Florida car insurance rate increase 2024 sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. The Sunshine State, known for its beautiful beaches and vibrant culture, is also facing a significant challenge in the form of rising car insurance premiums. This article delves into the reasons behind this increase, its impact on Florida drivers, and potential strategies to navigate the changing landscape of car insurance.

A complex interplay of factors is driving the predicted increase in car insurance rates in Florida. From legislative changes and legal decisions to inflation and rising repair costs, the forces at play are multifaceted and interconnected. This comprehensive analysis explores these contributing factors and their implications for Florida drivers, shedding light on the challenges they face in securing affordable car insurance.

Florida Car Insurance Market Overview

The Florida car insurance market is a complex and dynamic landscape, characterized by high rates and a competitive environment. Understanding the factors influencing car insurance rates is crucial for consumers and insurers alike.

History of Car Insurance Rates in Florida

Florida’s car insurance rates have historically been higher than the national average. This can be attributed to several factors, including a high volume of claims, a significant number of uninsured motorists, and the state’s susceptibility to natural disasters like hurricanes.

In recent years, the Florida car insurance market has seen a surge in rate increases. This is largely due to factors like:

* Increased Litigation: Florida’s legal system has been known to be favorable to plaintiffs in car accident cases, leading to higher claims costs for insurers.

* Fraudulent Claims: The state has a problem with fraudulent insurance claims, further increasing costs for insurers.

* Rising Repair Costs: The cost of car repairs has been on the rise, contributing to higher insurance premiums.

Factors Influencing Car Insurance Rates in Florida

Several factors contribute to the determination of car insurance rates in Florida. These include:

- Demographics: The state’s population demographics, including age, driving experience, and income levels, play a significant role in determining rates. Younger drivers, for instance, are statistically more likely to be involved in accidents, resulting in higher premiums.

- Driving History: Your driving history, including past accidents, traffic violations, and DUI convictions, significantly impacts your car insurance rate. A clean driving record typically translates to lower premiums.

- Vehicle Type: The type of vehicle you drive also influences your insurance rate. Sports cars and luxury vehicles, for example, tend to be more expensive to repair and replace, leading to higher premiums.

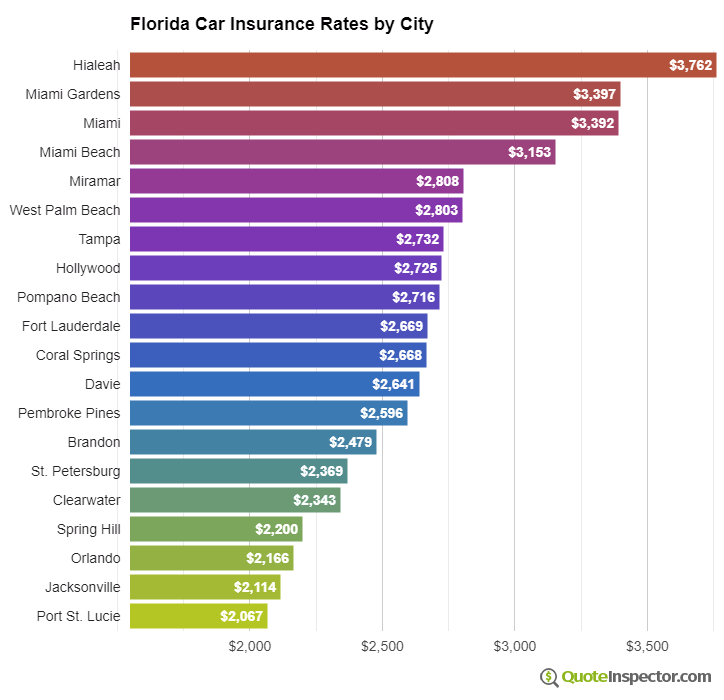

- Location: Your location within Florida also plays a role in determining your car insurance rate. Areas with higher crime rates and more traffic congestion typically have higher insurance premiums.

- Weather Patterns: Florida’s susceptibility to hurricanes and other natural disasters significantly influences car insurance rates. Insurers factor in the risk of damage and claims associated with these events.

