Florida Car Insurance Cancellation Law governs the circumstances under which your auto insurance policy can be terminated, outlining the rights and responsibilities of both policyholders and insurance companies. Understanding these laws is crucial, as a canceled policy can have significant financial and logistical consequences. This guide delves into the various reasons for cancellation, the legal procedures involved, and the protections available to policyholders in Florida.

From non-payment to policyholder actions, we’ll explore the intricacies of cancellation and provide insights into how to navigate these situations effectively. We’ll also discuss the impact of cancellation on obtaining new insurance and the potential legal recourse available to those who believe their policy was wrongfully terminated.

Legal Protections for Policyholders

Florida law provides several safeguards for policyholders who believe their car insurance cancellation was unjustified. These protections ensure that insurance companies act fairly and transparently when terminating coverage.

The Role of the Florida Department of Financial Services

The Florida Department of Financial Services (DFS) plays a crucial role in regulating the insurance industry in Florida. This department is responsible for overseeing insurance companies and ensuring they comply with state laws. The DFS investigates complaints filed by policyholders against insurance companies, including complaints regarding wrongful cancellation. Policyholders can file a complaint with the DFS by visiting their website or calling their hotline. The DFS can then take action against the insurance company, including issuing fines or requiring them to reinstate the policy.

Legal Options for Policyholders

If a policyholder believes their car insurance cancellation was unjustified, they have several legal options:

Negotiation with the Insurance Company

The first step is often to try to resolve the issue directly with the insurance company. Policyholders should contact the company and explain why they believe the cancellation was unjustified. The company may be willing to reconsider their decision or offer a compromise.

Filing a Complaint with the Florida Department of Financial Services

If negotiation with the insurance company fails, policyholders can file a complaint with the DFS. The DFS will investigate the complaint and determine if the insurance company violated any state laws.

Taking Legal Action

If the DFS investigation does not resolve the issue, policyholders can file a lawsuit against the insurance company. In a lawsuit, the policyholder would argue that the cancellation was unjustified and seek damages, such as reinstatement of the policy, payment of claims, or compensation for financial losses.

Examples of Successful Legal Challenges, Florida car insurance cancellation law

There have been numerous instances where policyholders have successfully challenged insurance companies for wrongful cancellation in court.

In 2019, a Florida court ruled in favor of a policyholder who had their car insurance canceled after a minor accident. The court found that the insurance company had violated state law by canceling the policy without providing the policyholder with a proper notice of cancellation.

In another case, a Florida court ruled that an insurance company could not cancel a policyholder’s coverage based on a fraudulent claim that the policyholder had not filed. The court found that the insurance company had failed to provide sufficient evidence to support its claim of fraud.

These cases demonstrate that policyholders have legal recourse when they believe their car insurance cancellation was unjustified. By understanding their rights and the available legal options, policyholders can effectively protect themselves from unfair treatment by insurance companies.

Final Wrap-Up

Navigating Florida’s car insurance cancellation laws can be complex, but understanding your rights and obligations is essential. By familiarizing yourself with the procedures and legal protections available, you can ensure that your interests are protected in the event of a policy cancellation. Remember, seeking professional legal advice is always recommended if you face a complex or challenging situation.

Essential Questionnaire: Florida Car Insurance Cancellation Law

What happens if I can’t afford to pay my car insurance premium?

In Florida, you have a grace period to make your payment. Contact your insurance company to discuss payment options or hardship programs.

Can I cancel my car insurance policy at any time?

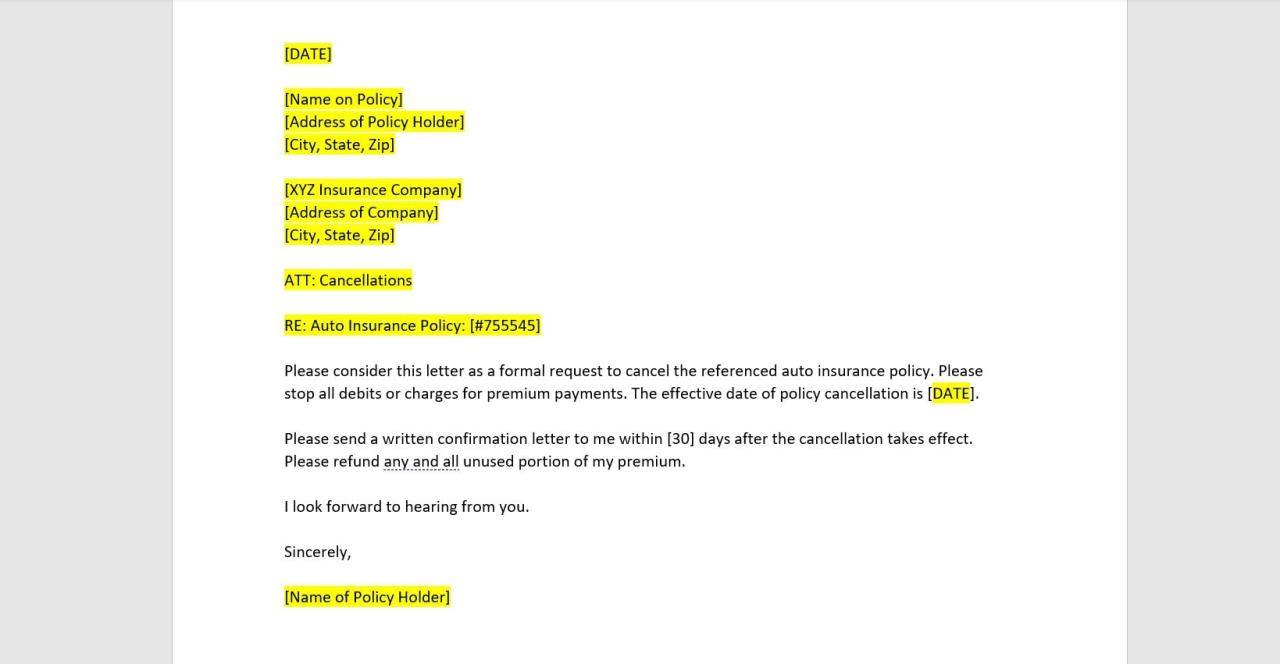

Yes, you can usually cancel your policy with proper notice. Check your policy for specific cancellation terms.

What if my insurance company cancels my policy without a valid reason?

You have the right to appeal the cancellation decision. Contact the Florida Department of Financial Services for assistance.

How do I find out if my car insurance policy is still active?

Contact your insurance company or check your policy documents for confirmation.