Florida long term care insurance – Florida long-term care insurance is a crucial aspect of financial planning, especially as individuals age and face potential health challenges. This type of insurance provides financial protection for the costs associated with long-term care services, such as assisted living, nursing homes, and in-home care. It can offer peace of mind knowing that your loved ones will have access to the necessary care without straining your financial resources.

Florida long-term care insurance policies vary in terms of coverage, benefits, and costs. Understanding the different options available is essential to make an informed decision that aligns with your individual needs and financial situation. This guide explores the intricacies of Florida long-term care insurance, providing valuable insights into eligibility, cost factors, key features, and regulatory considerations.

Understanding Florida Long-Term Care Insurance

Long-term care insurance is a valuable tool for Floridians seeking financial protection against the high costs of long-term care services. This type of insurance helps cover expenses associated with providing care for individuals who can no longer perform daily activities due to chronic illness, injury, or cognitive impairment.

Types of Long-Term Care Services Covered

Florida long-term care insurance policies typically cover a wide range of services, providing financial assistance for various care needs.

- Nursing Home Care: This includes skilled nursing care provided in a nursing home facility.

- Assisted Living Care: This covers services in assisted living facilities, offering personal care, medication management, and other support.

- Home Health Care: This provides skilled nursing care, physical therapy, occupational therapy, and other services delivered in the individual’s home.

- Adult Day Care: This offers supervised care in a community setting for individuals who need assistance with daily activities but can live at home.

- Respite Care: This provides temporary care for individuals with long-term care needs, allowing primary caregivers to take a break.

Benefits of Florida Long-Term Care Insurance

Florida long-term care insurance offers several benefits, providing financial protection and peace of mind for policyholders.

- Financial Protection: Long-term care insurance helps cover the significant costs of long-term care services, preventing financial strain on individuals and their families.

- Preservation of Assets: By covering long-term care expenses, insurance policies can help preserve assets for future generations.

- Choice of Care: Policyholders can choose the type of care setting and services that best meet their needs, including home care, assisted living, or nursing home care.

- Peace of Mind: Having long-term care insurance provides peace of mind knowing that financial resources are available to cover care needs in the future.

Limitations of Florida Long-Term Care Insurance

While Florida long-term care insurance offers numerous benefits, it’s important to understand its limitations.

- Premiums: Long-term care insurance premiums can be expensive, especially for individuals with pre-existing conditions or who are older.

- Eligibility Requirements: Insurance companies may have specific eligibility requirements, such as age, health status, and medical history.

- Limited Coverage: Policies may have limitations on the duration of coverage, the amount of benefits paid, or the types of services covered.

- Potential for Increased Premiums: Insurance companies may adjust premiums based on factors such as inflation and claims experience, potentially leading to higher costs over time.

Eligibility and Cost Factors

Understanding the eligibility requirements and factors that influence the cost of long-term care insurance in Florida is crucial for making an informed decision. This section delves into the key aspects of eligibility and cost considerations.

Eligibility Criteria

Eligibility for purchasing long-term care insurance in Florida is typically determined by factors such as age, health status, and financial capacity.

- Age: Most insurers have age limits for eligibility, typically ranging from 18 to 80 years old. However, some insurers may have higher age limits, depending on the policy and underwriting guidelines.

- Health Status: Insurers assess your health status through medical questionnaires, physical examinations, and sometimes medical records. Individuals with pre-existing conditions may face higher premiums or be denied coverage.

- Financial Capacity: Insurers evaluate your financial capacity to afford the premiums. This may involve reviewing your income, assets, and debt obligations. The premium amount is a significant factor in determining your ability to pay.

Cost Factors

The cost of long-term care insurance premiums in Florida is influenced by several factors, including:

- Age: Older individuals generally face higher premiums because they have a higher risk of needing long-term care.

- Health Status: Individuals with pre-existing conditions or poor health typically face higher premiums due to the increased likelihood of needing long-term care.

- Benefit Amount: The amount of coverage you choose will affect the premium cost. Higher benefit amounts will result in higher premiums.

- Benefit Period: The duration of the benefit period, or the length of time the policy will pay for care, will also impact the premium. Longer benefit periods will lead to higher premiums.

