Car insurance prices in Florida can vary significantly depending on a number of factors. The state’s unique climate, demographics, and driving conditions all contribute to the cost of car insurance. Florida’s no-fault insurance system also plays a role in determining premiums.

This guide will explore the factors that influence car insurance prices in Florida, provide insights into average costs, and offer tips for saving money on your premiums. We’ll also cover the top car insurance companies in the state and the different coverage options available.

Factors Influencing Car Insurance Prices in Florida

Florida’s unique combination of climate, demographics, and driving conditions significantly impacts car insurance premiums. Understanding these factors is crucial for individuals seeking affordable coverage.

Florida’s Climate and Driving Conditions

Florida’s subtropical climate, with its frequent thunderstorms and hurricanes, increases the risk of car accidents and damage. Additionally, the state’s high population density and heavy traffic contribute to a higher frequency of collisions.

Impact of Florida’s No-Fault Insurance System

Florida’s no-fault insurance system requires drivers to file claims with their own insurance company, regardless of who is at fault. This system can lead to higher premiums due to the potential for more claims and increased costs for insurance companies.

Factors Contributing to Price Variations

- Age: Younger drivers are statistically more likely to be involved in accidents, leading to higher premiums. Conversely, older drivers with proven safe driving records often receive discounts.

- Driving History: A clean driving record with no accidents or traffic violations will result in lower premiums. However, accidents, speeding tickets, and DUI convictions can significantly increase costs.

- Vehicle Type: The type of vehicle you drive plays a crucial role in determining your insurance premium. Sports cars and luxury vehicles are generally more expensive to insure due to their higher repair costs and greater risk of theft.

- Coverage Levels: The amount of coverage you choose, such as liability limits, comprehensive, and collision coverage, will directly impact your premium. Higher coverage levels typically mean higher premiums.

Average Car Insurance Costs in Florida

Florida is a state with a high volume of traffic and a significant number of accidents. Consequently, car insurance premiums tend to be higher than in other states. Understanding the average costs in Florida is essential for making informed decisions about your insurance coverage.

Average Annual Car Insurance Premiums by Vehicle Type

The cost of car insurance in Florida varies based on the type of vehicle you drive.

- Sedans: The average annual premium for a sedan in Florida is around $2,000.

- SUVs: SUVs are typically more expensive to insure than sedans, with an average annual premium of about $2,500.

- Trucks: Pickup trucks and larger trucks are considered high-risk vehicles and often have the highest premiums, averaging around $3,000 per year.

- Sports Cars: Due to their higher performance and potential for accidents, sports cars also tend to have higher insurance premiums.

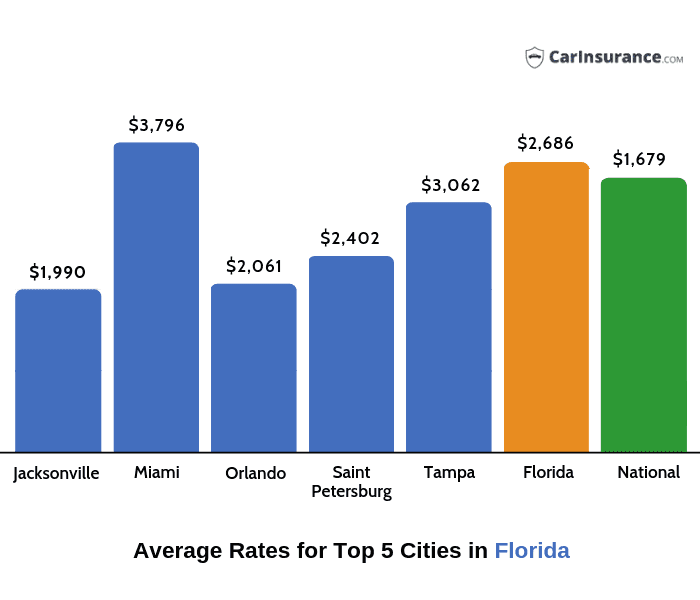

Average Car Insurance Costs in Major Florida Cities

Car insurance rates can vary significantly depending on the city you live in.

