Car insurance cheapest Florida sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Navigating the complex world of car insurance in Florida can feel like a daunting task, especially when you’re looking for the most affordable rates. With its unique insurance landscape and factors like high traffic and a large number of uninsured drivers, finding the cheapest car insurance in Florida requires a strategic approach. This guide will equip you with the knowledge and insights to navigate the Florida car insurance market effectively, ultimately helping you secure the best possible rates for your needs.

Florida’s car insurance market is known for its competitive nature, with numerous insurers vying for your business. Understanding the factors that influence car insurance costs in Florida is crucial to finding the best deals. This guide delves into the intricacies of Florida’s car insurance system, exploring the reasons behind its relatively high rates and providing actionable tips to help you lower your premiums. From understanding the impact of Florida’s no-fault insurance system to identifying the top providers offering competitive rates, this comprehensive guide serves as your roadmap to navigating the Florida car insurance landscape.

Understanding Florida’s Car Insurance Market

Florida’s car insurance market is distinct, influenced by various factors that contribute to its unique pricing dynamics. This makes it crucial to understand these factors to navigate the insurance landscape effectively.

The Impact of Florida’s No-Fault Insurance System, Car insurance cheapest florida

Florida operates under a no-fault insurance system, meaning that drivers are primarily responsible for covering their own injuries and damages after an accident, regardless of fault. This system, designed to expedite claims and reduce litigation, has significant implications for car insurance premiums.

- Personal Injury Protection (PIP): Florida’s no-fault system mandates PIP coverage, which pays for medical expenses and lost wages for the insured driver and passengers, regardless of who caused the accident. This coverage, however, is capped at $10,000 per person, which can be insufficient for significant injuries.

- Limited Tort Option: Florida offers a limited tort option, allowing drivers to sue for pain and suffering only if they meet specific criteria, such as significant injuries or permanent impairments. This option generally results in lower premiums but restricts access to full compensation for non-economic damages.

- Higher Litigation Rates: Despite the no-fault system, Florida has relatively high litigation rates compared to other states. This is attributed to factors like the availability of legal representation, the state’s permissive laws regarding lawsuits, and the prevalence of fraud and abuse in the system.

Factors Contributing to High Car Insurance Rates in Florida

Florida’s car insurance rates are among the highest in the nation, influenced by a combination of factors:

- High Number of Accidents: Florida has a significant number of car accidents, contributing to higher claims costs and, consequently, higher premiums. The state’s large population, tourist influx, and aging infrastructure contribute to this issue.

- Fraudulent Claims: Florida has a reputation for insurance fraud, which inflates claims costs and drives up premiums for all drivers. This issue is exacerbated by the state’s permissive laws regarding lawsuits and the presence of organized fraud rings.

- High Cost of Medical Care: The state’s high cost of medical care, driven by factors like a large elderly population and a high concentration of medical specialists, also contributes to higher insurance premiums.

- Natural Disasters: Florida is prone to hurricanes and other natural disasters, which can lead to significant damage to vehicles and property, increasing the risk for insurance companies and, in turn, premiums.

- Aggressive Driving: Florida has a reputation for aggressive driving, which increases the risk of accidents and, consequently, higher premiums.

Finding the Cheapest Car Insurance Options

Finding the most affordable car insurance in Florida requires a strategic approach. While rates vary based on individual factors, understanding the market and utilizing available resources can help you secure the best deal.

