Average Florida car insurance premium is a topic that concerns many residents of the Sunshine State. Florida’s unique driving environment, with its high population density and unpredictable weather, significantly influences insurance costs. Understanding the factors that determine your premium can help you make informed decisions to save money.

From the impact of your driving history and credit score to the type of vehicle you drive and the coverage levels you choose, there are numerous variables that can affect your car insurance rates. This guide will delve into the intricacies of the Florida car insurance market, providing insights into how premiums are calculated, strategies for reducing costs, and essential information about coverage options.

Factors Influencing Florida Car Insurance Premiums

Florida’s car insurance premiums are notoriously high, often exceeding the national average. Several factors contribute to this, including the state’s unique driving environment, demographic characteristics, and the types of vehicles driven. Understanding these factors is crucial for drivers seeking to navigate the complexities of Florida’s insurance market and make informed decisions about their coverage.

Florida’s Driving Environment

Florida’s driving environment presents unique challenges that significantly impact insurance premiums. The state’s warm climate and high population density contribute to increased traffic volume and a higher risk of accidents. The prevalence of tourists and seasonal residents adds to the complexity of the driving landscape, further elevating the likelihood of incidents. Furthermore, Florida’s susceptibility to hurricanes and other natural disasters necessitates comprehensive coverage, which in turn increases premiums.

Demographics

Demographic factors play a crucial role in determining car insurance premiums.

