Car insurance rates Florida are a hot topic for drivers in the Sunshine State. Florida’s unique climate, driving conditions, and insurance laws all play a role in determining how much you pay for car insurance. Understanding these factors can help you find affordable coverage and avoid costly mistakes.

This guide will delve into the key factors that affect car insurance rates in Florida, providing insights into how your driving history, demographics, and vehicle choice impact your premiums. We’ll also explore strategies for comparing quotes, lowering your costs, and navigating Florida’s unique insurance landscape.

Understanding Car Insurance Rates in Florida

Car insurance rates in Florida are among the highest in the nation, influenced by a complex interplay of factors that make the state a unique and challenging environment for insurers. Understanding these factors can help you navigate the process of finding affordable car insurance in Florida.

Factors Influencing Car Insurance Rates in Florida

Florida’s unique climate and driving conditions play a significant role in shaping car insurance rates. The state’s high population density, coupled with a large number of tourists and senior citizens, contributes to increased traffic congestion and accident rates. Moreover, Florida’s susceptibility to hurricanes and other natural disasters increases the risk of vehicle damage and insurance claims.

- Driving Record: Your driving history, including accidents, traffic violations, and DUI convictions, significantly impacts your insurance premiums. A clean driving record generally translates to lower rates.

- Vehicle Type and Value: The make, model, year, and value of your vehicle influence insurance costs. Luxury cars and high-performance vehicles are typically more expensive to insure due to their higher repair costs and increased risk of theft.

- Coverage Options: The types of coverage you choose, such as liability, collision, and comprehensive, directly affect your insurance premium. Higher coverage levels generally mean higher premiums.

- Credit Score: In Florida, insurers can use your credit score as a factor in determining your car insurance rates. Individuals with good credit scores generally receive lower rates than those with poor credit.

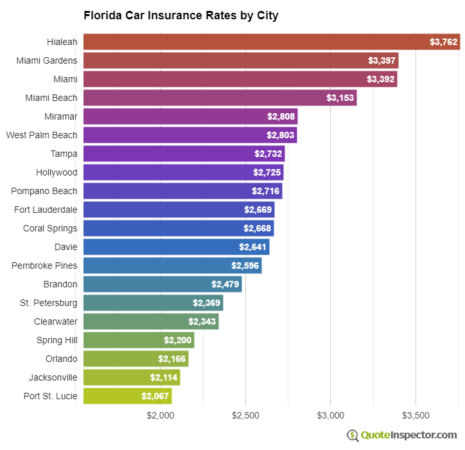

- Location: Your location in Florida plays a role in determining your insurance rates. Areas with higher accident rates or higher property values typically have higher insurance premiums.

