- Understanding Florida Car Insurance Requirements

- Factors Affecting Car Insurance Costs

- Finding Affordable Car Insurance Options

- Tips for Lowering Car Insurance Premiums

- Exploring Discount Programs

- The Role of Comparison Websites

- Understanding Policy Fine Print

- Seeking Professional Advice

- Closing Summary: How To Get Cheap Car Insurance In Florida

- Questions Often Asked

How to get cheap car insurance in Florida sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Florida, known for its sunshine and beaches, also boasts a vibrant automotive landscape. But navigating the complex world of car insurance in the Sunshine State can be a daunting task, especially for those seeking affordable coverage. This guide will demystify the process, providing you with the knowledge and strategies to secure the best possible rates without compromising on essential protection.

Understanding the nuances of Florida’s insurance market is crucial. The state mandates specific coverage levels, and penalties for driving without insurance can be severe. This guide will break down these requirements and explore the various types of car insurance available. We’ll then delve into the factors that influence insurance costs, such as age, driving history, vehicle type, and location. By understanding these factors, you can make informed decisions that can significantly impact your premiums.

Understanding Florida Car Insurance Requirements

Driving in Florida requires you to be aware of the state’s car insurance laws. Understanding these laws can help you make informed decisions about your coverage and avoid costly penalties.

Florida’s Mandatory Car Insurance Coverage

Florida requires all drivers to carry a minimum amount of liability insurance to protect others in case of an accident. This mandatory coverage includes:

- Personal Injury Protection (PIP): This coverage pays for medical expenses, lost wages, and other related costs for you and your passengers, regardless of fault. Florida requires a minimum of $10,000 in PIP coverage.

- Property Damage Liability (PDL): This coverage pays for damages to another person’s property, such as their car or other belongings, if you are at fault in an accident. Florida requires a minimum of $10,000 in PDL coverage.

Penalties for Driving Without Insurance

Driving without the required minimum car insurance in Florida can result in serious consequences, including:

- Fines: You can face a fine of up to $500 for driving without insurance.

- License Suspension: Your driver’s license can be suspended for up to three years if you are caught driving without insurance.

- Vehicle Impoundment: Your vehicle may be impounded until you provide proof of insurance.

- Jail Time: In some cases, driving without insurance can lead to jail time, especially if you are involved in an accident.

Types of Car Insurance Coverage in Florida

While Florida’s mandatory coverage is limited, there are other types of car insurance that can provide additional protection:

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it is damaged in an accident, regardless of fault.

- Comprehensive Coverage: This coverage protects your vehicle against damage from events other than accidents, such as theft, vandalism, fire, or natural disasters.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): This coverage protects you and your passengers if you are injured by a driver who is uninsured or underinsured.

- Medical Payments Coverage (Med Pay): This coverage pays for medical expenses for you and your passengers, regardless of fault, even if you don’t have PIP coverage.

- Rental Reimbursement Coverage: This coverage helps pay for a rental car while your vehicle is being repaired after an accident.

- Roadside Assistance Coverage: This coverage provides assistance with services such as towing, flat tire changes, and jump starts.

Factors Affecting Car Insurance Costs

In Florida, the cost of car insurance is influenced by various factors, including your driving history, the type of car you drive, your age, and your location. Understanding these factors can help you make informed decisions to potentially lower your insurance premiums.

Age

Your age is a significant factor that insurance companies consider when determining your car insurance rates. Younger drivers, especially those under 25, are generally considered to be at a higher risk of accidents due to inexperience and a tendency to engage in risky driving behaviors. As a result, they often face higher premiums. Conversely, older drivers, typically over 65, tend to have more experience on the road and a lower risk of accidents, leading to lower premiums.

Driving History

Your driving history is another crucial factor that impacts your insurance costs. A clean driving record with no accidents or traffic violations can significantly reduce your premiums. Conversely, having a history of accidents, speeding tickets, or DUI convictions will likely result in higher premiums. Insurance companies use your driving history as a predictor of your future driving behavior, and a poor record suggests a higher risk of future claims.

