Average Florida car insurance rates are influenced by a multitude of factors, including the state’s unique demographics, driving history, credit score, vehicle type, and coverage selections. Florida’s warm climate and large population contribute to a higher number of accidents, driving up insurance costs. This article explores these factors and provides insights into understanding the average rates across different cities and regions, along with tips for securing affordable coverage.

Navigating the complexities of Florida’s insurance market can be challenging, but understanding the key drivers of insurance rates empowers consumers to make informed decisions. By analyzing the average rates offered by various insurance providers, exploring available discounts, and considering different coverage options, individuals can find the best car insurance policy for their needs and budget.

Factors Influencing Florida Car Insurance Rates

Florida’s car insurance landscape is unique, shaped by a combination of factors that significantly influence premiums. Understanding these factors can empower drivers to make informed decisions and potentially lower their insurance costs.

Florida’s Demographics

Florida’s population is diverse and includes a large number of retirees, tourists, and seasonal residents. This unique demographic profile contributes to higher insurance rates due to several factors:

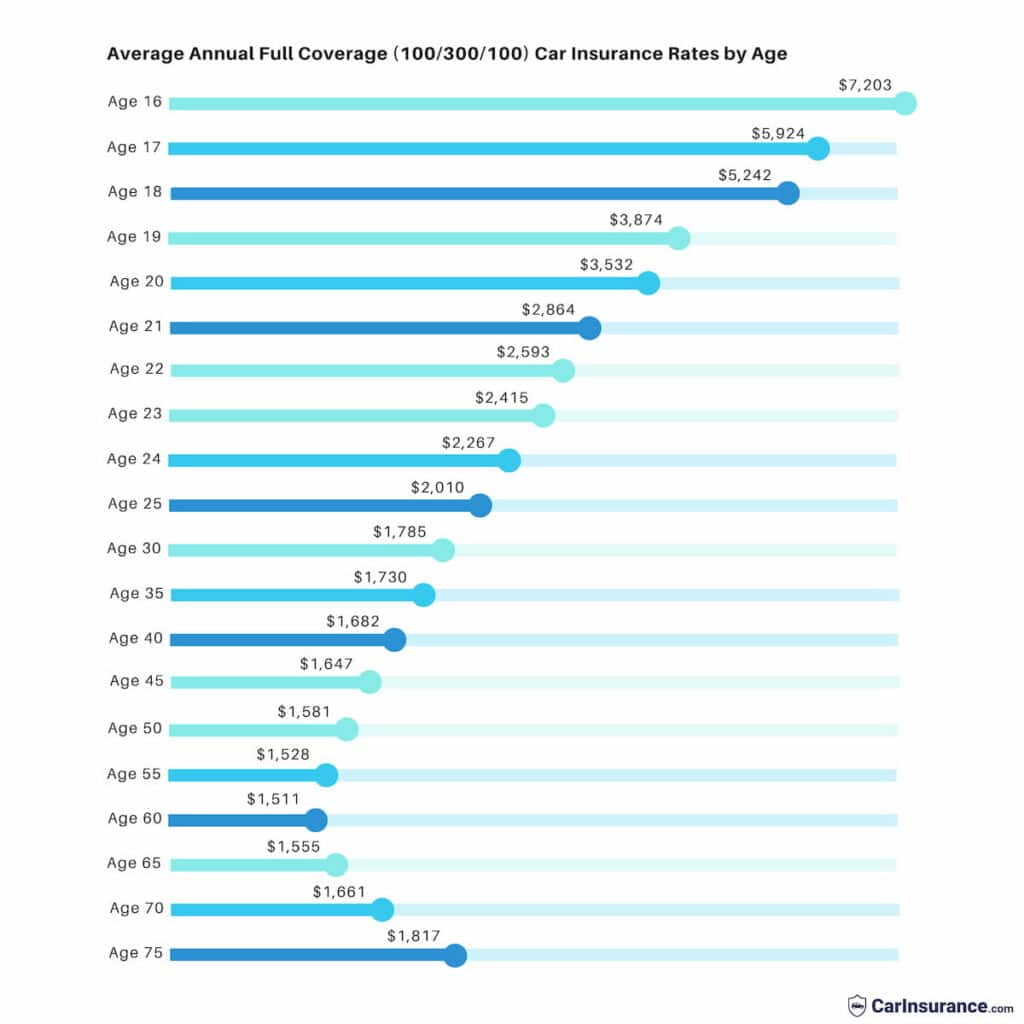

- Higher Number of Older Drivers: Older drivers are statistically more likely to be involved in accidents, leading to increased claims and higher premiums.