- Inflation Protection: Some policies offer inflation protection, which helps adjust benefits over time to keep pace with rising healthcare costs. This feature will increase the premium cost.

- Deductible: The deductible, or the amount you pay out-of-pocket before the policy starts paying benefits, will also influence the premium. Higher deductibles typically lead to lower premiums.

- Waiting Period: The waiting period, or the length of time you must wait after a qualifying event before benefits begin, can affect the premium. Longer waiting periods may result in lower premiums.

Premium Costs Comparison

Comparing premiums from different long-term care insurance providers in Florida is essential for finding the best value.

- Online Comparison Tools: Many websites and insurance brokers offer online comparison tools that allow you to compare quotes from multiple providers.

- Insurance Agents: Working with an independent insurance agent can help you obtain quotes from various providers and compare different policy options.

- Consumer Reports: Consumer Reports and other reputable organizations often publish ratings and reviews of long-term care insurance providers, which can provide valuable insights into the quality and financial stability of different companies.

Key Features and Considerations

Understanding the key features and considerations of Florida long-term care insurance policies is crucial to making an informed decision that aligns with your specific needs and financial situation. This section delves into the essential elements of these policies and provides insights to guide your selection process.

Coverage Limits

Coverage limits determine the maximum amount your long-term care insurance policy will pay for your care. These limits can be expressed as a daily, monthly, or lifetime benefit amount. It’s essential to choose a coverage limit that is sufficient to cover your potential long-term care costs.

- Daily Benefit: This refers to the maximum amount your policy will pay per day for your care.

- Monthly Benefit: This represents the maximum amount your policy will pay per month for your care.

- Lifetime Benefit: This refers to the total maximum amount your policy will pay for your care throughout your lifetime.

Benefit Periods

The benefit period defines the length of time your long-term care insurance policy will provide coverage. It’s crucial to consider your potential need for long-term care and choose a benefit period that aligns with your anticipated care duration.

- Limited Benefit Period: These policies provide coverage for a specific period, such as 2, 3, or 5 years.

- Unlimited Benefit Period: These policies offer coverage for as long as you require care, subject to the policy’s maximum lifetime benefit amount.

Waiting Periods

A waiting period is a time frame that must pass before your long-term care insurance policy begins to pay benefits. It’s important to understand the waiting period associated with your policy, as it can impact the timing of benefit payments.

- Elimination Period: This refers to the initial period of time you must pay for your care before your long-term care insurance policy begins to cover the costs.

- Standard Waiting Periods: Common waiting periods range from 30 to 90 days.

Essential Considerations

Choosing the right long-term care insurance policy in Florida requires careful consideration of several factors.

- Your Health and Lifestyle: Your current health status, family history of long-term care needs, and lifestyle choices can influence your likelihood of needing long-term care and the type of policy you choose.

- Your Financial Situation: Your income, assets, and savings play a crucial role in determining the affordability of premiums and the coverage you can afford.

- Your Long-Term Care Needs: Consider the potential types of care you might require, such as home care, assisted living, or nursing home care, and choose a policy that aligns with these needs.

- The Reputation of the Insurance Company: Research the financial stability and track record of the insurance company offering the policy.

- Policy Features and Benefits: Compare different policies to understand the specific coverage they offer, such as inflation protection, benefit period options, and waiting periods.

