Florida car insurance increase is a pressing issue for drivers in the Sunshine State. The average cost of car insurance in Florida is significantly higher than the national average, and premiums have been steadily rising in recent years. This upward trend has left many Floridians struggling to afford coverage, with the impact being felt across all income levels. The state’s unique circumstances, including a high frequency of accidents, rampant insurance fraud, and rising healthcare costs, are contributing to the escalating cost of car insurance.

This article delves into the factors driving this increase, explores its consequences for consumers, and examines potential solutions to make car insurance more affordable for Floridians. From understanding the complexities of the Florida car insurance market to navigating the process of finding the best coverage at the most competitive price, this comprehensive guide provides insights and actionable advice for all drivers.

Florida Car Insurance Landscape

Florida’s car insurance market is a complex and challenging environment for both drivers and insurance companies. The state’s unique regulatory framework, high frequency of accidents, and susceptibility to natural disasters contribute to higher premiums compared to many other parts of the country.

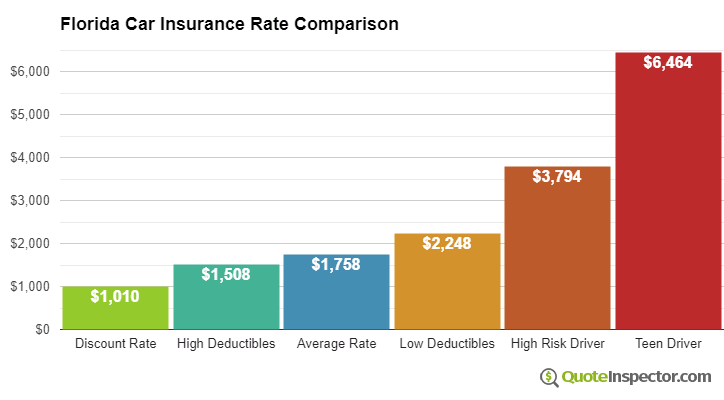

Average Car Insurance Premiums in Florida

The average annual car insurance premium in Florida is significantly higher than the national average. According to the Insurance Information Institute (III), the average annual premium in Florida was $2,840 in 2022, compared to the national average of $1,771.

Factors Contributing to High Car Insurance Costs in Florida

- High Accident Rates: Florida has a higher-than-average number of car accidents, which drives up insurance costs. Factors contributing to this include a large population of older drivers, a high concentration of tourists, and a significant number of uninsured drivers.

- Fraudulent Claims: Florida has a history of insurance fraud, which inflates premiums for all drivers. This includes staged accidents, fake injuries, and other schemes designed to defraud insurance companies.

- Natural Disasters: Florida is vulnerable to hurricanes, floods, and other natural disasters, which can lead to significant insurance claims. Insurance companies factor in these risks when setting premiums.

- State Regulations: Florida’s insurance regulations, including the “no-fault” system, can contribute to higher premiums. The no-fault system requires drivers to cover their own medical expenses after an accident, regardless of fault. This can lead to more claims and higher premiums.

- High Cost of Healthcare: Florida’s high cost of healthcare also impacts car insurance premiums. Insurance companies must pay for medical expenses related to car accidents, and these costs are higher in Florida than in many other states.

Key Players in the Florida Car Insurance Market, Florida car insurance increase

- State Farm: State Farm is the largest car insurance provider in Florida, with a significant market share. The company offers a wide range of coverage options and has a strong reputation for customer service.

- Geico: Geico is another major player in the Florida car insurance market, known for its competitive rates and online convenience. The company has a strong brand presence and a large customer base.

- Progressive: Progressive is a leading provider of car insurance in Florida, known for its innovative products and personalized pricing options. The company offers a variety of discounts and has a strong online presence.

- Allstate: Allstate is a well-established car insurance company in Florida, offering a comprehensive range of coverage options and a strong customer service network.

- Florida Peninsula Insurance Company: Florida Peninsula is a specialized insurance company that focuses on providing coverage to drivers who have difficulty obtaining insurance from other companies. The company is known for its willingness to insure high-risk drivers.

Factors Driving Increases

Florida’s car insurance rates have been steadily rising, creating financial strain for many residents. Multiple factors contribute to this trend, including rising healthcare costs, increased accident frequency and severity, and the prevalence of fraud and abuse within the insurance system.

Rising Healthcare Costs

The soaring cost of healthcare has a direct impact on car insurance premiums. When accidents occur, insurance companies are responsible for covering medical expenses, which have been escalating significantly. This rise in medical costs, driven by factors such as technological advancements, prescription drug prices, and administrative expenses, directly translates into higher insurance premiums for policyholders.

Increased Accident Frequency and Severity

Florida’s growing population and increased traffic volume have contributed to a rise in the number and severity of car accidents. More vehicles on the road mean a higher probability of collisions, and the increasing number of distracted drivers, including those using mobile devices, has exacerbated the problem. Additionally, the prevalence of aggressive driving behaviors and the state’s warm weather, which encourages open-air driving, can lead to more serious accidents.

