Florida home and car insurance presents a unique landscape for residents and those considering relocating to the Sunshine State. The state’s susceptibility to hurricanes and other natural disasters significantly impacts insurance premiums, leading to a market distinct from others across the nation. Understanding the intricacies of Florida’s insurance market is crucial for securing the right coverage at a competitive price.

This guide will explore the complexities of Florida’s home and car insurance market, providing insights into the factors that influence premiums, coverage options, and shopping strategies. We’ll delve into the state’s mandatory insurance requirements, explore the availability of flood insurance, and offer tips for finding affordable policies. Whether you’re a long-time Florida resident or a newcomer, this comprehensive overview will empower you to make informed decisions about your insurance needs.

Florida’s Unique Insurance Landscape

Florida’s home and car insurance market stands out as a distinct entity compared to other states in the nation. This distinctiveness arises from a confluence of factors, primarily driven by the state’s susceptibility to natural disasters, particularly hurricanes.

The Impact of Hurricanes and Natural Disasters

Hurricanes pose a significant threat to Florida, leading to substantial property damage and financial losses. The frequency and intensity of these storms directly influence insurance premiums. Insurance companies factor in the historical data on hurricane occurrences, their severity, and the associated costs to determine the risk levels and pricing.

The Role of the Florida Hurricane Catastrophe Fund

The Florida Hurricane Catastrophe Fund (FHCF) plays a crucial role in mitigating the financial impact of hurricanes on the insurance industry and policyholders. This state-run reinsurance fund provides financial support to insurers in the event of a catastrophic hurricane. The FHCF helps stabilize the market by offering a backstop against extreme losses, which in turn can influence the affordability of insurance premiums.

Home Insurance in Florida: Florida Home And Car Insurance

Navigating the world of home insurance in Florida can be complex due to the state’s unique susceptibility to natural disasters like hurricanes. This guide will break down the different types of home insurance policies available, compare coverage offered by insurers, and emphasize the critical role of flood insurance.

Types of Home Insurance Policies

Homeowners in Florida have several insurance policy options to choose from, each offering varying levels of coverage and protection.

- HO-3 (Special Form): This policy is considered the most comprehensive, providing coverage for all perils except those specifically excluded in the policy. This includes damage from hurricanes, windstorms, hail, fire, and theft. It also covers personal property, liability, and medical payments to others.

- HO-5 (Comprehensive Form): This policy offers the broadest coverage, providing protection for all perils, including those not specifically excluded in the policy. It is similar to the HO-3 but often includes additional coverage for personal property and liability.

- HO-8 (Modified Coverage Form): This policy is designed for older homes and provides coverage for specific perils like fire, lightning, and windstorms. It offers less comprehensive coverage than the HO-3 and HO-5 and may not cover damage from hurricanes or other natural disasters.

- HO-6 (Condominium Unit Owners): This policy is specifically designed for condo owners and covers their personal property and liability within the condo unit. It does not cover the building structure itself, which is typically covered by a separate master policy for the entire condominium complex.

Coverage Comparisons

Understanding the differences in coverage provided by various insurers is crucial for making an informed decision. Key factors to consider include:

- Deductibles: This is the amount you pay out-of-pocket before your insurance coverage kicks in. Higher deductibles generally result in lower premiums, while lower deductibles lead to higher premiums.

- Limits: The maximum amount your insurer will pay for a covered loss is known as the limit. Limits vary depending on the policy and the type of coverage.

- Exclusions: These are specific events or circumstances that are not covered by your insurance policy. Common exclusions include damage caused by earthquakes, floods, and acts of war.

Flood Insurance

Florida is highly susceptible to flooding, making flood insurance a critical component of comprehensive home protection.

Flood insurance is not typically included in standard homeowners insurance policies and must be purchased separately.

The National Flood Insurance Program (NFIP) offers flood insurance policies to homeowners in flood-prone areas. These policies cover damage caused by flooding from overflowing rivers, lakes, or oceans. While not mandatory, flood insurance is highly recommended for homeowners in Florida, especially those residing in coastal areas or near bodies of water.

Car Insurance in Florida

Florida has a unique and complex car insurance landscape, influenced by factors like high population density, a significant number of tourists, and a history of costly litigation. Understanding the intricacies of car insurance in Florida is crucial for drivers to ensure they have adequate coverage and comply with legal requirements.

Mandatory Coverage Requirements

Florida law mandates specific car insurance coverages for all drivers. These requirements aim to protect drivers and their passengers in the event of an accident.

