Car Insurance Tampa Florida Cheap: Navigating the world of car insurance in Tampa, Florida can be a daunting task, especially when you’re looking for affordable options. With its bustling streets and diverse population, Tampa presents a unique landscape for car insurance rates. Understanding the factors that influence these rates is crucial to finding the best coverage at a price that fits your budget.

From the impact of your driving record to the type of car you drive, several variables play a role in determining your car insurance premiums. This guide will delve into the intricacies of car insurance in Tampa, providing valuable insights and practical tips to help you secure affordable coverage without compromising on protection.

Understanding Car Insurance in Tampa, Florida

Navigating the world of car insurance in Tampa, Florida can seem daunting, but understanding the key factors influencing rates and the various coverage options available can make the process smoother. This guide provides an overview of car insurance in Tampa, including factors influencing rates, common coverage types, and state-mandated minimum requirements.

Factors Influencing Car Insurance Rates in Tampa

Several factors determine car insurance rates in Tampa. These factors are considered by insurance companies to assess the risk associated with insuring a particular driver. Understanding these factors can help drivers make informed decisions to potentially lower their premiums.

- Driving History: Your driving record plays a significant role in determining your insurance rates. Accidents, traffic violations, and DUI convictions can significantly increase your premiums. Maintaining a clean driving record is crucial for keeping your rates low.

- Age and Gender: Younger and inexperienced drivers are statistically more likely to be involved in accidents, leading to higher insurance premiums. Conversely, older drivers often benefit from lower rates due to their longer driving experience and lower risk profile.

- Vehicle Type and Value: The type and value of your vehicle significantly impact your insurance rates. Sports cars and luxury vehicles tend to have higher insurance premiums due to their higher repair costs and potential for theft.

- Location: Tampa’s geographic location and crime rates can influence insurance premiums. Areas with higher crime rates or more traffic congestion may see higher insurance rates due to the increased risk of accidents or theft.

- Credit Score: Surprisingly, your credit score can also influence your car insurance rates. Insurers often use credit scores as a proxy for risk, as individuals with lower credit scores may be more likely to file claims.

- Coverage Levels: The amount of coverage you choose, such as comprehensive, collision, and liability coverage, directly impacts your premium. Higher coverage levels typically result in higher premiums.

Common Types of Car Insurance Coverage

Understanding the different types of car insurance coverage available is crucial for making informed decisions about your insurance needs.

- Liability Coverage: This coverage protects you financially if you cause an accident that results in injuries or property damage to others. It typically includes bodily injury liability and property damage liability.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of fault.

- Comprehensive Coverage: This coverage protects your vehicle against damages from events other than collisions, such as theft, vandalism, fire, or natural disasters.

- Personal Injury Protection (PIP): This coverage pays for medical expenses, lost wages, and other related expenses for you and your passengers, regardless of fault.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you’re involved in an accident with a driver who doesn’t have insurance or has insufficient coverage.

State-Mandated Minimum Car Insurance Requirements

Florida requires all drivers to carry a minimum amount of car insurance coverage. These requirements are designed to ensure that drivers have financial protection in case of an accident.

The minimum car insurance requirements in Florida are:

* $10,000 for Personal Injury Protection (PIP)

* $10,000 for Property Damage Liability (PDL)

While meeting these minimum requirements is mandatory, it’s essential to consider the potential consequences of having only the minimum coverage. In the event of a serious accident, the minimum coverage may not be sufficient to cover all the costs, leaving you financially responsible for the difference.

Factors Affecting Cheap Car Insurance Rates

In Tampa, Florida, numerous factors can significantly impact your car insurance premiums. Understanding these factors can help you make informed decisions to potentially secure cheaper rates. Here’s a breakdown of some key aspects influencing your car insurance costs.

Driving Record, Car insurance tampa florida cheap

Your driving history is a major factor in determining your car insurance rates. A clean driving record, free of accidents, traffic violations, or DUI convictions, generally translates to lower premiums. However, any incidents can lead to substantial increases.

- Clean Record: A clean driving record signifies responsible driving habits, which insurers reward with lower premiums.

- Accidents: Even a single accident can lead to a significant rise in your insurance premiums. The severity of the accident and any fault assigned to you will further influence the increase.

- Traffic Violations: Speeding tickets, reckless driving citations, and other traffic violations can also increase your insurance rates. The severity of the violation and the frequency of occurrences play a role.

- DUI Convictions: DUI convictions are considered serious offenses and can result in substantial increases in your insurance premiums. These increases often persist for several years.

Age, Gender, and Credit Score

These factors can influence your car insurance rates in Tampa, though their impact varies by insurance company.