Vehicle Type, How to get cheap car insurance in florida

The type of vehicle you drive plays a substantial role in determining your insurance rates. Sports cars, luxury vehicles, and high-performance vehicles are often associated with higher insurance costs. This is because these vehicles are more expensive to repair or replace in the event of an accident. Additionally, the safety features of your car can also impact your premiums. Vehicles with advanced safety features like anti-lock brakes, airbags, and stability control may qualify for discounts.

Location

The location where you live also plays a role in determining your car insurance rates. Areas with high rates of traffic congestion, crime, and accidents typically have higher insurance premiums. This is because insurance companies consider these factors as indicators of a higher risk of accidents and claims.

Finding Affordable Car Insurance Options

Finding the right car insurance company in Florida can be challenging, especially when considering the wide range of options available. To make the process easier, it’s essential to understand the benefits and drawbacks of different providers and compare their coverage options and pricing.

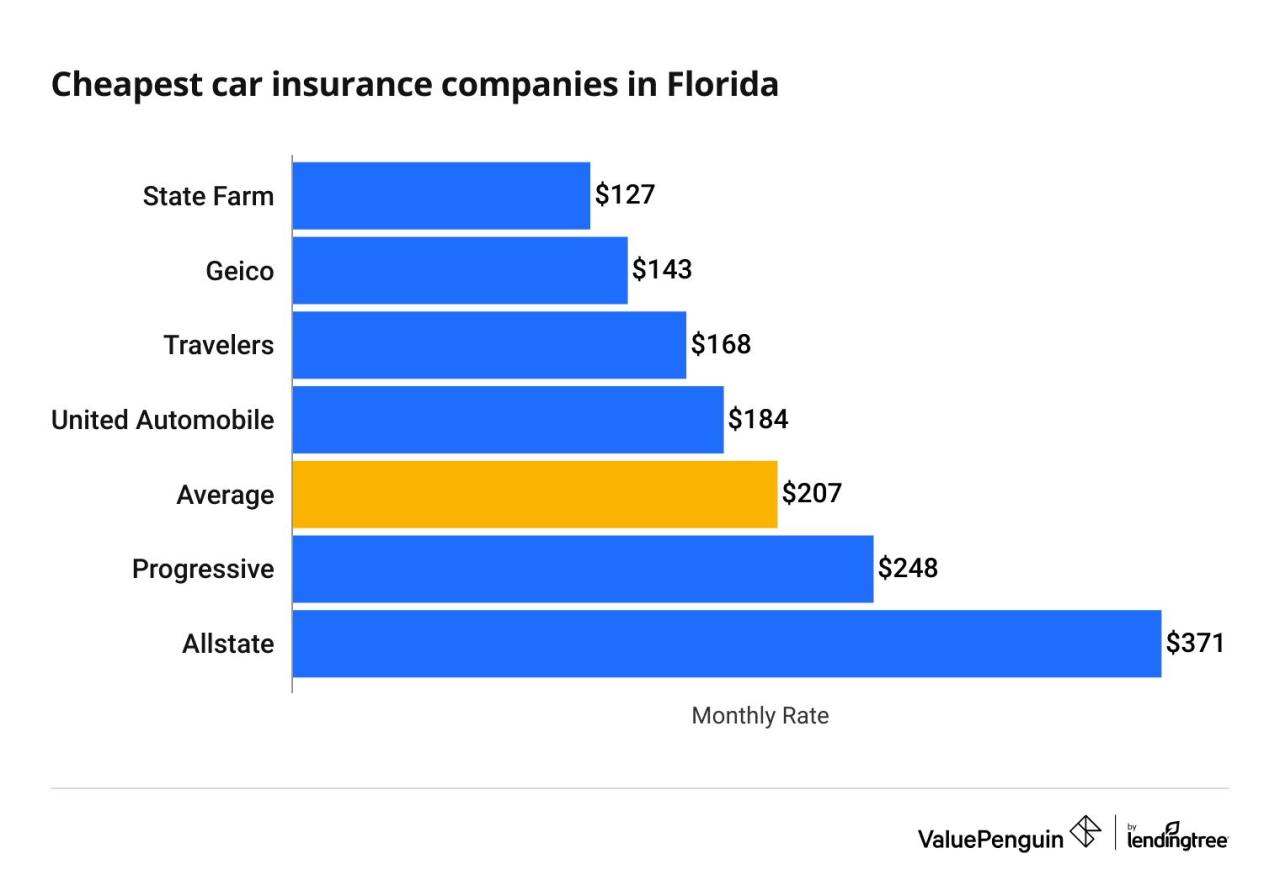

Reputable Car Insurance Companies in Florida

Several reputable car insurance companies operate in Florida, each offering unique coverage options and pricing structures. It’s crucial to research and compare different companies to find the best fit for your needs and budget.