- Claim Frequency: The frequency of car accidents and claims in a particular area also impacts insurance rates. Areas with a higher number of accidents tend to have higher premiums.

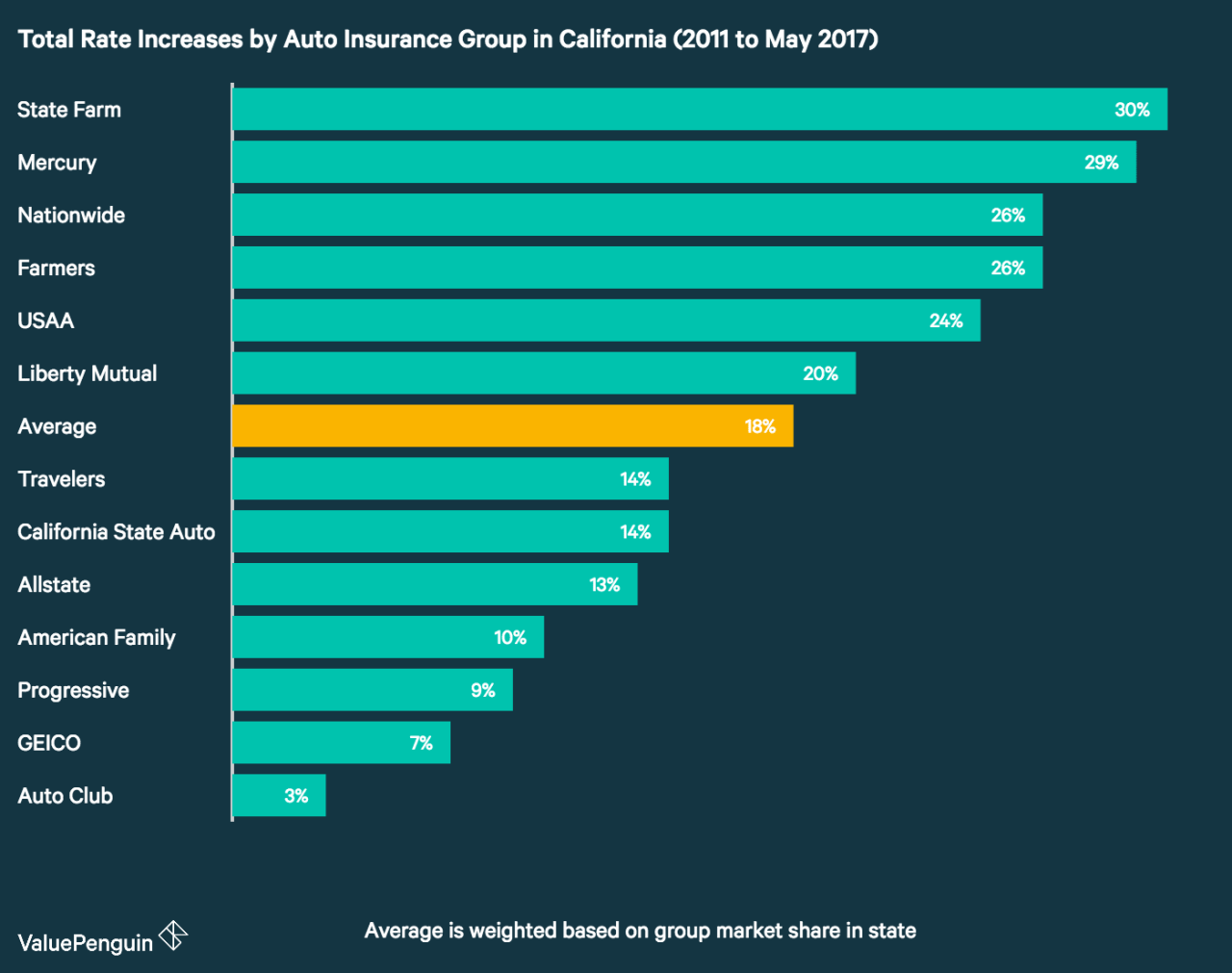

- Competition: The level of competition among insurance companies in a given area can also influence car insurance rates. More competition can lead to lower premiums as insurers strive to attract customers.