- Age: Young drivers, especially those under 25, are statistically more likely to be involved in accidents. This higher risk is often reflected in higher insurance premiums. As drivers gain experience and age, premiums tend to decrease.

- Gender: Historically, insurance companies have observed differences in accident rates between men and women. However, these differences are narrowing, and some states have banned gender-based pricing. In Tampa, it’s essential to compare quotes from different insurers to understand how gender might impact your rates.

- Credit Score: In some states, including Florida, insurers use credit scores as a factor in determining insurance premiums. A good credit score is generally associated with responsible financial behavior, which can lead to lower insurance rates.

Car Type, Usage, and Location

The type of car you drive, how you use it, and where you live can all influence your car insurance premiums.

- Car Type: The make, model, and year of your car are considered when calculating insurance premiums. Luxury vehicles, sports cars, and high-performance models are often associated with higher risk and therefore higher insurance costs. The safety features of your car, such as airbags and anti-theft systems, can also impact your rates.

- Usage: How you use your car can also influence your premiums. If you drive your car frequently for work or long commutes, you might be considered a higher risk than someone who uses their car primarily for short trips. Your driving habits, such as the number of miles you drive annually, can also affect your rates.

- Location: Your location in Tampa can impact your insurance premiums. Areas with higher crime rates or more traffic congestion may be considered higher risk and lead to higher insurance rates. The density of the population in your area can also be a factor.

Finding Affordable Car Insurance Options in Tampa

Finding affordable car insurance in Tampa, Florida, requires careful research and comparison. The right insurance policy can provide financial protection and peace of mind, but it’s essential to find a balance between coverage and cost. This section will explore reputable insurance companies operating in Tampa, their pricing and coverage options, and a step-by-step guide to obtaining quotes from multiple companies.

Reputable Car Insurance Companies in Tampa

Tampa is home to a diverse range of insurance companies, each offering unique coverage options and pricing structures.

