Car insurance license Florida sets the stage for a comprehensive guide, providing aspiring insurance agents with a detailed understanding of the licensing process, regulations, and industry landscape. Navigating the world of car insurance in Florida can be complex, but this guide offers valuable insights and practical advice to help individuals pursue a rewarding career in this field.

Whether you’re a seasoned professional looking to expand your license or a newcomer seeking to enter the industry, understanding the requirements, regulations, and key players is essential. This guide delves into the intricacies of obtaining a car insurance license in Florida, exploring the different license types, educational prerequisites, experience requirements, and application procedures. It also provides an overview of the state’s car insurance regulations, including minimum coverage requirements, premium factors, and available coverage options. By understanding these aspects, aspiring agents can confidently navigate the licensing process and establish a successful career in Florida’s car insurance market.

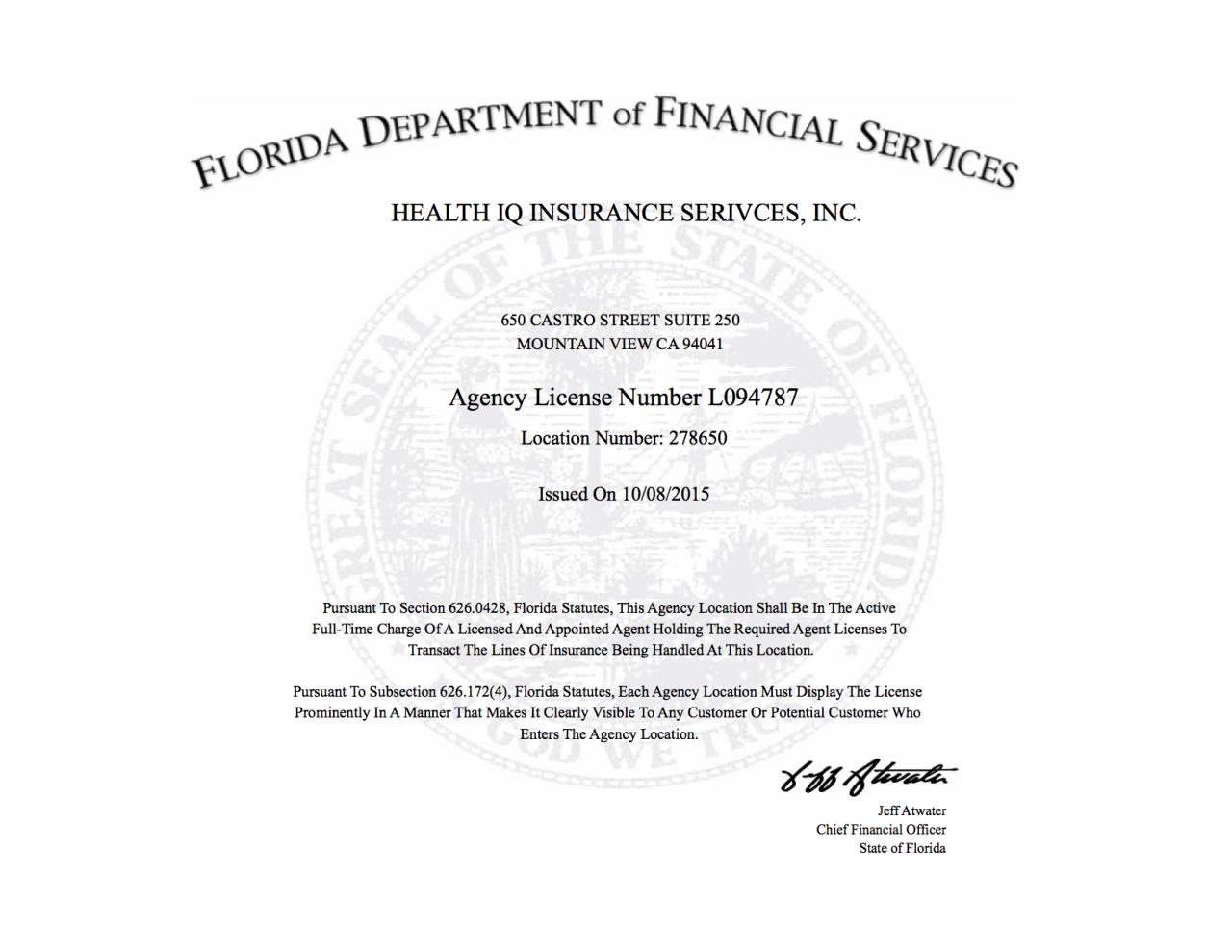

Florida Car Insurance Licensing Requirements

Becoming a licensed car insurance agent in Florida involves meeting specific educational and experience requirements, passing exams, and completing the application process. Understanding the different license types, the steps involved, and the associated fees is crucial for individuals seeking a career in the Florida insurance industry.