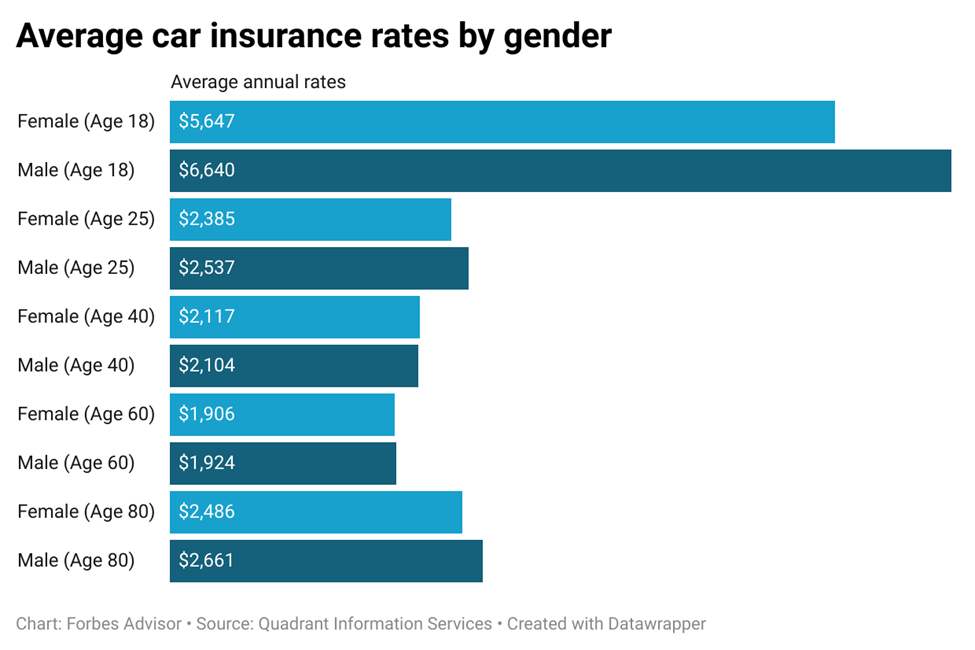

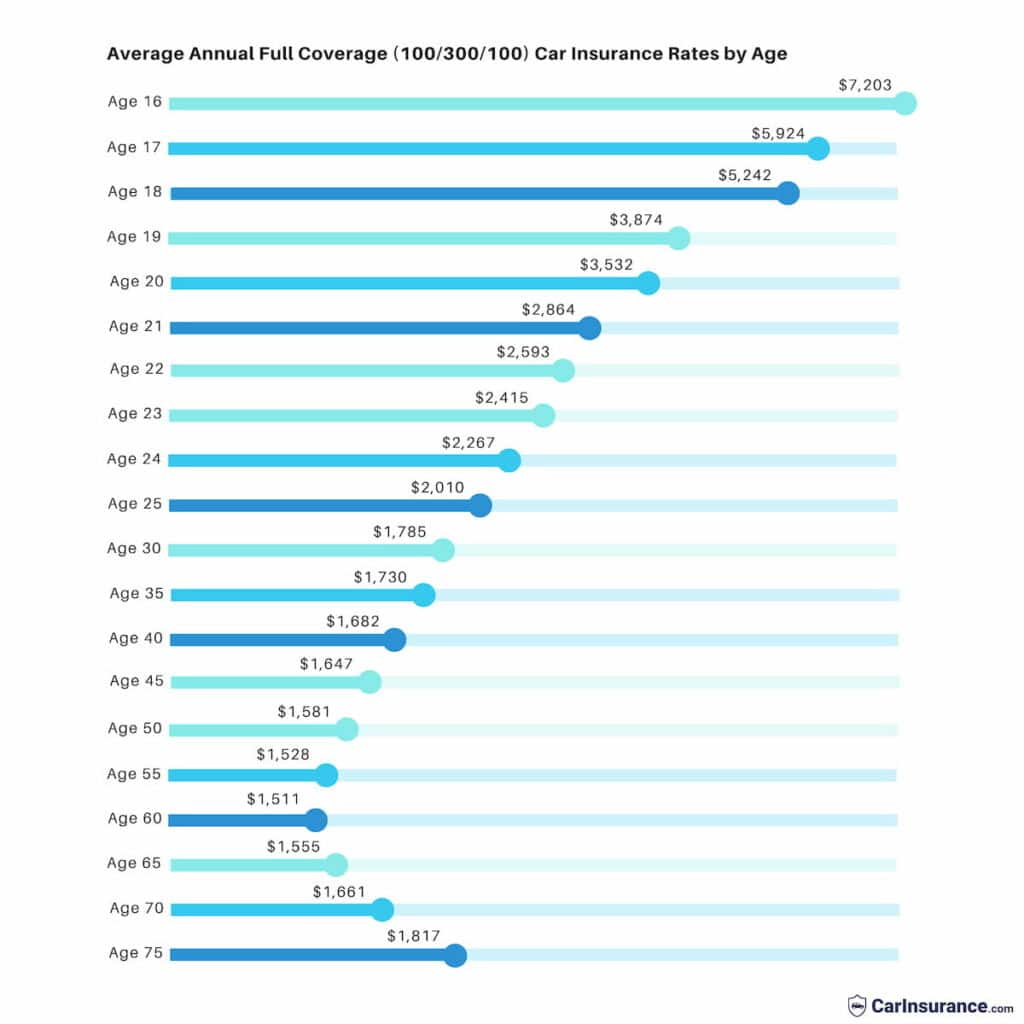

- Age: Younger drivers, particularly those under 25, are statistically more likely to be involved in accidents due to their lack of experience and higher risk-taking behavior. This translates into higher premiums for young drivers. Conversely, older drivers often benefit from lower rates as they have accumulated more driving experience and exhibit safer driving habits.

