Car insurance in Florida cost is a significant expense for many residents, influenced by a unique combination of factors. The Sunshine State’s hurricane risk, high population density, and frequent accidents contribute to higher premiums. Florida’s No-Fault insurance system also plays a crucial role, impacting coverage options and costs. Understanding the key factors that influence car insurance rates is essential for finding affordable coverage that meets your individual needs.

From vehicle type and driving history to credit score and coverage options, various elements come into play when determining your car insurance premiums. Additionally, demographic factors like age, gender, and marital status can also influence the cost. This comprehensive guide will explore the intricacies of Florida’s car insurance landscape, providing insights into how premiums are calculated and strategies for finding the best deals.

Understanding Florida’s Car Insurance Landscape: Car Insurance In Florida Cost

Florida’s car insurance landscape is unique and complex, influenced by a confluence of factors that drive costs higher than in many other states. This guide explores the key elements shaping Florida’s insurance market, providing insights into why car insurance in the Sunshine State can be a significant expense.

Hurricane Risk and Its Impact

Hurricanes are a significant threat to Florida, causing extensive damage to vehicles and property. Insurance companies factor in the high risk of hurricane damage when setting premiums, resulting in higher costs for Floridian drivers.

- Hurricane risk is a significant factor in determining car insurance rates. Insurance companies consider the likelihood and severity of hurricane events in specific areas, which directly impacts premiums.

- In the event of a hurricane, car insurance covers damage to vehicles, including wind damage, flooding, and debris impact. However, coverage limitations and deductibles may apply.

- Hurricane-related claims can lead to higher premiums for all policyholders, as insurance companies need to recoup losses from catastrophic events.

High Population Density and Traffic Congestion

Florida’s high population density and bustling cities contribute to a higher volume of traffic and accidents. The increased likelihood of accidents translates into higher insurance premiums for all drivers.

- Densely populated areas often experience heavier traffic, increasing the risk of collisions. This factor is factored into car insurance premiums, reflecting the increased likelihood of accidents.

- Traffic congestion can lead to more fender benders and minor accidents, further contributing to higher insurance claims and subsequent premium increases.

- The higher number of vehicles on the road in Florida also increases the risk of accidents, driving up the overall cost of insurance.

The Role of the Florida Department of Financial Services

The Florida Department of Financial Services (DFS) plays a crucial role in regulating the insurance industry, including car insurance. The DFS sets minimum coverage requirements, oversees rate filings, and investigates consumer complaints, aiming to ensure a fair and competitive market.

- The DFS reviews and approves insurance rate filings, ensuring that premiums are reasonable and justified. This process helps to prevent insurers from charging excessive rates.

- The DFS investigates consumer complaints against insurance companies, protecting policyholders from unfair practices and ensuring compliance with regulations.

- The DFS also promotes financial literacy and consumer education regarding car insurance, empowering Floridians to make informed decisions about their coverage.

Florida’s No-Fault Insurance System

Florida operates under a no-fault insurance system, meaning that drivers are required to carry Personal Injury Protection (PIP) coverage, which covers medical expenses and lost wages after an accident, regardless of fault.

- The no-fault system aims to simplify accident claims and reduce litigation. However, it also impacts insurance costs, as PIP coverage is mandatory and can contribute to higher premiums.

- PIP coverage typically covers medical expenses up to a certain limit, often $10,000. It also provides limited lost wage benefits, subject to specific requirements.

- While the no-fault system reduces litigation, it can lead to higher premiums due to the mandatory nature of PIP coverage and the potential for higher claims costs.

Key Factors Affecting Car Insurance Premiums

In Florida, like most states, car insurance premiums are influenced by a complex interplay of factors. These factors are carefully considered by insurance companies to assess the risk associated with insuring a particular driver and vehicle. Understanding these factors can empower you to make informed decisions that could potentially lower your insurance costs.

Vehicle Type, Age, and Model

The type, age, and model of your vehicle significantly impact your insurance premiums.

- Vehicle Type: Sports cars, SUVs, and luxury vehicles are generally considered higher risk due to their performance capabilities and higher repair costs. Therefore, they typically command higher premiums compared to sedans or hatchbacks.

- Vehicle Age: Newer vehicles often come with advanced safety features and are less prone to mechanical failures, leading to lower insurance premiums. Older vehicles, on the other hand, may have higher premiums due to their potential for breakdowns and higher repair costs.

- Vehicle Model: Some car models are known for their safety features and lower repair costs, while others may have a history of accidents or expensive repairs. Insurance companies carefully analyze historical data on vehicle models to determine their risk profiles and adjust premiums accordingly.

Driving History

Your driving history plays a crucial role in determining your insurance premiums.

- Accidents: Any accidents you’ve been involved in, regardless of fault, will likely increase your premiums. The severity of the accident, the number of accidents, and the time since the last accident are all considered by insurance companies.