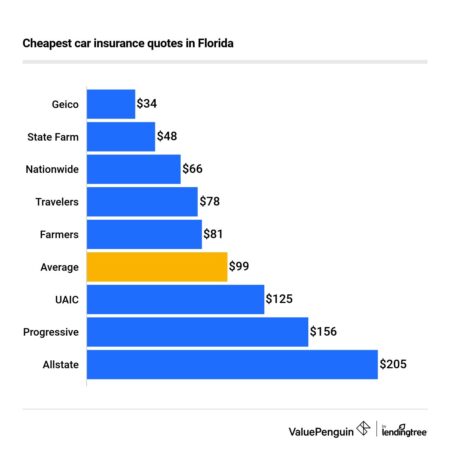

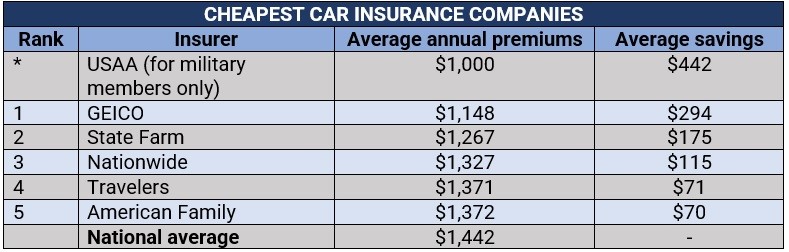

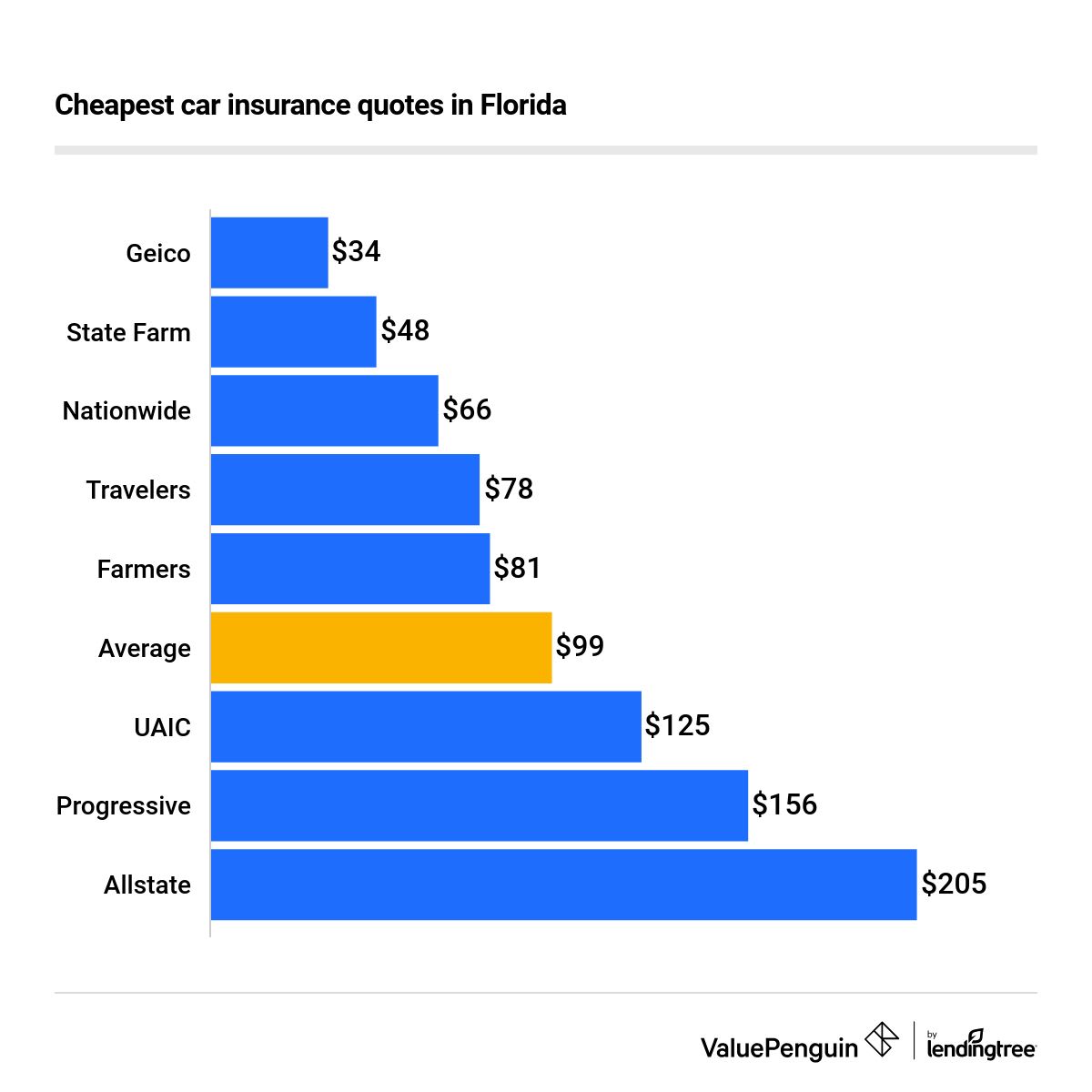

Top Car Insurance Providers in Florida

Several insurance companies are known for their competitive rates and comprehensive coverage in Florida. These companies often leverage technology and efficient operations to offer lower premiums while maintaining quality service.

- State Farm: State Farm is a major player in the Florida car insurance market, consistently ranked among the top providers. They offer a wide range of coverage options, including comprehensive and collision coverage, personal injury protection (PIP), and uninsured/underinsured motorist coverage. State Farm also offers discounts for safe driving, good student records, and bundling multiple insurance policies.

- Geico: Known for its catchy commercials and online-focused approach, Geico is another popular choice in Florida. They are known for their competitive rates and streamlined online quoting and claims processes. Geico offers various coverage options and discounts, including multi-car discounts, defensive driving course discounts, and good driver discounts.