- Increased Traffic Congestion: Florida’s popularity as a tourist destination and its large population contribute to heavy traffic, increasing the likelihood of accidents.

- High Number of Uninsured Drivers: Florida has a high percentage of uninsured drivers, which increases the financial burden on insured drivers when they are involved in accidents with uninsured motorists.

Driving History and Credit Score

Your driving history and credit score play a significant role in determining your car insurance rates.

- Driving Record: A clean driving record with no accidents or traffic violations will result in lower premiums. Conversely, a history of accidents, speeding tickets, or DUI convictions will lead to higher rates.

- Credit Score: Insurers use credit scores to assess your financial responsibility and predict your likelihood of filing a claim. A good credit score generally translates to lower premiums, while a poor credit score may result in higher rates.

Vehicle Type and Value

The type and value of your vehicle also influence your car insurance premiums.

- Vehicle Type: Sports cars and luxury vehicles are generally more expensive to repair and replace, leading to higher insurance rates. Conversely, smaller and less expensive vehicles typically have lower premiums.

- Vehicle Value: The higher the value of your car, the more expensive it will be to insure. This is because insurance premiums are based on the cost of replacing or repairing your vehicle in the event of an accident.

Coverage Types, Average florida car insurance rates

The type of coverage you choose will directly impact your car insurance premiums.

- Liability Coverage: This is the most basic type of coverage and is required by law in Florida. It covers damage to other people’s property and injuries to other people if you are at fault in an accident.

- Collision Coverage: This coverage pays for repairs to your vehicle if you are involved in an accident, regardless of fault.

- Comprehensive Coverage: This coverage protects your vehicle against damage from events other than accidents, such as theft, vandalism, or natural disasters.

Average Rates by City and Region

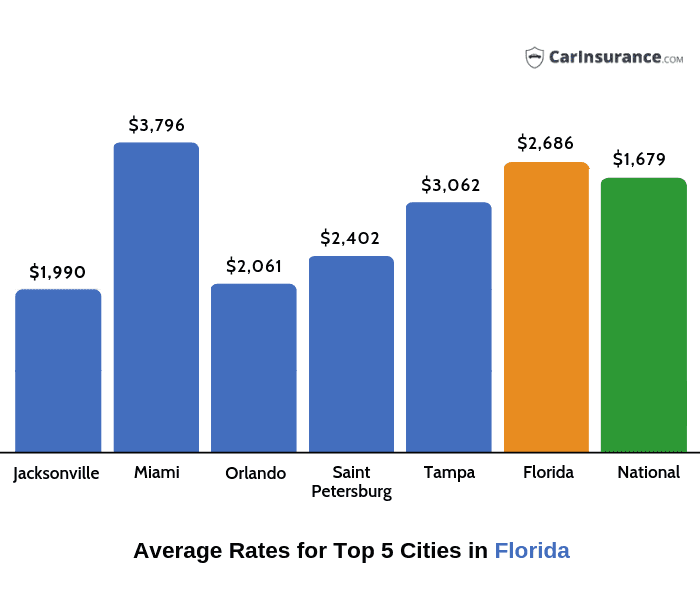

Car insurance rates in Florida can vary significantly depending on the city and region you live in. Factors such as population density, accident frequency, and the cost of living all contribute to these variations. Understanding these differences can help you find the best rates for your specific situation.

Average Rates in Major Cities

Average car insurance rates can vary considerably across major Florida cities. The following table provides a comparison of average annual premiums for full coverage insurance in some of the state’s most populated urban centers.

| City | Average Annual Premium |

|---|---|

| Miami | $2,500 |

| Orlando | $2,200 |

| Tampa | $2,000 |

Regional Variations in Rates

Car insurance rates tend to be higher in areas with higher population densities and more frequent accidents. For example, cities like Miami and Orlando, with their large populations and busy traffic, generally have higher rates than more rural areas. This is because insurance companies have to pay out more claims in these areas due to a greater likelihood of accidents.

Rates in Rural vs. Urban Areas

Car insurance rates are generally lower in rural areas compared to urban areas. This is attributed to several factors, including:

- Lower population density: Rural areas have fewer cars on the road, leading to a reduced risk of accidents.

