Car insurance plant city florida – Car insurance in Plant City, Florida, is a necessity for all drivers, and understanding the nuances of this complex system can be overwhelming. From determining the right coverage to finding the best rates, navigating the world of car insurance requires careful consideration. This guide delves into the essential aspects of car insurance in Plant City, Florida, providing insights into factors that influence premiums, types of coverage, and tips for finding the best deals.

Plant City, Florida, offers a unique driving environment, with its blend of suburban and rural areas. This diversity influences car insurance rates, as factors like traffic patterns, accident rates, and local laws play a role in determining premiums. Understanding these factors is crucial for making informed decisions about your car insurance coverage.

Understanding Car Insurance in Plant City, Florida

Plant City, Florida, is a vibrant community with a growing population. As residents navigate the roads, securing adequate car insurance is crucial. Understanding the factors that influence premiums, available coverage options, and common misconceptions can help you make informed decisions and ensure you have the right protection.

Factors Influencing Car Insurance Premiums in Plant City, Florida

Several factors play a role in determining car insurance premiums in Plant City, Florida. These factors are evaluated by insurance companies to assess risk and set premiums accordingly.

- Driving History: Your driving record, including accidents, traffic violations, and DUI convictions, significantly impacts your premium. A clean driving history generally translates to lower premiums.

- Age and Gender: Younger drivers, particularly those under 25, often face higher premiums due to their higher risk of accidents. Gender can also influence rates, as statistics show that males tend to have more accidents than females.

- Vehicle Type and Value: The make, model, and year of your vehicle influence your premium. High-performance or luxury vehicles typically have higher premiums due to their higher repair costs and greater risk of theft.

- Location: Your address in Plant City, Florida, can affect your premium. Areas with higher crime rates or more frequent accidents may have higher insurance rates.

- Credit Score: In many states, including Florida, insurance companies can use your credit score as a factor in determining your premium. A good credit score generally indicates financial responsibility and can lead to lower rates.

- Coverage Levels: The type and amount of coverage you choose will also impact your premium. Comprehensive and collision coverage, while providing greater protection, generally result in higher premiums.

Types of Car Insurance Coverage Available in Plant City, Florida

Understanding the different types of car insurance coverage available is essential for making informed decisions about your policy. Here are some common types of coverage:

- Liability Coverage: This coverage protects you financially if you cause an accident that results in injuries or damage to another person’s property. It typically includes bodily injury liability and property damage liability coverage.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of fault. Collision coverage is usually optional, but it’s often required if you have a car loan or lease.

- Comprehensive Coverage: This coverage protects your vehicle from damage caused by events other than accidents, such as theft, vandalism, fire, or natural disasters. Comprehensive coverage is usually optional, but it’s often required if you have a car loan or lease.

- Personal Injury Protection (PIP): This coverage, required in Florida, pays for medical expenses and lost wages for you and your passengers, regardless of fault.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): This coverage protects you if you’re involved in an accident with a driver who is uninsured or underinsured. It covers your medical expenses, lost wages, and property damage.

Common Car Insurance Myths and Misconceptions in Plant City, Florida, Car insurance plant city florida

There are several common misconceptions about car insurance that can lead to uninformed decisions. Here are some of them:

- Myth: You don’t need car insurance if you drive infrequently. Fact: Even if you drive infrequently, it’s essential to have car insurance. You could still be held liable for damages if you cause an accident.

- Myth: If you’re a good driver, you don’t need as much coverage. Fact: Accidents can happen to anyone, and having adequate coverage is crucial to protect you from financial ruin. Even if you’re a good driver, it’s essential to have sufficient liability coverage to protect others.

- Myth: Car insurance rates are the same for everyone. Fact: Car insurance rates vary widely based on factors like driving history, age, vehicle type, and location. It’s important to compare quotes from different insurance companies to find the best rate for your specific situation.

Finding the Right Car Insurance in Plant City, Florida

Navigating the world of car insurance in Plant City, Florida, can feel overwhelming. With numerous providers offering various coverage options, finding the right policy that suits your needs and budget can be challenging. This section will guide you through the process of comparing quotes, understanding the benefits of working with a local agent, and identifying the key factors to consider when choosing a car insurance policy.

Comparing Car Insurance Quotes

To find the best car insurance policy, comparing quotes from different providers is essential. Several online tools and resources can help you get multiple quotes quickly and efficiently.

- Online Comparison Websites: Websites like Compare.com, Policygenius, and The Zebra allow you to enter your information once and receive quotes from multiple insurance companies. These websites simplify the comparison process and save you time.

