How much is car insurance per month in Florida? The Sunshine State is known for its beautiful beaches and warm weather, but it also has a reputation for high car insurance costs. A number of factors influence how much you’ll pay for car insurance in Florida, from your driving history to the type of car you drive. Understanding these factors can help you make informed decisions about your coverage and potentially save money on your premiums.

This guide will delve into the intricacies of car insurance in Florida, providing insights into the key factors that impact premiums, average costs across different coverage levels, and practical tips to help you save money. We’ll also explore the unique aspects of Florida’s car insurance laws and regulations, offering valuable information to ensure you’re well-equipped to navigate the car insurance landscape in the Sunshine State.

Factors Affecting Car Insurance Costs in Florida

Florida’s car insurance market is unique due to its no-fault system and the state’s high population density. Several factors influence the cost of car insurance premiums, leading to significant variations among drivers.

Driving History

Your driving history plays a crucial role in determining your car insurance premiums. Insurance companies consider your past driving record, including accidents, traffic violations, and DUI convictions. Drivers with a clean driving record generally enjoy lower premiums compared to those with a history of accidents or violations. For instance, a driver with multiple speeding tickets or a DUI conviction can expect to pay significantly higher premiums than a driver with no violations.

Age

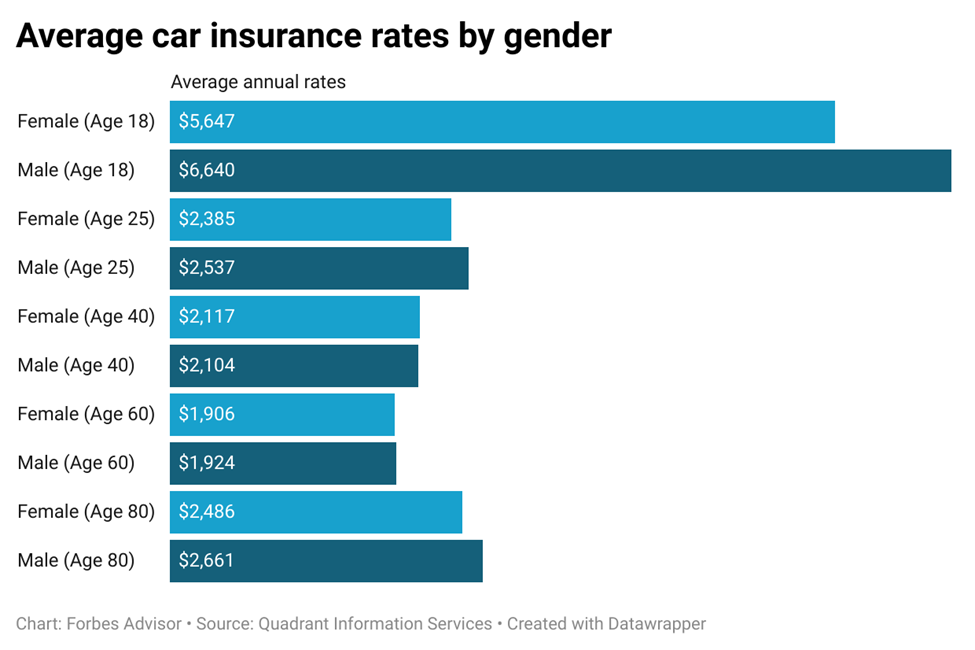

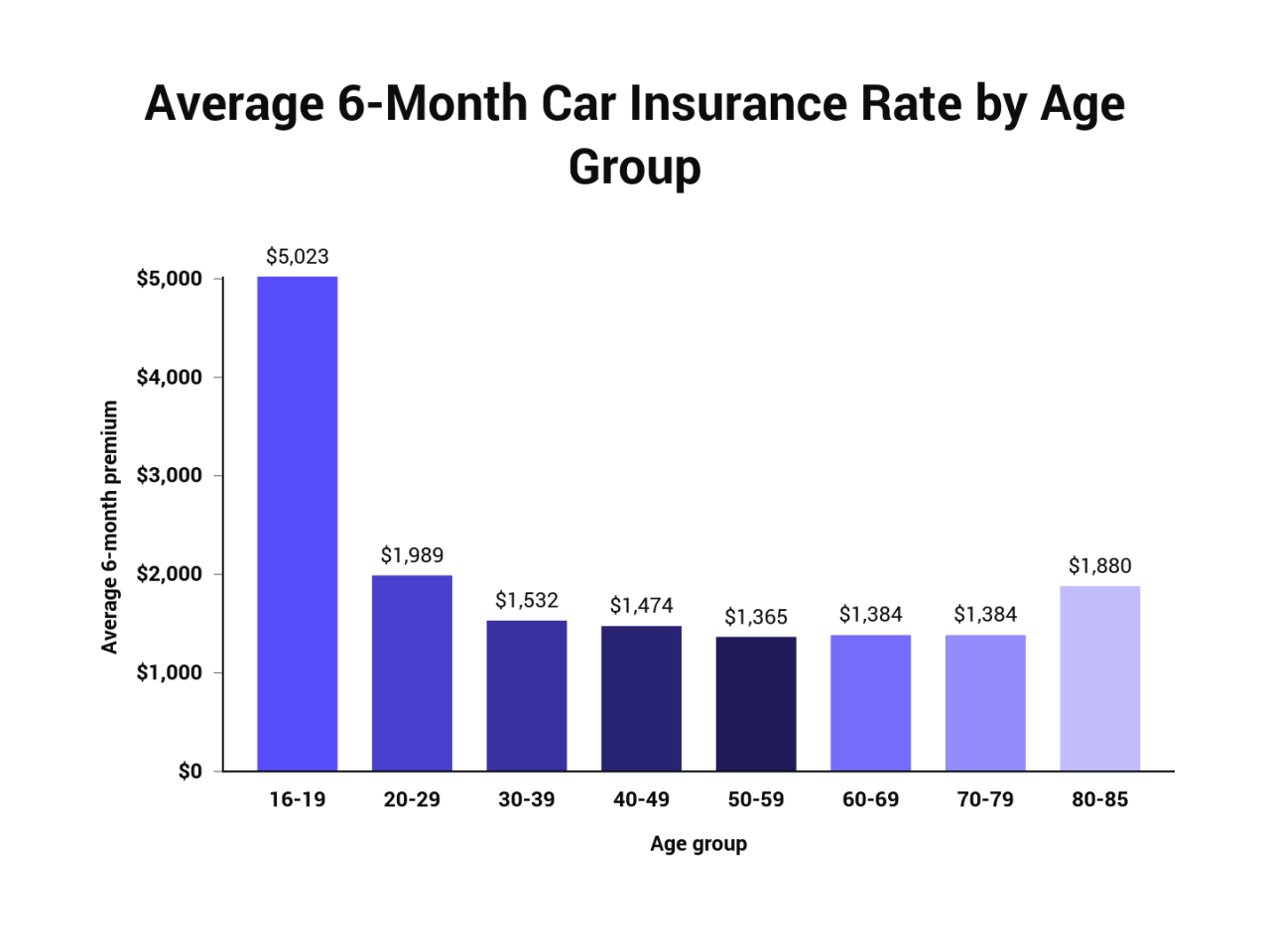