- Traffic Violations: Speeding tickets, DUI convictions, and other traffic violations can significantly increase your premiums. These violations indicate a higher risk of future accidents and are seen as a reflection of your driving habits.

Credit Score, Car insurance in florida cost

In Florida, insurance companies can use your credit score as a factor in determining your premiums.

- Credit Score and Risk: Insurance companies have found a correlation between credit score and driving behavior. Individuals with lower credit scores tend to have a higher risk of filing insurance claims. Therefore, a lower credit score can lead to higher premiums.

Coverage Options

The type and amount of coverage you choose will directly impact your insurance premiums.

- Liability Coverage: Higher liability limits offer greater protection in case of an accident but come at a higher cost.

- Collision and Comprehensive Coverage: These coverages protect you from damage to your own vehicle, but opting for higher deductibles can lower your premiums.

Demographics

Demographic factors like age, gender, and marital status can also influence insurance premiums.

- Age: Younger drivers often have less experience and are statistically more likely to be involved in accidents, leading to higher premiums. As drivers gain experience and age, premiums typically decrease.

- Gender: Historically, men have been statistically more likely to be involved in accidents than women, resulting in higher premiums for men. However, this trend is gradually changing, and some insurance companies are now offering gender-neutral rates.

- Marital Status: Married individuals tend to have lower premiums compared to single individuals. This is often attributed to the assumption that married drivers may have more stable lifestyles and are less likely to engage in risky behaviors.

Exploring Different Coverage Options

Florida’s car insurance landscape offers a variety of coverage options, each designed to protect you in different scenarios. Understanding the benefits and drawbacks of each coverage is crucial for making informed decisions that align with your individual needs and risk tolerance.

Liability Coverage

Liability coverage is mandatory in Florida, and it protects you financially if you cause an accident that results in injuries or property damage to others. It covers the costs of:

- Medical expenses for the other driver and passengers

- Property damage to the other vehicle

- Lost wages for the other driver

- Pain and suffering

Liability coverage is typically expressed as two numbers, such as 100/300/50, which represent:

- $100,000: Maximum amount paid per person for bodily injury

- $300,000: Maximum amount paid per accident for bodily injury

- $50,000: Maximum amount paid per accident for property damage

While Florida’s minimum liability limits are 10/20/10, it’s advisable to have higher limits, as a single accident can quickly exceed these minimums.

Collision Coverage

Collision coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of fault. This coverage is optional, but it’s often recommended for newer vehicles or those with significant loan balances.

Comprehensive Coverage

Comprehensive coverage protects your vehicle against damage caused by non-collision events, such as:

- Theft

- Vandalism

- Fire

- Hail

- Flooding

Like collision coverage, comprehensive coverage is optional and is generally recommended for newer or more expensive vehicles.

Personal Injury Protection (PIP)

PIP coverage, also known as “no-fault” insurance, covers your medical expenses and lost wages, regardless of fault, following an accident. In Florida, PIP coverage is mandatory, with a minimum coverage limit of $10,000.

Uninsured/Underinsured Motorist Coverage

This coverage protects you if you’re involved in an accident with a driver who doesn’t have insurance or has insufficient coverage. It covers your medical expenses, lost wages, and property damage.

Finding Affordable Car Insurance

Securing affordable car insurance in Florida is a priority for many drivers. With various factors influencing premiums, it’s essential to understand the available options and strategies for finding the best deals.