| City | Average Annual Premium |

|---|---|

| Miami | $2,300 |

| Orlando | $2,100 |

| Tampa | $2,000 |

Average Car Insurance Premiums for Different Driver Profiles

Car insurance premiums are also influenced by the driver’s profile, including age, driving record, and other factors.

| Driver Profile | Average Annual Premium Range |

|---|---|

| Young Drivers (Under 25) | $2,500 – $3,500 |

| Senior Citizens (Over 65) | $1,800 – $2,500 |

| Drivers with Good Driving Records | $1,500 – $2,200 |

| Drivers with Accidents or Violations | $2,800 – $4,000 |

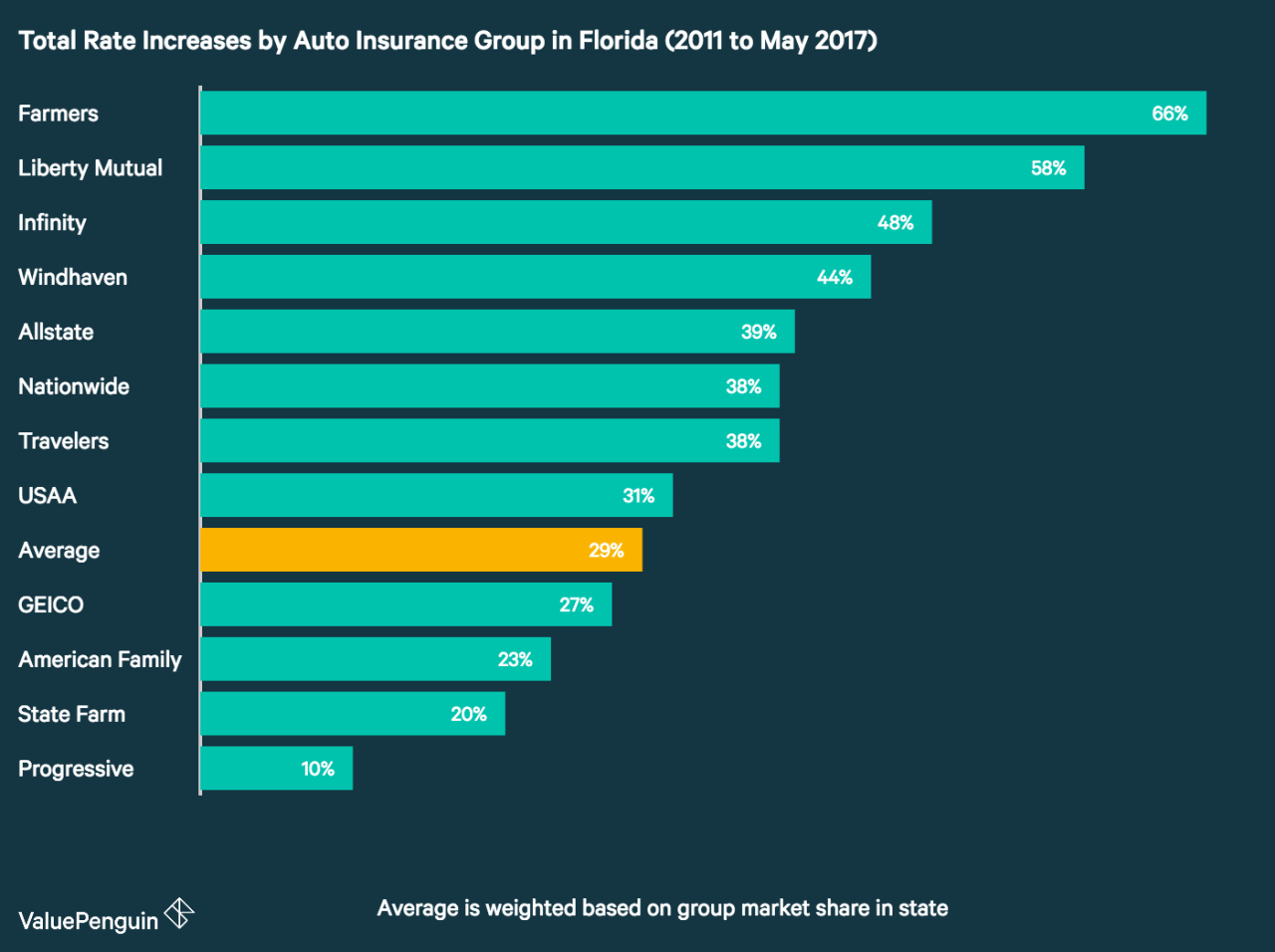

Top Car Insurance Companies in Florida

Choosing the right car insurance company in Florida is crucial for protecting your finances and ensuring you have adequate coverage in case of an accident. With numerous providers offering various plans and rates, finding the best fit for your needs can be overwhelming.

Top Car Insurance Providers in Florida

To help you make an informed decision, we have compiled a list of the top 10 car insurance providers in Florida based on market share and customer satisfaction.

| Company Name | Average Premium | Customer Reviews | Unique Features |

|---|---|---|---|

| State Farm | $2,000 | 4.5/5 | Wide range of coverage options, strong financial stability, excellent customer service |

| GEICO | $1,800 | 4.2/5 | Competitive rates, easy online quoting and policy management, 24/7 customer support |

| Progressive | $1,900 | 4.0/5 | Name Your Price tool, customizable coverage options, discounts for good drivers and safe vehicles |

| Allstate | $2,100 | 4.1/5 | Strong financial stability, multiple discounts, Drive Safe & Save program |

| USAA | $1,700 | 4.8/5 | Exclusive to military members and their families, excellent customer service, competitive rates |

| Florida Peninsula Insurance | $1,850 | 3.9/5 | Specialized in Florida property and casualty insurance, strong financial stability, competitive rates |