- State Farm: Known for its extensive network of agents, customer service, and a wide range of coverage options. However, State Farm’s rates can be higher compared to some competitors.

- Geico: Popular for its competitive rates and easy online quoting process. Geico also offers various discounts and benefits, making it a budget-friendly option.

- Progressive: Known for its personalized coverage options and innovative features like Name Your Price tool, which allows customers to set their desired price and find a policy that fits their budget. However, Progressive’s rates can fluctuate depending on the specific coverage and discounts.

- Allstate: Offers a wide range of coverage options and discounts, including accident forgiveness and Drive Safe & Save program. However, Allstate’s rates can be higher compared to other providers.

- USAA: Exclusively for active military personnel, veterans, and their families, USAA offers excellent customer service and competitive rates. However, eligibility is restricted to specific groups.

- Florida Peninsula Insurance Company: Specializes in providing affordable car insurance to Florida residents, particularly those with challenging driving records. They offer various discounts and programs designed to make insurance accessible to a wider audience.

Comparing Coverage Options and Pricing

The following table compares the coverage options and pricing of major insurance companies in Florida. Remember that rates can vary based on factors like your driving record, vehicle type, location, and coverage level.

| Insurance Company | Coverage Options | Average Annual Premium (Estimated) | Discounts Offered |

|---|---|---|---|

| State Farm | Liability, Collision, Comprehensive, Uninsured/Underinsured Motorist, Personal Injury Protection (PIP) | $1,500 – $2,000 | Safe Driver, Good Student, Multi-Policy, Defensive Driving, Anti-theft Device |

| Geico | Liability, Collision, Comprehensive, Uninsured/Underinsured Motorist, PIP | $1,300 – $1,800 | Safe Driver, Good Student, Multi-Policy, Defensive Driving, Anti-theft Device |

| Progressive | Liability, Collision, Comprehensive, Uninsured/Underinsured Motorist, PIP | $1,200 – $1,700 | Safe Driver, Good Student, Multi-Policy, Defensive Driving, Anti-theft Device |

| Allstate | Liability, Collision, Comprehensive, Uninsured/Underinsured Motorist, PIP | $1,600 – $2,100 | Safe Driver, Good Student, Multi-Policy, Defensive Driving, Anti-theft Device |

| USAA | Liability, Collision, Comprehensive, Uninsured/Underinsured Motorist, PIP | $1,400 – $1,900 | Safe Driver, Good Student, Multi-Policy, Defensive Driving, Anti-theft Device |

| Florida Peninsula Insurance Company | Liability, Collision, Comprehensive, Uninsured/Underinsured Motorist, PIP | $1,000 – $1,500 | Safe Driver, Good Student, Multi-Policy, Defensive Driving, Anti-theft Device |

Tips for Lowering Car Insurance Premiums

In Florida, car insurance is a necessity. But finding affordable coverage can be a challenge. Fortunately, there are several strategies you can employ to reduce your premiums. This section will guide you through some practical tips to help you lower your car insurance costs.

Safe Driving Habits

Maintaining a good driving record is crucial for securing lower car insurance premiums. Insurance companies assess your driving history to determine your risk level, and a clean record reflects a lower risk.

- Avoid Traffic Violations: Every traffic violation, from speeding tickets to parking violations, can increase your insurance premiums. Even minor offenses can add up over time.

- Drive Defensively: Defensive driving techniques, such as maintaining a safe distance from other vehicles, being aware of your surroundings, and anticipating potential hazards, can help you avoid accidents and maintain a clean driving record.

- Take Defensive Driving Courses: Completing a certified defensive driving course can demonstrate your commitment to safe driving and potentially earn you discounts on your insurance premiums. These courses often cover techniques for avoiding accidents and managing high-risk situations.