- Insurance Company Websites: You can also directly visit the websites of individual insurance companies, such as Geico, State Farm, Progressive, and Allstate, to get quotes. This allows you to explore their specific coverage options and discounts.

- Local Insurance Agents: Local insurance agents can provide personalized guidance and help you compare quotes from multiple companies. They often have access to exclusive discounts and promotions that may not be available online.

Benefits of Working with a Local Insurance Agent

Working with a local insurance agent in Plant City can offer several advantages.

- Personalized Service: Local agents understand the unique needs and challenges of drivers in Plant City. They can provide tailored advice and recommendations based on your specific circumstances.

- Local Expertise: Local agents are familiar with the local driving conditions, accident statistics, and insurance regulations. They can help you navigate the complexities of Florida’s insurance market.

- Relationship Building: Building a relationship with a local agent can be beneficial in the long run. They can be your advocate in case of an accident or claim, ensuring you receive the best possible support and outcome.

Key Factors to Consider When Choosing a Car Insurance Policy

Several key factors should be considered when choosing a car insurance policy in Plant City, Florida.

- Coverage Options: Florida requires drivers to have at least the following coverage:

- Liability Coverage: This protects you financially if you cause an accident that injures someone or damages their property.

- Personal Injury Protection (PIP): This covers your medical expenses, regardless of who is at fault in an accident.

- Property Damage Liability (PDL): This covers damages to another person’s vehicle or property if you cause an accident.

However, you may want to consider additional coverage options, such as collision coverage, comprehensive coverage, uninsured motorist coverage, and underinsured motorist coverage, to protect yourself financially in various situations.

- Deductibles: Deductibles are the amounts you pay out of pocket before your insurance coverage kicks in. Higher deductibles typically result in lower premiums, while lower deductibles mean higher premiums. Choose a deductible that fits your budget and risk tolerance.

