- Understanding Long-Term Care Insurance in Florida: Best Long-term Care Insurance In Florida

- Key Considerations for Choosing Long-Term Care Insurance in Florida

- Evaluating Top Long-Term Care Insurance Providers in Florida

- Resources and Guidance for Florida Residents

- Illustrating the Importance of Long-Term Care Planning

- Closing Notes

- FAQ Insights

Best long-term care insurance in Florida is crucial for safeguarding your financial well-being and ensuring peace of mind as you age. Long-term care needs can arise unexpectedly, leaving you with significant expenses for assisted living, nursing home care, or in-home services. By carefully considering your individual circumstances, exploring available options, and choosing a reputable provider, you can secure the financial protection you need to navigate these potential challenges.

Florida offers a diverse range of long-term care insurance policies, each with its own unique features, benefits, and limitations. Factors such as age, health, and coverage options play a crucial role in determining the cost of these policies. Understanding the intricacies of long-term care insurance in Florida is essential to making informed decisions that align with your individual needs and financial situation.

Understanding Long-Term Care Insurance in Florida: Best Long-term Care Insurance In Florida

Long-term care insurance (LTCI) is a valuable tool for Floridians seeking financial protection against the high costs of long-term care, which can include assistance with activities of daily living (ADLs) such as bathing, dressing, and eating. LTCI policies can help cover the costs of various care settings, including nursing homes, assisted living facilities, and home health care.

Types of Long-Term Care Insurance Policies

Long-term care insurance policies in Florida come in various forms, each offering different coverage options and benefits.

- Traditional Long-Term Care Insurance: This type of policy provides coverage for a range of care services, including nursing home care, assisted living, adult day care, and home health care. Traditional policies typically offer a daily benefit amount, a maximum benefit period, and an elimination period.

- Hybrid Long-Term Care Insurance: Hybrid policies combine long-term care coverage with other features, such as life insurance or an annuity. These policies can offer flexibility in terms of coverage options and benefit payouts.

- Partnership Long-Term Care Insurance: This type of policy is specifically designed to help individuals qualify for Medicaid benefits. Partnership policies offer a dollar-for-dollar asset protection feature, allowing individuals to retain more of their assets while receiving long-term care.

Benefits of Long-Term Care Insurance

- Financial Protection: LTCI can help protect your assets and savings from being depleted by the high costs of long-term care.

- Choice of Care: LTCI can give you more control over your care options, allowing you to choose the setting and level of care that best meets your needs.

- Peace of Mind: Knowing that you have LTCI in place can provide peace of mind, knowing that your financial well-being and care options are protected.

Limitations of Long-Term Care Insurance

- Cost: LTCI premiums can be expensive, especially for older individuals or those with pre-existing health conditions.

- Complexity: LTCI policies can be complex and difficult to understand, making it important to work with a qualified insurance agent.

- Limited Coverage: Some policies may have limitations on the types of care covered, the maximum benefit period, or the daily benefit amount.

Factors Affecting the Cost of Long-Term Care Insurance

Several factors can influence the cost of LTCI in Florida, including:

- Age: Younger individuals generally pay lower premiums than older individuals, as they have a lower risk of needing long-term care.

- Health: Individuals with pre-existing health conditions may pay higher premiums, as they are considered higher risk.

- Coverage Options: The type of coverage you choose, such as the daily benefit amount, the maximum benefit period, and the elimination period, will all affect the cost of your policy.

- State of Residence: The cost of LTCI can vary by state, depending on factors such as the cost of living and the availability of care providers.

Key Considerations for Choosing Long-Term Care Insurance in Florida

Choosing the right long-term care insurance policy in Florida is crucial to ensuring you have adequate financial protection for your future needs. It involves carefully evaluating your individual circumstances and financial situation to make an informed decision. This involves considering factors like your health, family history, lifestyle, and financial resources.

Assessing Individual Needs and Financial Situation

Before purchasing long-term care insurance, it is essential to understand your specific needs and financial situation. This involves considering your health, family history, lifestyle, and financial resources.

- Health and Family History: Evaluate your current health status and family history of chronic illnesses. If you have a higher risk of needing long-term care, you may need a more comprehensive policy with higher coverage.

