- Understanding Florida’s Car Insurance Landscape

- Key Factors Influencing Car Insurance Rates

- Types of Car Insurance Coverage in Florida

- Choosing the Right Car Insurance Provider

- Tips for Saving on Car Insurance in Florida

- Common Car Insurance Claims in Florida

- Protecting Yourself from Car Insurance Scams

- Concluding Remarks

- User Queries: General Car Insurance Florida

General car insurance Florida is a crucial aspect of driving in the Sunshine State, where unique laws and regulations shape the insurance landscape. Navigating the complexities of Florida’s no-fault insurance system, understanding the factors that influence premiums, and choosing the right coverage can feel overwhelming. This guide aims to provide a comprehensive overview of general car insurance in Florida, empowering you to make informed decisions about your coverage and save money.

From exploring the different types of coverage available to understanding how to find the best provider and negotiate favorable rates, this guide will equip you with the knowledge needed to secure the right car insurance for your needs and budget. We’ll also delve into common claims processes, scams to watch out for, and tips for protecting yourself in the event of an accident.

Understanding Florida’s Car Insurance Landscape

Florida’s car insurance landscape is distinct and presents unique challenges for drivers. Understanding the state’s regulations and their impact on premiums is crucial for making informed decisions.

Florida’s No-Fault Insurance System, General car insurance florida

Florida’s no-fault insurance system, also known as Personal Injury Protection (PIP), requires all drivers to carry a minimum of $10,000 in PIP coverage. This coverage pays for medical expenses and lost wages regardless of fault in an accident. While intended to simplify claims and reduce litigation, the no-fault system has contributed to higher car insurance costs in Florida.

Impact of No-Fault on Car Insurance Costs

The no-fault system has led to an increase in fraudulent claims and lawsuits, putting upward pressure on premiums. The system’s complexities and loopholes have created opportunities for abuse, leading to higher costs for all drivers.

Average Car Insurance Premiums in Florida

Florida consistently ranks among the states with the highest average car insurance premiums. According to the National Association of Insurance Commissioners (NAIC), the average annual premium in Florida was $2,474 in 2022, significantly higher than the national average of $1,771.

Key Factors Influencing Car Insurance Rates

In Florida, like in any other state, several factors play a significant role in determining your car insurance premiums. Understanding these factors can help you make informed decisions about your coverage and potentially lower your costs.

Age

Age is a key factor influencing car insurance rates. Younger drivers, particularly those under 25, generally pay higher premiums. This is because they are statistically more likely to be involved in accidents due to lack of experience, risk-taking behavior, and higher exposure to driving. Conversely, older drivers, especially those over 65, often benefit from lower rates due to their longer driving experience and lower risk profile.

Driving History

Your driving history significantly impacts your car insurance rates. A clean driving record with no accidents or traffic violations will generally result in lower premiums. However, any incidents like accidents, speeding tickets, DUI convictions, or other violations will likely increase your rates. Insurance companies consider these incidents as indicators of higher risk and adjust premiums accordingly.

Vehicle Type

The type of vehicle you drive also influences your insurance premiums. Luxury cars, sports cars, and high-performance vehicles are often associated with higher repair costs and a greater risk of accidents. Therefore, insurance companies tend to charge higher premiums for these vehicles. On the other hand, smaller, less expensive vehicles typically have lower insurance rates due to their lower repair costs and reduced risk profile.

Geographic Location

Where you live in Florida can also affect your car insurance rates. Areas with higher crime rates, denser traffic, and more accidents tend to have higher insurance premiums. For example, urban areas with heavy traffic and congested roads may experience more accidents, leading to higher insurance rates. Conversely, rural areas with lower population density and less traffic might have lower insurance rates.

Coverage Options

The type and amount of coverage you choose significantly affect your car insurance premiums. Comprehensive and collision coverage, which protect against damage to your vehicle, are generally more expensive than liability coverage, which protects you against claims from others. Higher coverage limits also lead to higher premiums.

Types of Car Insurance Coverage in Florida

In Florida, like in most states, car insurance is mandatory. Understanding the various types of coverage available is crucial for making informed decisions about your policy. This section will delve into the different types of car insurance coverage available in Florida, explaining their benefits, drawbacks, and when they are most essential.