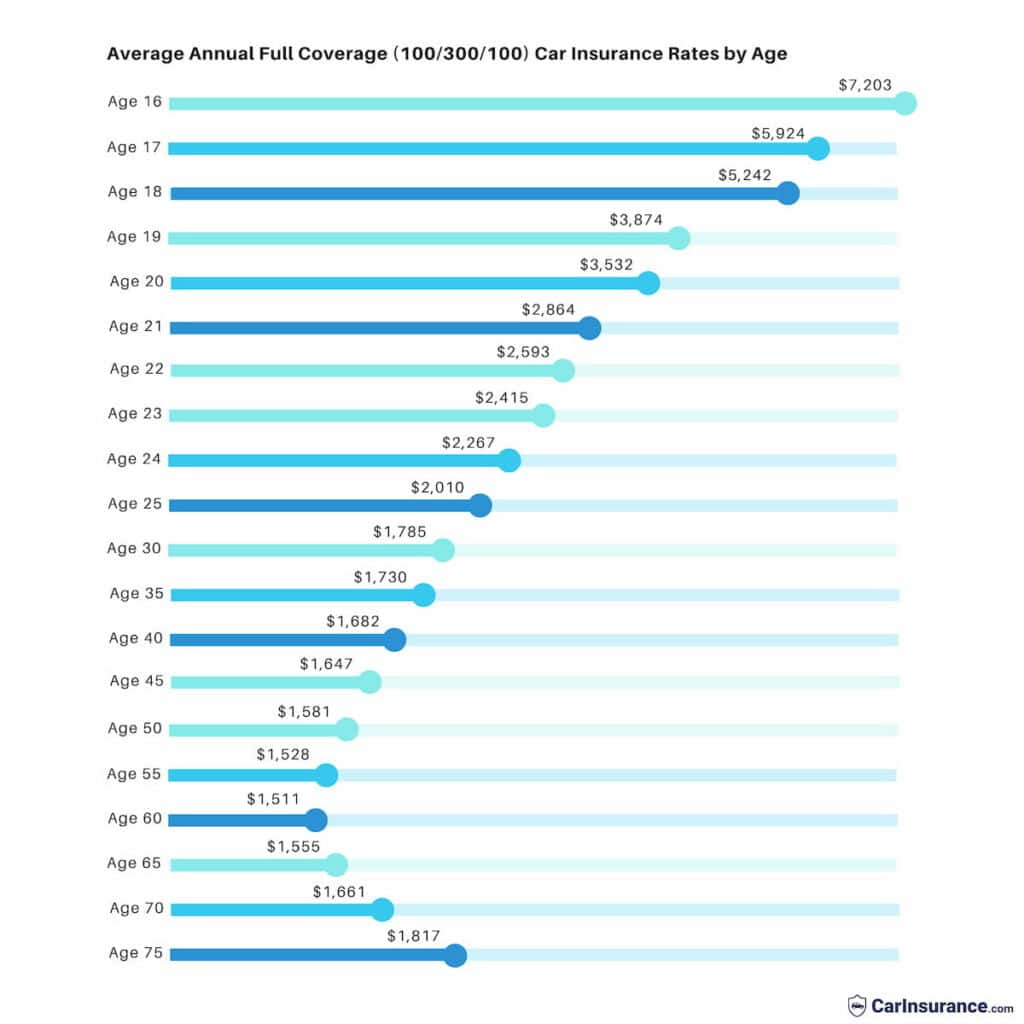

- Age and Gender: Younger drivers, particularly those under 25, tend to have higher insurance rates due to their higher risk of accidents. Gender can also play a role in determining insurance rates, although this is a controversial issue.

- Driving History: Your driving history, including accidents, traffic violations, and DUI convictions, significantly impacts your insurance premiums. A clean driving record generally translates to lower rates.

Key Factors Affecting Car Insurance Rates

Car insurance rates in Florida, like elsewhere, are influenced by a variety of factors. These factors are designed to assess the risk a driver poses to insurance companies. Understanding these factors can help you make informed decisions that might reduce your premiums.

Driving History, Car insurance rates florida

Your driving history is a significant factor in determining your car insurance rates. A clean driving record with no accidents, tickets, or DUI convictions will result in lower premiums. Conversely, any negative driving incidents can significantly increase your rates.

- Accidents: Each accident, regardless of fault, will likely raise your rates. The severity of the accident and the number of accidents will further influence the increase.

- Tickets: Traffic violations, such as speeding tickets or running red lights, can also increase your rates. The severity of the violation and the number of tickets you receive will affect the impact on your premiums.

- DUI Convictions: A DUI conviction is the most serious offense and will lead to a substantial increase in your insurance rates. Some insurers may even refuse to cover you after a DUI conviction.

Age and Gender

- Age: Younger drivers, especially those under 25, tend to have higher insurance rates due to their lack of experience and increased risk of accidents. As drivers gain experience and age, their rates typically decrease.

- Gender: Historically, insurance companies have found that men tend to have higher accident rates than women. As a result, men often pay slightly higher premiums than women. However, this trend is changing as women are increasingly involved in riskier driving behaviors.