- Progressive: Progressive is known for its innovative features and customizable coverage options. They offer a variety of discounts, including safe driver discounts, good student discounts, and discounts for multiple vehicles. Progressive also offers a unique “Name Your Price” tool that allows you to set a budget and find policies that fit within your price range.

- USAA: USAA is a highly-rated insurance company that primarily serves active military personnel, veterans, and their families. They offer competitive rates, excellent customer service, and a range of coverage options. USAA members often enjoy discounts for military service, good driving records, and bundling insurance policies.

- Florida Peninsula Insurance: This company specializes in providing coverage to Florida residents, particularly those in high-risk areas. They offer a range of coverage options, including hurricane coverage, and are known for their competitive rates, especially for drivers with a good driving history.

Using Online Comparison Tools

Online comparison tools are invaluable resources for finding the cheapest car insurance options. These tools allow you to compare quotes from multiple insurance providers simultaneously, saving you time and effort.

- Convenience: Online comparison tools streamline the process of getting quotes. You can easily input your information once and receive quotes from multiple insurers within minutes.

- Transparency: These tools often provide detailed breakdowns of coverage options and premium calculations, helping you understand the factors influencing your rates.

- Competitive Rates: By comparing quotes from various providers, you can identify the most competitive rates and ensure you’re getting the best deal possible.

Factors Influencing Car Insurance Costs: Car Insurance Cheapest Florida

Car insurance premiums in Florida are determined by a complex interplay of various factors. Understanding these factors is crucial for finding the cheapest car insurance options. While some factors are beyond your control, others can be influenced by your choices and actions. By understanding these factors and taking steps to mitigate their impact, you can potentially reduce your car insurance premiums.

Factors Affecting Car Insurance Premiums

The following table Artikels the key factors that affect car insurance premiums in Florida.

| Factor | Description | Impact on Premium | Example |

|---|---|---|---|

| Driving History | Your driving record, including accidents, traffic violations, and DUI convictions. | Higher premiums for drivers with poor driving records. | A driver with a recent speeding ticket or an at-fault accident will likely face higher premiums compared to a driver with a clean record. |

| Vehicle Type | The make, model, year, and safety features of your vehicle. | Higher premiums for vehicles that are more expensive to repair or replace, or have a higher risk of theft or accidents. | A high-performance sports car will typically have higher insurance premiums than a standard sedan. |

| Location | Your address and the crime rate, traffic density, and accident frequency in your area. | Higher premiums in areas with higher risk factors. | A driver living in a city with high traffic volume and a high rate of car theft may pay higher premiums compared to a driver living in a rural area. |

| Age and Gender | Your age and gender, as these factors correlate with driving risk. | Younger and male drivers often face higher premiums due to higher accident rates. | A 18-year-old male driver may face higher premiums than a 50-year-old female driver. |

| Credit Score | Your credit score, which insurers use as an indicator of financial responsibility. | Higher premiums for drivers with lower credit scores. | A driver with a poor credit score may be seen as a higher risk and charged higher premiums. |

| Coverage Levels | The amount of coverage you choose, including liability, collision, comprehensive, and uninsured motorist coverage. | Higher premiums for higher coverage levels. | A driver who chooses higher liability limits will pay higher premiums than a driver with lower limits. |

| Driving Habits | Your driving habits, such as mileage, driving style, and commuting patterns. | Higher premiums for drivers who drive more frequently, aggressively, or in high-risk areas. | A driver who commutes long distances daily or has a history of speeding violations may face higher premiums. |

Final Thoughts

Finding the cheapest car insurance in Florida requires careful research and a strategic approach. By understanding the unique factors influencing car insurance costs, comparing quotes from multiple providers, and implementing tips to lower your premiums, you can secure the best possible rates for your needs. Remember, the journey to finding the cheapest car insurance is a continuous process. Regularly review your policy and make necessary adjustments to ensure you’re always getting the best value for your money. With this guide, you are equipped to navigate the Florida car insurance market confidently, securing affordable coverage that provides peace of mind on the road.

Question Bank

What are the minimum car insurance requirements in Florida?

Florida law requires drivers to have a minimum of $10,000 in Personal Injury Protection (PIP) coverage, $10,000 in Property Damage Liability (PDL) coverage, and $10,000 in Bodily Injury Liability (BIL) coverage per person and $20,000 per accident.

What is the best car insurance company in Florida?

The best car insurance company for you depends on your individual needs and preferences. It’s essential to compare quotes from multiple providers and consider factors like coverage options, customer service, and claims handling experience.

Can I get car insurance without a driver’s license in Florida?

No, you need a valid driver’s license to obtain car insurance in Florida.

How often should I review my car insurance policy?

It’s recommended to review your car insurance policy at least once a year, or more frequently if you experience any significant life changes, such as a new car purchase, a change in driving history, or a move to a new location.