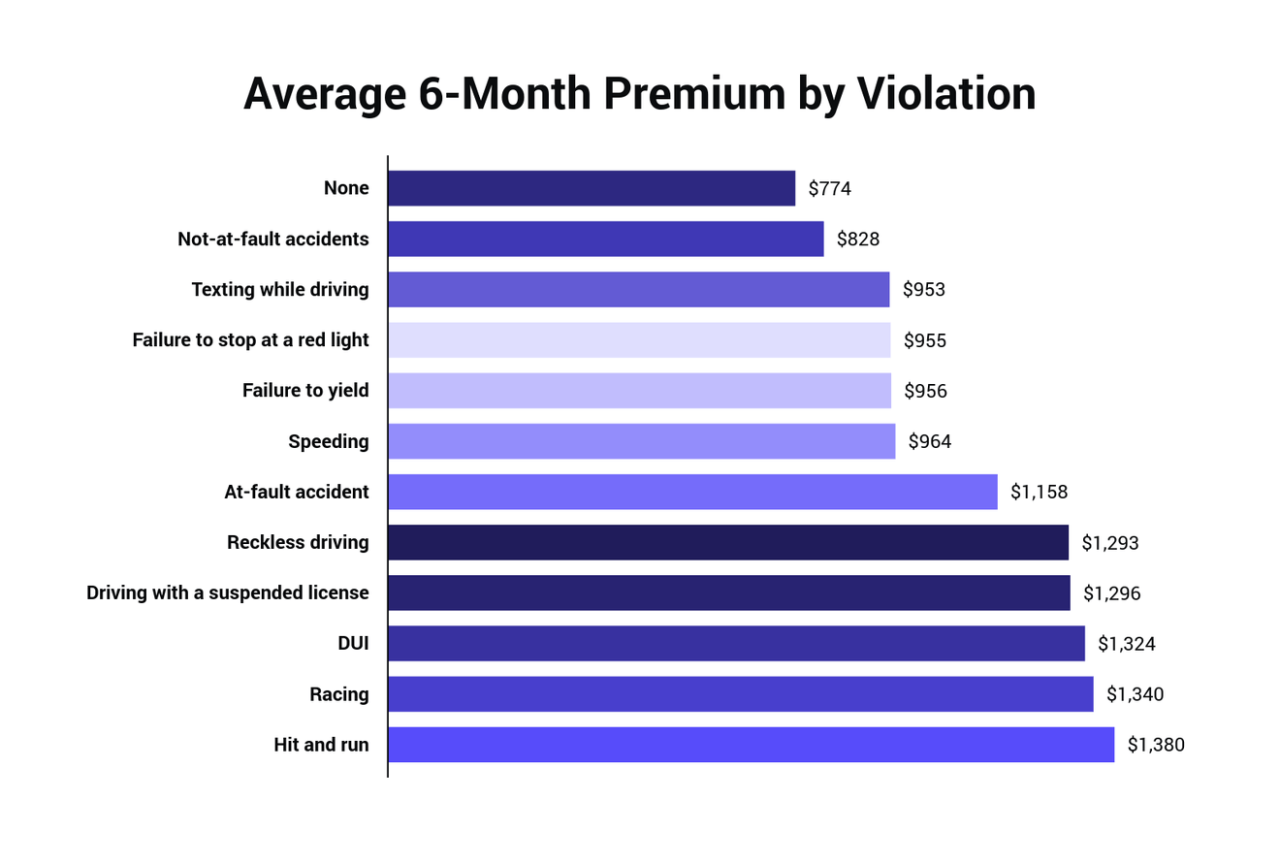

- Driving History: A clean driving record with no accidents or traffic violations is a significant factor in securing lower premiums. Drivers with a history of accidents or traffic violations are considered higher risk and face higher premiums. This reflects the increased likelihood of future incidents based on past behavior.

- Credit Score: While this may seem counterintuitive, a good credit score can lead to lower insurance premiums in Florida. Insurance companies often use credit scores as a proxy for responsible behavior, believing that individuals with good credit are more likely to be responsible drivers. However, it is important to note that credit scores are not the sole determining factor, and other factors such as driving history and vehicle type also play a role.

Vehicle Type

The type of vehicle you drive has a significant impact on your insurance premium.

- Luxury Cars: Luxury vehicles are often more expensive to repair and replace, leading to higher insurance premiums. Insurance companies consider these vehicles higher risk due to their higher value and potential for greater financial losses in the event of an accident.

- SUVs and Trucks: These vehicles are generally larger and heavier than sedans, which makes them more likely to cause significant damage in an accident. Their increased size and weight can also make them more difficult to handle, potentially contributing to accidents. As a result, SUVs and trucks often have higher insurance premiums than smaller vehicles.

Coverage Levels

The level of coverage you choose directly impacts your premium.

- Liability Coverage: This coverage protects you financially if you are at fault in an accident that causes damage to another person’s property or injuries to another person. Higher liability limits, which provide greater financial protection, typically result in higher premiums.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it is damaged in an accident, regardless of who is at fault. Collision coverage is optional, but it is often required if you have a car loan.