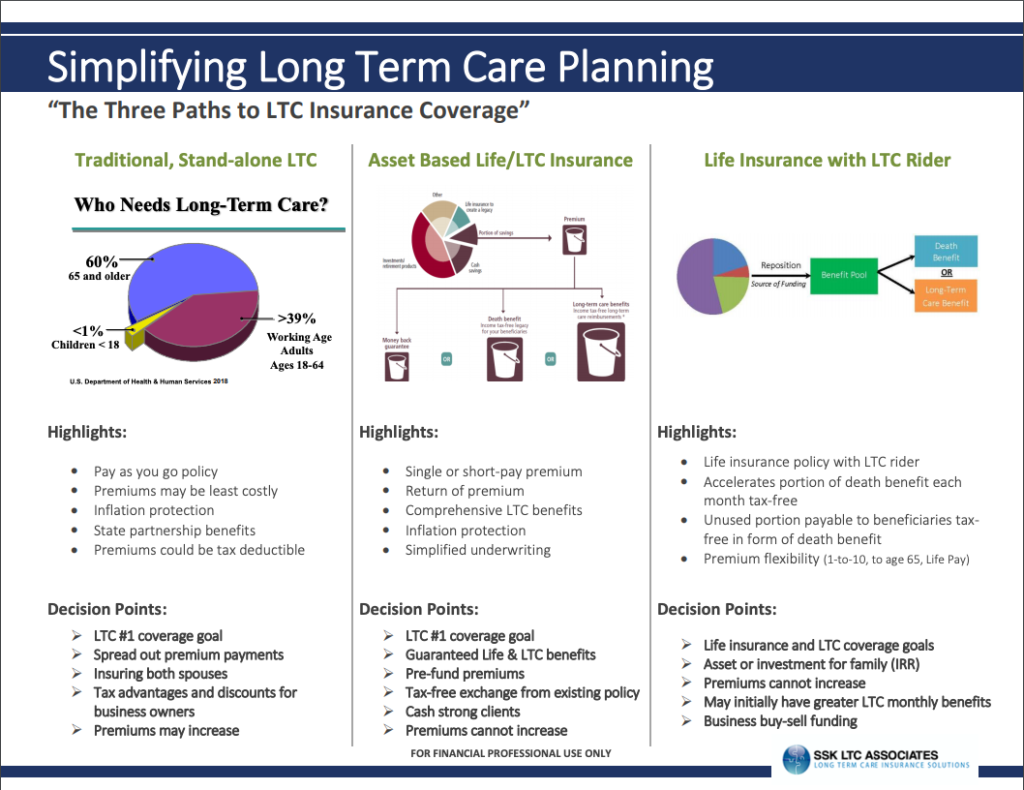

Long-Term Care Insurance Policy Options in Florida

| Policy Option | Key Features | Benefits |

|—|—|—|

| Traditional Long-Term Care Insurance | Comprehensive coverage for various care settings, customizable benefit periods, and inflation protection. | Offers financial protection against the rising costs of long-term care, provides flexibility in care choices, and can help preserve your assets. |

| Hybrid Long-Term Care Insurance | Combines long-term care benefits with life insurance, providing potential death benefits or long-term care coverage. | Offers financial protection for both long-term care needs and potential death benefits, providing a dual purpose for your insurance investment. |

| Annuities with Long-Term Care Riders | Combines an annuity with a long-term care rider, offering guaranteed income streams and long-term care benefits. | Provides a stable income stream and potential coverage for long-term care needs, offering financial security and flexibility. |

The Role of Florida Regulations

Florida state regulations play a crucial role in governing long-term care insurance, ensuring consumer protection and fair industry practices. These regulations establish standards for policy design, underwriting, marketing, and claims handling, safeguarding policyholders’ rights and promoting transparency in the market.

Florida-Specific Regulations

Florida’s Office of Insurance Regulation (OIR) has implemented specific regulations unique to long-term care insurance, including:

- Minimum Standards for Policy Benefits: Florida mandates minimum benefit levels for long-term care insurance policies, ensuring adequate coverage for policyholders. These standards cover essential services such as skilled nursing care, home health care, and assisted living.

- Prohibition of Pre-Existing Condition Exclusions: Florida prohibits insurers from excluding coverage for pre-existing conditions, ensuring that individuals with prior health issues can access long-term care insurance. This protects consumers from discrimination based on their medical history.

- Consumer Protection Provisions: Florida regulations include consumer protection provisions such as mandatory disclosure requirements, policy illustrations, and a right to cancel within a specified period. These provisions aim to provide transparency and empower consumers to make informed decisions.

Consumer Protection Measures, Florida long term care insurance

Florida regulations prioritize consumer protection through several key measures:

- Mandatory Disclosure Requirements: Florida requires insurers to provide clear and concise information about policy features, benefits, limitations, and costs. This ensures that consumers have access to all relevant details before purchasing a policy.

- Policy Illustrations: Florida mandates that insurers provide policy illustrations, which depict projected premium payments and benefit payouts over time. This helps consumers understand the financial implications of their policy choices.

- Right to Cancel: Florida grants policyholders a right to cancel their long-term care insurance policy within a specified period, typically 30 days, without penalty. This provides consumers with a cooling-off period to reconsider their decision.

