How much is car insurance in Florida for a 25-year-old? This is a common question for young adults in the Sunshine State, as they navigate the world of driving and insurance. While the cost of car insurance can vary significantly based on a multitude of factors, understanding these influences is crucial for finding the best coverage at the most affordable price. This guide delves into the key elements that shape car insurance rates for 25-year-olds in Florida, offering insights into how to get the most value for your money.

From the impact of age and driving history to the importance of credit score and coverage options, we explore the intricacies of car insurance in Florida. We’ll also provide tips for comparing quotes, securing discounts, and ultimately, finding the right policy to fit your individual needs. Whether you’re a new driver or simply looking to optimize your current coverage, this comprehensive guide will empower you to make informed decisions about your car insurance.

Factors Influencing Car Insurance Costs in Florida

Car insurance premiums in Florida are influenced by a variety of factors, and understanding these factors can help you make informed decisions about your coverage and potentially save money. While age is a significant factor, it’s not the only one that determines your insurance rates.

Age and Car Insurance Premiums

In Florida, younger drivers generally pay higher car insurance premiums than older drivers. This is because younger drivers are statistically more likely to be involved in accidents. As drivers gain experience and age, their risk profile decreases, leading to lower premiums. For example, a 25-year-old driver in Florida may pay significantly less than a 18-year-old driver with the same driving record and vehicle.

Common Factors Determining Car Insurance Rates

- Driving History: Your driving history, including accidents, traffic violations, and DUI convictions, has a significant impact on your car insurance rates. A clean driving record will result in lower premiums, while a history of accidents or violations will lead to higher rates.

- Vehicle Type: The type of vehicle you drive is another key factor. Sports cars and luxury vehicles are often more expensive to insure due to their higher repair costs and increased risk of theft. On the other hand, smaller, less expensive vehicles typically have lower insurance premiums.

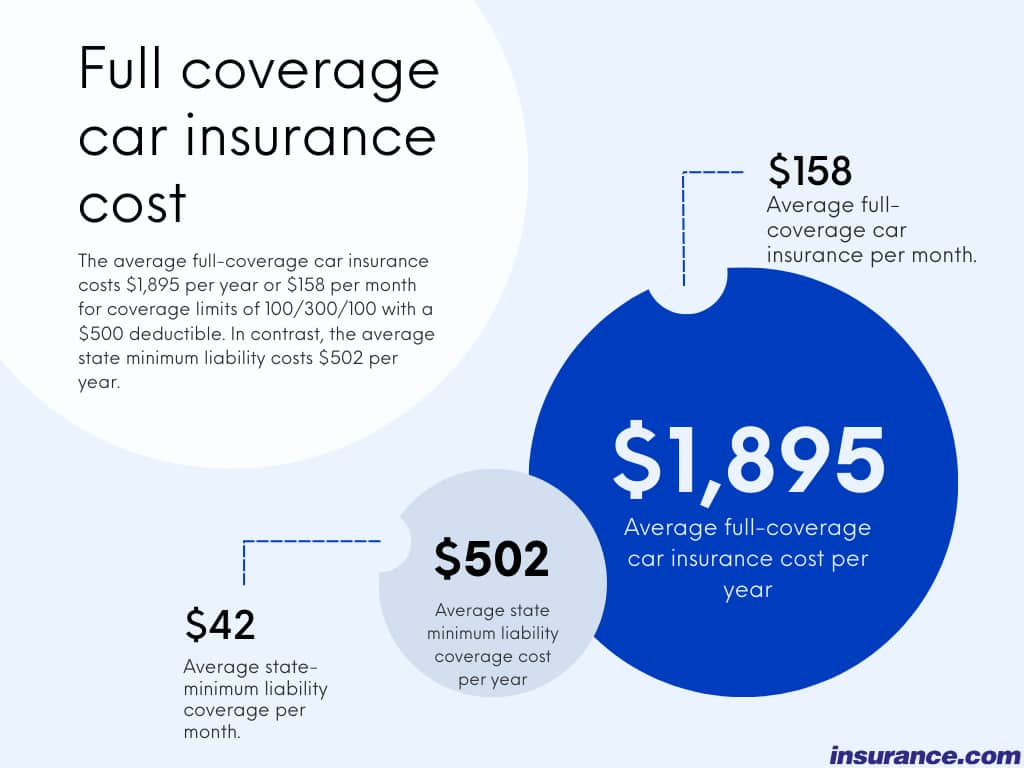

- Coverage Levels: The amount of coverage you choose will also affect your premiums. Higher coverage limits, such as comprehensive and collision coverage, will generally result in higher premiums. However, these higher limits can provide greater financial protection in the event of an accident.

- Location: Your location in Florida can impact your car insurance rates. Areas with higher crime rates or more traffic congestion tend to have higher premiums. For example, drivers in Miami may pay more than those in rural areas of Florida.

- Credit Score: In Florida, insurance companies can use your credit score as a factor in determining your car insurance rates. This is because a good credit score is often associated with responsible behavior, which can translate to safer driving habits. Drivers with poor credit scores may face higher premiums.

Top 5 Car Insurance Companies in Florida

- State Farm: Average rate for a 25-year-old: $1,200 per year

- Geico: Average rate for a 25-year-old: $1,150 per year

- Progressive: Average rate for a 25-year-old: $1,100 per year

- Allstate: Average rate for a 25-year-old: $1,050 per year

- USAA: Average rate for a 25-year-old: $1,000 per year

These rates are estimates and may vary depending on individual factors such as driving history, vehicle type, and coverage levels.

Driving History and Car Insurance Premiums

A clean driving record is essential for obtaining lower car insurance premiums in Florida. Accidents and traffic violations can significantly increase your rates. For example, a speeding ticket or a DUI conviction can lead to a substantial increase in premiums. It’s crucial to maintain a safe driving record to minimize your insurance costs.

Credit Score and Car Insurance Rates, How much is car insurance in florida for a 25-year-old

In Florida, insurance companies can consider your credit score when determining your car insurance rates. This practice is based on the idea that individuals with good credit scores tend to be more responsible, including when it comes to driving. Drivers with lower credit scores may face higher premiums. However, it’s important to note that this practice is not universal and some insurance companies may not use credit scores as a factor in their rate calculations.

Final Thoughts

Navigating the world of car insurance in Florida can be a complex process, especially for 25-year-olds who are just starting out. By understanding the factors that influence your rates, comparing quotes from multiple providers, and exploring available discounts, you can find the best coverage at a price that fits your budget. Remember, your insurance is there to protect you and your finances in the event of an accident, so investing in the right coverage is crucial for peace of mind on the road.

FAQ Guide: How Much Is Car Insurance In Florida For A 25-year-old

What are some common discounts offered by car insurance companies in Florida?

Common discounts include good driver discounts, safe driver discounts, multi-car discounts, and bundling discounts for combining car insurance with other types of insurance like homeowners or renters insurance.

How can I improve my credit score to potentially lower my car insurance rates?

Pay your bills on time, keep your credit utilization low, and avoid opening too many new credit accounts. You can also check your credit report for errors and dispute any inaccuracies.

What is the minimum car insurance coverage required in Florida?

Florida requires drivers to have at least $10,000 in Personal Injury Protection (PIP), $10,000 in Property Damage Liability (PDL), and $10,000 in Bodily Injury Liability (BIL) per person and $20,000 per accident.

What are some tips for finding the best car insurance rates in Florida?

Compare quotes from multiple providers, consider bundling your insurance, ask about discounts, and shop around every year to see if you can find better rates.