- Comprehensive Coverage: This coverage protects your vehicle from damage caused by events other than accidents, such as theft, vandalism, or natural disasters. Like collision coverage, comprehensive coverage is optional but is often required if you have a car loan.

Florida’s Insurance Market: Average Florida Car Insurance Premium

Florida boasts a highly competitive and complex car insurance market, shaped by various factors, including a high concentration of insured vehicles, a significant number of uninsured motorists, and a history of natural disasters. This dynamic landscape influences the cost of car insurance for Florida residents.

Major Insurance Providers in Florida, Average florida car insurance premium

Florida’s car insurance market is dominated by a diverse group of insurance companies, both national and regional. These providers compete for market share by offering various coverage options, discounts, and customer service experiences. Here are some of the major insurance providers operating in Florida:

- State Farm: A national insurance giant, State Farm is a leading provider of car insurance in Florida, known for its extensive network of agents and a wide range of coverage options.

- GEICO: Another national player, GEICO is popular for its competitive rates and online-focused approach to insurance.

- Progressive: Known for its innovative insurance products, Progressive offers a variety of discounts and personalized coverage options to cater to individual needs.

- Allstate: Allstate is a well-established insurance company with a strong presence in Florida, offering a comprehensive suite of insurance products.

- USAA: A military-focused insurance provider, USAA offers competitive rates and excellent customer service to active military personnel and their families.

- Florida Peninsula Insurance Company: A Florida-based insurance company specializing in providing coverage for high-risk drivers and those with difficult-to-insure vehicles.

Key Regulations and Laws Governing Florida’s Car Insurance Market

Florida’s car insurance market is governed by a comprehensive set of regulations and laws designed to protect consumers and ensure fair practices. These regulations cover various aspects of the insurance industry, including:

- Minimum Liability Coverage Requirements: Florida law mandates all drivers to carry a minimum amount of liability insurance to protect themselves and others in case of an accident. This requirement ensures that victims of accidents have access to financial compensation for damages and injuries.

- Personal Injury Protection (PIP): Florida’s PIP coverage is a unique feature of its car insurance system. It provides coverage for medical expenses and lost wages, regardless of fault, in the event of an accident. PIP coverage is mandatory for all drivers in Florida.

- No-Fault System: Florida operates under a no-fault system, meaning that drivers are primarily responsible for covering their own medical expenses and lost wages following an accident, regardless of who caused it. However, drivers can sue for pain and suffering damages if their injuries meet certain thresholds.

- Financial Responsibility Laws: Florida’s financial responsibility laws require drivers to demonstrate proof of insurance or financial ability to cover damages in case of an accident. This ensures that drivers are held accountable for their actions on the road.

Prevalence of Insurance Fraud in Florida

Insurance fraud is a significant concern in Florida, impacting the cost of car insurance premiums for all drivers. This type of fraud can take many forms, including:

- Staged Accidents: This type of fraud involves individuals intentionally creating an accident to file fraudulent insurance claims.

- False Claims: Individuals may falsely report accidents or exaggerate injuries to inflate insurance claims.

- Ghost Vehicles: Fraudsters may register non-existent vehicles to obtain insurance coverage and then file fraudulent claims.

The Florida Department of Financial Services actively investigates and prosecutes insurance fraud cases to protect consumers and ensure the integrity of the insurance market.

Availability of Different Types of Insurance Policies

Florida offers a wide range of car insurance policies to cater to the diverse needs of its drivers. These policies can be broadly categorized as follows:

- Standard Coverage: This type of coverage provides basic protection for drivers and their vehicles, including liability, PIP, and property damage liability.

- High-Risk Coverage: This coverage is designed for drivers with a history of accidents, violations, or other factors that make them considered high-risk. These policies often come with higher premiums to reflect the increased risk.

Strategies for Reducing Car Insurance Premiums in Florida

Lowering your car insurance premiums in Florida is achievable with the right strategies. By taking proactive steps to improve your driving habits, choose a safe vehicle, and shop around for the best rates, you can significantly reduce your insurance costs.

