Finding the best and cheapest car insurance in Florida can be a challenge, given the state’s unique factors that influence insurance costs. Florida boasts a high population density, experiences frequent weather events, and has a significant number of uninsured drivers. These factors all contribute to higher premiums, making it crucial for Florida residents to shop around and compare rates from multiple insurers. The Florida Department of Financial Services regulates the car insurance market, ensuring fairness and transparency. Florida offers various car insurance coverage options, each designed to protect you financially in different scenarios.

Understanding the factors that determine individual car insurance premiums is essential. Your driving history, age, the type of vehicle you drive, your location, and even your credit score can all impact your insurance rates. Different driving violations can significantly increase your premiums, so maintaining a clean driving record is essential. The type of coverage you choose, such as liability, collision, and comprehensive coverage, will also affect your rates. It’s important to weigh the risks and benefits of each coverage option to determine the best fit for your needs.

Understanding Florida’s Car Insurance Landscape: Best And Cheapest Car Insurance In Florida

Florida’s car insurance market is unique and complex, influenced by several factors that contribute to its high costs. Understanding these factors is crucial for navigating the insurance landscape and finding the best and most affordable coverage.

Factors Influencing Car Insurance Costs in Florida

Several factors contribute to the high cost of car insurance in Florida. These include:

- High Population Density: Florida is a densely populated state, leading to increased traffic congestion and a higher likelihood of accidents. This increased risk translates into higher insurance premiums.

- Frequent Weather Events: Florida is prone to hurricanes, severe thunderstorms, and other weather events that can cause significant damage to vehicles. Insurance companies factor in these risks when setting premiums.

- High Rate of Uninsured Drivers: Florida has a high number of uninsured drivers, making it more likely for insured drivers to be involved in accidents with uninsured motorists. This increases the risk for insurance companies, resulting in higher premiums for insured drivers.

- Fraudulent Claims: Florida has a history of insurance fraud, which contributes to higher premiums for all drivers. Insurance companies must account for the potential for fraudulent claims when setting rates.

Role of the Florida Department of Financial Services

The Florida Department of Financial Services (DFS) plays a crucial role in regulating the state’s car insurance market. The DFS:

- Licenses and Supervises Insurance Companies: The DFS ensures that insurance companies meet specific financial and operational requirements to operate in Florida.

- Protects Consumers: The DFS investigates consumer complaints and takes action against insurance companies that engage in unfair or deceptive practices.

- Regulates Rates: The DFS reviews and approves insurance rates to ensure they are fair and reasonable.

- Promotes Competition: The DFS encourages competition among insurance companies to offer consumers a wider range of choices and lower premiums.

Types of Car Insurance Coverage in Florida

Florida law requires drivers to carry at least the following minimum car insurance coverage:

- Personal Injury Protection (PIP): This coverage pays for medical expenses and lost wages for the insured driver and passengers, regardless of who caused the accident. It is mandatory in Florida.

- Property Damage Liability (PDL): This coverage pays for damage to the other driver’s vehicle or property if the insured driver is at fault in an accident. It is mandatory in Florida.

In addition to these mandatory coverages, drivers can choose to purchase other optional coverages, such as:

- Collision Coverage: This coverage pays for damage to the insured driver’s vehicle in an accident, regardless of fault.

- Comprehensive Coverage: This coverage pays for damage to the insured driver’s vehicle caused by events other than collisions, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): This coverage protects the insured driver in the event of an accident with an uninsured or underinsured driver.

Factors Affecting Car Insurance Rates

In Florida, car insurance premiums are calculated based on a complex set of factors that assess the risk associated with each individual driver. These factors are carefully considered to ensure that premiums accurately reflect the likelihood of an accident and the potential cost of claims. Understanding these factors can help you make informed decisions to potentially lower your insurance costs.

Driving History

Your driving history plays a significant role in determining your car insurance premiums. A clean driving record with no accidents or violations will typically result in lower rates. However, any incidents, such as traffic tickets, accidents, or DUI convictions, can significantly increase your premiums. The severity of the violation and the frequency of incidents will influence the impact on your rates. For instance, a speeding ticket might lead to a modest increase, while a DUI conviction could result in a substantial premium hike.

“The impact of driving violations on car insurance rates varies depending on the severity of the violation, the driver’s history, and the insurance company’s policies.”

Age

Age is another crucial factor that insurance companies consider. Younger drivers, especially those under 25, are statistically more likely to be involved in accidents. This increased risk is reflected in higher premiums for younger drivers. As drivers age and gain more experience, their premiums tend to decrease.

“Insurance companies typically offer lower rates to drivers over 25, as they are generally considered to be more experienced and responsible.”

