damage to the insured vehicle caused by events other than collisions, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): UM/UIM coverage protects the insured driver and passengers in case of an accident caused by an uninsured or underinsured driver.

Comparison of Key Features and Benefits Offered by Different Insurance Providers in Florida

Each insurance provider in Florida offers a unique combination of features and benefits, catering to different customer needs and preferences. Here’s a comparison of some key aspects:

| Provider | Coverage Options | Pricing | Customer Service | Discounts |

|---|---|---|---|---|

| State Farm | Comprehensive coverage options, including accident forgiveness and roadside assistance | Competitive pricing, with discounts for safe driving and good credit | Excellent customer service, with 24/7 support | Discounts for safe driving, good credit, bundling policies, and being a member of certain organizations |

| GEICO | Wide range of coverage options, including collision and comprehensive coverage | Known for its competitive pricing, often offering lower premiums than other providers | Good customer service, with online and phone support | Discounts for safe driving, good credit, bundling policies, and being a member of certain organizations |

| Progressive | Personalized coverage options, including customizable deductibles and coverage limits | Competitive pricing, with discounts for safe driving and good credit | Good customer service, with online and phone support | Discounts for safe driving, good credit, bundling policies, and being a member of certain organizations |

| Allstate | Comprehensive coverage options, including accident forgiveness and roadside assistance | Competitive pricing, with discounts for safe driving and good credit | Good customer service, with online and phone support | Discounts for safe driving, good credit, bundling policies, and being a member of certain organizations |

| USAA | Comprehensive coverage options, including accident forgiveness and roadside assistance | Competitive pricing, with discounts for safe driving and good credit | Excellent customer service, with 24/7 support | Discounts for safe driving, good credit, bundling policies, and being a member of certain organizations |

| Florida Peninsula Insurance Company | Specialized coverage options for drivers who may have difficulty finding insurance elsewhere | May offer higher premiums than other providers | Good customer service, with online and phone support | Discounts for safe driving, good credit, and being a member of certain organizations |

It’s important to compare quotes from multiple insurance providers before making a decision. This will ensure that you get the best coverage at the most affordable price.

Tips for Saving on Car Insurance in Florida

Navigating Florida’s car insurance market can be challenging, but there are ways to reduce your premiums and find the best coverage for your needs. By implementing smart strategies and understanding the factors that influence your rates, you can save money without sacrificing the protection you need.

Bundling Insurance Policies

One of the most effective ways to save on car insurance is to bundle your policies. This means combining your car insurance with other types of insurance, such as homeowners, renters, or life insurance. By bundling, you can often receive significant discounts from your insurer. These discounts can vary depending on the insurer and the policies you choose to bundle, but they can add up to significant savings over time.

Taking Advantage of Discounts

Insurance companies offer a variety of discounts to their policyholders. These discounts can be based on various factors, including your driving record, safety features in your car, your age, your occupation, and even your educational background. Understanding these discounts and taking advantage of them can help you save money on your car insurance.

- Good Driver Discount: This discount is awarded to drivers with a clean driving record, typically those without accidents or traffic violations.

- Safe Driver Discount: This discount is similar to the good driver discount, but it may also consider factors like defensive driving courses or other safety measures.

- Anti-theft Device Discount: If your car has anti-theft devices like alarms, immobilizers, or GPS tracking systems, you may qualify for a discount.

- Multi-Car Discount: Insuring multiple vehicles with the same company can often result in a discount.

- Loyalty Discount: Some insurance companies offer discounts to long-term policyholders who have maintained their coverage for a certain period.

- Student Discount: If you are a student with good grades, you may be eligible for a discount.

- Military Discount: Active military personnel and veterans may qualify for discounts on car insurance.

Negotiating Car Insurance Rates

It’s crucial to shop around and compare quotes from different insurance providers to find the best rates. Don’t be afraid to negotiate with insurers to see if they can offer you a better deal.

- Ask for a lower deductible: A higher deductible means you pay more out of pocket if you have an accident. But, a higher deductible can lead to lower premiums.

- Consider a lower coverage limit: If you have an older car, you may be able to reduce your coverage limits and save money.

- Be prepared to switch insurers: If you’re not satisfied with your current insurer, be prepared to switch to a different provider that offers better rates.

- Be persistent: Don’t be afraid to call your insurer and ask for a lower rate. They may be willing to negotiate with you, especially if you’re a loyal customer.

Florida’s No-Fault Insurance System

Florida’s no-fault insurance system is a unique approach to handling car accidents. It differs significantly from traditional fault-based systems found in many other states. Understanding how it works is crucial for anyone driving in Florida, as it impacts car insurance costs, coverage, and the claims process.

This system aims to streamline the process of resolving car accidents, reducing litigation and potentially lowering insurance premiums. However, it also has its share of challenges and criticisms, leading to debates about its effectiveness and fairness.

Personal Injury Protection (PIP) Coverage

PIP coverage is the cornerstone of Florida’s no-fault system. It is mandatory for all drivers in the state and provides coverage for medical expenses and lost wages, regardless of who caused the accident.

PIP coverage offers financial protection for the insured driver and passengers in their vehicle, regardless of fault. This means that even if the insured driver caused the accident, they can still access PIP benefits.

- Coverage: PIP covers 80% of reasonable and necessary medical expenses, up to $10,000. It also covers 60% of lost wages, up to $2,500 per week, for a maximum of 52 weeks.

- Limitations: PIP coverage has limitations. For example, it may not cover all medical expenses, such as those deemed unnecessary or not directly related to the accident. It also has a cap on the total amount of benefits payable. Additionally, PIP coverage is not intended to cover pain and suffering, which are often compensated in fault-based systems.

Challenges and Benefits of Florida’s No-Fault System

Florida’s no-fault system is designed to reduce litigation and expedite claims processing. However, it has also been criticized for its complexities and potential for abuse.

- Challenges: Critics argue that the system can be difficult to navigate, leading to disputes over coverage and benefits. They also point to the potential for fraud, with some individuals seeking to maximize their PIP benefits. Furthermore, the limitations on coverage can leave accident victims with significant out-of-pocket expenses.

- Benefits: Supporters of the system argue that it simplifies the claims process and reduces the number of lawsuits. They also point to the potential for lower insurance premiums, as fewer lawsuits lead to lower insurance costs. Additionally, the system ensures that accident victims have access to basic medical care, regardless of fault.

Ending Remarks

Finding the right car insurance in Florida requires research, comparison, and a good understanding of your individual needs. By considering the factors discussed in this guide, you can make informed decisions about your coverage and potentially save money on your premiums. Remember to shop around, compare quotes, and leverage available discounts to secure the best value for your car insurance needs.

Commonly Asked Questions: Average Car Insurance In Florida

What is the average car insurance premium in Florida?

The average car insurance premium in Florida can vary depending on factors like age, driving history, and vehicle type. However, it is generally higher than the national average.

What are the most common car insurance companies in Florida?

Some of the most common car insurance companies in Florida include State Farm, GEICO, Progressive, and Allstate.

What is Florida’s no-fault insurance system?

Florida has a no-fault insurance system, which means that drivers are required to have Personal Injury Protection (PIP) coverage to pay for their own medical expenses after an accident, regardless of fault.