Car insurance Florida rates are a significant expense for residents, and understanding how they are determined is crucial for finding the best coverage at the most affordable price. Florida’s unique insurance landscape, including its no-fault system and regulatory environment, plays a key role in shaping insurance costs. This comprehensive guide explores the factors that influence Florida car insurance rates, offering valuable insights for drivers seeking to make informed decisions about their coverage.

From driving history and vehicle type to coverage levels and discounts, numerous factors contribute to the final cost of car insurance in Florida. This guide delves into each of these elements, providing a detailed analysis of how they impact your premiums. Additionally, we explore strategies for finding affordable car insurance, including tips for comparing quotes, negotiating lower premiums, and understanding the benefits of working with an independent insurance agent.

Understanding Florida Car Insurance Rates

Navigating the complex world of Florida car insurance rates can feel overwhelming. A multitude of factors come into play, influencing the final cost of your policy. Understanding these factors is crucial to securing the most affordable and comprehensive coverage for your needs.

Factors Influencing Florida Car Insurance Rates

Several factors contribute to the determination of car insurance rates in Florida. These factors are grouped into categories:

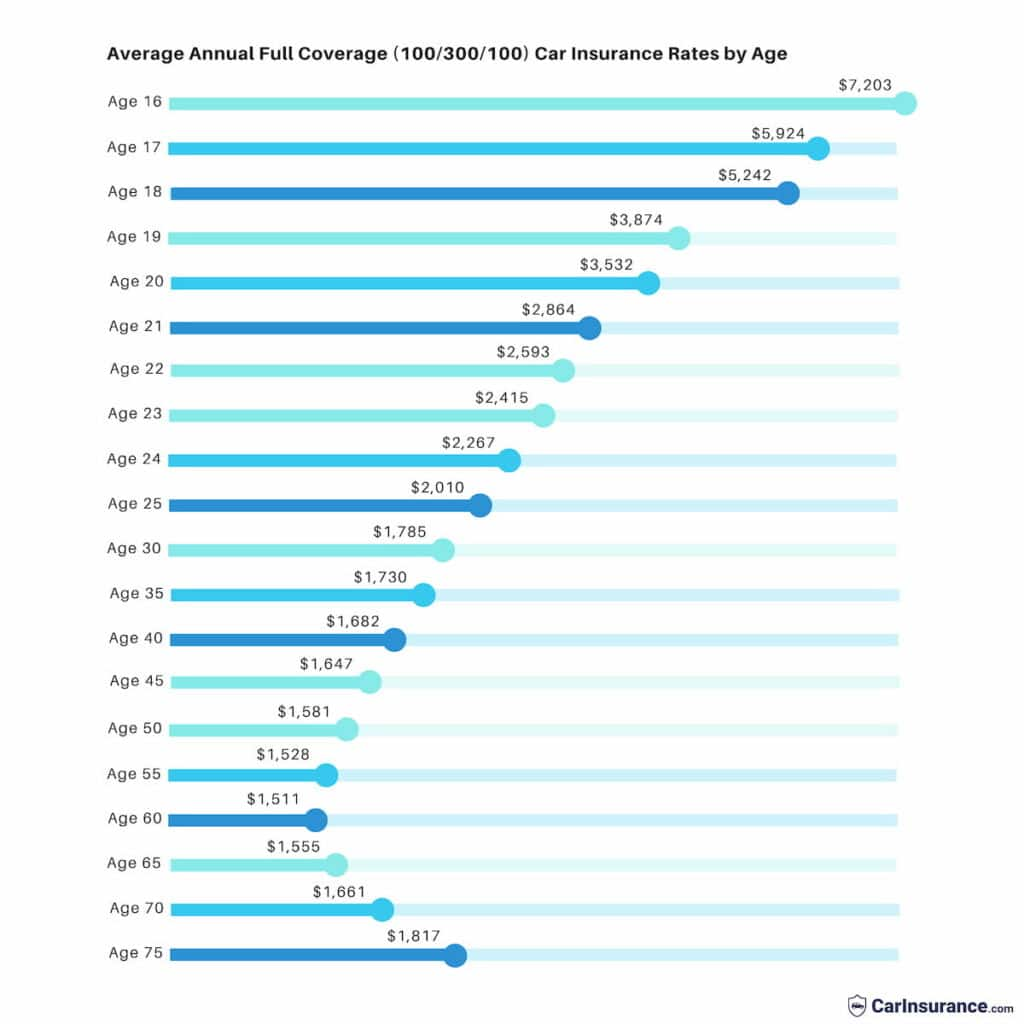

- Demographics: Your age, gender, and marital status are considered. Generally, younger drivers with less experience pay higher premiums than older, more experienced drivers.