- Personal Injury Protection (PIP): This coverage pays for medical expenses, lost wages, and other related costs for the insured driver and passengers, regardless of fault. Florida law requires a minimum PIP coverage of $10,000.

- Property Damage Liability (PDL): This coverage protects the insured driver from financial liability for damages to another person’s property in an accident. Florida law requires a minimum PDL coverage of $10,000.

Factors Affecting Car Insurance Premiums

Various factors influence car insurance premiums in Florida, impacting the cost of coverage for individual drivers. Understanding these factors can help drivers make informed decisions to potentially lower their premiums.

- Driving History: Drivers with a history of accidents, traffic violations, or DUI convictions typically face higher premiums. Insurance companies consider these factors as indicators of higher risk.

- Vehicle Type: The type of vehicle insured also plays a significant role in premium calculations. Sports cars, luxury vehicles, and high-performance models are generally considered riskier to insure due to their higher repair costs and potential for higher speeds.

- Location: Car insurance premiums can vary based on the driver’s location within Florida. Areas with higher traffic density, crime rates, or a history of accidents often have higher insurance premiums.

- Age and Gender: Younger drivers and male drivers tend to pay higher premiums due to statistical evidence suggesting higher risk factors in these demographics.

- Credit Score: In some states, including Florida, insurance companies may consider a driver’s credit score when determining premiums. A higher credit score can potentially lead to lower premiums.