Understanding Different Types of Car Insurance Coverage

Florida law mandates that all drivers carry at least the following types of coverage:

- Personal Injury Protection (PIP): This coverage pays for medical expenses, lost wages, and other related costs incurred by you or passengers in your vehicle, regardless of who is at fault in an accident. Florida’s PIP coverage is often referred to as “no-fault” insurance because it covers your own medical expenses, even if you are at fault.

- Property Damage Liability (PDL): This coverage protects you from financial responsibility for damage caused to another person’s vehicle or property in an accident that you are at fault for. It helps pay for repairs or replacement of the other driver’s vehicle, as well as any other property damage.

In addition to the mandatory coverages, you can opt for additional types of coverage, which can provide broader protection:

| Coverage Type | Description | Coverage Limits | Typical Costs |

|---|---|---|---|

| Collision | Covers damage to your vehicle resulting from a collision with another vehicle or object, regardless of who is at fault. | The actual cash value of your vehicle at the time of the accident. | Varies based on vehicle type, age, and driving history. |

| Comprehensive | Covers damage to your vehicle caused by events other than a collision, such as theft, vandalism, fire, hail, or natural disasters. | The actual cash value of your vehicle at the time of the accident. | Varies based on vehicle type, age, and driving history. |

| Uninsured/Underinsured Motorist (UM/UIM) | Protects you and your passengers in the event of an accident caused by a driver who is uninsured or underinsured. | Varies based on the policy. | Varies based on the policy and coverage limits. |

| Medical Payments (Med Pay) | Provides additional coverage for medical expenses incurred by you or your passengers in an accident, regardless of fault. | Varies based on the policy. | Varies based on the policy and coverage limits. |

| Rental Reimbursement | Covers the cost of renting a vehicle while your vehicle is being repaired after an accident. | Varies based on the policy. | Varies based on the policy and coverage limits. |

Benefits and Drawbacks of Different Coverage Types

Each type of car insurance coverage offers distinct advantages and disadvantages, which are crucial to consider when customizing your policy:

- Collision and Comprehensive Coverage:

- Benefits: These coverages provide financial protection for repairs or replacement of your vehicle in case of an accident or damage caused by events other than a collision. This can be particularly beneficial if you have a newer vehicle with a higher value or if you are financing your vehicle.

- Drawbacks: Collision and comprehensive coverage can increase your premium costs. It may not be as essential if you have an older vehicle with a lower value or if you are comfortable paying for repairs out of pocket.

- Uninsured/Underinsured Motorist (UM/UIM) Coverage:

- Benefits: This coverage is essential for protecting yourself and your passengers in case of an accident caused by a driver who does not have adequate insurance or no insurance at all. It can help cover medical expenses, lost wages, and other related costs.

- Drawbacks: While it offers valuable protection, UM/UIM coverage can add to your premium costs.

- Medical Payments (Med Pay) Coverage:

- Benefits: Med Pay coverage provides additional protection for medical expenses, regardless of fault. This can be helpful if your PIP coverage is insufficient to cover all your medical costs.

- Drawbacks: Med Pay coverage can increase your premium costs. It may be unnecessary if you have comprehensive health insurance that covers your medical expenses.

- Rental Reimbursement Coverage:

- Benefits: This coverage helps cover the cost of renting a vehicle while your vehicle is being repaired. It can be convenient and necessary, especially if you rely on your vehicle for work or daily activities.

- Drawbacks: Rental reimbursement coverage can add to your premium costs. It may not be essential if you have alternative transportation options or if you can afford to pay for a rental out of pocket.

