- Understanding Florida Full Coverage Car Insurance

- Benefits of Full Coverage Car Insurance in Florida

- Factors Affecting Full Coverage Car Insurance Rates in Florida

- Choosing the Right Full Coverage Car Insurance in Florida

- Understanding Florida’s No-Fault Insurance System: Florida Full Coverage Car Insurance

- Conclusion

- Question & Answer Hub

Florida Full Coverage Car Insurance is essential for drivers in the Sunshine State, known for its high traffic volume and potential for accidents. Full coverage provides peace of mind by protecting you financially in the event of an accident, covering repairs, medical expenses, and liability claims. But navigating the complexities of Florida’s no-fault insurance system and understanding the factors that influence your rates can be daunting.

This comprehensive guide delves into the world of Florida Full Coverage Car Insurance, breaking down its components, benefits, and the factors that determine your premiums. We’ll also explore the nuances of Florida’s no-fault insurance system and offer tips for choosing the right policy to meet your specific needs.

Understanding Florida Full Coverage Car Insurance

In Florida, full coverage car insurance is a comprehensive package that safeguards you financially against various risks associated with car ownership. It goes beyond the legal minimum requirements and provides extensive protection for both you and your vehicle.

Components of Full Coverage Car Insurance

Full coverage car insurance in Florida comprises several essential components that work together to provide comprehensive protection. Understanding these components is crucial for making informed decisions about your insurance needs.

- Liability Coverage: This coverage protects you financially if you are found at fault in an accident that causes injury or damage to others. It covers medical expenses, property damage, and legal fees incurred by the other party.

- Collision Coverage: Collision coverage reimburses you for repairs or replacement of your vehicle if it is damaged in an accident, regardless of who is at fault. This coverage is essential for protecting your investment in your car.

- Comprehensive Coverage: Comprehensive coverage safeguards you against damage to your vehicle caused by events other than collisions, such as theft, vandalism, natural disasters, or animal collisions. It helps protect your car from unexpected and potentially costly incidents.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): This coverage protects you if you are involved in an accident with a driver who is uninsured or has insufficient insurance to cover your losses. It provides compensation for your medical expenses, lost wages, and property damage.

Factors Determining Full Coverage Car Insurance Costs

The cost of full coverage car insurance in Florida is influenced by several factors that insurers consider when calculating premiums. Understanding these factors can help you make informed choices to potentially lower your insurance costs.

- Driving History: Your driving history plays a significant role in determining your insurance premiums. A clean driving record with no accidents or traffic violations will generally result in lower rates. However, if you have a history of accidents or traffic violations, your premiums will likely be higher.

- Vehicle Type: The type of vehicle you drive significantly impacts your insurance premiums. Higher-value vehicles, luxury cars, and sports cars are generally more expensive to insure due to their higher repair costs and potential for greater damage.

- Age: Your age is also a factor considered by insurance companies. Younger drivers, particularly those under 25, are statistically more likely to be involved in accidents, leading to higher premiums. As you age and gain experience, your premiums may decrease.

- Location: The location where you live can influence your insurance premiums. Areas with higher crime rates or a greater number of accidents may have higher insurance rates due to the increased risk of claims.

- Credit Score: Your credit score is increasingly being used by insurance companies to assess your risk. Individuals with good credit scores tend to have lower insurance premiums, while those with poor credit scores may face higher rates.

Benefits of Full Coverage Car Insurance in Florida

Florida boasts a large population and heavy traffic, making it prone to accidents. Choosing full coverage car insurance can provide significant financial protection for drivers in this environment. It offers a comprehensive safety net for various scenarios, safeguarding you from substantial financial burdens.

Financial Protection in Case of Accidents

Full coverage insurance provides financial protection against various expenses arising from accidents, including:

- Repair or Replacement Costs: If your vehicle is damaged in an accident, full coverage will cover the cost of repairs or replacement, up to the actual cash value of your car.

- Medical Expenses: Full coverage often includes medical payments coverage (MedPay), which helps pay for your medical expenses, regardless of who is at fault in an accident. This coverage can help cover things like doctor visits, hospital stays, and prescription drugs.