Age is another significant factor that influences car insurance premiums. Younger drivers, particularly those under 25, are statistically more likely to be involved in accidents. This higher risk profile leads to higher premiums for young drivers. Conversely, older drivers, especially those over 65, generally pay lower premiums due to their lower accident rates.

Vehicle Type

The type of vehicle you drive also influences your car insurance premiums. Luxury vehicles, sports cars, and high-performance vehicles are generally more expensive to insure due to their higher repair costs and potential for higher claims. Conversely, basic and fuel-efficient vehicles often come with lower premiums. For example, insuring a new BMW M3 will likely be more expensive than insuring a used Toyota Corolla.

Location

The location where you live in Florida can also impact your car insurance premiums. Areas with higher crime rates, traffic congestion, and a higher density of drivers tend to have higher insurance premiums. This is because insurance companies face a greater risk of claims in these areas. For example, drivers in Miami-Dade County might pay higher premiums than those in more rural areas of Florida.

Coverage Levels

The amount of coverage you choose also affects your car insurance premiums. Higher coverage limits, such as higher liability limits or comprehensive and collision coverage, generally lead to higher premiums. However, choosing adequate coverage levels is essential to protect yourself financially in the event of an accident.

Credit Score

In Florida, insurance companies can consider your credit score when determining your car insurance premiums. This practice is based on the theory that individuals with good credit scores are more likely to be responsible drivers. However, this practice is controversial and has been challenged in some states.