Good Credit Score

Your credit score, which reflects your financial responsibility, can influence your car insurance rates in some states, including Florida. Insurance companies often use credit scores as a proxy for risk assessment, believing that individuals with good credit are more likely to be responsible drivers.

- Improve Your Credit Score: If your credit score is low, focus on improving it by paying your bills on time, reducing debt, and avoiding new credit applications. A higher credit score can potentially translate to lower car insurance premiums.

- Check Your Credit Report: Review your credit report regularly for any errors that may be negatively impacting your score. Disputing any inaccuracies can help improve your credit standing.

Bundling Insurance Policies

Bundling multiple insurance policies, such as your car insurance, homeowners insurance, or renters insurance, with the same insurance company can often lead to significant savings. Insurance companies reward customers for consolidating their insurance needs, offering discounts for bundling.

- Compare Bundled Quotes: Contact your current insurance company or obtain quotes from other insurers to compare bundled policy rates. Ensure you are comparing apples to apples, meaning the same coverage levels for each policy type.

- Explore Different Bundling Options: Consider bundling your car insurance with other types of insurance, such as homeowners, renters, or life insurance, to maximize potential discounts.

Exploring Discount Programs

Florida car insurance companies offer various discount programs to help policyholders save money on their premiums. These discounts are designed to reward safe driving practices, responsible vehicle ownership, and other positive attributes. By taking advantage of these programs, you can significantly reduce your insurance costs and keep more money in your pocket.

Types of Car Insurance Discounts in Florida

Car insurance discounts in Florida can be categorized into several groups based on the factors they consider. These categories include:

- Driving Record Discounts: These discounts reward drivers with clean driving records. This includes discounts for accident-free driving, safe driving courses, and defensive driving training. For instance, drivers with no accidents or violations in a certain period might qualify for a “good driver discount.” Similarly, completing a defensive driving course can often earn you a “safe driver discount.”

- Vehicle Safety Features Discounts: These discounts are available for vehicles equipped with advanced safety features that reduce the risk of accidents and injuries. This includes discounts for anti-theft devices, airbags, anti-lock brakes, and other safety technologies. For example, vehicles with anti-theft systems may qualify for a “theft prevention discount,” while those with advanced braking systems could receive an “anti-lock brake discount.”

- Group Affiliation Discounts: These discounts are available to members of certain groups or organizations. This includes discounts for affiliations with professional organizations, alumni associations, and even employers. For instance, if you’re a member of a specific professional organization, you might qualify for a “professional association discount.”

- Payment and Policy Discounts: These discounts are available for making prompt payments and maintaining continuous coverage. This includes discounts for paying premiums in full, bundling multiple insurance policies, and maintaining continuous coverage without lapses. For instance, paying your premiums annually instead of monthly could qualify you for a “payment plan discount.”

Eligibility Criteria for Car Insurance Discounts

To be eligible for car insurance discounts, you must meet certain criteria. These criteria can vary depending on the insurance company and the specific discount program. However, some common eligibility requirements include:

- Good Driving Record: Most discounts require a clean driving record, which typically means no accidents or traffic violations for a specific period. The length of the required clean record can vary depending on the discount and the insurer.

- Vehicle Safety Features: For discounts related to safety features, your vehicle must be equipped with the specific features required by the insurance company. This may involve providing proof of installation or documentation of the vehicle’s safety features.

- Group Affiliation: For discounts based on group affiliation, you must provide proof of membership in the eligible organization. This could involve providing a membership card, a letter of membership, or other documentation.

- Payment and Policy History: To qualify for discounts related to payment and policy history, you must maintain a consistent payment record and avoid any lapses in coverage. This may involve providing evidence of on-time payments or a history of continuous coverage.