Improving Driving Habits

Maintaining a good driving record is paramount for lowering your insurance premiums. Traffic violations, accidents, and other driving offenses can significantly increase your rates. Here are some strategies for improving your driving habits:

- Avoid Traffic Violations: Speeding tickets, reckless driving, and other traffic violations can lead to higher insurance premiums. Drive cautiously and obey all traffic laws to maintain a clean driving record.

- Take Defensive Driving Courses: Enroll in a defensive driving course to learn techniques for safe driving and accident prevention. Many insurance companies offer discounts for completing these courses.

- Avoid Distracted Driving: Put away your phone, avoid texting, and refrain from eating while driving. Focus your attention on the road to minimize the risk of accidents.

- Maintain Vehicle Condition: Regularly service your car, including oil changes, tire rotations, and brake inspections. A well-maintained vehicle is less likely to break down or be involved in an accident, which can lower your insurance premiums.

Increasing Deductibles

Your deductible is the amount you pay out of pocket before your insurance coverage kicks in. Increasing your deductible can significantly lower your premium, as you are taking on more financial responsibility in case of an accident. However, ensure you can afford the higher deductible in case of an accident.

Bundling Insurance Policies

Many insurance companies offer discounts for bundling multiple policies, such as car insurance, homeowners insurance, and renters insurance. By combining your policies with the same insurer, you can often secure a significant discount on your premiums.

Choosing a Safe Vehicle

The type of vehicle you drive significantly impacts your insurance premiums. Vehicles with safety features like anti-lock brakes, airbags, and electronic stability control are generally considered safer and can lead to lower insurance rates.

- Safety Features: Cars with advanced safety features like automatic emergency braking, lane departure warning, and adaptive cruise control can significantly reduce the risk of accidents, leading to lower premiums.

- Vehicle History: Choosing a car with a good safety record and a history of fewer accidents can also result in lower insurance rates.

- Vehicle Size and Type: Sports cars and luxury vehicles are often associated with higher insurance premiums due to their higher repair costs and perceived risk. Choosing a smaller, more economical car can lead to lower rates.

Shopping Around for Quotes

Comparing quotes from multiple insurance companies is crucial for securing the best possible rates. Use online comparison tools or contact insurance agents directly to obtain quotes. Consider factors like coverage options, deductibles, and discounts offered by each insurer.

- Compare Coverage Options: Carefully evaluate the coverage options offered by each insurer to ensure you have adequate protection while minimizing unnecessary costs.

- Consider Discounts: Ask about available discounts, such as good driver discounts, safe vehicle discounts, and multi-policy discounts. Some insurers offer discounts for completing driver safety courses, having a good credit score, or being a member of certain organizations.

- Review Your Policy Regularly: Review your insurance policy annually to ensure you are still receiving the best rates and that your coverage meets your current needs.

Understanding Insurance Quotes and Coverage

Car insurance quotes can seem complex, but understanding their components is crucial for making informed decisions. This section will guide you through the key elements of a typical car insurance quote, helping you decipher the information presented and make the best choice for your needs.

Essential Components of a Car Insurance Quote

A typical car insurance quote will include several essential components that determine your premium. These components are:

| Component | Description |

|---|---|

| Coverage Limits | The maximum amount the insurer will pay for covered losses. |

| Deductibles | The amount you pay out-of-pocket before the insurance covers the rest. |

| Coverage Exclusions | Situations or events not covered by your policy. |

| Premium | The amount you pay for your insurance policy. |

Key Terms Explained

Several key terms are essential to understand when reviewing a car insurance quote.

- Liability Limits: These limits define the maximum amount your insurance company will pay for damages caused to others in an accident. They are typically expressed as a combination of numbers, such as 100/300/50, representing:

- $100,000: Maximum payout per person for bodily injury.

- $300,000: Maximum payout per accident for bodily injury.

- $50,000: Maximum payout per accident for property damage.

Higher liability limits provide greater financial protection in case of a serious accident.

- Deductibles: The amount you agree to pay out-of-pocket before your insurance coverage kicks in. A higher deductible typically results in a lower premium, while a lower deductible means a higher premium. For example, a $500 deductible means you pay the first $500 of any covered repair costs, and your insurance covers the rest.

