- Understanding Florida’s Unique Insurance Landscape: What Is The Best Car Insurance In Florida

- Key Factors to Consider When Choosing Car Insurance

- Types of Car Insurance Providers in Florida

- Top Car Insurance Companies in Florida

- Finding the Best Car Insurance for Your Needs

- Tips for Saving Money on Car Insurance

- Ultimate Conclusion

- Key Questions Answered

What is the best car insurance in Florida? Finding the right car insurance in the Sunshine State can be a challenge, given its unique insurance landscape. Florida’s susceptibility to hurricanes, prevalence of fraud, and high traffic density all contribute to a market with higher premiums than many other states. But with careful research and a bit of savvy, you can find the best car insurance policy for your needs and budget.

To make an informed decision, it’s crucial to understand the key factors that influence car insurance costs in Florida. These include your driving record, the type of vehicle you drive, your coverage needs, and your credit score. Knowing how these factors play a role will empower you to make the best choices when comparing insurance providers.

Understanding Florida’s Unique Insurance Landscape: What Is The Best Car Insurance In Florida

Florida’s car insurance market is distinct from other states due to a complex interplay of factors, including its susceptibility to natural disasters, a high prevalence of fraud, and a unique legal environment. This unique combination creates a landscape where insurance premiums are often higher than in other states.

Hurricane Risk and Insurance Premiums

Hurricanes pose a significant threat to Florida, causing widespread damage to property and vehicles. The potential for catastrophic losses from hurricanes significantly impacts car insurance premiums. Insurance companies must factor in the increased risk associated with hurricanes, leading to higher premiums for Florida residents.

Prevalence of Fraud and Its Impact

Florida has a higher-than-average rate of insurance fraud, particularly in the auto insurance sector. This fraud can take various forms, including staged accidents, fake claims, and inflated repair costs. The prevalence of fraud increases the cost of insurance for all policyholders as insurance companies must raise premiums to cover the losses incurred due to fraudulent claims.

Florida’s Unique Legal Environment

Florida’s legal environment also contributes to the high cost of car insurance. The state has a “no-fault” insurance system, where drivers are required to carry personal injury protection (PIP) coverage. This coverage covers medical expenses regardless of fault, leading to increased claims and higher premiums. Additionally, Florida’s “tort” system allows injured drivers to sue for pain and suffering, potentially leading to larger payouts and higher insurance costs.

Key Factors to Consider When Choosing Car Insurance

Choosing the right car insurance policy in Florida can be a daunting task, as there are many factors to consider. Understanding these factors will help you make an informed decision and ensure you have the coverage you need at a price you can afford.

Coverage Types

The type of coverage you choose will significantly impact your premium and the level of protection you receive. Here’s a breakdown of the most common types of car insurance:

- Liability Coverage: This is the most basic type of insurance and is required by law in Florida. It covers damages to other people’s property and injuries to other people in an accident that you cause. Liability coverage is typically expressed as a limit per person and a limit per accident. For example, 25/50/10 means $25,000 for injuries per person, $50,000 for injuries per accident, and $10,000 for property damage.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of fault. If you have a car loan, your lender may require collision coverage.

- Comprehensive Coverage: This coverage pays for damage to your vehicle caused by events other than an accident, such as theft, vandalism, fire, or hail. It is typically optional but may be required by your lender if you have a car loan.

- Personal Injury Protection (PIP): Florida is a “no-fault” state, which means your insurance company pays for your medical expenses and lost wages after an accident, regardless of who is at fault. PIP coverage is required in Florida, and you can choose a coverage limit of $10,000 or $25,000.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are injured in an accident caused by a driver who doesn’t have insurance or doesn’t have enough insurance to cover your damages. It’s highly recommended in Florida, where uninsured drivers are common.

Deductibles and Premiums

Deductibles and premiums are two key factors that influence the overall cost of your car insurance.

- Deductible: This is the amount you pay out of pocket for repairs or replacement of your vehicle before your insurance coverage kicks in. A higher deductible typically means a lower premium.

- Premium: This is the amount you pay for your car insurance policy. Premiums are calculated based on several factors, including your driving history, age, location, vehicle type, and coverage levels.

Choosing the right balance between deductibles and premiums is essential. A higher deductible may save you money on your premium, but you’ll have to pay more out of pocket if you have an accident. Conversely, a lower deductible will result in a higher premium but lower out-of-pocket costs in the event of an accident.