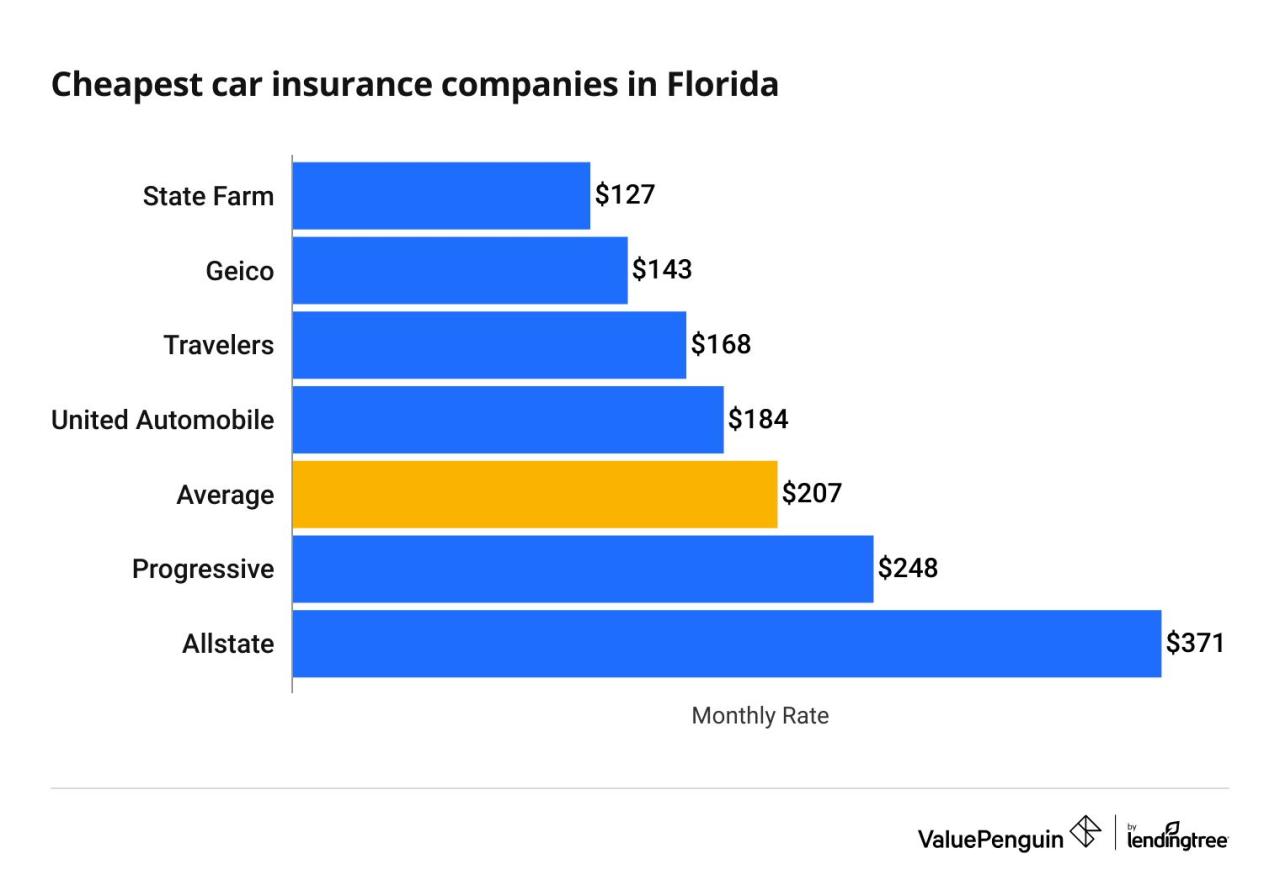

- State Farm: Known for its widespread availability and comprehensive coverage options, State Farm is a popular choice for many Tampa residents. Their policies typically offer competitive rates and a strong reputation for customer service.

- GEICO: GEICO is another prominent insurer with a national presence. They are known for their competitive pricing and straightforward policies, often offering discounts for good driving records and safety features.

- Progressive: Progressive is recognized for its innovative insurance products, including its name-your-price tool that allows customers to customize their coverage and budget. They also offer a wide range of discounts, including those for bundling multiple insurance policies.

- Allstate: Allstate provides a variety of insurance products, including car insurance, and is known for its strong customer service and personalized insurance plans.

- USAA: USAA is a highly-rated insurer that specializes in serving military personnel and their families. They offer competitive rates and exceptional customer service, particularly for active-duty military members and veterans.

Comparing Pricing and Coverage Options

Insurance companies often have different pricing structures and coverage options. To find the most affordable and suitable policy, it’s crucial to compare quotes from multiple providers.

- Coverage Levels: Insurance companies offer various coverage levels, from basic liability coverage to comprehensive and collision coverage. It’s important to understand the different types of coverage and choose a policy that aligns with your individual needs and budget.

- Deductibles: Deductibles are the amount you pay out-of-pocket before your insurance coverage kicks in. Higher deductibles typically result in lower premiums, while lower deductibles lead to higher premiums.

- Discounts: Insurance companies offer various discounts, including those for good driving records, safety features, multiple policy bundling, and membership in certain organizations. Taking advantage of these discounts can significantly reduce your premium costs.

Obtaining Car Insurance Quotes

Getting car insurance quotes from multiple companies is essential to find the best deal. Here’s a step-by-step guide:

- Gather Your Information: Before requesting quotes, gather essential information, including your driving history, vehicle details, and personal information.

- Contact Insurance Companies: Contact multiple insurance companies either online, over the phone, or in person. Provide them with your information and request a quote.

- Compare Quotes: Carefully compare the quotes you receive, considering the coverage levels, deductibles, and discounts offered.

- Choose a Policy: Select the policy that best suits your needs and budget, considering factors like coverage, price, and customer service.

Tips for Saving on Car Insurance in Tampa

Car insurance in Tampa can be expensive, but there are several strategies you can use to lower your premiums. By understanding the factors that affect your rates and implementing these tips, you can find more affordable car insurance options.

Shop Around and Compare Quotes

The first step to saving money on car insurance is to shop around and compare quotes from multiple insurance companies. Different insurers use different formulas to calculate premiums, so you may find significant price variations between them. Online comparison tools can help you quickly gather quotes from various companies, making it easier to find the best deal.

Consider Bundling Insurance Policies

Many insurance companies offer discounts for bundling multiple insurance policies, such as car insurance, home insurance, and renters insurance. Bundling your policies can save you money on your overall premiums by allowing the insurer to offer you a combined rate.

Improve Your Driving Record

Your driving record is a major factor in determining your car insurance rates. A clean driving record with no accidents or traffic violations will earn you lower premiums. Maintaining a safe driving record is crucial for keeping your insurance costs down.

Choose a Safe Car

The type of car you drive can significantly impact your insurance premiums. Cars with safety features, such as anti-lock brakes, airbags, and stability control, are often considered safer and can lead to lower insurance rates. Researching car safety ratings before purchasing a vehicle can help you make an informed decision that considers both affordability and safety.

Increase Your Deductible

Your deductible is the amount you pay out of pocket before your insurance coverage kicks in. Raising your deductible can lower your monthly premiums. However, ensure you can afford to pay the higher deductible in case of an accident. Consider your financial situation and risk tolerance when making this decision.