- Coverage Exclusions: These are situations or events specifically excluded from your policy coverage. Common exclusions include:

- Driving under the influence (DUI): Accidents caused by driving under the influence of alcohol or drugs.

- Unlicensed driving: Accidents caused by driving without a valid driver’s license.

- Intentional damage: Deliberately damaging your own vehicle or causing damage to others.

It is crucial to review your policy carefully to understand what is and is not covered.

Types of Coverage Available

Car insurance policies offer various types of coverage to protect you and your vehicle.

- Bodily Injury Liability: Covers medical expenses, lost wages, and other damages to people injured in an accident caused by you. This coverage is required in most states.

- Property Damage Liability: Covers damages to another person’s property, such as their car, in an accident caused by you. This coverage is also required in most states.

- Collision Coverage: Covers damages to your vehicle in an accident, regardless of fault. This coverage is optional but recommended, especially if you have a loan or lease on your vehicle.

- Comprehensive Coverage: Covers damages to your vehicle from events other than collisions, such as theft, vandalism, or natural disasters. This coverage is optional but recommended for newer or more expensive vehicles.

Factors Affecting Insurance Premium

Your insurance premium is determined by several factors, including:

- Driving history: Your past driving record, including accidents, tickets, and DUI convictions, significantly impacts your premium.

- Vehicle type: The make, model, year, and safety features of your vehicle influence your premium. Newer, more expensive vehicles with advanced safety features generally have higher premiums.

- Location: Your geographic location affects your premium due to varying risks of accidents, theft, and natural disasters.

- Age and gender: Statistics show that younger and male drivers tend to have higher accident rates, which can lead to higher premiums.

- Credit score: In some states, your credit score can influence your insurance premium. This is based on the idea that individuals with good credit are more financially responsible and less likely to file claims.

- Coverage limits: Higher coverage limits generally result in higher premiums. You need to balance the level of protection you desire with the affordability of your premium.

- Deductibles: Choosing a higher deductible can lower your premium, as you are agreeing to pay more out-of-pocket in case of an accident.

- Discounts: Several discounts can reduce your premium, such as good student discounts, safe driver discounts, and multi-car discounts.

Understanding Your Insurance Quote

When reviewing your insurance quote, pay close attention to the following details:

- Coverage limits: Ensure the liability limits are adequate to cover potential damages in case of an accident. Consider your financial situation and the potential risks involved.

- Deductibles: Choose a deductible you can comfortably afford. A higher deductible can lower your premium but will require a larger out-of-pocket payment in case of an accident.

- Coverage exclusions: Carefully review the list of exclusions to understand what is not covered by your policy. Make sure you are aware of any potential gaps in your coverage.

- Premium: Compare premiums from different insurance companies to find the best value for your needs. Remember that the lowest premium may not always be the best option if it comes with insufficient coverage.

Resources and Additional Information

Navigating the complexities of Florida car insurance can be daunting, but numerous resources and support systems are available to assist you. This section provides a comprehensive guide to accessing crucial information, understanding claim procedures, and navigating the insurance landscape effectively.

Government Websites and Consumer Protection Organizations

Government websites and consumer protection organizations play a vital role in safeguarding your rights and providing valuable information about car insurance in Florida.

- Florida Department of Financial Services (DFS): The DFS is the primary regulatory body for the insurance industry in Florida. Their website provides comprehensive information on car insurance requirements, consumer rights, and complaint procedures. You can access information about licensed insurance companies, find out about insurance fraud, and file complaints regarding insurance practices.

- Florida Office of Insurance Regulation (OIR): The OIR is responsible for overseeing the insurance market in Florida. Their website offers valuable resources for consumers, including information on insurance rates, coverage options, and financial stability of insurance companies. You can also find details about insurance regulations, consumer protection laws, and how to file a complaint.

- National Association of Insurance Commissioners (NAIC): The NAIC is a non-profit organization that works to promote uniformity and efficiency in insurance regulation across the United States. Their website provides information on insurance regulations, consumer protection issues, and industry trends. You can find resources on car insurance, including model laws and regulations, and information on insurance fraud.