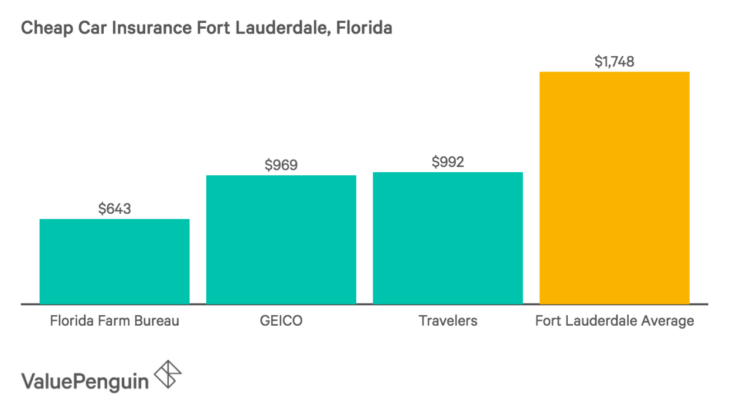

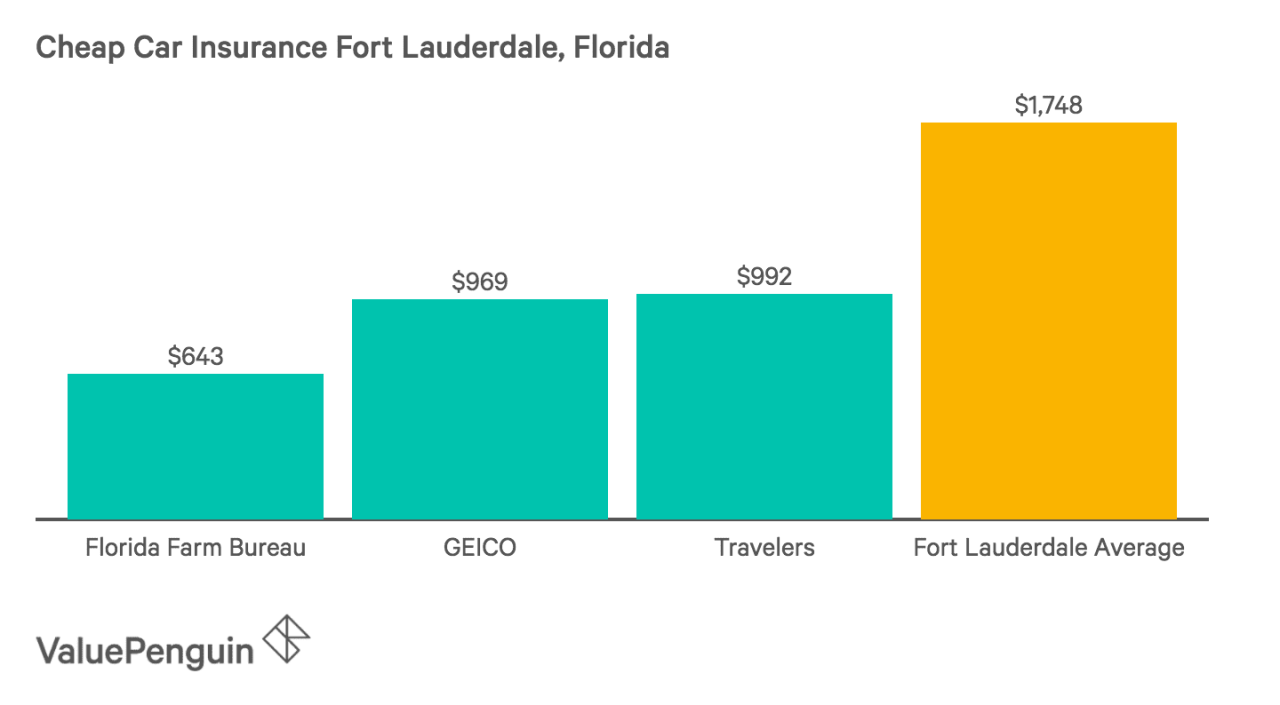

Comparing Top Car Insurance Providers

To help you make an informed decision, here’s a comparison of top car insurance providers in Florida based on key factors:

| Provider | Customer Satisfaction | Claim Handling | Average Premiums |

|---|---|---|---|

| State Farm | High | Excellent | Competitive |

| Geico | High | Good | Competitive |

| Progressive | Moderate | Good | Competitive |

| Allstate | Moderate | Good | Slightly Higher |

| USAA | High | Excellent | Competitive |

This table provides a general overview. It’s crucial to obtain personalized quotes from multiple providers to compare rates accurately.

Obtaining Car Insurance Quotes

To obtain car insurance quotes, follow these steps:

- Gather your personal information: This includes your driver’s license number, Social Security number, vehicle information, and driving history.

- Contact multiple insurance providers: You can obtain quotes online, over the phone, or by visiting an insurance agent in person. Be sure to provide accurate information to ensure accurate quotes.

- Compare quotes carefully: Review each quote thoroughly, paying attention to coverage options, deductibles, and premiums. Consider factors like customer service, claims handling, and financial stability of the provider.

- Negotiate for a better rate: Once you’ve identified a provider you’re interested in, don’t hesitate to negotiate for a lower rate. You can leverage discounts, such as bundling policies, increasing deductibles, or taking defensive driving courses.

Negotiating Lower Insurance Rates

Here are some effective strategies for negotiating lower insurance rates:

- Bundle your policies: Combining your car insurance with other policies, such as homeowners or renters insurance, can often result in significant discounts.

- Increase your deductibles: A higher deductible means you pay more out of pocket in case of an accident but can lead to lower premiums. It’s important to choose a deductible you can comfortably afford.

- Take a defensive driving course: Completing a defensive driving course can demonstrate your commitment to safe driving and qualify you for discounts. These courses are often offered online or in person.

- Maintain a clean driving record: Avoiding traffic violations and accidents is crucial for keeping your premiums low. A clean driving record is a significant factor in determining your insurance rate.

- Shop around regularly: It’s a good practice to compare rates from different providers periodically, even if you’re satisfied with your current insurance. The market is constantly changing, and you might find better deals elsewhere.