- Liability Claims: If you are at fault in an accident, full coverage will protect you against liability claims from the other driver, including damages to their vehicle and medical expenses.

Factors Affecting Full Coverage Car Insurance Rates in Florida

In Florida, obtaining full coverage car insurance is essential for protecting yourself financially in case of accidents, theft, or other covered events. However, the cost of this insurance can vary significantly depending on several factors. Understanding these factors can help you make informed decisions about your insurance coverage and potentially save money on your premiums.

Driving History

Your driving history is a significant factor influencing your full coverage car insurance rates in Florida. Insurance companies carefully analyze your driving record to assess your risk of future accidents.

- Accidents: A history of accidents, especially those resulting in claims, will likely increase your insurance rates. The severity and frequency of accidents are considered. For instance, a single at-fault accident may result in a higher premium compared to a minor accident with no fault assigned.

- Traffic Violations: Traffic violations, such as speeding tickets, reckless driving, or DUI convictions, can significantly impact your insurance rates. These violations indicate a higher risk of future accidents and can lead to increased premiums.

- Driving Experience: Insurance companies generally consider drivers with more experience to be less risky. Drivers with a longer driving history and a clean record often qualify for lower insurance rates. Conversely, young and inexperienced drivers are typically associated with higher premiums due to their lack of experience and higher risk of accidents.

Choosing the Right Full Coverage Car Insurance in Florida

Finding the best full coverage car insurance in Florida involves careful consideration of your individual needs and circumstances. You’ll want to compare various insurance providers, their coverage options, and pricing to ensure you’re getting the most comprehensive and cost-effective protection for your vehicle.

Step-by-Step Guide to Choosing Full Coverage Car Insurance in Florida, Florida full coverage car insurance

The process of selecting the right full coverage car insurance policy can be broken down into a series of steps:

- Assess Your Needs: Begin by considering your specific needs and risk tolerance. What type of coverage do you require? Are you comfortable with a higher deductible to lower your premium?

- Gather Quotes: Contact several insurance companies and request quotes for full coverage car insurance. Be sure to provide accurate information about your vehicle, driving history, and desired coverage levels.

- Compare Coverage Options: Carefully review the quotes you receive, paying attention to the coverage levels, deductibles, and premiums offered by each insurer. Compare the different features and benefits of each policy to determine which best aligns with your needs and budget.

- Consider Discounts: Inquire about available discounts, such as those for good driving records, safety features, multiple vehicle insurance, or bundling with other insurance products.

- Read the Fine Print: Before making a decision, thoroughly review the policy documents, including the terms and conditions, exclusions, and limitations. Understand the coverage details, deductibles, and any potential limitations on claims.

- Check Customer Service and Claims Processing: Research the insurer’s reputation for customer service and claims processing. Look for reviews and ratings from other customers to gauge their experience.

- Make Your Choice: Based on your assessment of the available options, choose the insurance provider that offers the best combination of coverage, price, and customer service.

Comparing Key Features of Florida Insurance Providers

| Insurance Provider | Coverage Options | Discounts | Customer Service | Claims Processing |

|---|---|---|---|---|

| Geico | Comprehensive, collision, liability, personal injury protection (PIP), uninsured/underinsured motorist (UM/UIM) | Good driver, multiple vehicle, safety features, bundling | Highly rated | Efficient and timely |

| State Farm | Comprehensive, collision, liability, PIP, UM/UIM | Good driver, multiple vehicle, safety features, bundling | Highly rated | Efficient and timely |

| Progressive | Comprehensive, collision, liability, PIP, UM/UIM | Good driver, multiple vehicle, safety features, bundling | Highly rated | Efficient and timely |

| Allstate | Comprehensive, collision, liability, PIP, UM/UIM | Good driver, multiple vehicle, safety features, bundling | Highly rated | Efficient and timely |

| USAA | Comprehensive, collision, liability, PIP, UM/UIM | Good driver, multiple vehicle, safety features, bundling | Highly rated | Efficient and timely |

Questions to Ask Potential Insurance Providers

- What specific coverage options are available under your full coverage car insurance policy?

- What are the deductibles for comprehensive and collision coverage?

- What discounts are available for my driving history, vehicle safety features, or bundling with other insurance products?