Types of Car Insurance Licenses in Florida

Florida offers various car insurance licenses, each with its own specific requirements and scope of practice. The most common types include:

- Property and Casualty (P&C) License: This license allows agents to sell various types of insurance, including auto insurance. It is the most comprehensive license and requires a broader knowledge base.

- Personal Lines License: This license focuses on personal insurance products, including auto, homeowners, and renters insurance. It is a more specialized license compared to the P&C license.

- Life, Accident, and Health (LAH) License: This license allows agents to sell life insurance, health insurance, and accident insurance. While it doesn’t directly involve car insurance, it may be relevant for individuals seeking to expand their insurance offerings.

Educational and Experience Requirements, Car insurance license florida

The educational and experience requirements for obtaining a car insurance license in Florida vary depending on the chosen license type.

- P&C License: To qualify for a P&C license, applicants must complete a 40-hour pre-licensing course approved by the Florida Department of Financial Services (DFS). They must also pass a state-administered exam covering insurance principles and practices.

- Personal Lines License: Applicants for a Personal Lines license must complete a 20-hour pre-licensing course approved by the DFS and pass the corresponding state exam.

- LAH License: Similar to the P&C license, applicants for a LAH license must complete a 40-hour pre-licensing course and pass the relevant state exam.

Application Process for a Car Insurance License

The application process for a car insurance license in Florida involves several steps:

- Complete Pre-licensing Education: Enroll in and complete the required pre-licensing course for the chosen license type.

- Pass the State Exam: Schedule and pass the state-administered exam for the chosen license type. The exam is offered by the DFS and covers insurance principles and practices.

- Submit an Application: Complete the application form provided by the DFS, including personal information, education details, and other relevant information.

- Pay the Application Fee: Submit the required application fee to the DFS. The fee varies depending on the license type and can be paid online or through mail.

- Background Check: The DFS will conduct a background check to ensure the applicant meets the eligibility requirements.

- Receive License: Upon successful completion of all steps, the DFS will issue the car insurance license to the applicant.

Fees Associated with Car Insurance Licensing

There are several fees associated with obtaining and maintaining a car insurance license in Florida:

- Application Fee: The application fee for a car insurance license in Florida varies depending on the license type. For example, the application fee for a P&C license is $100, while the fee for a Personal Lines license is $50.

- Exam Fee: The exam fee for the state-administered car insurance exam is typically around $50.

- License Renewal Fee: The license renewal fee for car insurance agents in Florida is $50 per year.

- Continuing Education: Florida requires car insurance agents to complete continuing education courses to maintain their license. The specific requirements vary depending on the license type. The cost of these courses can range from $50 to $100 or more, depending on the course provider and duration.

Florida Car Insurance Regulations

Florida’s car insurance regulations are designed to ensure that drivers have adequate financial protection in case of accidents. The state has specific requirements for minimum coverage, and various factors influence the cost of car insurance premiums. Understanding these regulations is crucial for drivers in Florida.

Minimum Coverage Requirements

Florida requires all drivers to have a minimum amount of car insurance coverage. This minimum coverage is known as the “Financial Responsibility Law” and includes:

- Personal Injury Protection (PIP): This coverage pays for medical expenses, lost wages, and other related costs for the insured driver and passengers, regardless of who is at fault. Florida’s PIP coverage is $10,000 per person.

- Property Damage Liability (PDL): This coverage pays for damages to other vehicles or property if the insured driver is at fault in an accident. Florida’s PDL coverage is $10,000 per accident.

It is important to note that while these are the minimum requirements, drivers are encouraged to purchase higher coverage limits to protect themselves from potential financial losses.

Factors Influencing Car Insurance Premiums

Several factors influence car insurance premiums in Florida. Understanding these factors can help drivers make informed decisions about their coverage:

- Driving Record: Drivers with a history of accidents, traffic violations, or DUI convictions will generally pay higher premiums.

- Age and Gender: Younger and inexperienced drivers typically pay higher premiums than older, more experienced drivers. Gender also plays a role, with men generally paying higher premiums than women.

- Vehicle Type: The type of vehicle, its value, and its safety features can influence premium costs. For example, luxury vehicles or vehicles with high performance engines typically have higher premiums.