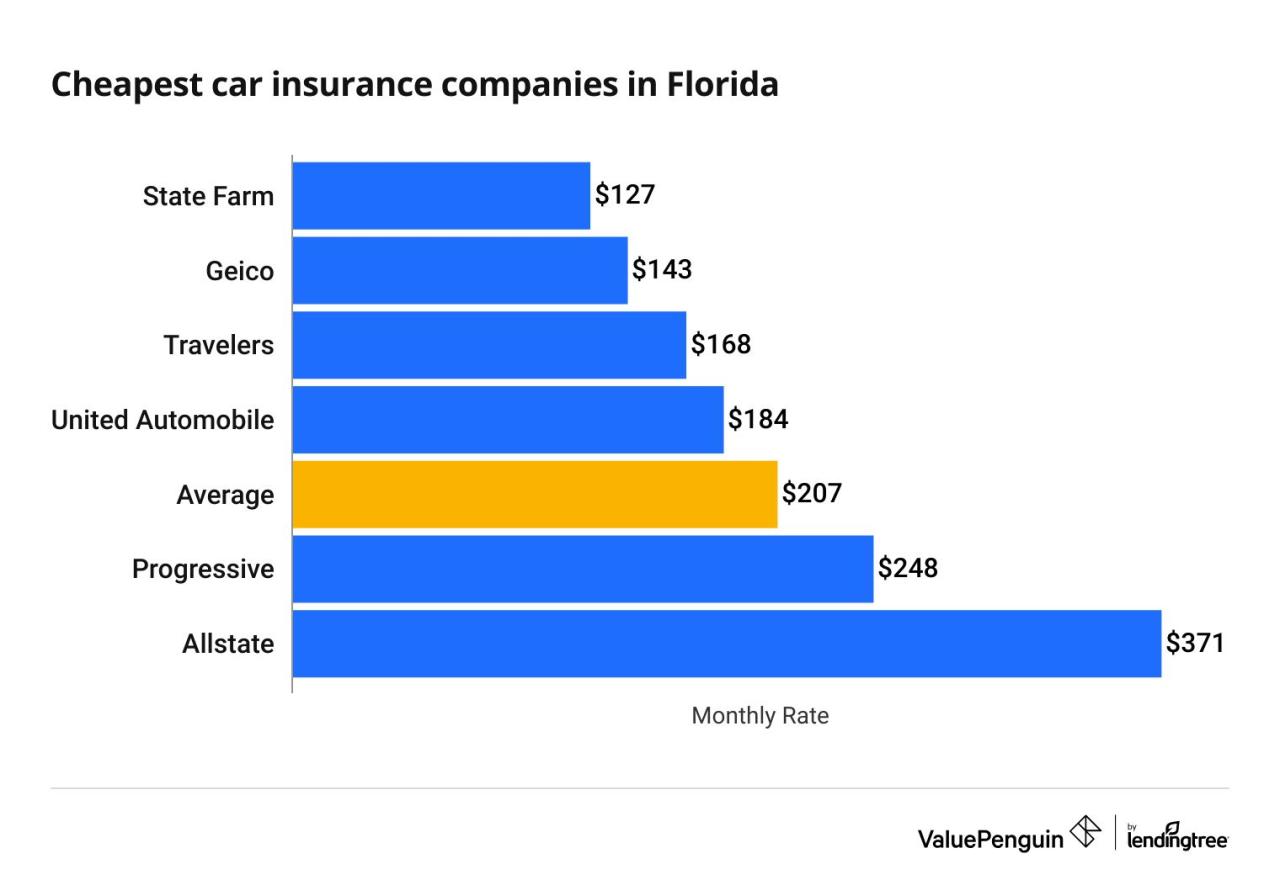

Choosing the Right Car Insurance Provider

Navigating the diverse landscape of car insurance providers in Florida can be a daunting task. With numerous options available, finding the best fit for your specific needs and budget is crucial. To make an informed decision, it’s essential to compare the services, features, and customer satisfaction ratings of different companies.

Comparing Services and Features

When choosing a car insurance provider, it’s essential to compare the services and features offered by different companies. This includes factors such as coverage options, discounts, customer service, and claims processing.

- Coverage Options: Different providers offer varying levels of coverage, including liability, collision, comprehensive, and personal injury protection (PIP). Compare the specific coverage options and limits offered by each company to ensure they meet your individual needs.

- Discounts: Many car insurance companies offer discounts for various factors, such as safe driving records, good grades for students, and vehicle safety features. Compare the discounts offered by different providers to see which ones apply to you and potentially save you money.