Car Insurance Discount Programs Table

The following table summarizes some common car insurance discount programs offered by insurance companies in Florida:

| Discount Program | Description | Eligibility Criteria |

|---|---|---|

| Good Driver Discount | Rewarding drivers with clean driving records | No accidents or traffic violations for a specified period |

| Safe Driver Discount | Discount for completing defensive driving courses | Completion of an approved defensive driving course |

| Anti-Theft Device Discount | Discount for vehicles equipped with anti-theft devices | Installation of a qualified anti-theft system |

| Airbag Discount | Discount for vehicles with airbags | Vehicle must be equipped with factory-installed airbags |

| Anti-Lock Brake Discount | Discount for vehicles with anti-lock brakes | Vehicle must be equipped with anti-lock brakes |

| Multi-Policy Discount | Discount for bundling multiple insurance policies | Purchasing multiple insurance policies from the same company |

| Payment Plan Discount | Discount for paying premiums in full | Paying premiums annually or semi-annually |

| Continuous Coverage Discount | Discount for maintaining continuous insurance coverage | No lapses in insurance coverage for a specified period |

| Group Affiliation Discount | Discount for members of specific organizations | Proof of membership in an eligible organization |

The Role of Comparison Websites

In today’s digital age, finding the best car insurance deals is easier than ever, thanks to the availability of numerous comparison websites. These online platforms streamline the process of shopping for car insurance by allowing you to compare quotes from multiple insurance providers simultaneously.

Comparison websites play a crucial role in helping Florida residents find affordable car insurance by simplifying the process and providing valuable insights into available options.

Popular Comparison Websites and Their Features

Comparison websites are designed to make the process of finding affordable car insurance straightforward and efficient. They typically gather information about your vehicle, driving history, and coverage needs, then present you with a range of quotes from different insurance companies. This allows you to quickly compare prices and coverage options without having to contact each provider individually.

Here are some popular car insurance comparison websites and their features:

- Insurify: Insurify is a popular comparison website that allows users to compare quotes from over 20 insurance companies. It offers features like personalized recommendations, coverage analysis, and a user-friendly interface.

- Policygenius: Policygenius is another well-known comparison website that provides quotes from multiple insurance providers. It offers features like personalized recommendations, policy analysis, and a dedicated customer support team.

- QuoteWizard: QuoteWizard is a comprehensive comparison website that offers quotes for various insurance products, including car insurance. It allows users to compare quotes from over 50 insurance companies and offers features like personalized recommendations and coverage analysis.

How Comparison Websites Help Consumers Find the Best Deals

Comparison websites empower consumers to make informed decisions by providing them with the tools to compare quotes and coverage options from multiple insurance providers. These websites typically use sophisticated algorithms to analyze your information and present you with personalized recommendations. This process ensures that you are presented with the most relevant and competitive quotes based on your specific needs and circumstances.

Comparison websites offer several benefits to consumers:

- Time-saving: Instead of contacting multiple insurance companies individually, comparison websites allow you to get quotes from several providers in minutes. This saves you time and effort during the car insurance shopping process.

- Convenience: Comparison websites can be accessed from anywhere with an internet connection, making it easy to compare quotes at your convenience. You can shop for car insurance from the comfort of your home or on the go.

- Transparency: Comparison websites typically display quotes from various insurance providers side by side, allowing you to compare prices, coverage options, and deductibles transparently. This helps you make informed decisions based on your budget and insurance needs.

- Personalized Recommendations: Comparison websites often use algorithms to analyze your information and provide personalized recommendations based on your driving history, vehicle type, and coverage preferences. This ensures that you are presented with the most relevant and competitive quotes.

Understanding Policy Fine Print

It’s crucial to carefully review your car insurance policy before signing on the dotted line. Understanding the fine print can help you make informed decisions about your coverage and ensure you’re getting the best value for your money. This section will delve into key terms and conditions that impact your coverage and premiums, along with the process of filing claims and understanding policy limitations.

Key Terms and Conditions

Understanding the language used in your car insurance policy is essential. Here are some common terms and conditions that you should be aware of:

- Deductible: The amount you pay out-of-pocket before your insurance coverage kicks in. A higher deductible generally means lower premiums.

- Coverage Limits: The maximum amount your insurance company will pay for a covered claim. Ensure your coverage limits are sufficient to cover potential expenses in case of an accident.

- Exclusions: Specific situations or events that are not covered by your insurance policy. These exclusions may include things like driving under the influence, using your vehicle for commercial purposes, or certain types of accidents.

- Premium: The amount you pay for your car insurance policy. Premiums are typically calculated based on factors like your driving record, age, vehicle type, and location.