- Location: Drivers residing in areas with higher accident rates or crime rates will generally pay higher premiums.

- Credit Score: Insurance companies may consider credit scores when determining premiums, with individuals with lower credit scores often paying higher premiums.

- Coverage Options: The type and amount of coverage chosen will impact the premium. For example, purchasing comprehensive and collision coverage will increase the premium compared to only having liability coverage.

Types of Car Insurance Coverage

In addition to the minimum required coverage, drivers in Florida can choose from various optional coverage options to provide additional protection. These options include:

- Comprehensive Coverage: This coverage pays for damages to the insured vehicle caused by events other than accidents, such as theft, vandalism, or natural disasters.

- Collision Coverage: This coverage pays for damages to the insured vehicle resulting from a collision with another vehicle or object.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): This coverage protects the insured driver and passengers if they are involved in an accident with an uninsured or underinsured driver.

- Medical Payments Coverage (MedPay): This coverage provides medical benefits for the insured driver and passengers, regardless of fault, for injuries sustained in an accident.

- Rental Car Coverage: This coverage provides reimbursement for rental car expenses if the insured vehicle is damaged or stolen.

- Roadside Assistance: This coverage provides assistance with services such as towing, flat tire changes, and jump starts.

Drivers should carefully consider their individual needs and financial situation when choosing coverage options. Consulting with an insurance agent can help determine the most suitable coverage for their specific circumstances.

Florida Car Insurance Companies

Choosing the right car insurance company in Florida is crucial, as it directly impacts your financial well-being in case of an accident. This section provides an overview of the top car insurance companies operating in Florida, their key features, and their performance in terms of financial stability and customer satisfaction.

Top Car Insurance Companies in Florida

| Company Name | Website | Contact Information | Key Features |

|---|---|---|---|

| State Farm | www.statefarm.com | 1-800-424-2424 | Wide range of coverage options, discounts, and customer service. |

| Geico | www.geico.com | 1-800-432-4433 | Competitive pricing, online quotes, and 24/7 customer support. |

| Progressive | www.progressive.com | 1-800-776-4737 | Name Your Price tool, customizable coverage options, and various discounts. |

| Allstate | www.allstate.com | 1-800-255-7828 | Drive Safe & Save program, multiple discounts, and 24/7 roadside assistance. |

| USAA | www.usaa.com | 1-800-531-USAA (8722) | Exclusive for military members and their families, strong financial stability, and excellent customer service. |

Company Overview and Performance

- State Farm: One of the largest insurance companies in the US, State Farm has a long history of financial stability and customer satisfaction. It offers a wide range of coverage options and discounts, including good driver discounts, multi-policy discounts, and safe driver discounts.

- Geico: Known for its competitive pricing and convenient online services, Geico has gained popularity in recent years. It offers a variety of coverage options and discounts, including good driver discounts, multi-policy discounts, and defensive driving course discounts.

- Progressive: Progressive is known for its innovative features, such as the Name Your Price tool, which allows customers to set their desired price and find policies that fit their budget. It also offers a wide range of coverage options and discounts, including good driver discounts, multi-policy discounts, and safe driver discounts.

- Allstate: Allstate is a well-established insurance company with a strong reputation for customer service. It offers a variety of coverage options and discounts, including good driver discounts, multi-policy discounts, and safe driver discounts. Its Drive Safe & Save program rewards safe drivers with discounts based on their driving behavior.

- USAA: Exclusively for military members and their families, USAA has a strong financial stability and a reputation for excellent customer service. It offers a variety of coverage options and discounts, including good driver discounts, multi-policy discounts, and military-specific discounts.

Comparison Chart

| Company | Pros | Cons |

|---|---|---|

| State Farm | Wide range of coverage options, discounts, and customer service. | May not always offer the most competitive pricing. |

| Geico | Competitive pricing, online quotes, and 24/7 customer support. | Limited coverage options compared to some competitors. |

| Progressive | Name Your Price tool, customizable coverage options, and various discounts. | Customer service can be inconsistent. |

| Allstate | Drive Safe & Save program, multiple discounts, and 24/7 roadside assistance. | Pricing can be higher than some competitors. |

| USAA | Exclusive for military members and their families, strong financial stability, and excellent customer service. | Not available to the general public. |

Consumer Tips for Car Insurance in Florida

Navigating the world of car insurance in Florida can be overwhelming, but by following these tips, you can secure the best rates and coverage for your needs.