| Auto-Owners Insurance | $2,050 | 4.3/5 | Excellent customer service, strong financial stability, competitive rates |

| Nationwide | $2,150 | 4.2/5 | Wide range of coverage options, discounts for good drivers and safe vehicles, strong financial stability |

| Liberty Mutual | $1,950 | 4.0/5 | Competitive rates, discounts for good drivers and safe vehicles, strong financial stability |

| Farmers Insurance | $2,000 | 4.1/5 | Wide range of coverage options, discounts for good drivers and safe vehicles, strong financial stability |

Comparing Key Features, Coverage Options, and Pricing Strategies

While the average premiums listed above provide a general overview, it is essential to remember that individual rates can vary significantly based on factors like driving history, age, vehicle type, and location. Each company offers distinct features, coverage options, and pricing strategies, which we will explore further.

Coverage Options

Most car insurance companies in Florida offer standard coverage options, including:

* Liability Coverage: This covers damages to other people’s property or injuries caused by an accident.

* Collision Coverage: This covers damages to your vehicle in an accident, regardless of fault.

* Comprehensive Coverage: This covers damages to your vehicle from events like theft, vandalism, or natural disasters.

* Personal Injury Protection (PIP): This covers medical expenses for you and your passengers in an accident, regardless of fault.

* Uninsured/Underinsured Motorist Coverage (UM/UIM): This protects you in an accident caused by a driver without insurance or with insufficient coverage.

Pricing Strategies

Car insurance companies in Florida utilize various pricing strategies to attract customers and compete in the market. Some common strategies include:

* Discounts: Many companies offer discounts for good driving records, safe vehicles, multiple policies, and other factors.

* Bundling: Combining multiple insurance policies, such as car and homeowners, can often lead to significant discounts.