- Lifestyle and Care Needs: Consider your lifestyle and potential future care needs. If you are active and independent, you may not need as much coverage as someone who is more frail or has a higher risk of needing assistance.

- Financial Resources: Determine your budget and how much you can afford to pay for premiums. Consider your other financial obligations, such as mortgage payments, retirement savings, and other debts.

Key Features to Consider When Comparing Policies

When comparing long-term care insurance policies in Florida, consider the following key features:

- Coverage Amount: This refers to the maximum amount the policy will pay for long-term care services. Choose a coverage amount that is sufficient to cover your anticipated care costs.

- Benefit Period: This is the length of time the policy will provide benefits. Select a benefit period that aligns with your anticipated care needs.

- Daily Benefit: This is the amount the policy will pay per day for long-term care services. Choose a daily benefit that is adequate to cover your expected daily care costs.

- Elimination Period: This is the waiting period before benefits begin. A shorter elimination period means you will start receiving benefits sooner, but premiums will be higher. A longer elimination period will result in lower premiums, but you will have to wait longer for benefits.

- Inflation Protection: This feature helps to protect the value of your benefits against inflation. Consider adding inflation protection to ensure your benefits keep pace with rising care costs.

- Waiver of Premium: This feature allows you to stop paying premiums if you become disabled and require long-term care. This can be a valuable benefit if you are concerned about the financial burden of paying premiums while receiving care.

Reputable Insurance Companies and Financial Stability

Choosing a long-term care insurance policy from a reputable insurance company is essential to ensure financial stability and the ability to pay claims. Consider the following factors:

- Financial Strength: Look for companies with strong financial ratings from reputable agencies like A.M. Best, Standard & Poor’s, and Moody’s. These ratings indicate the company’s ability to meet its financial obligations.

- Claims History: Research the company’s claims history and customer satisfaction ratings. Look for companies with a good track record of paying claims promptly and fairly.

- Customer Service: Evaluate the company’s customer service reputation. Look for companies that are responsive and helpful in addressing customer inquiries and concerns.

Evaluating Top Long-Term Care Insurance Providers in Florida

Choosing the right long-term care insurance provider is crucial for securing your financial future and ensuring access to quality care when you need it most. Florida offers a diverse range of providers, each with unique features, benefits, and pricing structures. Understanding the nuances of these providers is essential for making an informed decision that aligns with your individual needs and budget.

Comparison of Top Long-Term Care Insurance Providers in Florida

To help you navigate the complex world of long-term care insurance in Florida, we have compiled a comprehensive comparison of leading providers. This table highlights key features, benefits, and pricing structures, providing you with valuable insights to guide your selection process.

| Provider Name | Key Features | Benefits | Pricing |

|---|---|---|---|

| Genworth Financial |

|

|

|

| John Hancock |

|

|

|

| Mutual of Omaha |

|

|

|

| UnitedHealthcare |

|

|

|

| AIG Life & Retirement |

|

|

|

Resources and Guidance for Florida Residents

Navigating the world of long-term care insurance in Florida can be overwhelming. Thankfully, various resources and guidance are available to help residents make informed decisions. This section explores valuable resources, essential questions to ask, and the importance of seeking professional advice.

Government Websites

Government websites offer a wealth of information on long-term care insurance in Florida. The Florida Office of Insurance Regulation (OIR) provides consumer guides, FAQs, and a database of licensed insurance companies. Additionally, the Florida Department of Elder Affairs offers resources and support for seniors, including information on long-term care options.

- Florida Office of Insurance Regulation (OIR): https://www.floir.com/

- Florida Department of Elder Affairs: https://elderaffairs.state.fl.us/

Consumer Advocacy Groups

Consumer advocacy groups play a crucial role in protecting the interests of Floridians seeking long-term care insurance. These organizations provide unbiased information, advocacy support, and resources to help consumers make informed decisions.

- Florida Senior Legal Services: https://www.fsls.org/

- AARP: https://www.aarp.org/

Independent Insurance Agents

Independent insurance agents can provide valuable guidance and support in choosing the right long-term care insurance policy. They work with multiple insurance companies, allowing them to compare policies and find the best fit for individual needs.