Types of Car Insurance Providers in Florida

Florida’s car insurance market is diverse, offering a range of options for drivers. Understanding the different types of insurance providers can help you navigate the market effectively and find the best fit for your needs.

Types of Car Insurance Providers in Florida

The Florida car insurance market offers a variety of provider types, each with its own strengths and weaknesses. Here’s a breakdown:

| Type | Advantages | Disadvantages |

|---|---|---|

| Traditional Insurance Companies |

|

|

| Direct-to-Consumer Insurers |

|

|

| Online Brokers |

|

|

Top Car Insurance Companies in Florida

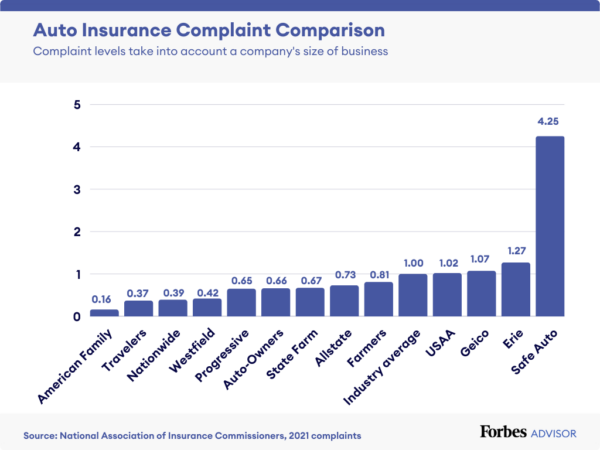

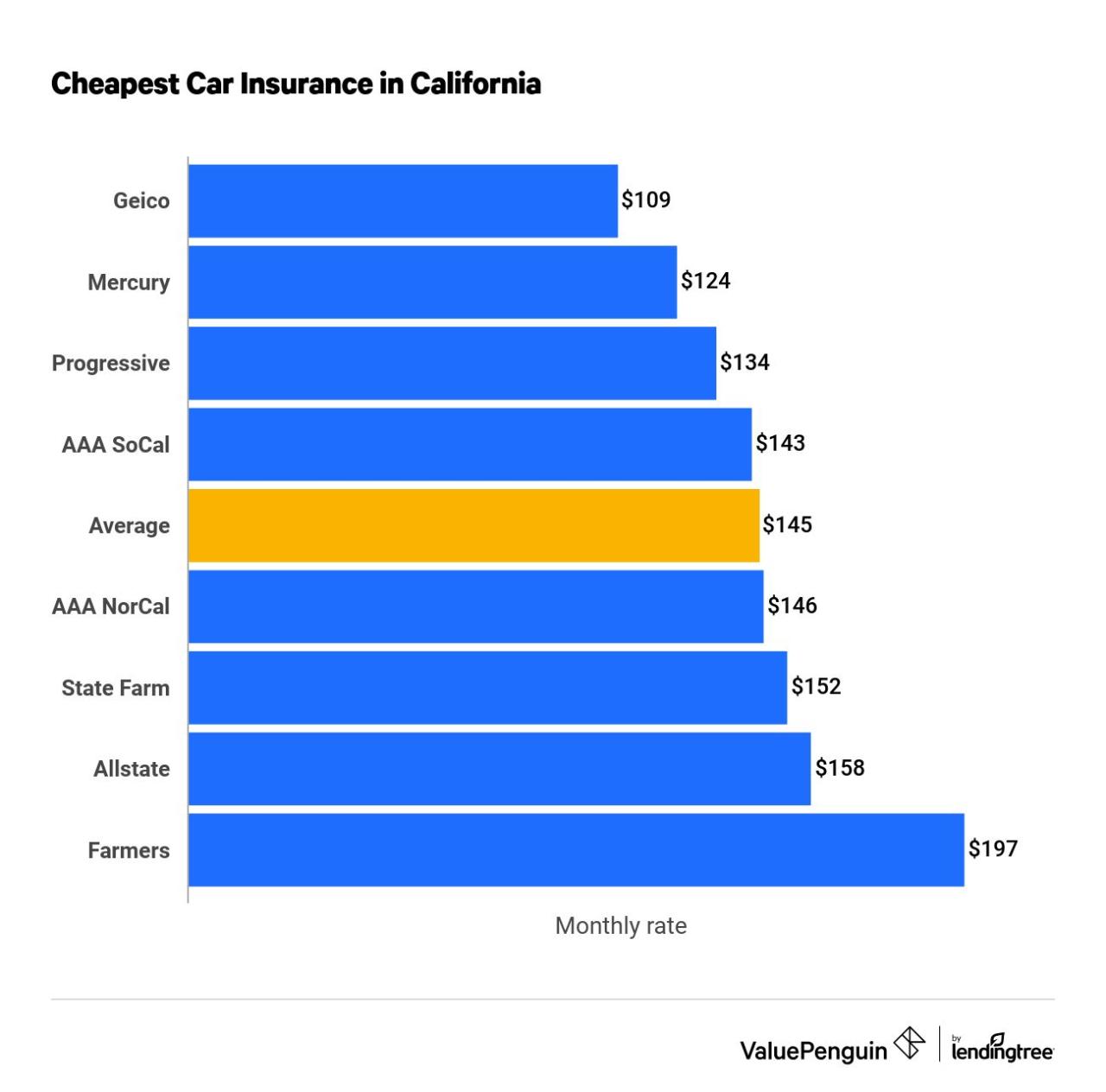

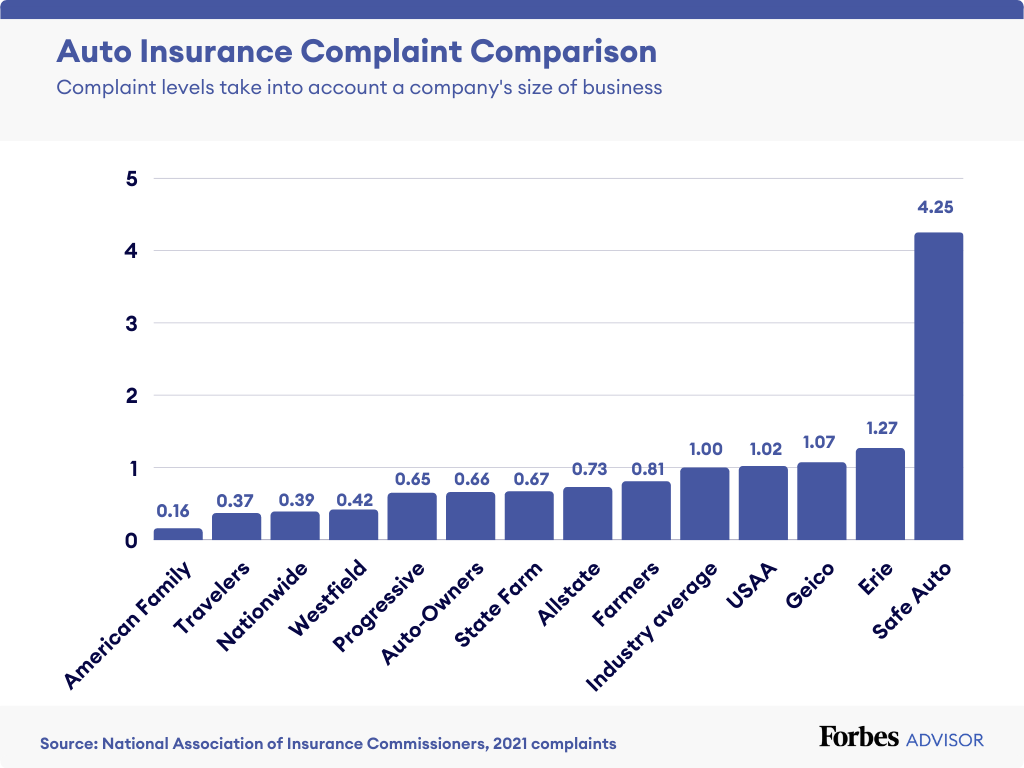

Choosing the right car insurance company in Florida can be a daunting task. With so many options available, it’s essential to compare different providers based on factors such as customer satisfaction, financial stability, and claims handling. This section will provide an overview of some of the top-rated car insurance companies in Florida, helping you make an informed decision.

Top-Rated Car Insurance Companies in Florida

To help you navigate the vast landscape of car insurance providers, here’s a list of top-rated companies in Florida, known for their customer satisfaction, financial stability, and claims handling:

- State Farm: Renowned for its comprehensive coverage options, competitive pricing, and extensive network of agents, State Farm consistently ranks high in customer satisfaction surveys. Its wide range of discounts and user-friendly online tools further enhance its appeal.