Credit Score

Your credit score, surprisingly, can impact your car insurance rates. Insurance companies use credit scores as a proxy for risk assessment. Individuals with good credit scores are often considered less risky, and therefore, receive lower premiums.

Type of Car Driven

The type of car you drive plays a crucial role in your insurance costs.

- Make and Model: Certain car models are known for their safety features and lower repair costs, resulting in lower insurance premiums. Conversely, cars with a history of high repair costs or safety concerns tend to have higher premiums.

- Value: The value of your car is directly correlated with your insurance rates. More expensive cars typically cost more to insure because the potential repair costs and replacement value are higher.

- Engine Size: Cars with larger engines often have higher insurance rates due to their potential for higher speeds and increased risk of accidents.

Finding Affordable Car Insurance in Florida

Navigating the world of car insurance in Florida can be overwhelming, especially when trying to find the most affordable options. However, with a strategic approach, you can find coverage that fits your budget without compromising on necessary protection. This section will provide a guide to help you compare quotes, implement strategies to lower premiums, and identify resources for finding affordable car insurance options.

Comparing Car Insurance Quotes

Comparing quotes from different providers is crucial to finding the best deal. Here’s how to approach this process:

- Gather Your Information: Before contacting insurance companies, have your driver’s license, vehicle information (make, model, year), and any relevant details about your driving history (accidents, violations) readily available. This will streamline the quote process.

- Use Online Comparison Tools: Websites like PolicyGenius, NerdWallet, and The Zebra allow you to compare quotes from multiple insurers simultaneously. These tools are convenient and save you time.

- Contact Insurance Companies Directly: While online tools are helpful, don’t hesitate to contact insurance companies directly to discuss your specific needs and get personalized quotes. This allows you to ask questions and gain a deeper understanding of their coverage options.

- Compare Coverage and Deductibles: Don’t just focus on the premium amount. Compare the coverage offered by each insurer, including liability limits, collision and comprehensive coverage, and deductibles. Ensure you understand what each policy covers and the potential out-of-pocket expenses you might face in case of an accident.

Strategies for Lowering Car Insurance Premiums

Several strategies can help you lower your car insurance premiums in Florida. Here are some effective methods:

- Maintain a Good Driving Record: Your driving history significantly impacts your insurance premiums. Avoid traffic violations, accidents, and other incidents that could lead to higher rates. In Florida, points are assigned to your driving record for violations. The more points you accumulate, the higher your insurance premiums will be.

- Choose a Safe Vehicle: The type of vehicle you drive affects your insurance costs. Cars with safety features, good safety ratings, and lower theft rates tend to have lower premiums. For example, a Honda Civic generally has a lower insurance rate than a high-performance sports car.

- Increase Your Deductible: A higher deductible means you pay more out-of-pocket in case of an accident, but it can lead to lower premiums. Consider increasing your deductible if you can afford to pay a larger amount in the event of a claim. However, be sure to choose a deductible that you can comfortably afford.

- Bundle Your Policies: Many insurance companies offer discounts if you bundle your car insurance with other policies, such as homeowners or renters insurance. This can save you money on both policies.

- Take Defensive Driving Courses: Completing a defensive driving course can lower your premiums. These courses teach you safe driving techniques and can reduce your risk of accidents. Florida offers a driver improvement course for drivers with traffic violations, which can help lower your premiums.

- Ask About Discounts: Insurance companies offer various discounts, such as good student discounts, safe driver discounts, and discounts for anti-theft devices. Ask your insurer about all available discounts you may qualify for.

Resources for Finding Affordable Car Insurance

Several resources can help you find affordable car insurance options in Florida.

- Florida Office of Insurance Regulation: The Florida Office of Insurance Regulation (OIR) provides information on insurance companies, rates, and consumer rights. You can visit their website or call their hotline for assistance.

- Consumer Reports: Consumer Reports provides independent reviews and ratings of car insurance companies. Their website can help you compare providers and find the best options based on your needs.