- Consumer Reports: Consumer Reports is a non-profit organization that provides independent reviews and ratings of products and services. Their website offers valuable information on car insurance, including ratings of insurance companies, comparisons of coverage options, and tips for finding affordable insurance. You can find resources on car insurance, including ratings of insurance companies, comparisons of coverage options, and tips for finding affordable insurance.

- Better Business Bureau (BBB): The BBB is a non-profit organization that promotes ethical business practices. Their website provides information on insurance companies, including customer reviews and ratings. You can also file complaints with the BBB if you have issues with an insurance company.

Filing a Claim with an Insurance Provider

Filing a claim with your insurance provider can be a stressful process, but understanding the steps involved can make it more manageable.

- Report the Accident: Immediately contact your insurance company to report the accident. Provide all relevant details, including the date, time, location, and circumstances of the accident.

- Gather Information: Collect as much information as possible about the accident, including the names and contact information of all parties involved, the police report number, and any witness statements. Take photographs of the damage to your vehicle and the accident scene.

- File the Claim: Once you have gathered the necessary information, file a claim with your insurance company. They will provide you with a claim number and instructions on how to proceed.

- Cooperate with the Insurance Company: Provide all requested information and documentation to your insurance company in a timely manner. This will help expedite the claims process.

- Negotiate a Settlement: Once your claim is reviewed, the insurance company will offer a settlement. If you are not satisfied with the settlement offer, you have the right to negotiate with the insurance company.

Role of Insurance Agents and Brokers

Insurance agents and brokers play a crucial role in helping individuals find the right car insurance policy.

- Insurance Agents: Insurance agents represent specific insurance companies and sell their products. They can provide personalized advice and help you choose a policy that meets your specific needs.

- Insurance Brokers: Insurance brokers work independently and represent multiple insurance companies. They can shop around for the best rates and coverage options from different companies.

Appealing an Insurance Rate Increase or Denial of Coverage

If you disagree with an insurance rate increase or denial of coverage, you have the right to appeal the decision.

- Review the Denial or Increase Notice: Carefully review the notice from your insurance company, paying attention to the reasons provided for the denial or increase.

- Gather Supporting Documentation: Collect any documentation that supports your appeal, such as medical records, police reports, or evidence of your driving record.

- Submit a Formal Appeal: Contact your insurance company and submit a formal appeal in writing. Explain your reasons for appealing the decision and provide supporting documentation.

- Consider Mediation or Arbitration: If your appeal is denied, you may consider mediation or arbitration to resolve the dispute. These processes involve a neutral third party who helps facilitate a settlement between you and the insurance company.

Rights and Responsibilities of Florida Residents Regarding Car Insurance

Florida residents have specific rights and responsibilities regarding car insurance.

- Minimum Coverage Requirements: Florida law requires all drivers to carry a minimum amount of car insurance, including personal injury protection (PIP) and property damage liability (PDL).

- Right to Choose Your Insurance Company: You have the right to choose your insurance company and the coverage options that best suit your needs.

- Right to Appeal: You have the right to appeal an insurance rate increase or denial of coverage.

- Responsibility to Maintain Coverage: It is your responsibility to maintain continuous car insurance coverage. Driving without insurance can result in fines and penalties.

Last Recap

Navigating the Florida car insurance landscape can seem daunting, but with a thorough understanding of the factors that influence premiums, you can make informed choices to ensure you have the right coverage at the best possible price. By implementing the strategies Artikeld in this guide, you can take control of your insurance costs and drive with peace of mind knowing you’re financially protected.

Key Questions Answered

What is the average car insurance premium in Florida?

The average car insurance premium in Florida varies depending on factors like your driving history, vehicle type, and coverage levels. It’s best to get personalized quotes from multiple insurers to determine your specific rate.

How can I find the cheapest car insurance in Florida?

To find the cheapest car insurance, compare quotes from multiple insurers, consider increasing your deductible, bundle your policies, and maintain a good driving record. It’s also helpful to shop around every year to see if you can find better rates.

What are the minimum car insurance requirements in Florida?

Florida requires drivers to have at least $10,000 in Personal Injury Protection (PIP) and $10,000 in Property Damage Liability (PDL). You can choose higher limits to provide greater financial protection in case of an accident.