Fraud and Abuse

Fraudulent claims and abuse within the insurance system are a significant factor driving up car insurance rates. Examples include staged accidents, inflated injury claims, and the use of fraudulent medical documentation. These fraudulent activities put a strain on the insurance system, forcing legitimate policyholders to bear the burden of increased premiums.

Impact of Different Types of Insurance Claims

Different types of insurance claims have varying impacts on premium increases. For instance, bodily injury claims, which cover medical expenses and lost wages, typically contribute more significantly to premium increases than property damage claims. This is because bodily injury claims are often more complex and costly to resolve, involving medical evaluations, legal fees, and potential long-term care.

Impact on Consumers

The surge in car insurance premiums in Florida has a direct and significant impact on consumers, affecting their financial well-being and driving habits. This rise in costs can lead to increased financial strain, particularly for families struggling to make ends meet.

Financial Strain on Families

Higher car insurance premiums can significantly impact family budgets, especially those already facing financial challenges. The added expense can strain household finances, forcing families to make difficult choices, such as cutting back on other essential expenses like groceries, healthcare, or education. This can lead to a cycle of financial hardship, where families struggle to keep up with rising insurance costs while also managing other essential expenses.

For example, a family in Florida with a household income of $50,000 might find that a $500 increase in their annual car insurance premium represents a significant portion of their disposable income. This could force them to make difficult choices about spending on other necessities, potentially leading to a decline in their overall financial well-being.

Challenges for Low-Income Families

For low-income families, the rising cost of car insurance can be particularly challenging. These families often rely on their vehicles for transportation to work, school, and essential services. The need for reliable transportation, coupled with limited financial resources, puts them in a difficult position when facing higher insurance premiums.

- Increased Risk of Financial Instability: Higher insurance premiums can significantly increase the risk of financial instability for low-income families. They may be forced to make difficult choices, such as delaying essential medical care, foregoing education, or even choosing between paying for insurance and putting food on the table.

- Reduced Access to Transportation: If low-income families cannot afford the rising insurance costs, they may be forced to cancel their car insurance, potentially leading to a loss of access to reliable transportation. This can have a ripple effect on their ability to maintain employment, access healthcare, and participate in other essential activities.

Perspectives from Floridian Drivers

Floridian drivers have expressed concerns about the rising cost of car insurance. Many feel that the increases are unfair and unsustainable, especially given the current economic climate. Some drivers have reported that they are forced to make difficult choices, such as driving less, cancelling their insurance, or even driving without insurance, putting themselves at risk.

“I’ve been driving for over 20 years and have never seen car insurance rates this high,” said a Floridian driver. “It’s getting increasingly difficult to afford the rising costs, and I’m worried about what the future holds.”

Potential Solutions and Mitigation Strategies

The rising cost of car insurance in Florida has become a major concern for residents, highlighting the need for comprehensive solutions to address affordability and ensure a sustainable insurance market. This section explores potential strategies for mitigating the impact of escalating insurance premiums, focusing on initiatives that can improve affordability, reduce fraud, and promote legislative reforms.

Strategies for Enhancing Affordability

Addressing the affordability of car insurance requires a multifaceted approach that considers both individual and systemic solutions. The following strategies aim to make car insurance more accessible for Floridians:

- Financial Assistance Programs: Expanding access to financial assistance programs, such as low-income subsidies or premium discounts for safe drivers, can help low- and moderate-income individuals afford coverage. These programs can be funded through a combination of state and federal resources, as well as private sector partnerships.

- Driver Education and Training: Investing in comprehensive driver education and training programs can reduce accidents and claims, ultimately lowering insurance costs. These programs can focus on defensive driving techniques, traffic safety awareness, and responsible driving practices.

- Promote Usage-Based Insurance (UBI): UBI programs, which use telematics devices to track driving habits, can reward safe drivers with lower premiums. This incentivizes safer driving behavior and can lead to lower overall insurance costs.

Strategies for Reducing Fraud and Abuse

Fraudulent claims and abuse of the insurance system contribute significantly to rising premiums. Implementing robust measures to combat these issues is crucial for maintaining a fair and stable insurance market.

- Strengthened Fraud Detection Mechanisms: Enhancing the capabilities of the Florida Department of Financial Services (DFS) and insurance companies to detect and investigate fraudulent claims is essential. This includes investing in advanced data analytics tools, fostering collaboration with law enforcement agencies, and implementing stricter verification processes for claims.

- Increased Penalties for Fraudulent Activity: Imposing stricter penalties for individuals and entities involved in insurance fraud, including harsher fines and potential jail time, can deter fraudulent behavior and create a greater deterrent effect.

- Public Awareness Campaigns: Educating the public about the consequences of insurance fraud and encouraging reporting of suspicious activities can help prevent fraud and create a culture of accountability.

Legislative Reforms for Addressing Car Insurance Costs

Legislative reforms can play a significant role in addressing the root causes of high car insurance costs. The following reforms have the potential to create a more favorable environment for both consumers and insurance companies:

- Reforming the No-Fault System: Reforming the state’s no-fault system, which requires all drivers to carry Personal Injury Protection (PIP) coverage, can potentially reduce costs by streamlining the claims process and limiting unnecessary medical expenses.