Regulation Enforcement

The OIR actively enforces Florida’s long-term care insurance regulations through:

- Market Monitoring: The OIR regularly monitors the long-term care insurance market to identify any potential violations or unfair practices. This includes reviewing insurer filings, investigating consumer complaints, and conducting audits.

- Enforcement Actions: The OIR has the authority to take enforcement actions against insurers who violate Florida’s regulations. These actions can include fines, cease and desist orders, and license revocation.

- Consumer Education: The OIR provides educational resources and information to consumers about long-term care insurance, helping them understand their rights and make informed decisions.

Financial Planning and Long-Term Care Insurance: Florida Long Term Care Insurance

Integrating long-term care insurance into your financial plan can help you safeguard your assets and ensure your long-term care needs are met without jeopardizing your financial security.

Incorporating Long-Term Care Insurance into a Financial Plan

To incorporate long-term care insurance into your financial plan, follow these steps:

- Assess Your Needs: Determine your potential need for long-term care based on your age, health, family history, and lifestyle. Consider factors like your ability to perform daily living activities, your desired level of care, and the potential duration of care.

- Calculate Your Costs: Estimate the potential costs of long-term care in your area, considering factors like facility type, level of care, and duration of care. Use online calculators or consult with a financial advisor to get a realistic estimate.

- Explore Insurance Options: Research different long-term care insurance policies available in Florida, comparing coverage, benefits, premiums, and eligibility requirements. Consider factors like the policy’s benefit period, inflation protection, and waiver of premium provisions.

- Determine Your Budget: Assess your financial resources and determine how much you can afford to allocate towards long-term care insurance premiums. Factor in your current expenses, savings, and income streams.

- Seek Professional Advice: Consult with a qualified financial advisor or insurance agent to discuss your individual needs, financial situation, and insurance options. They can help you create a personalized financial plan that incorporates long-term care insurance.

Tax Benefits and Financial Implications

Long-term care insurance premiums are generally not deductible as medical expenses for federal income tax purposes. However, some states, including Florida, may offer tax benefits for long-term care insurance premiums. In Florida, you can deduct a portion of your long-term care insurance premiums from your state income tax.

- Florida Tax Deduction: Florida residents can deduct up to $5,000 in long-term care insurance premiums from their state income tax, regardless of age or health status. This deduction can help reduce your overall tax burden.

- Potential Estate Planning Benefits: Long-term care insurance can help protect your assets from depletion due to long-term care costs. This can preserve your estate for your heirs and reduce the potential need for Medicaid assistance in the future.

- Financial Implications: Purchasing long-term care insurance can provide financial protection against the potentially high costs of long-term care. It can help you avoid depleting your savings, investments, and other assets to pay for care.

Preparing for Future Care Needs

Long-term care insurance can play a crucial role in helping individuals and families prepare for potential future care needs.

- Financial Security: By providing coverage for long-term care expenses, insurance can help ensure your financial security and protect your assets from depletion. It can alleviate the financial burden on your family and allow you to maintain your desired lifestyle.

- Care Options: Long-term care insurance can provide you with a wider range of care options, including home health care, assisted living, and nursing home care. It can give you the flexibility to choose the care setting that best meets your needs and preferences.

- Peace of Mind: Having long-term care insurance can provide peace of mind knowing that your care needs will be financially covered. It can reduce stress and anxiety associated with the potential costs and uncertainties of long-term care.

Resources and Information

Navigating the complexities of Florida long-term care insurance can be daunting. To ensure you make informed decisions, it’s essential to access reliable resources and guidance from reputable organizations.

This section provides a comprehensive list of resources that offer valuable information, support, and assistance in understanding Florida long-term care insurance options.

Florida Department of Financial Services

The Florida Department of Financial Services (DFS) serves as the primary regulatory body for insurance in the state. It plays a crucial role in protecting consumers and ensuring fair and transparent insurance practices. The DFS website offers a wealth of information about long-term care insurance, including:

- A dedicated section on long-term care insurance, providing insights into policy features, consumer rights, and regulatory requirements.

- A comprehensive guide to long-term care insurance, outlining key considerations, policy types, and cost factors.