- Local Insurance Agents: Talking to local insurance agents can provide personalized advice and help you find the best coverage at an affordable price. They can also help you understand the complexities of Florida’s insurance market.

- Community Organizations: Organizations like the Florida Consumer Action Network (FCAN) provide consumer education and advocacy services. They can offer resources and support if you are facing difficulties with your insurance company.

Florida’s Unique Insurance Landscape

Florida’s car insurance market is distinct from other states due to a combination of factors, including its no-fault insurance system, high number of uninsured drivers, and regulatory environment. Understanding these factors is crucial for navigating the complexities of car insurance in the Sunshine State.

The Role of the Florida Department of Financial Services

The Florida Department of Financial Services (DFS) plays a significant role in regulating the state’s car insurance market. The DFS is responsible for:

- Licensing and supervising insurance companies.

- Enforcing insurance laws and regulations.

- Investigating consumer complaints.

- Providing education and resources to consumers about insurance.

The DFS’s regulatory oversight aims to ensure fair and competitive pricing, protect consumers from fraud, and promote financial stability within the insurance industry.

Impact of Florida’s No-Fault Insurance System

Florida’s no-fault insurance system requires drivers to file claims with their own insurance company, regardless of who is at fault in an accident. This system is designed to streamline the claims process and reduce litigation. However, it can also lead to higher insurance premiums, as drivers are required to carry Personal Injury Protection (PIP) coverage, which covers medical expenses and lost wages.

Prevalence of Uninsured Drivers in Florida

Florida has a high prevalence of uninsured drivers, contributing to a more challenging insurance environment. The reasons for this include:

- The state’s large population and diverse demographics.

- The high cost of car insurance in Florida.

- The availability of alternative forms of transportation, such as public transportation and ride-sharing services.

The presence of uninsured drivers increases the risk for insured drivers, as they may be held financially liable for accidents caused by uninsured motorists. This risk is reflected in higher insurance premiums for insured drivers.

Common Car Insurance Mistakes to Avoid

Navigating the world of car insurance in Florida can be a complex process, and making the wrong choices can lead to financial hardship in the event of an accident. Understanding common mistakes drivers make when purchasing car insurance can help you make informed decisions and ensure you have adequate protection.

Choosing the Lowest Premium Without Considering Coverage

The allure of low premiums is understandable, but prioritizing cost over coverage can be a costly mistake. Inadequate insurance can leave you financially vulnerable if you’re involved in an accident.

- Underinsurance: This occurs when your insurance policy limits are too low to cover the full cost of damages or injuries caused by an accident. If you’re at fault and your coverage is insufficient, you may be personally liable for the remaining expenses, which could include medical bills, property damage, and legal fees.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): This coverage is crucial for protecting yourself in the event of an accident with a driver who has no insurance or insufficient coverage. Without UM/UIM, you may be responsible for covering your own medical expenses and vehicle repairs.

Conclusion

Navigating the world of car insurance in Florida can be challenging, but by understanding the factors that influence rates and following the tips Artikeld in this guide, you can find the right coverage at a price that fits your budget. Remember to shop around, compare quotes, and stay informed about Florida’s insurance laws and regulations.

General Inquiries: Car Insurance Rates Florida

What are the minimum car insurance requirements in Florida?

Florida is a no-fault insurance state, requiring drivers to carry Personal Injury Protection (PIP) coverage and Property Damage Liability (PDL) coverage. The minimum limits for PIP are $10,000 and for PDL are $10,000.

What is the average car insurance rate in Florida?

The average car insurance rate in Florida can vary significantly depending on individual factors. It’s best to get personalized quotes from multiple insurance providers to determine your specific rate.

How often can I expect my car insurance rates to change in Florida?

Car insurance rates in Florida can fluctuate based on various factors, including changes in your driving record, vehicle usage, and insurance company adjustments. It’s important to review your policy regularly and consider shopping around for better rates.