- What is the process for filing a claim, and how long does it typically take to process a claim?

- What is your customer service availability, and how can I contact you for assistance?

- What is your reputation for customer satisfaction and claims handling?

- Are there any specific exclusions or limitations on coverage?

- Can you provide me with a detailed policy summary outlining the terms and conditions?

Understanding Florida’s No-Fault Insurance System: Florida Full Coverage Car Insurance

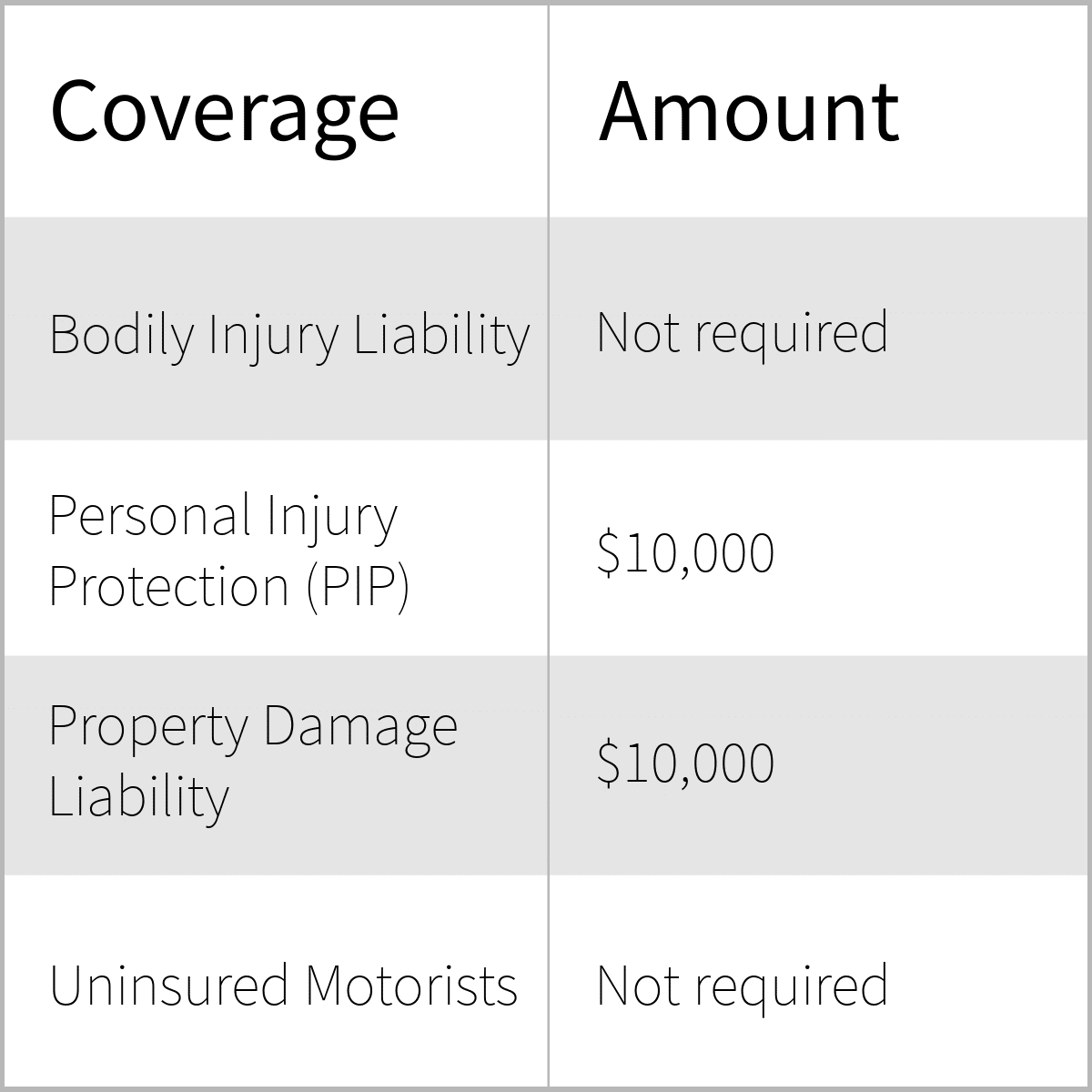

Florida operates under a no-fault insurance system, which means that after an accident, each driver involved is primarily responsible for covering their own medical expenses and lost wages, regardless of who caused the accident. This system is designed to streamline the claims process and reduce litigation.