- A list of licensed long-term care insurance companies operating in Florida, enabling consumers to compare options and find reputable providers.

- Consumer complaint forms and procedures for addressing any concerns or disputes related to long-term care insurance policies.

Florida Long-Term Care Insurance Ombudsman

The Florida Long-Term Care Insurance Ombudsman is a dedicated resource for consumers facing issues or seeking guidance related to long-term care insurance. The Ombudsman serves as an advocate for policyholders, offering assistance with:

- Resolving disputes with insurance companies regarding policy coverage, claims, or other matters.

- Providing information and education about long-term care insurance policies, rights, and responsibilities.

- Mediating between policyholders and insurance companies to reach mutually agreeable solutions.

Florida Association of Insurance Agents

The Florida Association of Insurance Agents (FAIA) represents independent insurance agents across the state. FAIA members are knowledgeable about long-term care insurance and can provide personalized advice and guidance to consumers. Through FAIA, you can:

- Connect with a local independent insurance agent specializing in long-term care insurance.

- Access resources and information on long-term care insurance options, including policy comparisons and cost analysis.

- Benefit from the expertise and experience of FAIA members in navigating the complexities of long-term care insurance.

National Long-Term Care Ombudsman Program

The National Long-Term Care Ombudsman Program (NLTCO) is a nationwide network of ombudsman programs dedicated to advocating for the rights of long-term care residents. The NLTCO website provides information on long-term care insurance, including:

- Resources and guidance for consumers seeking to understand long-term care insurance options.

- Information on the rights and responsibilities of long-term care residents, including those covered by insurance.

- A directory of state and local ombudsman programs, providing access to advocacy services and support.

National Association of Insurance Commissioners

The National Association of Insurance Commissioners (NAIC) is a non-profit organization representing state insurance regulators across the country. The NAIC website offers a wealth of information on long-term care insurance, including:

- Model regulations and best practices for long-term care insurance, ensuring consistency and consumer protection across states.

- Consumer guides and resources on long-term care insurance, providing comprehensive information on policy features, costs, and considerations.

- Information on insurance company financial solvency and regulatory oversight, helping consumers identify reputable providers.

Consumer Reports

Consumer Reports is a non-profit organization dedicated to providing independent and unbiased product and service reviews. Consumer Reports offers valuable insights into long-term care insurance, including:

- Comparisons of different long-term care insurance policies based on features, costs, and consumer satisfaction.

- Tips and strategies for choosing the right long-term care insurance policy based on individual needs and circumstances.

- Information on potential risks and pitfalls associated with long-term care insurance, helping consumers make informed decisions.

AARP

AARP, a non-profit organization dedicated to empowering people 50 and over, provides valuable resources and guidance on long-term care insurance. AARP offers:

- Information and resources on long-term care insurance options, including policy features, costs, and considerations.

- Tips and strategies for navigating the complexities of long-term care planning, including insurance considerations.

- Advocacy efforts to ensure fair and equitable access to long-term care insurance and services.

Medicare

Medicare is a federal health insurance program for people 65 and over, as well as certain younger individuals with disabilities. While Medicare does not cover long-term care, it offers limited coverage for skilled nursing care under certain circumstances.

- Medicare website provides information on its coverage for skilled nursing care, helping consumers understand the limitations and requirements.

- Medicare offers resources and guidance on other long-term care options, such as home health care and adult day care.

Final Conclusion

In conclusion, Florida long-term care insurance plays a vital role in safeguarding your financial well-being and ensuring access to quality care during your golden years. By carefully evaluating your needs, exploring available options, and consulting with financial advisors, you can make an informed decision that provides peace of mind and protects your future.

User Queries

What are the different types of long-term care services covered by Florida long-term care insurance?

Florida long-term care insurance typically covers a range of services, including assisted living, nursing home care, adult day care, home health care, and hospice care.

How can I find a reputable long-term care insurance provider in Florida?

You can consult with a financial advisor, research online, and check with the Florida Department of Insurance for a list of licensed providers. It’s essential to compare quotes and policies carefully before making a decision.

What are the tax benefits of purchasing long-term care insurance in Florida?

Florida offers certain tax benefits for long-term care insurance premiums. Consult with a tax professional for specific details and eligibility requirements.