- Customer Service: Customer service is a critical aspect of the car insurance experience. Look for companies with a strong reputation for responsive and helpful customer service, including 24/7 availability and easy-to-use online platforms.

- Claims Processing: The claims process can be stressful, so it’s essential to choose a provider with a straightforward and efficient claims process. Research companies’ claims handling procedures, including their average processing time and customer satisfaction with their claims experience.

The Importance of Customer Reviews and Ratings

Customer reviews and ratings can provide valuable insights into the overall experience of a car insurance company. Websites like J.D. Power, Consumer Reports, and the Better Business Bureau offer independent ratings and reviews from actual customers, allowing you to gauge a company’s reputation for customer satisfaction, claims handling, and overall service.

- J.D. Power: J.D. Power is a well-respected independent research firm that conducts customer satisfaction surveys for various industries, including car insurance. Their ratings provide insights into customer satisfaction with factors such as price, claims handling, and overall customer experience.

- Consumer Reports: Consumer Reports is a non-profit organization that provides unbiased reviews and ratings for various products and services, including car insurance. Their ratings are based on customer satisfaction surveys, claims data, and financial stability.

- Better Business Bureau (BBB): The BBB is a non-profit organization that accredits businesses and provides consumer information. Their website includes customer complaints, business reviews, and ratings, allowing you to assess a company’s reputation for customer service and business practices.

Factors to Consider When Choosing a Car Insurance Provider

Choosing the right car insurance provider involves considering various factors beyond just price. Here are some key considerations to guide your decision:

- Financial Stability: Choose a company with a strong financial rating, indicating its ability to pay claims in the event of an accident. Check the company’s rating with agencies like A.M. Best or Standard & Poor’s.

- Coverage Options: Ensure the provider offers the specific coverage options you need, including liability, collision, comprehensive, and PIP. Compare the coverage limits and deductibles offered by different companies.

- Discounts: Explore the available discounts offered by each company, such as safe driving discounts, good student discounts, and multi-car discounts. Maximize your savings by taking advantage of all applicable discounts.

- Customer Service: Look for a company with a strong reputation for customer service, including 24/7 availability, responsive communication, and easy-to-use online platforms. Read customer reviews and ratings to assess their customer service experience.

- Claims Processing: Research the claims handling procedures of different companies, including their average processing time and customer satisfaction with their claims experience. Choose a provider with a straightforward and efficient claims process.

Tips for Saving on Car Insurance in Florida

Florida’s car insurance rates can be high, but there are several strategies you can employ to reduce your premiums. By understanding the factors that influence your rates and taking proactive steps, you can potentially save a significant amount of money on your car insurance.

Understanding How Discounts Can Impact Insurance Costs

Discounts are a powerful tool for reducing your car insurance premiums. Florida insurance companies offer a variety of discounts based on factors like your driving history, vehicle safety features, and even your occupation. Taking advantage of these discounts can significantly reduce your overall costs.

- Good Driver Discount: Maintaining a clean driving record with no accidents or traffic violations is crucial. Insurance companies often reward drivers with a good driver discount for their safe driving habits.

- Safe Vehicle Discount: Cars equipped with advanced safety features, such as anti-lock brakes, airbags, and electronic stability control, are generally considered safer and can qualify for a discount.

- Multi-Policy Discount: Bundling your car insurance with other policies, such as homeowners or renters insurance, can often result in a significant discount.

- Student Discount: If you are a full-time student with good grades, you may be eligible for a student discount.

- Senior Citizen Discount: Drivers over a certain age, typically 55 or 65, may qualify for a senior citizen discount.

Negotiating with Insurance Companies for Better Rates

While discounts are helpful, negotiating with your insurance company can also lead to lower premiums. Here are some tips for effective negotiation:

- Shop Around: Compare quotes from multiple insurance companies to see who offers the best rates for your specific needs.

- Review Your Policy: Thoroughly review your current policy and identify areas where you can potentially save money.

- Ask for a Discount: Inquire about available discounts, especially if you have recently taken steps to improve your driving safety or your vehicle’s safety features.