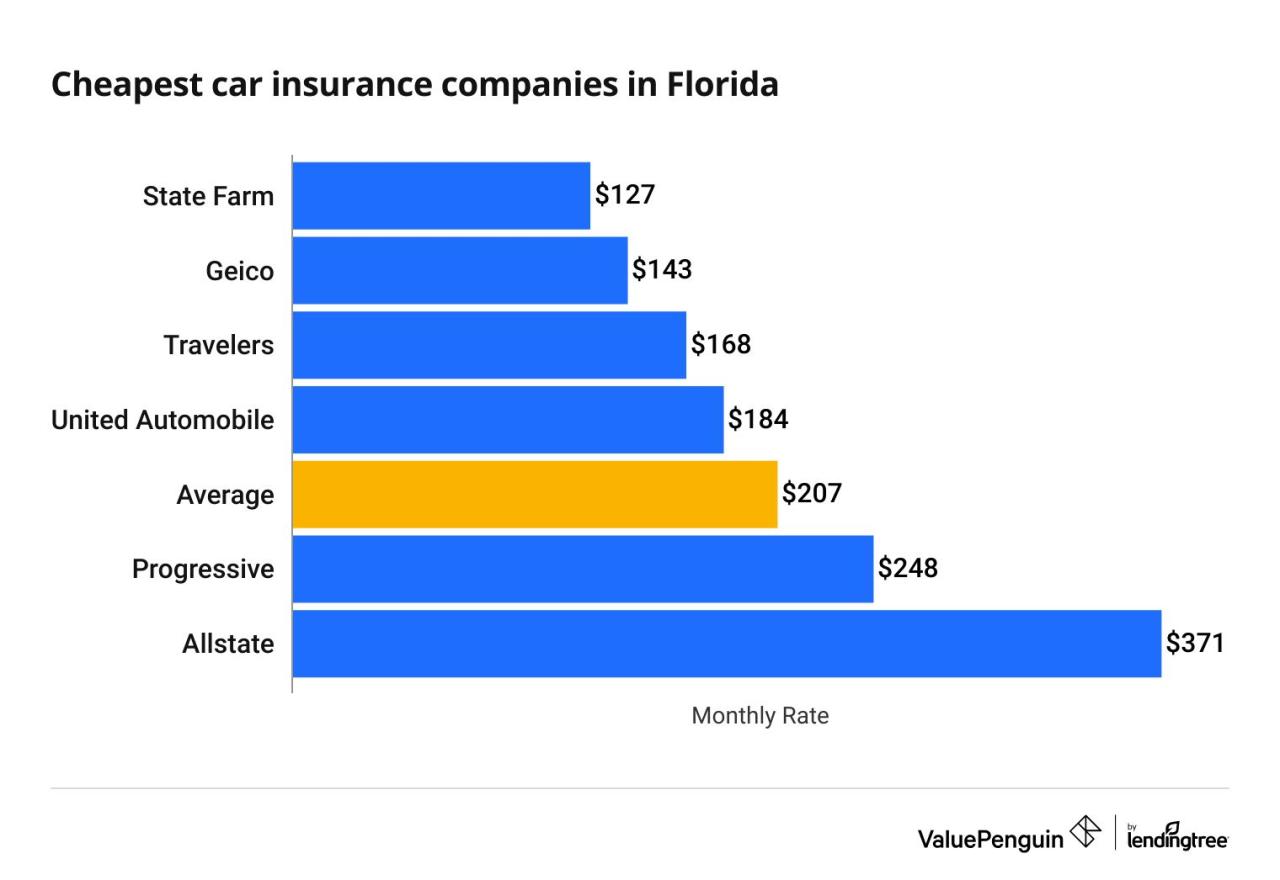

- Premiums: Premiums are the monthly payments you make for your car insurance. Several factors can influence your premiums, including your age, driving history, credit score, vehicle type, and location. Compare quotes from multiple providers to find the most competitive rates.

- Discounts: Many insurance companies offer discounts for various factors, such as good driving records, safety features in your vehicle, bundling multiple insurance policies, and being a member of certain organizations. Ask about available discounts to potentially lower your premiums.

Car Insurance and Driving in Plant City, Florida: Car Insurance Plant City Florida

Plant City, Florida, is a vibrant community with a unique driving environment. Understanding the local traffic patterns, road conditions, and safety tips can significantly impact your car insurance premiums and overall driving experience.

Traffic Patterns and Road Conditions

Traffic patterns in Plant City can be influenced by several factors, including:

- Seasonal Influx: Plant City experiences a surge in traffic during peak tourist seasons, especially during the winter months. This increased congestion can lead to more accidents and higher insurance premiums.

- Agricultural Activity: Plant City is known as the “Winter Strawberry Capital of the World,” with significant agricultural activity. Heavy truck traffic and farm equipment on roads can increase the risk of accidents and impact insurance rates.

- Growth and Development: Plant City is experiencing rapid growth, leading to new construction projects and increased traffic volume. This can result in road closures, detours, and higher accident rates, impacting insurance costs.

Impact on Car Insurance Rates

Local traffic patterns and road conditions directly influence car insurance rates in Plant City.

- Increased Accident Rates: Higher traffic volume and congestion often lead to more accidents. Insurance companies consider accident frequency in a region when determining premiums, so higher accident rates can result in higher insurance costs.

- Severity of Accidents: Road conditions, such as potholes, uneven surfaces, and narrow roads, can contribute to more severe accidents. This can lead to higher repair costs and increased insurance premiums.

- Risk Assessment: Insurance companies use data and statistics to assess risk in different areas. Areas with high accident rates and challenging road conditions are typically considered higher risk, leading to higher insurance premiums.

Driving Safety Tips to Reduce Insurance Premiums

Implementing safe driving practices can help reduce your insurance premiums. Here are some tips:

- Defensive Driving: Be aware of your surroundings, anticipate potential hazards, and maintain a safe distance from other vehicles. This can significantly reduce your risk of accidents.

- Avoid Distractions: Refrain from using your phone, texting, or engaging in other distracting activities while driving. Focusing on the road is crucial for safe driving.

- Obey Traffic Laws: Follow speed limits, stop signs, and traffic signals. Driving safely and responsibly can lower your risk of accidents and insurance premiums.

- Maintain Your Vehicle: Regular maintenance, including oil changes, tire rotations, and brake checks, can help prevent mechanical issues that could lead to accidents.

Car Insurance Costs in Plant City Compared to Nearby Cities

| City | Average Annual Car Insurance Cost |

|—|—|

| Plant City, FL | $1,600 |

| Tampa, FL | $1,800 |

| Lakeland, FL | $1,500 |

| Orlando, FL | $1,900 |

| Miami, FL | $2,200 |

Note: These are average costs and can vary based on factors like driving history, age, vehicle type, and coverage levels.

Car Insurance Resources in Plant City, Florida

Finding the right car insurance in Plant City can be a daunting task, but luckily, you have access to various resources that can help you navigate the process and make informed decisions. This section explores some of the most reputable car insurance providers operating in Plant City and highlights local resources that can provide valuable information and assistance.

Reputable Car Insurance Providers in Plant City, Florida

Finding a car insurance provider that suits your needs and budget is crucial. Several reputable companies operate in Plant City, Florida, offering various coverage options and competitive rates. Here are some of the top car insurance providers in the area:

- State Farm: State Farm is a well-known and trusted national insurance provider with a strong presence in Plant City. They offer a wide range of insurance products, including car insurance, and are known for their excellent customer service.