- GEICO: Known for its affordable rates and convenient online services, GEICO has gained popularity among Florida drivers. Its strong financial standing and efficient claims handling process contribute to its reputation.

- Progressive: With its focus on personalized coverage options and innovative features like its “Name Your Price” tool, Progressive caters to diverse driver needs. Its commitment to customer service and extensive discounts further enhance its appeal.

- USAA: While exclusive to military members and their families, USAA consistently receives high praise for its exceptional customer service, competitive pricing, and seamless claims process. Its dedication to serving its target audience has earned it a loyal following.

- Allstate: Allstate offers a wide range of coverage options and a strong reputation for customer satisfaction. Its commitment to innovation, evident in its Drive Safe & Save program, has contributed to its popularity.

Key Features, Pricing, and Coverage Options, What is the best car insurance in florida

Here’s a table comparing key features, pricing, and coverage options for the top-rated car insurance companies in Florida:

| Company | Key Features | Pricing | Coverage Options |

|---|---|---|---|

| State Farm | Comprehensive coverage options, competitive pricing, extensive agent network, discounts, user-friendly online tools | Competitive rates, varies based on factors like driving history, vehicle type, and location | Liability, collision, comprehensive, uninsured/underinsured motorist, personal injury protection (PIP), medical payments |

| GEICO | Affordable rates, convenient online services, strong financial standing, efficient claims handling | Typically lower rates, varies based on individual factors | Liability, collision, comprehensive, uninsured/underinsured motorist, PIP, medical payments |

| Progressive | Personalized coverage options, “Name Your Price” tool, customer service focus, extensive discounts | Competitive rates, varies based on individual factors | Liability, collision, comprehensive, uninsured/underinsured motorist, PIP, medical payments |

| USAA | Exceptional customer service, competitive pricing, seamless claims process, exclusive to military members and families | Competitive rates, varies based on individual factors | Liability, collision, comprehensive, uninsured/underinsured motorist, PIP, medical payments |

| Allstate | Wide range of coverage options, customer satisfaction focus, Drive Safe & Save program | Competitive rates, varies based on individual factors | Liability, collision, comprehensive, uninsured/underinsured motorist, PIP, medical payments |

Pros and Cons of Top Car Insurance Companies

To make an informed decision, it’s crucial to consider the pros and cons of each company:

State Farm

- Pros: Extensive coverage options, competitive pricing, widespread agent network, discounts, user-friendly online tools, strong financial stability, high customer satisfaction ratings.

- Cons: May not be the cheapest option for all drivers, customer service can vary depending on the agent.

GEICO

- Pros: Affordable rates, convenient online services, strong financial standing, efficient claims handling, wide range of discounts.

- Cons: Limited agent network, customer service may not be as personalized as other providers.

Progressive

- Pros: Personalized coverage options, “Name Your Price” tool, customer service focus, extensive discounts, innovative features.

- Cons: May not be the most affordable option for all drivers, customer service can vary.

USAA

- Pros: Exceptional customer service, competitive pricing, seamless claims process, exclusive benefits for military members and families, strong financial stability.

- Cons: Only available to military members and their families.

Allstate

- Pros: Wide range of coverage options, customer satisfaction focus, Drive Safe & Save program, strong financial stability.

- Cons: Rates can be higher than some competitors, customer service can vary.

Finding the Best Car Insurance for Your Needs

Finding the best car insurance in Florida requires careful consideration of your individual needs and a strategic approach to the search process. This involves understanding your coverage requirements, comparing quotes from multiple providers, and negotiating for the best possible rates.

Comparing Quotes from Multiple Providers

It is crucial to obtain quotes from multiple insurance companies to ensure you’re getting the best possible rate. This allows you to compare coverage options, deductibles, and premiums side-by-side. Online comparison tools and insurance brokers can simplify this process, enabling you to gather quotes from various providers within minutes.

- Online Comparison Tools: Websites like Policygenius, Insurance.com, and The Zebra allow you to enter your information once and receive quotes from multiple insurers. This streamlines the process and provides a comprehensive comparison.

- Insurance Brokers: Brokers act as intermediaries, working with multiple insurance companies to find the best policy for your needs. They can offer personalized recommendations and handle the negotiation process on your behalf.

Negotiating for the Best Possible Rates

Once you’ve gathered quotes from multiple providers, you can leverage this information to negotiate for the best possible rates. This may involve discussing discounts, adjusting coverage options, or exploring alternative payment plans.