* Telematics Programs: These programs use technology to track your driving habits and reward safe driving with lower premiums.

* Usage-Based Insurance: This type of insurance calculates premiums based on your actual driving habits, such as mileage and time of day.

Unique Features

Each insurance company distinguishes itself with unique features and benefits to cater to specific customer needs. These features can include:

* Accident Forgiveness: Some companies waive your first accident, preventing a premium increase.

* Ride-Sharing Coverage: This coverage extends to accidents while driving for ride-sharing services like Uber or Lyft.

* Rental Car Reimbursement: This coverage helps pay for a rental car while your vehicle is being repaired.

* Roadside Assistance: This service provides help with flat tires, jump starts, and towing.

* 24/7 Customer Support: Some companies offer round-the-clock customer support for assistance with claims, policy changes, and other inquiries.

Tips for Saving on Car Insurance in Florida

Lowering your car insurance premiums in Florida can be a challenge, but with a little effort, you can save a significant amount of money. By understanding the factors that influence your rates and implementing some smart strategies, you can reduce your insurance costs and keep more money in your pocket.

Shop Around for Quotes

Comparing quotes from different insurance companies is crucial for finding the best rates. Each insurer uses its own pricing algorithms and factors, so you may find that one company offers a much better deal than others.

- Use online comparison tools: Websites like Policygenius, Insurify, and NerdWallet allow you to enter your information once and receive quotes from multiple insurers simultaneously. This saves you time and effort compared to contacting each company individually.

- Contact insurance agents directly: Some insurance agents work with multiple companies and can help you compare quotes from different insurers. They can also provide personalized advice based on your specific needs and circumstances.

- Consider local insurance companies: Local insurance companies often offer competitive rates, especially if you have a good driving record and live in a low-risk area.

Bundle Insurance Policies

Bundling your car insurance with other policies, such as homeowners or renters insurance, can result in significant discounts. Insurance companies often reward customers who bundle their policies by offering lower premiums.

- Homeowners or Renters Insurance: Combining your car insurance with homeowners or renters insurance can lead to discounts of 10% to 25% or more.

- Life Insurance: Some insurers offer discounts when you bundle car insurance with life insurance.

Maintain a Good Driving Record

Your driving record is a significant factor in determining your car insurance rates. A clean driving record with no accidents or violations will result in lower premiums.

- Avoid Traffic Violations: Speeding tickets, reckless driving citations, and other traffic violations can significantly increase your insurance rates.

- Drive Safely: Practice safe driving habits, such as obeying traffic laws, maintaining a safe distance from other vehicles, and avoiding distractions while driving.

- Take a Defensive Driving Course: Completing a defensive driving course can lower your insurance premiums in some states, including Florida. These courses teach you safe driving techniques and strategies to avoid accidents.

Increase Your Deductible

Your deductible is the amount you pay out of pocket before your insurance coverage kicks in. Increasing your deductible can lower your monthly premiums, as you are taking on more financial responsibility in case of an accident.

- Assess Your Risk Tolerance: Consider your financial situation and determine how much you can comfortably afford to pay in case of an accident.

- Increase Deductible Gradually: Instead of drastically increasing your deductible, consider gradually increasing it over time to adjust to the higher out-of-pocket costs.

Choose a Safer Vehicle, Car insurance prices in florida

The type of car you drive significantly influences your insurance rates. Vehicles with safety features like anti-lock brakes, airbags, and stability control are considered safer and often have lower insurance premiums.

- Research Vehicle Safety Ratings: Organizations like the Insurance Institute for Highway Safety (IIHS) and the National Highway Traffic Safety Administration (NHTSA) provide safety ratings for different vehicles.

- Consider Safety Features: Look for vehicles with features like anti-theft devices, anti-lock brakes, and electronic stability control, which can reduce your insurance premiums.