Florida’s No-Fault Insurance System, How much is car insurance per month in florida

Florida has a no-fault insurance system, which means that drivers are required to file claims with their own insurance companies, regardless of who is at fault in an accident. This system is designed to reduce litigation and expedite the claims process. However, it also contributes to higher car insurance premiums in Florida. The no-fault system requires drivers to carry Personal Injury Protection (PIP) coverage, which covers medical expenses and lost wages after an accident. The state-mandated minimum PIP coverage is $10,000, but drivers can choose higher coverage limits. The no-fault system also requires drivers to carry Property Damage Liability (PDL) coverage, which covers damage to the other driver’s vehicle in an accident. The state-mandated minimum PDL coverage is $10,000, but drivers can choose higher coverage limits.

Average Car Insurance Premiums in Florida

Average car insurance premiums vary significantly in Florida depending on various factors, such as driving history, age, vehicle type, location, and coverage levels.

- Young Drivers: Young drivers, especially those under 25, typically face higher premiums due to their higher risk profile. For example, a 20-year-old driver with a clean driving record in Miami-Dade County might pay an average of $200-$300 per month for basic coverage.

- Senior Drivers: Senior drivers, particularly those over 65, generally pay lower premiums due to their lower accident rates. For example, a 70-year-old driver with a clean driving record in a rural area of Florida might pay an average of $100-$150 per month for basic coverage.

- Drivers with a Clean Driving Record: Drivers with a clean driving record typically enjoy lower premiums compared to those with a history of accidents or violations. For example, a 35-year-old driver with a clean driving record in Orlando might pay an average of $150-$200 per month for basic coverage.

Average Car Insurance Costs in Florida

The cost of car insurance in Florida can vary greatly depending on a number of factors, including your driving record, the type of car you drive, and your location. However, understanding the average costs can help you get a better idea of what to expect when shopping for car insurance.

Average Monthly Car Insurance Costs by Coverage Level

Here is a breakdown of average monthly car insurance costs in Florida, categorized by different coverage levels:

| Coverage Level | Average Monthly Premium |

|—|—|

| Liability Only | $40 – $60 |

| Liability + Collision | $70 – $100 |

| Liability + Comprehensive | $80 – $120 |

| Full Coverage | $100 – $150 |

These are just average figures, and your actual costs may be higher or lower depending on your individual circumstances.

Average Monthly Car Insurance Costs by Vehicle Type

The type of vehicle you drive also plays a significant role in determining your car insurance premiums. Here is a table showcasing average monthly premiums for different vehicle types in Florida:

| Vehicle Type | Average Monthly Premium |

|—|—|

| Sedan | $80 – $120 |

| SUV | $100 – $150 |

| Truck | $120 – $180 |

| Sports Car | $150 – $250 |

It’s important to note that these are just averages, and your actual premium may vary depending on the specific make and model of your vehicle, as well as other factors.

Examples of Car Insurance Quotes from Major Providers

Here are some examples of car insurance quotes from major insurance providers in Florida, highlighting variations in pricing based on different factors:

* State Farm: For a 30-year-old driver with a clean driving record, driving a 2018 Honda Civic in Miami, Florida, State Farm offers a monthly premium of $85 for liability-only coverage, $115 for liability + collision, and $135 for full coverage.

* Geico: For the same driver and vehicle in the same location, Geico offers a monthly premium of $75 for liability-only coverage, $105 for liability + collision, and $125 for full coverage.

* Progressive: For the same driver and vehicle in the same location, Progressive offers a monthly premium of $90 for liability-only coverage, $120 for liability + collision, and $140 for full coverage.

As you can see, even for the same driver and vehicle in the same location, there can be significant variations in pricing between different insurance providers. It’s important to shop around and compare quotes from multiple providers before choosing a policy.

Tips for Saving on Car Insurance in Florida: How Much Is Car Insurance Per Month In Florida

Car insurance is a significant expense for most Floridians. However, there are several strategies you can employ to reduce your premiums and save money. By taking proactive steps to manage your risk and leverage available discounts, you can significantly lower your insurance costs.

Safe Driving Practices

Safe driving is paramount for reducing your car insurance premiums. Insurance companies often reward drivers with a clean driving record by offering lower rates. Here are some tips for maintaining a safe driving record:

- Avoid Speeding: Speeding tickets can significantly increase your insurance premiums. Always adhere to posted speed limits and practice defensive driving techniques.

- Obey Traffic Laws: Following all traffic laws, including stop signs, traffic lights, and lane markings, is crucial for safe driving and preventing accidents.

- Maintain a Safe Distance: Always leave ample space between your vehicle and the car in front of you to allow for safe braking and maneuverability.

- Avoid Distracted Driving: Refrain from using your phone, eating, or engaging in other distractions while driving. Focus solely on the road ahead.