- Be Prepared to Switch: If your current insurer is unwilling to negotiate, be prepared to switch to another company that offers better rates.

Exploring Additional Savings Opportunities

Beyond discounts and negotiation, other strategies can help you save on car insurance:

- Increase Your Deductible: Raising your deductible, the amount you pay out-of-pocket before insurance coverage kicks in, can lower your premium. However, make sure you can afford the higher deductible in case of an accident.

- Maintain a Good Driving Record: As mentioned earlier, a clean driving record is essential for securing discounts and lower rates.

- Consider Pay-as-You-Drive Programs: These programs use telematics devices to track your driving habits and offer discounts based on safe driving behavior.

- Explore Group Discounts: Certain organizations, such as alumni associations or professional groups, may offer group discounts on car insurance.

Common Car Insurance Claims in Florida

Florida experiences a high volume of car insurance claims due to its large population, heavy traffic, and susceptibility to severe weather events. Understanding the most common types of claims can help Florida drivers better prepare for potential situations and navigate the claims process effectively.

Types of Car Insurance Claims

The most frequent types of car insurance claims filed in Florida are:

- Collision Claims: These claims arise when your vehicle collides with another vehicle, an object, or a stationary object. They are typically filed when the damage to your vehicle is significant enough to warrant repairs or replacement. Examples of collision claims include accidents at intersections, rear-end collisions, and collisions with stationary objects like poles or fences.

- Comprehensive Claims: These claims cover damage to your vehicle caused by events other than collisions, such as theft, vandalism, natural disasters, and animal collisions. For instance, if your car is damaged by a hailstorm or stolen, you can file a comprehensive claim to cover the repairs or replacement costs.

- Liability Claims: These claims are filed when you are at fault for an accident that causes injury or damage to another person or property. The liability coverage pays for the other party’s medical expenses, property damage, and legal costs. Examples of liability claims include accidents where you caused another driver’s injuries or damaged their vehicle.

- Personal Injury Protection (PIP) Claims: This coverage, mandatory in Florida, pays for your own medical expenses, lost wages, and other related costs, regardless of who is at fault in an accident. It is a no-fault system, meaning you can file a PIP claim even if you were responsible for the accident.

- Uninsured/Underinsured Motorist (UM/UIM) Claims: These claims come into play when you are involved in an accident with a driver who has no insurance or insufficient insurance to cover your losses. UM/UIM coverage protects you from financial hardship in such situations. For example, if you are injured in an accident caused by an uninsured driver, your UM coverage would help pay for your medical expenses and other related costs.

The Claims Process

The claims process begins when you notify your insurance company about the accident. You will need to provide details about the accident, including the date, time, location, and parties involved. Your insurance company will then assign an insurance adjuster to investigate the claim.

Role of Insurance Adjusters

Insurance adjusters play a crucial role in the claims process. They gather information about the accident, assess the damage to your vehicle, and determine the amount of coverage you are entitled to. They will also negotiate with you on the settlement amount and may require you to provide documentation, such as medical bills and repair estimates.

Common Claim Disputes

Disputes can arise during the claims process, often related to the following:

- Liability: Disputes may occur when there is disagreement about who is at fault for the accident. If you are involved in a multi-vehicle accident, determining fault can be complex, especially if there are conflicting accounts or evidence.

- Damages: Disputes can arise over the extent of the damage to your vehicle or the cost of repairs. You may disagree with the insurance adjuster’s assessment of the damage or the amount they are willing to pay for repairs.

- Medical Expenses: Disputes can arise over the amount of medical expenses covered by your insurance. You may disagree with the insurance company’s assessment of your medical bills or the amount they are willing to pay.

- Lost Wages: Disputes can arise over the amount of lost wages covered by your insurance. You may disagree with the insurance company’s assessment of your lost wages or the amount they are willing to pay.

Resolving Claim Disputes

If you cannot resolve a claim dispute with your insurance company, you have several options:

- Negotiate with the Adjuster: You can try to negotiate a higher settlement amount with the insurance adjuster. Be prepared to present evidence to support your claim, such as medical bills, repair estimates, and witness statements.