- Lower accident frequency: Fewer cars and less congested roads generally result in fewer accidents in rural areas.

- Lower cost of living: The cost of living in rural areas is often lower, which can translate to lower car insurance premiums.

Insurance Companies and Their Rates: Average Florida Car Insurance Rates

Choosing the right car insurance provider in Florida can significantly impact your premiums. Several reputable insurers offer competitive rates and varying coverage options. Understanding their strengths and weaknesses, along with the impact of discounts, is crucial for making an informed decision.

Average Rates by Major Insurers

The average car insurance rates in Florida can vary widely depending on the insurer. Here is a table comparing average annual premiums for a sample driver profile:

| Insurance Company | Average Annual Premium |

|---|---|

| State Farm | $2,100 |

| Geico | $1,950 |

| Progressive | $2,000 |

| Allstate | $2,200 |

| USAA | $1,800 |

It’s important to note that these rates are averages and can vary based on individual factors such as age, driving history, vehicle type, and location.

Strengths and Weaknesses of Different Insurers

Each insurer offers a unique combination of coverage options, customer service, and pricing.

- State Farm: Known for its extensive network of agents and customer service, State Farm offers a wide range of coverage options and discounts. However, their rates can be higher than some competitors.

- Geico: Geico is renowned for its competitive pricing and convenient online and mobile tools. While their coverage options are comprehensive, their customer service may not be as personalized as some other insurers.

- Progressive: Progressive is known for its innovative products like Name Your Price and Snapshot, which can help customers save money based on their driving habits. However, their coverage options may be less comprehensive than other insurers.

- Allstate: Allstate offers a wide range of coverage options and a strong focus on customer service. Their rates can be higher than some competitors, but they often provide comprehensive coverage.

- USAA: USAA exclusively serves military personnel and their families. They offer competitive rates, excellent customer service, and a wide range of coverage options. However, eligibility is restricted to those affiliated with the military.

Impact of Insurer Discounts

Insurer discounts can significantly reduce your premiums. Some common discounts include:

- Safe Driver Discount: Awarded to drivers with a clean driving record and no accidents or violations.

- Good Student Discount: Available to students who maintain a certain GPA or academic standing.

- Multi-Policy Discount: Offered for bundling multiple insurance policies, such as auto and home insurance, with the same insurer.

- Anti-theft Device Discount: Given for installing anti-theft devices in your vehicle.

- Defensive Driving Course Discount: Awarded for completing a certified defensive driving course.

Tip: Contact multiple insurers to obtain personalized quotes and compare their coverage options and discounts. This will help you find the best value for your insurance needs.

Tips for Lowering Car Insurance Costs

Finding affordable car insurance in Florida can be challenging, but with the right strategies, you can significantly reduce your premiums. Understanding how insurance companies determine rates and exploring various options can help you save money.

Comparing Quotes and Shopping Around

It is essential to compare quotes from multiple insurance companies before making a decision. Many online platforms and comparison websites allow you to easily enter your information and receive quotes from various insurers. By comparing quotes, you can identify the most competitive rates and find the best value for your needs.

Improving Your Driving Record

Your driving history is a significant factor in determining your car insurance rates. Maintaining a clean driving record with no accidents or violations can lead to lower premiums. Taking defensive driving courses can also help you improve your driving skills and potentially earn discounts.

Choosing a Higher Deductible

A higher deductible means you pay more out of pocket if you have an accident, but it can also result in lower premiums. Consider your financial situation and risk tolerance when deciding on a deductible amount. If you can afford to pay a higher deductible, you may be able to save on your insurance premiums.

Bundling Insurance Policies

Many insurance companies offer discounts for bundling multiple policies, such as car insurance, home insurance, and renters insurance. By combining your insurance needs with a single provider, you can often qualify for significant savings.

Exploring Discounts

Insurance companies offer various discounts to their policyholders. These discounts can include:

- Good student discounts for students with high GPAs

- Safe driver discounts for drivers with clean driving records

- Multi-car discounts for insuring multiple vehicles with the same company

- Loyalty discounts for long-term policyholders

- Discounts for safety features on your vehicle, such as anti-theft devices or airbags

- Discounts for paying your premiums annually instead of monthly

Negotiating with Your Insurance Company

Don’t hesitate to negotiate with your insurance company to try and secure lower rates. Be prepared to discuss your driving history, vehicle details, and any relevant discounts you qualify for. You can also inquire about special promotions or discounts offered by the insurer.