Reasons for the 2024 Rate Increase

Florida’s car insurance rates are expected to rise in 2024, driven by a confluence of factors, including legislative changes, legal decisions, and economic pressures. This upward trend reflects the complex interplay of these factors, ultimately impacting the cost of car insurance for Florida residents.

Impact of Legislative Changes and Legal Decisions

Legislative changes and legal decisions have significantly impacted the Florida car insurance market, leading to increased costs for insurers.

- Passage of the Florida Insurance Reforms in 2023: The 2023 reforms aimed to address the rising costs of insurance by limiting attorney fees and enacting stricter rules for filing claims. While intended to stabilize the market, these changes have also contributed to increased premiums, as insurers adjust their pricing strategies to account for the new regulations.

- Court Decisions and Litigation: Florida courts have seen an increase in lawsuits related to car accidents, leading to higher claims payouts for insurers. These legal challenges have put pressure on insurers to raise rates to cover their increased costs.

Inflation and Rising Repair Costs

Inflation and rising repair costs have played a significant role in driving up car insurance premiums.

- Increased Cost of Parts and Labor: The rising cost of car parts, particularly those involving advanced technology and electronics, has significantly impacted repair costs. Additionally, labor costs for mechanics have also risen, further increasing the overall cost of repairs.

- Supply Chain Disruptions: Global supply chain disruptions, particularly following the COVID-19 pandemic, have led to shortages of essential parts and materials, driving up prices and extending repair times.

Impact on Florida Drivers

The 2024 car insurance rate increase in Florida will have a significant impact on drivers across the state, potentially affecting their financial well-being and access to essential coverage. The impact will vary depending on individual circumstances, including income level, driving history, and the type of vehicle insured.

Impact on Different Demographics

The rate increase will affect drivers of all ages, but younger and older drivers may face more significant challenges. Younger drivers, often with less driving experience and higher risk profiles, may experience steeper increases. Older drivers, particularly those on fixed incomes, may find the increase harder to absorb.

- Young Drivers: Young drivers are generally considered higher risk, leading to higher premiums. The rate increase will exacerbate this, potentially making car insurance unaffordable for some young adults, particularly those starting out in their careers or attending college.

- Older Drivers: While older drivers often have better driving records, they may face higher rates due to factors like health conditions or increased risk of accidents. The rate increase could disproportionately affect older drivers on fixed incomes, forcing them to make difficult choices about their insurance coverage.

- Low-Income Drivers: Drivers with lower incomes are already more likely to struggle with the cost of car insurance. The rate increase will further strain their budgets, potentially forcing them to choose between essential needs and insurance coverage. This could lead to an increase in uninsured drivers, further jeopardizing road safety.

Impact on Affordability and Access

The rate increase could make car insurance less affordable for many Florida drivers, particularly those with limited financial resources. This could lead to:

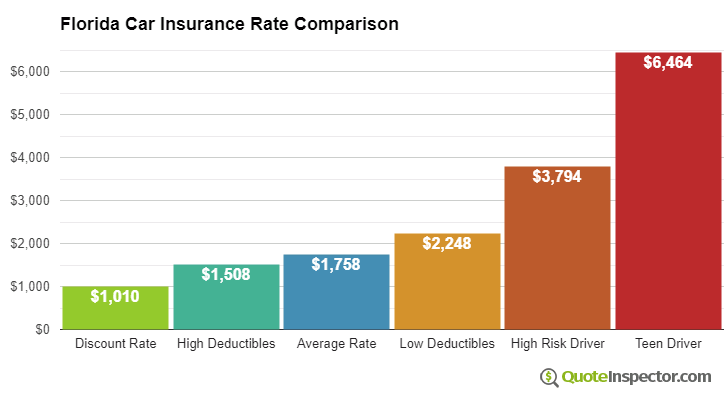

- Reduced Coverage: Drivers may be forced to reduce their coverage levels to lower premiums, leaving them with less protection in case of an accident. This could lead to financial hardship and difficulty recovering from accidents.