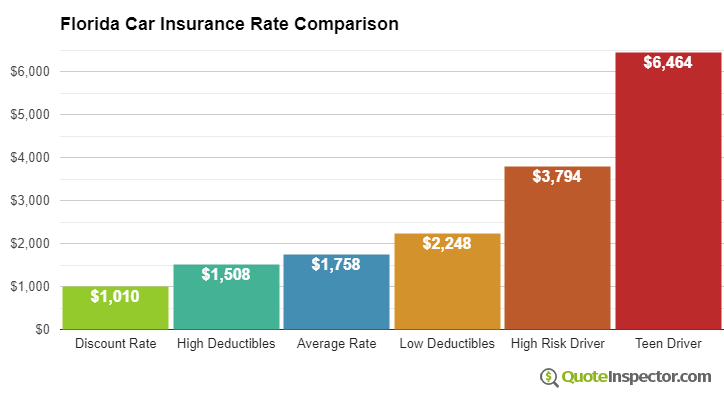

- Driving History: Your driving record holds significant weight. Accidents, traffic violations, and DUI convictions can lead to significantly higher premiums. Maintaining a clean driving record is crucial to securing affordable rates.

- Vehicle Type: The make, model, and year of your vehicle play a role in determining your insurance rates. Luxury or high-performance vehicles often attract higher premiums due to their potential for greater repair costs.

- Coverage Levels: The type and amount of coverage you choose significantly impact your premiums. Comprehensive and collision coverage, which protect against damage from various events, typically cost more than liability coverage, which primarily protects against financial losses to others in an accident.

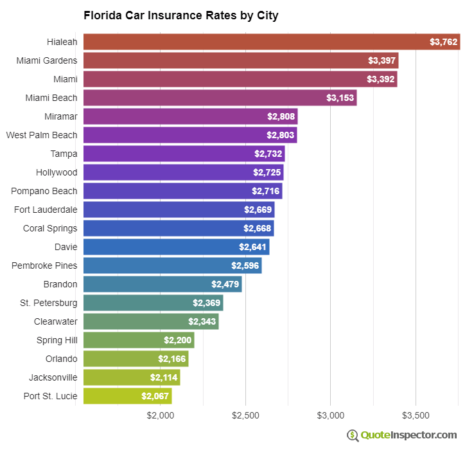

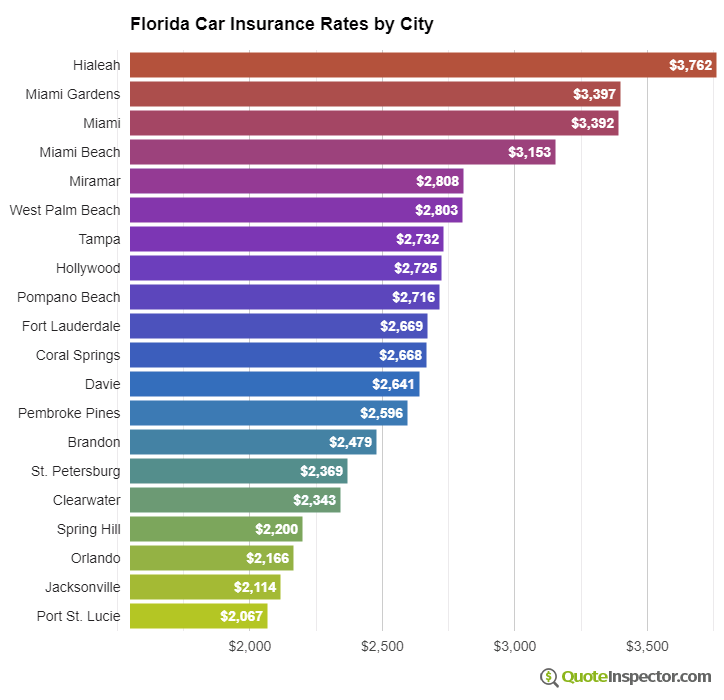

- Location: Your address impacts your rates. Areas with higher rates of accidents or crime generally have higher premiums.

- Credit Score: In some cases, insurers consider your credit score as a factor in determining your rates. This practice is controversial, and some states have banned it.