“It’s always worth asking for a better rate. You might be surprised at what you can achieve.”

Maintaining a Good Credit Score

In some states, including Florida, insurance companies can use your credit score as a factor in determining your car insurance rates. A good credit score can lead to lower premiums. Maintaining a good credit score by paying bills on time and managing debt responsibly can positively impact your insurance costs.

Understanding Florida’s No-Fault Insurance System

Florida operates under a unique no-fault insurance system, meaning drivers are primarily responsible for covering their own medical expenses and lost wages after an accident, regardless of fault. This system is designed to streamline the claims process and reduce litigation.

Personal Injury Protection (PIP)

Personal Injury Protection (PIP) is a mandatory coverage in Florida that pays for medical expenses, lost wages, and other related costs for the insured and their passengers, regardless of who caused the accident. PIP benefits are limited to $10,000 per person, and coverage typically includes:

- Medical expenses: This covers medical bills for treatment related to the accident, including doctor visits, hospital stays, and rehabilitation.

- Lost wages: PIP can reimburse you for lost income if you’re unable to work due to injuries sustained in the accident.

- Other expenses: This can include funeral expenses, death benefits, and other related costs.

Limitations and Implications of Florida’s No-Fault System

While the no-fault system aims to simplify the claims process, it also has its limitations. Here are some key aspects to consider:

- Limited PIP coverage: The $10,000 limit on PIP benefits may not be enough to cover all medical expenses, especially in severe accidents. If your medical bills exceed the PIP limit, you may need to pursue additional coverage from other sources, such as your health insurance or the at-fault driver’s liability insurance.

- No pain and suffering compensation: Unlike traditional fault-based insurance systems, Florida’s no-fault system does not allow for compensation for pain and suffering, emotional distress, or other non-economic damages unless the injuries meet specific criteria, such as permanent disfigurement or significant disability. This can be challenging for individuals who have experienced significant emotional or psychological trauma as a result of the accident.

- Limited lawsuit options: Florida’s no-fault system restricts your right to sue the at-fault driver for pain and suffering unless you meet certain “threshold” requirements. This means you can only sue for pain and suffering if you have sustained a “serious injury,” such as permanent disfigurement, significant disability, or death. This can be difficult to prove and may require expert medical opinions.

Navigating the Claims Process

Here are some tips for navigating the claims process under Florida’s no-fault system:

- Report the accident promptly: It’s crucial to report the accident to your insurance company as soon as possible, ideally within 24 hours. This will help ensure that your claim is processed efficiently and that you receive the benefits you’re entitled to.

- Seek medical attention: If you’ve been injured in an accident, it’s essential to seek medical attention immediately, even if you don’t feel seriously injured. This will establish a record of your injuries and ensure you receive proper treatment.

- Keep detailed records: Maintain detailed records of all medical expenses, lost wages, and other related costs. This will be essential when filing your PIP claim and for any potential legal action.

- Consult with an attorney: If you’re unsure about your rights or have questions about the claims process, it’s advisable to consult with an experienced personal injury attorney. They can help you understand your options and navigate the complexities of Florida’s no-fault system.

Last Point

Florida’s car insurance market is a complex landscape, with rates influenced by a unique blend of factors. Understanding the drivers of these rates, comparing options across providers, and exploring available discounts are crucial steps in finding affordable coverage. By taking a proactive approach and engaging with insurance providers, individuals can secure the protection they need at a price that fits their budget. Remember, knowledge is power, and understanding the intricacies of Florida’s car insurance market can lead to significant savings.

Common Queries

How do I compare car insurance rates in Florida?

Use online comparison tools or contact multiple insurance providers directly to obtain quotes. Be sure to provide accurate information about your driving history, vehicle, and coverage needs for an accurate comparison.

What are the best car insurance companies in Florida?

The “best” company depends on your individual needs and preferences. Research different providers, consider their coverage options, customer service ratings, and available discounts to find the best fit.

Can I lower my car insurance rates in Florida?

Yes, there are several ways to reduce your premiums. Maintain a clean driving record, consider bundling policies, explore discounts, and shop around for competitive rates.

What is the minimum car insurance coverage required in Florida?

Florida requires a minimum of $10,000 in Personal Injury Protection (PIP), $10,000 in Property Damage Liability (PDL), and $10,000 in Bodily Injury Liability (BIL) per person and $20,000 per accident.