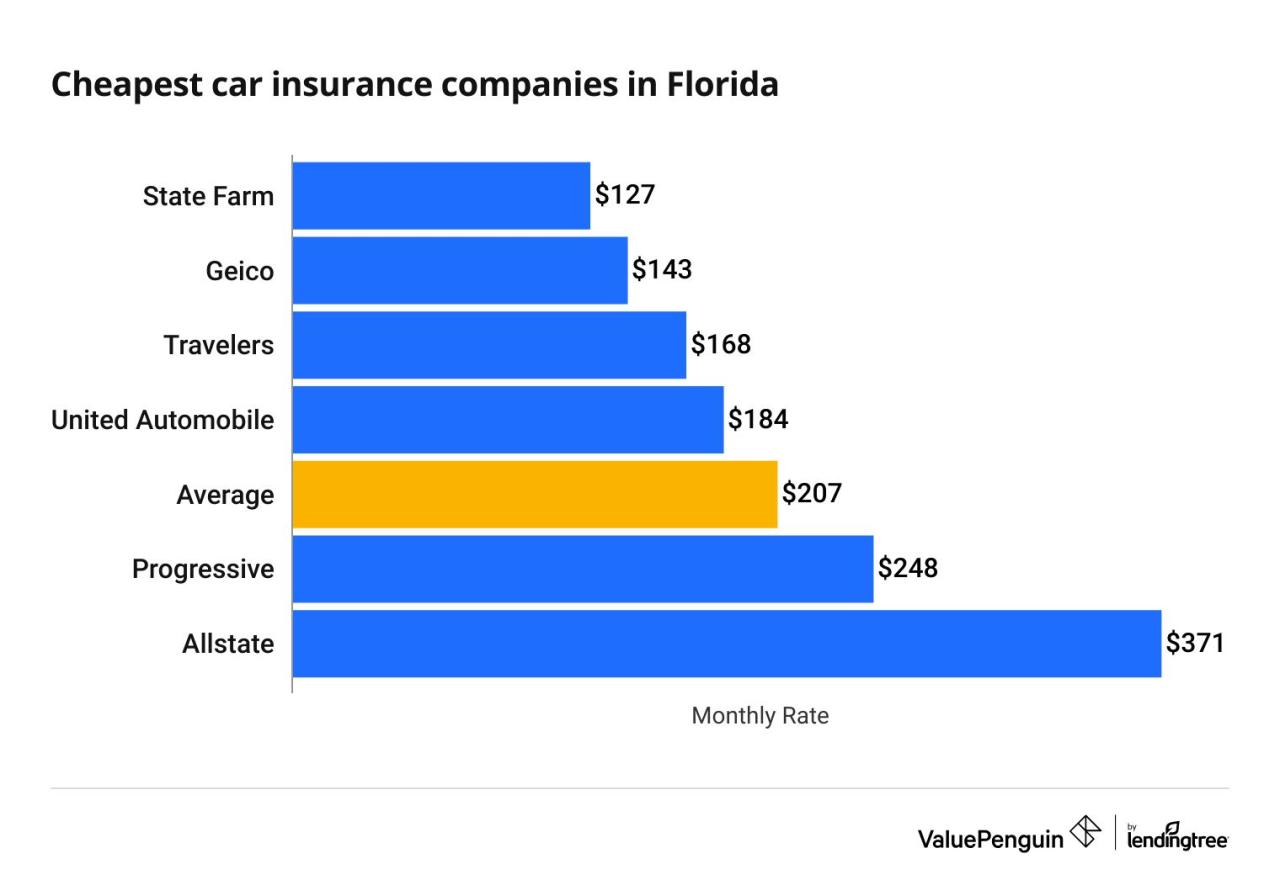

Finding Affordable Car Insurance Options, Florida home and car insurance

Finding affordable car insurance in Florida requires research, comparison, and negotiation. Drivers can implement several strategies to secure competitive rates.

- Shop Around: Obtaining quotes from multiple insurance companies is essential to compare rates and coverage options. Online comparison tools can streamline this process.

- Consider Bundling: Combining home and auto insurance with the same provider can often lead to discounts.

- Maintain a Good Driving Record: Avoiding accidents, traffic violations, and DUI convictions can significantly impact premiums.

- Increase Deductibles: Choosing higher deductibles can lower premiums, but drivers should ensure they can afford to pay the deductible in case of an accident.

- Ask About Discounts: Many insurance companies offer discounts for factors such as good student status, safe driver courses, and anti-theft devices.

Insurance Shopping and Comparison

Finding the best home and car insurance in Florida involves more than just getting a few quotes. It’s about understanding your needs, comparing policies, and finding the right balance between coverage and price. This guide will help you navigate the process of insurance shopping and comparison in Florida.

Step-by-Step Guide to Comparing Quotes

Before requesting quotes, gather information about your home and car, including details like:

- Home address and square footage

- Car make, model, year, and mileage

- Any existing insurance policies and coverage details

Once you have this information, follow these steps to compare quotes:

- Get Quotes from Multiple Providers: Contact at least three to five different insurance companies. This ensures you have a diverse range of options to compare.

- Compare Coverage and Pricing: Review the quotes carefully, paying attention to the coverage details, deductibles, and premiums. Look for any additional features or discounts offered.

- Consider Your Individual Needs: Evaluate your specific needs and risk tolerance. For example, if you live in a hurricane-prone area, you may prioritize higher coverage limits for your home insurance.

- Ask Questions and Seek Clarification: Don’t hesitate to contact the insurance companies if you have any questions about the policies or need further clarification.

- Read Reviews and Ratings: Research the financial stability, customer service, and claim handling procedures of the insurance companies you are considering.

- Compare Overall Value: Don’t solely focus on the cheapest option. Consider the overall value, including coverage, customer service, and the insurer’s financial stability.

Key Factors to Consider When Choosing an Insurance Company

- Financial Stability: Choose an insurance company with a strong financial rating. This ensures they can pay claims even during catastrophic events like hurricanes.

- Customer Service: Look for companies with excellent customer service reputations. This is important when you need to file a claim or have questions about your policy.

- Claim Handling Procedures: Understand how the insurance company handles claims. Look for companies with a track record of fair and efficient claim processing.

- Discounts and Features: Explore available discounts, such as those for good driving records, home security systems, or bundling home and car insurance.

Comparing Major Insurance Companies in Florida

| Insurance Company | Home Insurance Features | Car Insurance Features | Average Premium (Home) | Average Premium (Car) |

|---|---|---|---|---|

| State Farm | Hurricane coverage, windstorm coverage, replacement cost coverage | Liability coverage, collision coverage, comprehensive coverage | $2,000 – $3,000 | $1,500 – $2,500 |

| Geico | Hurricane coverage, windstorm coverage, optional flood coverage | Liability coverage, collision coverage, comprehensive coverage | $1,800 – $2,800 | $1,300 – $2,300 |

| Progressive | Hurricane coverage, windstorm coverage, optional flood coverage | Liability coverage, collision coverage, comprehensive coverage | $1,900 – $2,900 | $1,400 – $2,400 |

| Allstate | Hurricane coverage, windstorm coverage, replacement cost coverage | Liability coverage, collision coverage, comprehensive coverage | $2,100 – $3,100 | $1,600 – $2,600 |

Note: These average premiums are for illustrative purposes only and may vary depending on individual factors like coverage levels, deductibles, and driving history.