Car Insurance Coverage Options in Florida: Car Insurance Prices In Florida

Florida law requires drivers to carry specific types of car insurance coverage to protect themselves and others on the road. Understanding these coverage options is crucial for ensuring you have adequate financial protection in case of an accident.

Types of Car Insurance Coverage in Florida

Florida offers a variety of car insurance coverage options to meet different needs and budgets. Here’s a breakdown of the most common types:

- Liability Coverage: This coverage is mandatory in Florida and protects you financially if you cause an accident that results in injuries or property damage to others. It includes:

- Bodily Injury Liability: Covers medical expenses, lost wages, and other damages for injuries to others in an accident you cause.

- Property Damage Liability: Covers damage to other vehicles or property you damage in an accident.

- Personal Injury Protection (PIP): This coverage, also known as “no-fault” insurance, covers your medical expenses, lost wages, and other related costs, regardless of who caused the accident. It’s mandatory in Florida.

- Collision Coverage: This optional coverage pays for repairs or replacement of your vehicle if it’s damaged in a collision, regardless of who is at fault.

- Comprehensive Coverage: This optional coverage pays for repairs or replacement of your vehicle if it’s damaged by events other than a collision, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): This optional coverage protects you if you’re injured in an accident caused by a driver without insurance or with insufficient coverage.

- Medical Payments Coverage (Med Pay): This optional coverage pays for medical expenses for you and your passengers, regardless of who is at fault.

Minimum Coverage Requirements in Florida

Florida law requires all drivers to carry a minimum amount of liability and PIP coverage. These minimums are:

- Bodily Injury Liability: $10,000 per person, $20,000 per accident.

- Property Damage Liability: $10,000 per accident.

- Personal Injury Protection (PIP): $10,000 per person.

Car Insurance Coverage Options in Florida: Benefits and Potential Costs

| Coverage Option | Benefits | Potential Costs |

|---|---|---|

| Liability Coverage | Protects you financially if you cause an accident that results in injuries or property damage to others. | Lower premiums than other coverage options. |

| Personal Injury Protection (PIP) | Covers your medical expenses, lost wages, and other related costs, regardless of who caused the accident. | Higher premiums than liability coverage, but offers greater financial protection. |

| Collision Coverage | Pays for repairs or replacement of your vehicle if it’s damaged in a collision, regardless of who is at fault. | Higher premiums than liability and PIP coverage, but essential for protecting your vehicle. |

| Comprehensive Coverage | Pays for repairs or replacement of your vehicle if it’s damaged by events other than a collision, such as theft, vandalism, or natural disasters. | Higher premiums than liability, PIP, and collision coverage, but valuable for protecting your vehicle from unexpected damage. |

| Uninsured/Underinsured Motorist Coverage (UM/UIM) | Protects you if you’re injured in an accident caused by a driver without insurance or with insufficient coverage. | Higher premiums, but essential for protecting yourself financially in the event of an accident with an uninsured or underinsured driver. |

| Medical Payments Coverage (Med Pay) | Pays for medical expenses for you and your passengers, regardless of who is at fault. | Higher premiums, but provides additional financial protection for medical expenses. |

End of Discussion

Understanding the factors that affect car insurance prices in Florida is essential for finding the best coverage at the most affordable rate. By comparing quotes, taking advantage of discounts, and choosing the right coverage options, you can ensure that you’re adequately protected while staying within your budget.

Answers to Common Questions

What is the minimum car insurance coverage required in Florida?

Florida requires drivers to carry a minimum of $10,000 in Personal Injury Protection (PIP) coverage and $10,000 in Property Damage Liability (PDL) coverage.

How can I get a discount on my car insurance in Florida?

Many insurance companies offer discounts for good driving records, safe driving courses, bundling insurance policies, and installing safety features in your car.

What are the best car insurance companies in Florida?

The best car insurance company for you will depend on your individual needs and budget. It’s important to compare quotes from multiple companies to find the best deal.