Understanding Discounts and Savings

Lowering your car insurance costs in Florida is possible by taking advantage of the numerous discounts available. These discounts can significantly reduce your premiums, making insurance more affordable. By understanding the different types of discounts and how to qualify for them, you can potentially save a considerable amount of money.

Types of Discounts

Florida car insurance companies offer a wide range of discounts, allowing policyholders to reduce their premiums. These discounts can be categorized into several groups:

- Safe Driver Discounts: These discounts reward drivers with a clean driving record, demonstrating responsible driving habits. Typically, drivers who haven’t been involved in accidents or received traffic violations for a certain period, often three to five years, are eligible for these discounts. The specific requirements and discount amounts may vary depending on the insurance company.

- Good Student Discounts: These discounts are available to students who maintain a good academic standing. To qualify, students must typically have a specific GPA or be enrolled in a specific program. This discount acknowledges the responsibility and maturity associated with academic success, often leading to lower insurance premiums.

- Multi-Car Discounts: Insuring multiple vehicles with the same insurance company can result in significant savings. These discounts recognize that multiple vehicles under one policy indicate a greater commitment to the insurer, leading to lower premiums for each vehicle.

- Other Common Discounts: Besides the aforementioned discounts, Florida insurance companies offer a variety of other discounts. These can include:

- Loyalty Discounts: Long-term customers who have maintained their insurance policy for a significant period are often rewarded with loyalty discounts.

- Bundling Discounts: Bundling your car insurance with other types of insurance, such as homeowners or renters insurance, can lead to significant savings. This approach demonstrates a strong relationship with the insurer, often resulting in lower premiums.

- Safety Feature Discounts: Vehicles equipped with safety features like anti-theft devices, airbags, or anti-lock brakes may qualify for discounts. These features reduce the risk of accidents and damage, making the vehicle less risky to insure.

- Payment Discounts: Paying your insurance premiums in full or opting for automatic payments can result in a discount. This approach simplifies the billing process and reduces administrative costs for the insurance company, leading to lower premiums for the policyholder.

Qualifying for and Applying for Discounts

The process of qualifying for and applying for car insurance discounts can vary depending on the insurance company. However, the general process typically involves:

- Contacting your insurance company: The first step is to contact your insurance company and inquire about the discounts they offer. You can do this by phone, email, or visiting their website.

- Providing required documentation: You will likely need to provide documentation to verify your eligibility for specific discounts. This may include:

- Proof of good driving record: For safe driver discounts, you may need to provide your driving history report, which can be obtained from the Florida Department of Motor Vehicles (DMV).

- Academic transcripts: For good student discounts, you will likely need to provide your academic transcripts or a letter of enrollment from your school.

- Vehicle registration: For multi-car discounts, you will need to provide proof of ownership and registration for all vehicles you wish to insure.

- Proof of safety features: For safety feature discounts, you may need to provide documentation or a copy of your vehicle’s specifications showing the installed safety features.

- Reviewing your policy: Once your eligibility has been verified, the insurance company will review your policy and apply the applicable discounts. You will then receive a revised policy with the updated premium.

Potential Savings

The potential savings from car insurance discounts can vary depending on the specific discounts you qualify for and the insurance company you choose. However, these discounts can significantly reduce your premiums.

| Discount Type | Potential Savings |

|---|---|

| Safe Driver Discount | 10-20% |

| Good Student Discount | 5-15% |

| Multi-Car Discount | 10-25% |

| Loyalty Discount | 5-10% |

| Bundling Discount | 10-20% |

| Safety Feature Discount | 5-15% |

| Payment Discount | 2-5% |

Remember: The actual savings you receive may vary depending on your individual circumstances. Contact your insurance company for specific details about the discounts available and their potential impact on your premiums.

Final Review

Navigating the world of car insurance in Florida can seem daunting, but with a clear understanding of the key factors, coverage options, and available discounts, you can find affordable insurance that provides the protection you need. By comparing quotes from multiple providers, negotiating rates, and taking advantage of available discounts, you can secure the best possible coverage at a price that fits your budget. Remember, knowledge is power, and being informed about your options is crucial for making smart decisions about your car insurance.

Expert Answers

What are the main reasons why car insurance is more expensive in Florida?

Florida’s high population density, frequent accidents, and susceptibility to hurricanes contribute to higher car insurance premiums. The state’s No-Fault insurance system also impacts costs.

How does my driving history affect my car insurance rates?

A clean driving record with no accidents or traffic violations will generally result in lower premiums. However, accidents and violations can significantly increase your rates.

Can I bundle my car and home insurance to save money?

Yes, bundling your car and home insurance policies with the same provider can often lead to significant discounts.

What are some common car insurance discounts available in Florida?

Common discounts include safe driver, good student, multi-car, and defensive driving course discounts.