- Be Aware of Your Surroundings: Always be aware of your surroundings, including other vehicles, pedestrians, and cyclists. Anticipate potential hazards and react accordingly.

Increasing Deductibles

Your deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. Increasing your deductible can lead to lower monthly premiums. Consider increasing your deductible if you can comfortably afford to pay a higher amount in the event of an accident.

For example, if you have a $500 deductible and increase it to $1000, you may see a significant reduction in your monthly premium. However, remember that you will have to pay the higher deductible in the event of an accident.

Bundling Policies

Bundling your car insurance with other insurance policies, such as homeowners or renters insurance, can often result in substantial discounts. Insurance companies offer bundled packages to encourage customers to consolidate their policies and provide a more comprehensive coverage solution.

Comparing Quotes from Multiple Insurers

One of the most effective ways to save on car insurance is to compare quotes from multiple insurers. Different insurance companies offer varying rates and discounts, so it’s essential to shop around to find the best deal. Use online comparison tools or contact insurance agents directly to obtain quotes from various providers.

Defensive Driving Courses

Taking a defensive driving course can not only enhance your driving skills but also lead to significant discounts on your car insurance. These courses teach you safe driving techniques, hazard recognition, and accident avoidance strategies. Many insurance companies offer discounts for completing approved defensive driving courses.

For instance, in Florida, completing a state-approved defensive driving course can reduce your insurance premium by up to 10%.

Finding and Utilizing Car Insurance Discounts

Insurance companies offer various discounts to incentivize safe driving practices and loyalty. Here are some common discounts you can explore:

- Good Student Discount: This discount is available to students who maintain a good academic record, typically a GPA of 3.0 or higher.

- Multi-Car Discount: If you insure multiple vehicles with the same insurer, you can qualify for a multi-car discount, which can save you money on each policy.

- Safe Driver Discount: Drivers with a clean driving record and no accidents or violations are eligible for safe driver discounts.

- Anti-theft Device Discount: Installing anti-theft devices, such as alarms or tracking systems, can reduce your insurance premiums by demonstrating your commitment to vehicle security.

- Loyalty Discount: Insurance companies often reward long-term customers with loyalty discounts for staying with them for an extended period.

Florida-Specific Car Insurance Considerations

Florida’s car insurance landscape is unique due to its specific laws and regulations. Understanding these nuances is crucial for drivers in the state to make informed decisions about their coverage and protect themselves financially.

Personal Injury Protection (PIP) Coverage

Florida law mandates that all drivers carry Personal Injury Protection (PIP) coverage. This coverage pays for medical expenses, lost wages, and other related costs for the policyholder and passengers in their vehicle, regardless of fault in an accident. PIP coverage is typically limited to $10,000 per person.

Florida Office of Insurance Regulation (OIR)

The Florida Office of Insurance Regulation (OIR) plays a vital role in overseeing the state’s car insurance market. The OIR sets rates, monitors insurance companies, and investigates complaints. It also promotes fair and competitive practices within the insurance industry.

Common Car Insurance Scams in Florida

Florida is known for its high volume of car insurance scams, which can significantly impact insurance rates for all drivers. Some common scams include:

- Staged Accidents: These scams involve individuals intentionally causing accidents to file fraudulent claims for injuries and vehicle damage.

- Fake Accident Claims: Individuals may fabricate accidents or exaggerate injuries to receive compensation.

- Insurance Fraud Rings: Organized groups may collaborate to stage accidents and submit fraudulent claims for financial gain.

Epilogue

Navigating the world of car insurance in Florida can be a complex endeavor. However, by understanding the factors that influence premiums, comparing quotes from multiple insurers, and taking advantage of available discounts, you can find a policy that meets your needs and fits your budget. Remember to review your coverage periodically and make adjustments as needed to ensure you have the right protection for your driving needs.

Essential Questionnaire

What are the minimum car insurance requirements in Florida?

Florida requires all drivers to carry a minimum amount of Personal Injury Protection (PIP) and Property Damage Liability (PDL) coverage. PIP coverage pays for your medical expenses and lost wages if you’re injured in an accident, while PDL coverage covers damages to other vehicles or property.

How can I get a car insurance quote in Florida?

You can obtain car insurance quotes online, over the phone, or by visiting an insurance agent’s office. Most insurance companies allow you to get a quote online by providing your personal information and details about your vehicle and driving history.

What are some common car insurance discounts available in Florida?

Some common car insurance discounts in Florida include good student discounts, safe driver discounts, multi-car discounts, and discounts for anti-theft devices.