Impact of Florida’s No-Fault Insurance System

Florida operates under a no-fault insurance system. This means that after an accident, each driver files a claim with their own insurance company, regardless of who caused the accident. This system aims to streamline the claims process and reduce litigation.

However, Florida’s no-fault system has a unique aspect known as “Personal Injury Protection” (PIP). PIP coverage provides medical benefits to the policyholder, regardless of fault. This coverage is mandatory in Florida and must be at least $10,000. The mandatory nature of PIP coverage contributes to higher premiums compared to states with optional or lower minimum PIP requirements.

Florida Department of Financial Services (DFS)

The Florida Department of Financial Services (DFS) plays a crucial role in regulating the insurance industry in Florida. The DFS is responsible for:

- Licensing and overseeing insurance companies operating in the state.

- Enforcing insurance laws and regulations.

- Protecting consumers from unfair or deceptive insurance practices.

- Investigating complaints against insurance companies.

- Providing information and resources to consumers about insurance.

The DFS works to ensure a fair and competitive insurance market, safeguarding the interests of both consumers and insurers.

Key Factors Affecting Rates

Several factors influence car insurance rates in Florida, and understanding these factors can help you make informed decisions to potentially lower your premiums. These factors fall into several categories, including driving history, vehicle type, coverage levels, and other personal details.

Driving History

Your driving history is a significant factor in determining your car insurance rates. Insurance companies carefully analyze your past driving record, looking for any incidents that might increase your risk of future accidents.

- Accidents: Any at-fault accidents you’ve been involved in will likely lead to higher premiums. The severity of the accident, the number of accidents, and the time since the accidents occurred all play a role.

- Violations: Traffic violations, such as speeding tickets, running red lights, or reckless driving, can also raise your insurance rates. The severity of the violation and the frequency of violations impact the increase.

- DUI Convictions: Driving under the influence (DUI) convictions have the most significant impact on your insurance rates. Insurance companies view DUI as a serious risk factor, and your rates may increase substantially or even result in policy cancellation.

Vehicle Type

The type of vehicle you drive also affects your car insurance rates. Insurance companies categorize vehicles based on their safety features, repair costs, and theft risk.

- Sedans: Sedans are generally considered safer and less expensive to repair than other vehicle types, leading to lower insurance rates.

- SUVs and Trucks: SUVs and trucks are typically larger and heavier, making them more expensive to repair in the event of an accident. They may also be at a higher risk of theft, leading to higher insurance premiums.

- Sports Cars: Sports cars are often associated with higher speeds and a higher risk of accidents. They also tend to be more expensive to repair, leading to higher insurance rates.

Coverage Levels

The amount of coverage you choose significantly impacts your insurance costs. Higher coverage levels provide more financial protection but also come with higher premiums.

- Liability Coverage: This coverage protects you financially if you cause an accident that results in injuries or property damage to others. Higher liability limits offer greater financial protection but also come with higher premiums.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of who’s at fault. Collision coverage is optional, but it’s often required if you have a car loan or lease.

- Comprehensive Coverage: This coverage protects you from losses caused by non-accident events, such as theft, vandalism, or natural disasters. Comprehensive coverage is optional, but it’s often a good idea to have it, especially if your vehicle is new or has a high value.

Finding Affordable Car Insurance in Florida: Car Insurance Florida Rates

Navigating the complex world of car insurance in Florida can be daunting, especially when you’re looking for the most affordable option. This section will equip you with strategies and tools to find the best car insurance coverage at a price that fits your budget.

Comparing Car Insurance Quotes, Car insurance florida rates

Before committing to a specific insurance policy, it’s crucial to compare quotes from multiple providers. This allows you to identify the best coverage at the most competitive price. Here’s a guide to comparing car insurance quotes:

- Gather your information: To receive accurate quotes, be prepared to provide your driving history, vehicle information, and personal details. This includes your name, address, date of birth, and social security number.

- Use online comparison tools: Many websites, like Policygenius, allow you to compare quotes from multiple insurance providers simultaneously. This saves time and effort compared to contacting each company individually.

- Consider various coverage options: Don’t just focus on the price; ensure the coverage meets your needs. Compare liability limits, comprehensive and collision coverage, and optional add-ons like roadside assistance or rental car reimbursement.

- Check for discounts: Many insurers offer discounts for good driving records, safety features in your car, multiple policy bundling, and more. Ask about these discounts and ensure they are reflected in the quotes you receive.