- Increased Uninsured Drivers: Some drivers may choose to go uninsured altogether to avoid the high premiums, creating a greater risk for all drivers on the road. Uninsured drivers are more likely to be involved in accidents and less likely to be able to compensate victims for their losses.

- Greater Financial Strain: The rate increase will place a greater financial burden on drivers, especially those with limited incomes. This could lead to difficulty paying bills, accessing other essential services, and achieving financial stability.

Potential Consequences for Individuals and Families

The rate increase could have a ripple effect, impacting individuals and families in various ways:

- Increased Financial Stress: The added expense of car insurance could lead to increased financial stress, affecting household budgets and overall well-being.

- Limited Access to Transportation: For some drivers, the increased cost of insurance may make it difficult to afford car ownership, limiting their access to transportation and impacting their ability to work, attend school, or participate in social activities.

- Increased Risk of Accidents: The increase in uninsured drivers could lead to a higher risk of accidents, as uninsured drivers are less likely to be held accountable for their actions.

Consumer Actions and Strategies

The rising cost of car insurance in Florida can significantly impact your budget. Fortunately, several strategies can help you mitigate the impact of the rate increase and find more affordable coverage. By understanding these options and taking proactive steps, you can navigate the changing insurance landscape and protect your financial well-being.

Comparing Insurance Quotes

It’s crucial to compare quotes from multiple insurance companies to find the best rates. This process involves gathering information about your vehicle, driving history, and desired coverage.

- Use online comparison tools: Websites like Insurance.com, NerdWallet, and Bankrate allow you to enter your information and receive quotes from various insurers. This saves you time and effort by automating the process.

- Contact insurance companies directly: Call or visit the websites of different insurance providers to request personalized quotes. This allows you to discuss specific needs and ask questions.

- Consider different coverage options: Evaluate the different types of coverage you need and consider adjusting your deductibles to lower premiums. For example, increasing your deductible can result in lower monthly payments.

Improving Driving Habits

Your driving record significantly influences your insurance premiums. By adopting safe driving practices, you can lower your risk profile and potentially reduce your rates.

- Maintain a clean driving record: Avoid speeding tickets, accidents, and other traffic violations. These incidents can significantly increase your insurance costs.

- Practice defensive driving: Be aware of your surroundings, anticipate potential hazards, and maintain a safe distance from other vehicles. Defensive driving courses can help you develop these skills.

- Avoid distractions: Refrain from using your phone or engaging in other distracting activities while driving. Focus on the road and prioritize safety.

Exploring Additional Options

Beyond comparing quotes and improving driving habits, consider these strategies to further reduce your insurance costs:

- Bundle your insurance policies: Many insurance companies offer discounts when you bundle multiple policies, such as home, auto, and renters insurance.

- Ask about available discounts: Inquire about potential discounts based on your profession, membership in certain organizations, or safety features in your vehicle.

- Consider a telematics device: Some insurers offer discounts for using telematics devices that track your driving habits and provide feedback on your performance.

Industry Perspective

The recent announcement of car insurance rate increases in Florida has sparked a wave of concern among drivers. However, from the perspective of insurance companies, these adjustments are a necessary response to the rising costs and risks associated with providing coverage in the state.

Insurance Companies’ Perspective on Rate Increases

Insurance companies are facing a perfect storm of challenges in Florida, including a surge in fraudulent claims, rising repair costs, and a high frequency of accidents. These factors contribute to a significant increase in claims payouts, forcing insurers to raise premiums to maintain financial stability.

Addressing the Challenges of Rising Costs and Claim Frequency

Insurers are actively implementing strategies to mitigate the impact of these challenges. Some of the measures include:

- Strengthening fraud detection and prevention measures: Insurance companies are investing in advanced technologies and data analytics to identify and deter fraudulent claims.