- Geico: Geico is another popular national insurance company known for its competitive rates and convenient online and mobile services. They offer various car insurance plans to cater to different needs and budgets.

- Progressive: Progressive is a leading national insurance company with a focus on personalized coverage options. They offer various discounts and features, including their popular “Name Your Price” tool, allowing customers to find coverage that fits their budget.

- Allstate: Allstate is a well-established national insurance provider offering comprehensive car insurance plans and excellent customer support. They also offer various discounts and programs to help customers save on their premiums.

- Florida Peninsula Insurance Company: Florida Peninsula is a regional insurance company specializing in providing affordable car insurance to Florida residents. They offer various coverage options and discounts tailored to the unique needs of Florida drivers.

It’s essential to compare quotes from multiple providers before making a decision. Consider factors like coverage options, deductibles, discounts, and customer service when choosing the right car insurance provider for you.

Local Resources for Car Insurance Information and Assistance in Plant City, Florida

In addition to national insurance providers, Plant City offers various local resources that can provide valuable information and assistance with car insurance.

- Plant City Chamber of Commerce: The Plant City Chamber of Commerce can provide information on local insurance providers and other resources related to car insurance. They also offer networking opportunities with local businesses and professionals.

- Florida Department of Financial Services: The Florida Department of Financial Services (DFS) is a state agency responsible for regulating insurance companies and protecting consumers. Their website provides valuable information on car insurance, including consumer rights and how to file a complaint.

- Florida Office of Insurance Regulation: The Florida Office of Insurance Regulation (OIR) is another state agency responsible for regulating insurance companies and ensuring fair market practices. Their website provides information on car insurance rates, coverage options, and consumer protection.

- Local Insurance Brokers: Independent insurance brokers in Plant City can provide personalized advice and help you find the best car insurance policy for your needs. They often work with multiple insurance providers and can compare quotes from different companies.

These local resources can provide valuable insights and support as you navigate the car insurance process in Plant City.

Filing a Car Insurance Claim in Plant City, Florida

If you’re involved in a car accident, it’s crucial to file a claim with your insurance provider promptly. The following steps Artikel the general process for filing a car insurance claim in Plant City:

- Report the Accident to Your Insurance Company: Contact your insurance provider immediately after the accident to report the incident. Provide them with all the necessary details, including the date, time, location, and any injuries involved.

- Gather Information and Evidence: Collect all relevant information from the accident, including the other driver’s contact information, insurance details, and any witness statements. Take pictures of the damage to your vehicle and the accident scene.

- File a Claim Form: Your insurance provider will provide you with a claim form to complete. Be sure to fill it out accurately and thoroughly, including all the required information.

- Provide Supporting Documentation: Submit any supporting documentation, such as police reports, medical records, and repair estimates, to support your claim.

- Cooperate with Your Insurance Company: Be prepared to answer questions from your insurance company and cooperate with their investigation. They may request additional information or documentation to process your claim.

- Review and Negotiate Settlement: Once your insurance company has reviewed your claim, they will offer a settlement. You have the right to review the settlement offer and negotiate if you believe it’s not fair. You may need to consult with an attorney if you’re unable to reach a satisfactory agreement.

Following these steps will help ensure a smooth and efficient process when filing a car insurance claim in Plant City, Florida.

Epilogue

In conclusion, car insurance in Plant City, Florida, is an essential part of responsible driving. By understanding the key factors that influence premiums, exploring different coverage options, and utilizing available resources, drivers can find the right insurance policy to meet their needs and protect themselves financially. Remember, staying informed, comparing quotes, and practicing safe driving habits can lead to significant savings and peace of mind on the road.

Top FAQs

What are the common factors that affect car insurance rates in Plant City, Florida?

Several factors influence car insurance rates in Plant City, including your driving history, age, credit score, vehicle type, and coverage options. Understanding these factors can help you make informed decisions about your policy.

How can I find the best car insurance rates in Plant City, Florida?

To find the best car insurance rates, compare quotes from multiple providers. Utilize online comparison tools or contact local insurance agents to get personalized quotes. Remember to consider factors like coverage, deductibles, and discounts when comparing options.

What are some tips for improving my driving safety in Plant City, Florida?

To improve your driving safety, follow traffic laws, avoid distractions, maintain a safe distance from other vehicles, and be aware of your surroundings. Consider defensive driving courses to enhance your skills and reduce your risk of accidents.