- Bundle Your Policies: Combining your car insurance with other policies, such as homeowners or renters insurance, can often lead to significant discounts.

- Ask About Discounts: Most insurance companies offer discounts for good driving records, safety features, and other factors. Inquire about these discounts and ensure you’re receiving all eligible reductions.

- Consider Higher Deductibles: Choosing a higher deductible can lower your premium, but it means you’ll pay more out-of-pocket in the event of an accident. Carefully weigh the trade-offs between premium savings and potential out-of-pocket expenses.

- Shop Around Regularly: It’s advisable to review your insurance rates annually, as premiums can fluctuate. Compare quotes from other providers to ensure you’re still getting the best value.

Tips for Saving Money on Car Insurance

Finding the best car insurance in Florida isn’t just about getting the lowest price. It’s also about ensuring you have adequate coverage for your specific needs. However, saving money on your premiums is a significant consideration. Several strategies can help you lower your car insurance costs, allowing you to keep more money in your pocket.

Bundling Insurance Policies

Bundling your car insurance with other policies like homeowners, renters, or life insurance can result in significant savings. Insurance companies often offer discounts to customers who bundle their policies. This is because they can manage your policies more efficiently and reduce administrative costs. Bundling can save you 5% to 25% on your premiums, depending on the insurer and the policies you combine.

Maintaining a Good Driving Record

Your driving history plays a significant role in determining your car insurance rates. Maintaining a clean driving record with no accidents or traffic violations can significantly reduce your premiums. Insurance companies consider you a lower risk when you have a good driving record, leading to lower premiums. Conversely, having accidents or traffic violations can increase your premiums significantly.

Taking Advantage of Discounts

Insurance companies offer various discounts to help customers save money. These discounts can be based on factors like:

- Good student discounts: These are available to students with good grades.

- Safe driver discounts: These are offered to drivers with no accidents or violations.

- Anti-theft device discounts: These are available for vehicles equipped with anti-theft devices.

- Loyalty discounts: These are offered to customers who have been with the insurer for a long time.

- Multi-car discounts: These are available for customers who insure multiple vehicles with the same insurer.

Driving Safely

Driving safely is not only crucial for your own well-being but also for keeping your car insurance premiums low. By practicing safe driving habits, you can reduce the risk of accidents, which can lead to higher insurance rates.

Examples of safe driving habits include:

- Avoiding speeding: Speeding increases the risk of accidents and can lead to traffic violations.

- Not driving under the influence of alcohol or drugs: Drunk driving is one of the leading causes of fatal accidents.

- Wearing a seatbelt: Seatbelts can significantly reduce the severity of injuries in an accident.

- Maintaining your vehicle: Regular maintenance ensures your vehicle is in good working condition and reduces the risk of breakdowns or accidents.

Maintaining a Good Credit Score

In Florida, insurers can use your credit score to determine your car insurance rates. This is because credit score is seen as an indicator of your financial responsibility, and insurance companies believe that individuals with good credit scores are less likely to file claims.

To improve your credit score:

- Pay your bills on time: Late payments can negatively impact your credit score.

- Keep your credit utilization low: Aim to use less than 30% of your available credit.

- Avoid opening too many new credit accounts: Each new account inquiry can slightly lower your credit score.

- Check your credit report for errors: Errors can negatively impact your score, so it’s essential to dispute any inaccuracies.

Ultimate Conclusion

Navigating the Florida car insurance market can seem daunting, but by understanding the factors that drive prices, comparing quotes from multiple providers, and utilizing available discounts, you can secure a policy that provides the coverage you need at a price you can afford. Remember, the best car insurance in Florida is the one that offers the right balance of protection and affordability for your individual circumstances.

Key Questions Answered

How often should I review my car insurance policy?

It’s recommended to review your car insurance policy at least annually, or even more frequently if you experience significant life changes, such as moving to a new location, getting married, or adding a new driver to your policy.

What are the common discounts offered by car insurance companies in Florida?

Common discounts include safe driver discounts, good student discounts, multi-car discounts, and bundling discounts for combining auto and home insurance.

Can I file a claim online?

Many car insurance companies offer online claim filing options, which can make the process faster and more convenient.

What are the penalties for driving without car insurance in Florida?

Driving without car insurance in Florida is illegal and can result in fines, license suspension, and even jail time.