Take Advantage of Discounts

Insurance companies offer various discounts to their policyholders. Some common discounts include:

- Good Student Discount: This discount is available to students with good grades.

- Safe Driver Discount: This discount is awarded to drivers with a clean driving record.

- Multi-Car Discount: This discount is available to policyholders with multiple cars insured under the same policy.

- Anti-theft Device Discount: This discount is available to drivers who have anti-theft devices installed in their vehicles.

- Loyalty Discount: This discount is offered to policyholders who have been with the same insurance company for a certain period.

- Pay-in-Full Discount: This discount is available to policyholders who pay their premiums in full upfront.

- Electronic Payment Discount: This discount is available to policyholders who pay their premiums electronically.

Contact your insurance company to inquire about available discounts and eligibility requirements.

Consider Defensive Driving Courses

Completing a defensive driving course can help you become a safer driver and potentially lower your insurance premiums. These courses teach you safe driving techniques and strategies to avoid accidents. Some insurance companies offer discounts to policyholders who complete defensive driving courses.

Maintain a Good Credit Score

In some states, insurance companies use credit scores to determine car insurance rates. A good credit score can lead to lower premiums. Maintaining a good credit score by paying your bills on time and managing your debt responsibly can benefit your insurance costs.

Understanding Coverage and Exclusions: Car Insurance Tampa Florida Cheap

Car insurance policies in Tampa, Florida, offer various types of coverage to protect you financially in case of an accident or other incidents involving your vehicle. It is crucial to understand the different coverage options and their limitations to ensure you have adequate protection.

Types of Car Insurance Coverage

Different types of car insurance coverage provide different levels of protection. Understanding these types of coverage helps you choose the right level of protection for your needs and budget.

- Liability Coverage: This coverage protects you financially if you are at fault in an accident that causes injury or damage to another person or property. It typically includes bodily injury liability and property damage liability.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it is damaged in an accident, regardless of who is at fault.

- Comprehensive Coverage: This coverage protects your vehicle against damages caused by events other than collisions, such as theft, vandalism, fire, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are involved in an accident with a driver who is uninsured or underinsured. It covers your medical expenses and property damage.

- Personal Injury Protection (PIP): This coverage, often required in Florida, pays for your medical expenses, lost wages, and other related costs, regardless of who is at fault in an accident.

Common Exclusions and Limitations

While car insurance policies provide comprehensive coverage, certain situations and circumstances are typically excluded.

- Intentional Acts: Most car insurance policies exclude coverage for damages caused by intentional acts, such as driving under the influence of alcohol or drugs.

- Wear and Tear: Coverage generally does not extend to damages resulting from normal wear and tear, such as tire punctures or brake pad wear.

- Mechanical Failures: Damages caused by mechanical failures, such as engine problems or transmission issues, are typically not covered.

- Acts of War: Car insurance policies generally exclude coverage for damages caused by acts of war or terrorism.

- Certain Types of Vehicles: Some policies may exclude coverage for specific types of vehicles, such as motorcycles, recreational vehicles, or commercial vehicles.

Choosing the Right Coverage Level

The right level of car insurance coverage depends on your individual needs and circumstances. Consider the following factors:

- Your Financial Situation: Assess your ability to pay for potential damages or legal expenses in case of an accident.

- Your Vehicle’s Value: If you have a new or expensive vehicle, you may want to consider comprehensive and collision coverage.

- Your Driving History: If you have a clean driving record, you may qualify for lower premiums and can potentially opt for lower coverage levels.

- Your Location: The risk of accidents and theft can vary depending on your location.

- Your Personal Risk Tolerance: Consider your willingness to take on financial risk in case of an accident.

Closure

Finding cheap car insurance in Tampa doesn’t have to be a stressful endeavor. By understanding the factors that affect rates, comparing quotes from multiple insurance companies, and taking advantage of available discounts, you can secure the coverage you need at a price that works for you. Remember, it’s essential to prioritize your safety and financial well-being by choosing a reputable insurance provider that offers comprehensive protection and excellent customer service.

Common Queries

What are some common car insurance discounts available in Tampa?

Common car insurance discounts in Tampa include good driver discounts, safe car discounts, multi-policy discounts, and student discounts.

How often should I review my car insurance policy?

It’s recommended to review your car insurance policy at least annually to ensure it still meets your needs and to take advantage of any potential discounts or rate changes.

What happens if I get into an accident and don’t have enough car insurance coverage?

If you don’t have enough coverage, you could be personally liable for any damages or injuries exceeding your policy limits. This can lead to significant financial hardship.