Understanding Your Policy

Your insurance policy is a legally binding contract that Artikels the terms and conditions of your coverage. It’s crucial to understand the details of your policy to ensure you have the protection you need and avoid surprises during a claim. Thoroughly reviewing your policy will help you understand the extent of your coverage, identify any potential gaps, and make informed decisions about your insurance needs.

Policy Components

Understanding the different sections of your policy is essential. These sections typically include:

- Declarations Page: This page summarizes your policy’s key details, such as your name, address, policy number, coverage limits, and premium amount.

- Insuring Agreement: This section Artikels the insurer’s promise to provide coverage for specific perils or events.

- Exclusions: This section specifies the events or circumstances that are not covered by your policy.

- Conditions: This section details the responsibilities of both the insured and the insurer, including procedures for filing claims and handling disputes.

Endorsements and Riders

Endorsements and riders are additional coverage options that can be added to your policy to provide more comprehensive protection. These can include:

- Flood Insurance: Provides coverage for damage caused by flooding, which is typically excluded from standard homeowner’s insurance policies.

- Earthquake Insurance: Offers protection against damage caused by earthquakes, which is often not covered by standard policies.

- Personal Property Coverage: Provides additional coverage for valuable items like jewelry, artwork, or electronics.

- Liability Coverage: Extends coverage for personal liability beyond the standard limits.

Filing a Claim

Filing a claim with your insurance company involves the following steps:

- Report the Claim: Contact your insurance company immediately after an insured event occurs.

- Provide Necessary Documentation: You’ll likely need to provide documentation such as police reports, medical records, or repair estimates.

- Cooperate with the Insurance Company: Respond promptly to any requests for information or inspections.

- Review the Claim Settlement: Carefully review the claim settlement offer to ensure it accurately reflects your losses.

Preventing Losses and Saving Money

In Florida’s unique insurance landscape, where natural disasters are frequent and insurance costs can be high, proactive measures can significantly reduce your risk and potentially save you money. By implementing preventative strategies, you can minimize the likelihood of claims, lower your premiums, and ultimately safeguard your financial well-being.

Home Security Systems and Safety Measures

Investing in home security systems can significantly lower your insurance premiums. These systems act as a deterrent to potential burglars and can help reduce the risk of property damage.

- Alarm Systems: Installing a professionally monitored alarm system can alert authorities in case of an intrusion, increasing the chances of catching criminals and preventing damage.

- Security Cameras: Surveillance cameras can deter crime and provide valuable evidence in case of a break-in. They can also help in identifying perpetrators and recovering stolen property.

- Motion Sensors: Motion sensors installed around your property can detect movement and trigger alarms, alerting you to potential intruders.

Good Driving Habits and a Clean Driving Record

Maintaining a clean driving record and practicing safe driving habits can significantly reduce your car insurance premiums. By avoiding accidents and traffic violations, you demonstrate responsible driving behavior, which insurance companies reward with lower rates.

- Defensive Driving: Taking a defensive driving course can help you learn strategies to avoid accidents and stay safe on the road.

- Speed Limits: Adhering to speed limits is crucial for preventing accidents and ensuring your safety.

- Distracted Driving: Avoiding distractions while driving, such as using mobile phones or eating, can significantly reduce the risk of accidents.

- DWI/DUI: Driving under the influence of alcohol or drugs is a serious offense that can result in high insurance premiums and even license suspension.

Conclusion

Navigating Florida’s home and car insurance market can be a complex endeavor, but understanding the nuances of this unique landscape is essential for securing adequate coverage and minimizing costs. By carefully comparing quotes, understanding the factors that influence premiums, and taking advantage of available discounts, you can find the right insurance policy to protect your assets and provide peace of mind. Remember to review your policy regularly and consult with a qualified insurance agent to ensure you have the coverage you need.

FAQ Corner

What are the mandatory car insurance coverages in Florida?

Florida requires all drivers to carry Personal Injury Protection (PIP) and Property Damage Liability (PDL) insurance. PIP covers medical expenses for the insured and passengers in their vehicle, while PDL covers damages to other vehicles or property in an accident.

How do I know if I need flood insurance in Florida?

While standard homeowners insurance policies do not cover flood damage, flood insurance is available through the National Flood Insurance Program (NFIP). If you live in a flood-prone area, you may be required to purchase flood insurance as a condition of your mortgage.

What factors affect my car insurance premiums in Florida?

Car insurance premiums in Florida are influenced by factors such as your driving history, the type of vehicle you drive, your age, and your location. Good driving habits, choosing a safer vehicle, and maintaining a clean driving record can help lower your premiums.