- Renewal: The process of extending your car insurance policy for another term. You may receive a notice from your insurance company before your current policy expires.

Filing Claims

Knowing how to file a claim in case of an accident is crucial. Most insurance companies have a straightforward process for filing claims:

- Contact your insurance company immediately: Report the accident to your insurance company as soon as possible, providing all necessary details.

- Gather information: Collect information about the accident, including the date, time, location, and names and contact details of all parties involved.

- File a claim: Follow your insurance company’s instructions for filing a claim. This may involve completing a claim form and providing supporting documentation, such as police reports or medical bills.

- Cooperate with your insurance company: Be truthful and cooperative with your insurance company during the claims process. This includes providing any requested information or attending any required appointments.

Understanding Policy Limitations

Car insurance policies come with certain limitations. It’s important to understand these limitations before you need to file a claim:

- Coverage limits: Your insurance policy will have coverage limits, which are the maximum amounts your insurer will pay for specific types of claims. For example, there may be a limit on the amount paid for medical expenses or property damage.

- Exclusions: Your policy will also have exclusions, which are specific situations or events that are not covered. For example, your insurance may not cover damages caused by driving under the influence of alcohol or drugs.

- Deductibles: You will typically have to pay a deductible before your insurance coverage kicks in. This means that you will be responsible for a certain amount of the costs associated with a claim.

Seeking Professional Advice

Navigating the complex world of car insurance in Florida can be overwhelming, even with all the information available online. Seeking guidance from a qualified insurance professional can make the process smoother and more rewarding, helping you find the best coverage at the most affordable price.

Insurance brokers and agents possess extensive knowledge of the Florida insurance market and can provide personalized advice tailored to your specific needs. They can help you understand different policy options, compare quotes from various insurance companies, and negotiate favorable terms. This personalized approach ensures you secure the most suitable car insurance plan, one that offers comprehensive protection without breaking the bank.

Choosing a Reliable Insurance Professional

Selecting a trustworthy insurance professional is crucial to ensure you receive competent and unbiased advice. Here’s how to make an informed decision:

- Check Their Credentials: Look for brokers or agents licensed by the Florida Department of Financial Services. This ensures they meet the state’s minimum requirements and adhere to ethical standards.

- Verify Their Experience: Consider their experience in the insurance industry, particularly in handling car insurance policies in Florida. A seasoned professional will possess in-depth knowledge of local regulations and market trends.

- Read Reviews and Testimonials: Explore online reviews and testimonials from previous clients to gauge their satisfaction with the professional’s services. Look for feedback on their responsiveness, communication, and ability to resolve issues.

- Seek Referrals: Ask friends, family, or colleagues for recommendations. Personal referrals often provide valuable insights into a professional’s reputation and expertise.

- Schedule a Consultation: Before committing to any professional, schedule a consultation to discuss your insurance needs and expectations. This allows you to assess their understanding of your situation and their ability to address your concerns.

Closing Summary: How To Get Cheap Car Insurance In Florida

Navigating the complexities of car insurance in Florida doesn’t have to be a stressful endeavor. By understanding the requirements, factors influencing costs, and available discounts, you can empower yourself to make informed choices that lead to affordable coverage. Remember, comparing quotes, utilizing discount programs, and seeking professional advice can all contribute to securing the best possible deal. Embrace the knowledge you’ve gained, and confidently embark on your journey towards securing cheap car insurance in Florida.

Questions Often Asked

What is the minimum car insurance coverage required in Florida?

Florida requires drivers to have a minimum of Personal Injury Protection (PIP) coverage of $10,000 and Property Damage Liability (PDL) coverage of $10,000. This is known as the “Florida No-Fault” system.

Can I get car insurance without a credit check in Florida?

While some insurers may not explicitly require a credit check, most will consider your credit history as a factor in determining your premium. You can try contacting insurers that emphasize factors other than credit, but it’s important to be transparent about your credit situation.

What are the consequences of driving without car insurance in Florida?

Driving without insurance in Florida is illegal and can result in hefty fines, license suspension, and even vehicle impoundment. It’s crucial to maintain valid car insurance coverage at all times.