- Limiting Attorney Fees: Implementing caps on attorney fees for personal injury claims can help reduce the cost of litigation and prevent excessive payouts, ultimately contributing to lower premiums.

- Promoting Competition in the Insurance Market: Encouraging greater competition among insurance companies can lead to more affordable rates. This can be achieved by simplifying the licensing process for new insurers and reducing regulatory barriers.

Potential Solutions and Expected Impact

| Solution | Expected Impact on Insurance Rates |

|---|---|

| Financial Assistance Programs | Potentially lower rates for low- and moderate-income individuals, but may increase costs for other policyholders. |

| Driver Education and Training | Long-term potential for lower rates by reducing accidents and claims. |

| Usage-Based Insurance (UBI) | Lower rates for safe drivers, but may not benefit all policyholders. |

| Strengthened Fraud Detection Mechanisms | Potentially lower rates by reducing fraudulent claims. |

| Increased Penalties for Fraudulent Activity | Potentially lower rates by deterring fraudulent behavior. |

| Public Awareness Campaigns | Potentially lower rates by reducing fraud and abuse. |

| Reforming the No-Fault System | Potentially lower rates by streamlining claims and reducing medical expenses. |

| Limiting Attorney Fees | Potentially lower rates by reducing litigation costs. |

| Promoting Competition in the Insurance Market | Potentially lower rates by increasing competition and driving down prices. |

Consumer Guidance and Tips

Navigating the complex landscape of Florida car insurance can be daunting, especially with rising premiums. This section provides practical tips and guidance to help you make informed decisions and potentially save money on your insurance.

Comparing and Shopping for Car Insurance

It’s crucial to compare quotes from multiple insurers to find the best rates.

- Use online comparison websites: These platforms allow you to enter your information once and receive quotes from various insurers. Popular options include Insurance.com, The Zebra, and Policygenius.

- Contact insurance agents directly: Agents can provide personalized guidance and help you understand different coverage options.

- Consider your individual needs: Factors such as your driving history, vehicle type, and coverage requirements will influence your insurance costs.

- Don’t automatically renew: Regularly review your policy and compare quotes from other insurers to ensure you’re getting the best value.

Driving Safely and Reducing Accident Risk

Safe driving habits are essential for minimizing insurance premiums.

- Maintain a clean driving record: Avoiding traffic violations and accidents can significantly reduce your insurance costs.

- Practice defensive driving: Be aware of your surroundings, anticipate potential hazards, and maintain a safe distance from other vehicles.

- Avoid distractions: Put away your phone, avoid eating while driving, and limit passengers to minimize distractions.

- Get regular vehicle maintenance: Ensure your car is in good working order to prevent breakdowns and accidents.

Minimizing Insurance Costs

Several strategies can help you reduce your insurance premiums.

- Bundle your policies: Combining your car insurance with other policies, such as homeowners or renters insurance, can often lead to discounts.

- Increase your deductible: Choosing a higher deductible can lower your monthly premium, but you’ll be responsible for paying more out of pocket if you file a claim.

- Ask about discounts: Insurers offer various discounts, such as safe driver discounts, good student discounts, and multi-car discounts.

- Consider a telematics device: These devices track your driving habits and can potentially earn you discounts if you demonstrate safe driving practices.

Understanding Car Insurance Policies and Coverage

It’s essential to understand the different types of coverage and their importance.

- Liability coverage: This protects you financially if you cause an accident that injures someone or damages their property.

- Collision coverage: This covers damage to your vehicle in an accident, regardless of who is at fault.

- Comprehensive coverage: This covers damage to your vehicle from events other than collisions, such as theft, vandalism, or natural disasters.

- Uninsured/underinsured motorist coverage: This protects you if you’re involved in an accident with a driver who doesn’t have insurance or has insufficient coverage.

Final Summary

The issue of Florida car insurance increase is multifaceted, demanding a multifaceted approach to find solutions. By understanding the underlying causes, drivers can become more informed consumers and advocate for changes that prioritize affordability. From pursuing legislative reforms to exploring alternative insurance options, there are steps individuals can take to navigate this challenging landscape. Ultimately, addressing the affordability of car insurance is crucial for ensuring that Floridians have access to the coverage they need while remaining financially secure.

Quick FAQs: Florida Car Insurance Increase

What are some common discounts that can help reduce car insurance premiums in Florida?

Common discounts include good driver discounts, safe driver discounts, multi-car discounts, and bundling discounts for combining auto and home insurance.

What are some tips for avoiding car accidents and reducing the risk of insurance claims?

Defensive driving techniques, maintaining your vehicle, avoiding distractions while driving, and being aware of your surroundings can all contribute to safer driving and a lower risk of accidents.

How can I compare car insurance quotes from different providers?

Use online comparison websites, contact insurance agents directly, and compare quotes based on coverage options and premium costs.