Essential Questions to Ask

When discussing long-term care insurance with a potential provider, it’s crucial to ask the following questions:

- What is the policy’s coverage amount and duration?

- What are the policy’s benefits and exclusions?

- What are the premium costs and how are they calculated?

- What are the policy’s renewal provisions and how can premiums increase?

- What are the policy’s waiting periods and elimination periods?

- Does the policy offer inflation protection?

- What are the policy’s cancellation and refund provisions?

- What are the policy’s claim procedures?

- Does the policy offer any optional riders or benefits?

- What are the policy’s financial stability ratings?

Seeking Professional Advice

Seeking professional advice from a qualified financial advisor or insurance agent is highly recommended. These professionals can provide personalized guidance, assess individual needs, and recommend the best long-term care insurance options.

“It’s crucial to have a comprehensive understanding of your options and the potential risks and benefits involved before making any decisions about long-term care insurance.”

Illustrating the Importance of Long-Term Care Planning

Imagine a Florida resident named Sarah, a vibrant and active 65-year-old, enjoying her retirement years. However, an unexpected fall leads to a debilitating injury, leaving her unable to perform basic daily tasks. Sarah requires long-term care, potentially for several years. This scenario, while hypothetical, highlights the reality of long-term care needs and the financial burden they can impose.

Understanding the Potential Financial Impact, Best long-term care insurance in florida

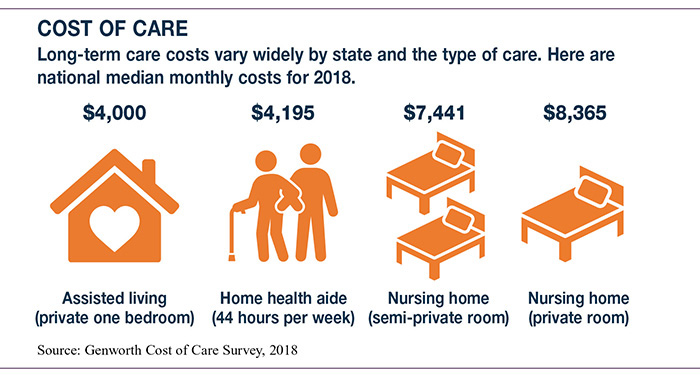

Without long-term care insurance, the costs of Sarah’s care could quickly escalate, potentially draining her savings and impacting her family’s financial security. Long-term care can encompass a wide range of services, including assisted living, nursing home care, home health aides, and adult day care. The average annual cost of a private room in a nursing home in Florida is around $100,000, according to Genworth Financial’s 2023 Cost of Care Survey.

Visualizing the Financial Burden

To illustrate the potential financial impact, consider this visual representation: A bar graph depicting the rising cost of long-term care over time. The graph shows the escalating cost of care for a hypothetical individual, demonstrating how expenses can quickly outpace savings and retirement funds. The bar graph can be labeled with years on the x-axis and the cost of care on the y-axis. This visual representation can effectively convey the financial burden that long-term care can impose without insurance.

Closing Notes

Navigating the complexities of long-term care insurance in Florida requires careful planning and informed decision-making. By understanding your needs, exploring available options, and seeking professional guidance, you can secure the financial protection you need to face the uncertainties of aging with confidence. Remember, investing in long-term care insurance can provide peace of mind and safeguard your financial future in the event of unexpected health challenges.

FAQ Insights

What is the average cost of long-term care insurance in Florida?

The cost of long-term care insurance in Florida varies depending on factors like age, health, coverage options, and the insurance company. It’s recommended to obtain quotes from multiple providers to compare costs and find the best value.

How long does it take to process a long-term care insurance claim in Florida?

The claim processing time can vary depending on the insurance company and the specific circumstances of your claim. It’s essential to contact your insurance provider promptly and provide all necessary documentation to expedite the process.

Are there any tax benefits for long-term care insurance in Florida?

While premiums for long-term care insurance are not typically tax deductible, certain benefits received from the policy may be tax-free under specific circumstances. Consult with a tax advisor to determine your eligibility for tax benefits.