- File a Complaint with the Florida Department of Financial Services: If you believe your insurance company is acting in bad faith, you can file a complaint with the Florida Department of Financial Services. This department can investigate your complaint and may be able to help you resolve the dispute.

- Seek Legal Counsel: If you are unable to resolve the dispute through negotiation or mediation, you may need to seek legal counsel. A lawyer can help you understand your rights and options and can represent you in court if necessary.

Protecting Yourself from Car Insurance Scams

Florida’s car insurance landscape is unfortunately susceptible to scams, making it crucial for policyholders to be vigilant and informed. Understanding the tactics used by fraudsters and implementing preventative measures can help you safeguard yourself and your finances.

Types of Car Insurance Scams in Florida

Car insurance scams can take various forms, targeting both drivers and insurance companies. Here are some common types prevalent in Florida:

- Staged Accidents: These involve individuals intentionally causing accidents to file fraudulent claims for injuries and vehicle damage. They may use accomplices or even orchestrate minor collisions with their own vehicles.

- Fake Accident Claims: In this type of scam, individuals claim to have been involved in an accident that never occurred, fabricating details to receive compensation.

- Inflated Claims: Policyholders may exaggerate the extent of their injuries or vehicle damage to receive a larger payout from their insurance company.

- Ghost Cars: This involves reporting a vehicle as stolen when it has actually been sold or scrapped, with the intent of collecting insurance benefits.

- Premium Fraud: Individuals may provide false information on their insurance applications to secure lower premiums, such as omitting driving violations or claiming a different address.

Recognizing and Avoiding Insurance Fraud

While it’s impossible to eliminate the risk of fraud entirely, you can take steps to protect yourself:

- Be cautious of unsolicited offers: Avoid dealing with individuals who approach you with suspicious offers related to insurance claims or accident settlements.

- Report any suspicious activity: If you witness an accident that seems staged or encounter individuals offering to help you file a fraudulent claim, report it to the authorities immediately.

- Be wary of exaggerated claims: If you are involved in an accident, be honest about the extent of your injuries and vehicle damage. Do not inflate your claim.

- Know your insurance policy: Familiarize yourself with your coverage and understand the claims process. This will help you identify any inconsistencies or red flags.

- Choose a reputable insurance provider: Opt for a company with a strong reputation for integrity and fraud prevention measures. Look for insurers that have robust fraud detection systems in place.

Reporting Suspected Scams to Authorities

If you suspect a car insurance scam, it is crucial to report it to the appropriate authorities. This not only protects you but also helps prevent further fraudulent activity.

- Florida Department of Financial Services (DFS): The DFS is responsible for regulating insurance companies and investigating insurance fraud. You can report suspected scams online or by phone.

- Your insurance company: Contact your insurer and report any suspicious activity. They have a vested interest in preventing fraud and may have resources to assist you.

- Local law enforcement: If you witness a staged accident or believe a crime has been committed, contact your local police department.

Concluding Remarks

Navigating general car insurance in Florida can be a complex journey, but with the right information and strategies, you can secure the best possible coverage at an affordable price. By understanding the unique features of Florida’s insurance landscape, comparing providers, and taking advantage of available discounts, you can drive with peace of mind knowing that you’re adequately protected on the road.

User Queries: General Car Insurance Florida

What is the minimum car insurance coverage required in Florida?

Florida requires drivers to have a minimum of $10,000 in Personal Injury Protection (PIP) and $10,000 in Property Damage Liability (PDL) coverage. This is known as the “no-fault” system.

How can I get a free car insurance quote in Florida?

Many insurance companies offer free online quotes. You can also contact insurance agents directly to request a quote.

What factors affect car insurance rates in Florida?

Factors such as age, driving history, vehicle type, location, and coverage options can all impact your insurance rates.

What are some common car insurance scams in Florida?

Common scams include staged accidents, fraudulent claims, and fake insurance policies. Be cautious of any suspicious offers or requests for information.

How do I file a car insurance claim in Florida?

Contact your insurance company as soon as possible after an accident. They will guide you through the claims process and provide instructions on how to file a claim.