Personal Injury Protection (PIP) Coverage

A key component of Florida’s no-fault system is Personal Injury Protection (PIP) coverage, which is mandatory for all drivers in the state. PIP coverage provides benefits to the insured driver and their passengers, regardless of fault, for medical expenses and lost wages resulting from a car accident.

Limitations of PIP Coverage

PIP coverage in Florida has limitations, including:

- Maximum Benefit Amount: The maximum benefit amount for PIP coverage is $10,000 per person, per accident. This means that if your medical expenses exceed $10,000, you will be responsible for the remaining costs.

- Medical Treatment Requirements: PIP coverage requires that medical treatment be provided by a licensed physician, such as a doctor or chiropractor. Treatment from other healthcare providers, such as massage therapists or acupuncturists, is not covered under PIP.

Circumstances for Pursuing a Claim Against Another Driver

While Florida’s no-fault system generally requires drivers to seek coverage through their own PIP, there are circumstances under which a driver can pursue a claim against another driver, even if they were not at fault. These circumstances include:

- “Serious Injury” Threshold: Florida law allows drivers to sue the other driver for pain and suffering, lost wages, and other damages if they can prove they sustained a “serious injury” in the accident. A serious injury is defined as one that results in:

- Permanent injury

- Significant disfigurement

- A permanent impairment of a bodily function

- A permanent loss of a bodily function

- Significant and permanent scarring

- Death

- “Economic Threshold”: If a driver’s medical expenses exceed $10,000, they can pursue a claim against the other driver for all damages, regardless of whether they sustained a “serious injury”.

Conclusion

By understanding the intricacies of Florida Full Coverage Car Insurance, you can make informed decisions about your coverage and ensure you have the protection you need. Remember to compare quotes from multiple insurance providers, ask questions about policy terms and conditions, and choose a policy that aligns with your budget and driving habits. With the right knowledge and a comprehensive insurance plan, you can navigate the roads of Florida with confidence.

Question & Answer Hub

What are the different types of coverage included in Florida Full Coverage Car Insurance?

Florida Full Coverage Car Insurance typically includes liability coverage, collision coverage, comprehensive coverage, and uninsured/underinsured motorist coverage. Liability coverage protects you against financial losses if you cause an accident. Collision coverage covers damage to your vehicle in an accident, regardless of fault. Comprehensive coverage protects your vehicle against damage from non-collision events like theft, vandalism, or natural disasters. Uninsured/underinsured motorist coverage protects you if you are hit by a driver without insurance or with insufficient insurance.

How much does Florida Full Coverage Car Insurance cost?

The cost of Florida Full Coverage Car Insurance varies depending on several factors, including your driving history, vehicle type, age, location, and credit score. Drivers with a clean driving record and newer, safer vehicles typically pay lower premiums. Your location also plays a role, with areas with higher accident rates or crime rates generally having higher insurance costs.

What are the benefits of having Florida Full Coverage Car Insurance?

Florida Full Coverage Car Insurance offers significant financial protection in the event of an accident. It covers repairs to your vehicle, medical expenses, and liability claims, ensuring you are not burdened with substantial financial losses. It also provides peace of mind knowing you are adequately protected in the event of a major accident.

What is Florida’s no-fault insurance system?

Florida has a no-fault insurance system, which means that after an accident, you file a claim with your own insurance company, regardless of who was at fault. This system is designed to expedite the claims process and reduce litigation. Florida’s no-fault system includes Personal Injury Protection (PIP) coverage, which covers your medical expenses and lost wages after an accident.

When can I pursue a claim against another driver in Florida?

While Florida has a no-fault system, you can still pursue a claim against another driver in certain circumstances. For example, if you suffer significant injuries that exceed the limits of your PIP coverage, or if the other driver was at fault for the accident and their insurance is insufficient, you may be able to file a claim against them.