Vehicle Type

The type of vehicle you drive also influences your insurance premiums. Sports cars and luxury vehicles are often more expensive to repair or replace, leading to higher insurance costs. Conversely, smaller and less expensive vehicles generally have lower insurance premiums.

“The value of your vehicle, its safety features, and its theft risk all contribute to your insurance rates.”

Location

Your location in Florida can significantly affect your car insurance rates. Areas with higher crime rates, denser traffic, or a greater frequency of accidents typically have higher premiums.

“Urban areas with heavy traffic and higher crime rates often have higher insurance premiums compared to rural areas.”

Credit Score

Surprisingly, your credit score can also impact your car insurance premiums in some states, including Florida. Insurance companies use credit scores as a proxy for financial responsibility, believing that individuals with good credit are more likely to pay their bills on time, including their insurance premiums.

“While not universally used, some insurance companies in Florida use credit scores to assess risk and determine premiums.”

Coverage Type

The type of coverage you choose for your car insurance policy also plays a major role in determining your premiums. Liability coverage, which is required in Florida, covers damages to other people and their property in case of an accident. Collision coverage pays for repairs to your vehicle if you are involved in an accident, regardless of who is at fault. Comprehensive coverage protects your vehicle from damage caused by non-collision events, such as theft, vandalism, or natural disasters. The more coverage you choose, the higher your premiums will be.

“Selecting the right coverage levels for your needs is crucial to finding affordable car insurance in Florida.”

Finding Affordable Car Insurance Options

Navigating the car insurance market in Florida can feel overwhelming, but finding affordable options is achievable with a little research and strategic planning. This section will equip you with the knowledge and tools to make informed decisions and secure the best possible rates.

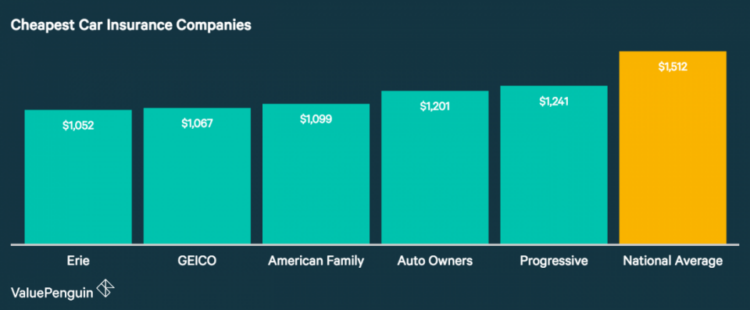

Comparing Top Car Insurance Providers

To help you narrow down your choices, we’ve compiled a table comparing five of the top car insurance providers in Florida based on average premium, customer satisfaction, and coverage options. Remember that individual rates can vary based on factors like your driving history, vehicle type, and location.

| Provider | Average Premium | Customer Satisfaction | Coverage Options |

|—|—|—|—|

| State Farm | $1,500 | 4.5/5 | Comprehensive, Collision, Liability, Uninsured/Underinsured Motorist |

| Geico | $1,400 | 4.2/5 | Comprehensive, Collision, Liability, Uninsured/Underinsured Motorist |

| Progressive | $1,350 | 4.0/5 | Comprehensive, Collision, Liability, Uninsured/Underinsured Motorist, Personal Injury Protection (PIP) |

| Allstate | $1,600 | 4.3/5 | Comprehensive, Collision, Liability, Uninsured/Underinsured Motorist, Medical Payments Coverage |

| USAA | $1,200 | 4.7/5 | Comprehensive, Collision, Liability, Uninsured/Underinsured Motorist, Rental Reimbursement |

Obtaining Car Insurance Quotes

To find the most competitive rates, it’s essential to obtain quotes from multiple providers. Follow these steps to streamline the process:

1. Gather your information: Before contacting insurers, have your driver’s license, vehicle information (make, model, year), and any relevant details about your driving history readily available.

2. Utilize online quote tools: Many insurance companies offer online quote tools that allow you to quickly compare rates without providing personal information.

3. Contact insurers directly: Once you’ve narrowed down your choices, contact insurers directly to discuss your specific needs and obtain personalized quotes.

4. Compare quotes side-by-side: Once you have quotes from multiple providers, carefully compare them based on coverage options, premiums, and customer service.

5. Choose the best option: Select the insurance provider that offers the best combination of price, coverage, and customer satisfaction.

Negotiating Lower Premiums

While you can’t always control factors like your driving history or vehicle type, there are steps you can take to potentially lower your premiums:

* Shop around regularly: Don’t settle for your current insurer’s rates. Get quotes from other providers every year to ensure you’re getting the best deal.

* Bundle your policies: Combining your car insurance with other policies, such as homeowners or renters insurance, can lead to significant discounts.