Negotiating Lower Premiums

Once you have a few quotes, you can explore strategies to negotiate lower premiums:

- Bundle your policies: Many insurers offer discounts when you bundle your car insurance with other policies, such as homeowners or renters insurance. This can lead to significant savings.

- Increase your deductible: A higher deductible means you pay more out of pocket if you have an accident, but it can lower your premium. This can be a good option if you have a good driving record and can afford a higher deductible.

- Consider a usage-based insurance program: Some insurers offer programs that track your driving habits, rewarding safe drivers with lower premiums. This can be a good option if you’re a cautious driver.

- Shop around regularly: Insurance rates can fluctuate, so it’s a good idea to compare quotes from different providers every year or two to ensure you’re getting the best deal.

Seeking Advice from an Independent Insurance Agent

While online comparison tools can be helpful, consider consulting an independent insurance agent. They can provide personalized guidance and access to a broader range of insurance providers, helping you find the most suitable coverage at the most competitive price.

- Independent agents act as your advocate: They represent your interests and work to find the best policy for your needs, not just the one that benefits a specific insurance company.

- Access to a wider network: Independent agents can compare quotes from multiple insurance companies, giving you a broader selection of options.

- Personalized advice: They can provide expert advice tailored to your specific situation, helping you understand your coverage options and make informed decisions.

Insurance Coverage Options in Florida

Florida car insurance offers various coverage options to protect you and your vehicle in the event of an accident. Understanding the different types of coverage and their limits is crucial for choosing the right protection for your individual needs and budget. This section delves into the key types of car insurance coverage available in Florida, explaining their features, benefits, and implications.

Liability Coverage

Liability coverage is the most basic type of car insurance, and it is required by law in Florida. This coverage protects you financially if you cause an accident that results in injury or damage to another person or their property. It covers the costs of:

- Bodily Injury Liability: Covers medical expenses, lost wages, and other damages for injuries to others involved in an accident caused by you.

- Property Damage Liability: Covers repairs or replacement costs for damage to another person’s vehicle or property caused by you.

Liability coverage limits are expressed as a pair of numbers, such as 100/300/50. These numbers represent the maximum amount the insurance company will pay per accident, as follows:

- First Number: Maximum amount paid for bodily injury per person.

- Second Number: Maximum amount paid for bodily injury per accident.

- Third Number: Maximum amount paid for property damage per accident.

For instance, a 100/300/50 policy would pay up to $100,000 per person for bodily injury, up to $300,000 total for bodily injury per accident, and up to $50,000 for property damage per accident.

Collision Coverage

Collision coverage protects your vehicle against damage resulting from a collision with another vehicle or object, regardless of who is at fault. This coverage pays for repairs or replacement of your vehicle, minus your deductible.

The deductible is the amount you pay out-of-pocket before your insurance kicks in. For example, if you have a $500 deductible and your vehicle suffers $2,000 in damage, you would pay $500, and your insurance would cover the remaining $1,500.

Comprehensive Coverage

Comprehensive coverage protects your vehicle against damage from events other than collisions, such as theft, vandalism, fire, hail, or natural disasters. Like collision coverage, comprehensive coverage also has a deductible that you must pay before your insurance covers the remaining costs.

Personal Injury Protection (PIP)

PIP coverage, also known as “no-fault” insurance, covers your own medical expenses and lost wages after an accident, regardless of who is at fault. It is mandatory in Florida, and you must carry at least $10,000 in PIP coverage.

PIP coverage can be a valuable asset in Florida, as it can help you cover medical bills and lost income even if you are not at fault for the accident. It can also help you avoid a lawsuit against the other driver, which can be a complex and time-consuming process.

Closure

Navigating the complexities of car insurance in Florida can be daunting, but armed with the right knowledge and resources, drivers can find the coverage they need at a price they can afford. By understanding the factors that influence rates, exploring different coverage options, and utilizing available resources, you can make informed decisions about your car insurance and ensure you are adequately protected while minimizing your costs.

Detailed FAQs

What is the average car insurance rate in Florida?

Average car insurance rates in Florida vary depending on factors like age, driving history, vehicle type, and coverage levels. However, it’s generally higher than the national average due to Florida’s unique insurance landscape.

What is the no-fault insurance system in Florida?

Florida operates under a no-fault insurance system, where drivers are required to carry Personal Injury Protection (PIP) coverage. This coverage pays for medical expenses and lost wages regardless of fault in an accident.

How can I get a discount on my car insurance in Florida?

There are various discounts available, including safe driving discounts, good student discounts, multi-car discounts, and bundling discounts for combining auto and home insurance.