Obtaining the Best Car Insurance Rates

Finding the most competitive car insurance rates in Florida involves exploring various options and making informed decisions.

- Compare Quotes from Multiple Insurers: Obtaining quotes from multiple insurers allows you to compare prices and coverage options, enabling you to identify the most favorable deal. Online comparison websites, insurance brokers, and direct contact with insurers are effective methods for gathering quotes.

- Maintain a Good Driving Record: A clean driving record, free from accidents, violations, and traffic tickets, significantly reduces your insurance premiums.

- Consider Bundling Policies: Combining your car insurance with other policies, such as homeowners or renters insurance, often results in substantial discounts from insurers.

- Choose a Higher Deductible: Opting for a higher deductible, which is the amount you pay out of pocket before your insurance coverage kicks in, can lower your premiums. This strategy is particularly advantageous if you have a good driving record and are financially prepared to cover a higher deductible in case of an accident.

- Take Advantage of Discounts: Many insurers offer discounts based on various factors, such as good student status, completion of defensive driving courses, vehicle safety features, and membership in certain organizations.

- Shop Around Regularly: It’s beneficial to regularly compare quotes from different insurers, as rates can fluctuate over time. This proactive approach helps you ensure you’re consistently receiving the most competitive prices.

Negotiating Car Insurance Premiums

Negotiating car insurance premiums can be a valuable strategy for securing a more favorable rate.

- Be Prepared to Switch Insurers: Mentioning your willingness to switch insurers if a better offer isn’t presented can motivate your current insurer to provide a more competitive rate.

- Highlight Your Positive Factors: Emphasize your clean driving record, safe driving habits, and any relevant discounts you qualify for.

- Ask for a Review of Your Policy: Request a review of your current policy to ensure you’re not paying for unnecessary coverage or that your policy accurately reflects your current needs.

- Consider Paying Annually: Paying your car insurance premiums annually rather than monthly can often result in a lower overall cost.

Filing a Car Insurance Claim

Filing a car insurance claim in Florida involves a series of steps to ensure a smooth and successful process.

- Report the Accident Promptly: Contact your insurer immediately after an accident to report the incident and obtain instructions for proceeding with the claim.

- Gather Necessary Information: Collect relevant information from the other parties involved in the accident, including their names, contact details, insurance information, and vehicle details.

- Take Photos and Videos: Document the accident scene by taking clear photos and videos of the damage to your vehicle, the other vehicles involved, and any relevant surroundings.

- Seek Medical Attention: If you or any passengers are injured, seek medical attention immediately.

- File the Claim: Follow your insurer’s instructions for filing the claim, providing all necessary documentation and information.

- Be Honest and Accurate: Provide truthful and accurate information during the claim process.

Understanding Car Insurance Policy Terms and Conditions

Understanding the terms and conditions of your car insurance policy is crucial for navigating potential situations and ensuring you have the necessary coverage.

- Coverage Types: Familiarize yourself with the different types of coverage offered by your policy, including liability coverage, collision coverage, comprehensive coverage, and uninsured/underinsured motorist coverage.

- Deductibles: Understand the amount of your deductible for each coverage type, as this is the amount you pay out of pocket before your insurance coverage kicks in.

- Limits: Be aware of the coverage limits for each type of coverage, which represent the maximum amount your insurer will pay for a claim.

- Exclusions: Familiarize yourself with any exclusions in your policy, which are specific situations or circumstances not covered by your insurance.

- Renewals and Cancellations: Understand the process for renewing your policy and the circumstances under which your policy may be canceled.

End of Discussion

Armed with the knowledge gained from this guide, aspiring car insurance agents in Florida can confidently embark on their journey to obtain a license and contribute to the well-being of the state’s drivers. By understanding the licensing requirements, regulations, and industry landscape, agents can effectively serve their clients and navigate the complex world of car insurance with expertise and professionalism.

Answers to Common Questions: Car Insurance License Florida

What are the different types of car insurance licenses available in Florida?

Florida offers various car insurance licenses, including Property & Casualty, Life & Health, and Surplus Lines.

What are the educational requirements for obtaining a car insurance license in Florida?

Aspiring agents must complete a pre-licensing course approved by the Florida Department of Financial Services.

How long does it take to obtain a car insurance license in Florida?

The time required depends on the individual’s learning pace and the chosen course. Typically, it takes several weeks to complete the necessary coursework.

What are the fees associated with obtaining and maintaining a car insurance license in Florida?

There are fees associated with the application, exam, and license renewal. The exact amounts vary depending on the license type.