* Improve your driving record: Maintain a clean driving record by avoiding traffic violations and accidents.

* Consider a higher deductible: Choosing a higher deductible can reduce your monthly premiums. However, ensure you can afford to pay the deductible in case of an accident.

* Ask about discounts: Many insurers offer discounts for things like good grades, safe driving courses, and installing anti-theft devices.

* Pay your premium in full: Paying your premium annually or semi-annually can often result in lower rates than monthly payments.

* Negotiate with your current insurer: Don’t be afraid to negotiate with your current insurer. If you’ve been a loyal customer with a good driving record, they may be willing to offer you a lower rate.

Minimizing Insurance Costs

While Florida’s car insurance landscape can be complex, understanding how to reduce your costs is crucial. Several strategies can help you save on your premiums. By implementing these tactics, you can lower your expenses and ensure you have the coverage you need without breaking the bank.

Increasing Deductibles

Your deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. Raising your deductible can significantly lower your premiums. This is because insurance companies are less likely to pay out claims if you have a higher deductible.

- Increased Deductibles: Lower Premiums: A higher deductible means you’ll pay more out-of-pocket in case of an accident. However, you’ll save on your monthly premiums.

- Assess Risk Tolerance: Consider your financial situation and risk tolerance when deciding on a deductible. A higher deductible might be suitable if you have a good emergency fund and are comfortable absorbing a larger upfront cost in case of an accident.

- Balance Savings and Risk: Carefully weigh the potential savings in premiums against the increased financial burden of a higher deductible. Make sure you can comfortably handle the deductible amount if you need to file a claim.

Taking Defensive Driving Courses, Best and cheapest car insurance in florida

Demonstrating your commitment to safe driving can earn you discounts. Defensive driving courses teach you valuable skills and strategies for avoiding accidents.

- Enhanced Driving Skills: These courses equip you with the knowledge and techniques to handle various driving situations more effectively, potentially reducing your risk of accidents.

- Lower Premiums: Insurance companies often offer discounts to drivers who complete approved defensive driving courses, recognizing their commitment to safety.

- Proof of Safe Driving: Successfully completing a defensive driving course provides concrete evidence of your commitment to safe driving, which can influence your insurance rates.

Maintaining a Good Driving Record

Your driving record is a significant factor in determining your insurance rates. A clean driving record demonstrates your responsibility and reduces your risk profile in the eyes of insurance companies.

- Avoid Traffic Violations: Speeding tickets, reckless driving citations, and other traffic violations can significantly increase your premiums.

- No Accidents: Accidents, even minor ones, can also negatively impact your rates.

- Positive Impact on Rates: A clean driving record reflects your responsible driving habits and can lead to lower insurance premiums.

Bundling Insurance Policies

Combining your car insurance with other types of insurance, such as home or renters insurance, can often result in significant savings. This is because insurance companies offer discounts for bundling multiple policies.

- Combined Coverage: Bundling allows you to manage all your insurance needs under one policy, simplifying your insurance administration.

- Discount Benefits: Insurance companies typically offer discounts for bundling multiple policies, recognizing the loyalty and reduced risk associated with multiple-policy customers.

- Cost-Effective Approach: Bundling can significantly lower your overall insurance costs, making it a financially advantageous strategy.

Epilogue

Navigating Florida’s car insurance landscape can be complex, but with the right knowledge and strategies, you can find affordable coverage that protects you financially. By understanding the factors that influence insurance costs, comparing quotes from multiple providers, and implementing cost-saving strategies, you can minimize your premiums and ensure you have the right coverage to protect yourself and others in case of an accident. Remember to review your insurance policy regularly and make adjustments as needed to ensure you’re getting the best value for your money.

FAQ Resource

What is the minimum car insurance coverage required in Florida?

Florida requires all drivers to have a minimum of $10,000 in Personal Injury Protection (PIP) coverage and $10,000 in Property Damage Liability (PDL) coverage.

What are the consequences of driving without car insurance in Florida?

Driving without car insurance in Florida is illegal and can result in fines, license suspension, and even jail time.

How can I get a discount on my car insurance in Florida?

There are several ways to get discounts on your car insurance in Florida, such as maintaining a good driving record, taking a defensive driving course, bundling your car insurance with other types of insurance, and installing safety features in your vehicle.

What is the best way to find the cheapest car insurance in Florida?

The best way to find the cheapest car insurance in Florida is to compare quotes from multiple providers. You can use online comparison tools or contact insurance agents directly.

What should I consider when choosing a car insurance provider in Florida?

When choosing a car insurance provider in Florida, consider factors such as price, coverage options, customer service, financial stability, and claims handling process.