- Partnering with repair shops and suppliers to negotiate better rates: This helps to control the cost of repairs and reduces the overall claim payouts.

- Promoting safe driving practices through awareness campaigns and driver education programs: By reducing the number of accidents, insurers can decrease the frequency of claims.

- Refining underwriting practices: This involves more accurately assessing the risk associated with individual drivers, leading to more tailored premiums and a fairer allocation of costs.

Potential Impact of Rate Increase on Insurance Companies’ Profitability, Florida car insurance rate increase 2024

The rate increase is expected to have a positive impact on the profitability of insurance companies in Florida. By aligning premiums with the actual costs of providing coverage, insurers can improve their financial stability and ensure their ability to continue operating in the state. However, the impact will vary depending on factors such as the company’s existing pricing strategies, risk profile, and operational efficiency.

Future Outlook

Predicting the future of car insurance rates in Florida is a complex task, as numerous factors influence their trajectory. While the recent rate increases have been significant, several factors could impact future trends, potentially leading to further increases or even stabilization.

Factors Influencing Future Rate Changes

The future of Florida car insurance rates hinges on a complex interplay of factors, including legislative actions, economic conditions, and the behavior of insurance companies.

- Legislative Actions: The Florida Legislature continues to grapple with reforms aimed at addressing the affordability and accessibility of car insurance. These reforms may impact future rates. For example, changes to the no-fault system, which currently requires drivers to carry personal injury protection (PIP) coverage, could influence the cost of insurance. Additionally, legislation addressing fraud and abuse within the system could impact rates.

- Economic Conditions: Inflation, interest rates, and the cost of repairs are significant factors affecting car insurance rates. If inflation continues to rise, insurance companies may need to adjust their rates to reflect the increased cost of claims. Similarly, rising interest rates can impact investment returns for insurance companies, potentially leading to higher premiums.

- Insurance Company Behavior: Insurance companies are businesses that aim to make a profit. Their pricing strategies, risk assessments, and investment decisions can significantly influence the cost of insurance. If companies perceive an increased risk in Florida due to factors like high claim frequency or fraud, they may increase premiums to offset those risks.

Potential Solutions and Strategies

Addressing the challenges of affordability and access to car insurance in Florida requires a multifaceted approach involving policymakers, insurance companies, and consumers.

- Legislative Reforms: Implementing comprehensive legislative reforms that address the root causes of high insurance rates is crucial. This may include measures to reduce fraud, streamline the claims process, and promote competition in the insurance market.

- Consumer Education and Awareness: Educating consumers about safe driving practices, risk management strategies, and available discounts can help them reduce their insurance costs. Promoting awareness of fraud prevention techniques and the importance of reporting fraudulent activities can also contribute to a more stable insurance market.

- Innovative Insurance Products: Insurance companies can explore innovative products and services tailored to the specific needs of Florida drivers. This could include telematics-based insurance programs that reward safe driving behavior or alternative coverage options that provide greater flexibility and affordability.

End of Discussion

The 2024 Florida car insurance rate increase presents a complex challenge for drivers and the insurance industry alike. While the rising costs and claim frequency create hurdles for insurers, the impact on drivers’ affordability and access to insurance is undeniable. By understanding the reasons behind the increase, exploring available strategies for cost mitigation, and advocating for solutions to address the challenges of affordability and access, Florida drivers can navigate this changing landscape with greater confidence and preparedness.

Query Resolution: Florida Car Insurance Rate Increase 2024

What are the main reasons for the predicted increase in car insurance rates in Florida?

The primary reasons for the predicted increase in car insurance rates in Florida include legislative changes, legal decisions, rising repair costs, and inflation.

How will the rate increase affect different demographics of Florida drivers?

The impact of the rate increase will vary depending on factors such as age, driving history, and vehicle type. Drivers with a history of accidents or violations may experience a more significant increase than those with clean driving records.

What steps can Florida drivers take to mitigate the impact of the rate increase?

Drivers can mitigate the impact of the rate increase by comparing insurance quotes from multiple providers, improving their driving habits, and considering options like increasing their deductibles.