Florida Care Insurance stands as a vital lifeline for residents seeking affordable healthcare access. This comprehensive program, designed to bridge the gap in medical coverage, offers a range of plans tailored to individual needs and financial situations. From basic coverage to more comprehensive options, Florida Care Insurance provides a safety net for those navigating the complexities of the healthcare system.

Understanding the intricacies of Florida Care Insurance is crucial for maximizing its benefits. This guide delves into the program’s eligibility criteria, enrollment process, coverage details, premium structures, and access to healthcare providers. We aim to empower individuals with the knowledge necessary to make informed decisions regarding their healthcare needs.

Understanding Florida Care Insurance

Florida Care Insurance is a type of health insurance plan designed specifically for Florida residents. It aims to provide affordable and accessible healthcare coverage to individuals and families across the state.

Types of Florida Care Insurance

Florida Care Insurance offers a variety of plans to cater to different needs and budgets. Here are some common types:

- Medicaid: A government-funded program providing health insurance to low-income individuals and families. It covers a wide range of medical services, including doctor visits, hospital stays, prescription drugs, and mental health care.

- Children’s Health Insurance Program (CHIP): A program providing health insurance to children from families who earn too much to qualify for Medicaid but cannot afford private insurance. CHIP offers comprehensive coverage similar to Medicaid.

- Florida Health Choices (FHC): A program offering subsidized health insurance plans through the Affordable Care Act (ACA) marketplace. FHC plans provide coverage for essential health benefits, such as preventive care, hospitalization, and prescription drugs.

- Private Health Insurance: This option offers a wider range of plans and coverage choices, including individual and family plans. However, premiums can be higher compared to other Florida Care Insurance options.

Benefits of Florida Care Insurance

Having Florida Care Insurance offers numerous benefits, including:

- Affordable Healthcare: Florida Care Insurance plans are designed to be affordable, with subsidized premiums and cost-sharing options. This ensures access to quality healthcare without financial strain.

- Comprehensive Coverage: Most Florida Care Insurance plans provide comprehensive coverage for essential health benefits, including preventive care, hospitalization, and prescription drugs. This helps individuals and families manage their healthcare costs effectively.

- Access to Quality Healthcare Providers: Florida Care Insurance plans allow access to a network of qualified healthcare providers, including doctors, hospitals, and specialists. This ensures individuals receive quality care from experienced professionals.

- Peace of Mind: Having Florida Care Insurance provides peace of mind knowing that you have financial protection in case of unexpected medical expenses. This helps individuals and families focus on their health and well-being.

Eligibility and Enrollment

Florida Care Insurance is a government-funded program that provides health insurance to low-income Floridians. To be eligible for Florida Care Insurance, you must meet certain criteria.

Eligibility Criteria

To be eligible for Florida Care Insurance, you must meet the following criteria:

- Be a resident of Florida.

- Be a U.S. citizen or legal resident.

- Have an income that is at or below a certain level.

- Be a child under the age of 19 or a pregnant woman.

- Not be eligible for other health insurance coverage, such as Medicare or Medicaid.

Enrollment Process

To enroll in Florida Care Insurance, you must complete an application and provide the following documentation:

- Proof of identity, such as a driver’s license or birth certificate.

- Proof of residency, such as a utility bill or lease agreement.

- Proof of income, such as pay stubs or tax returns.

- Proof of citizenship or legal residency, such as a passport or visa.

The enrollment process can take several weeks, so it is important to apply well in advance of your need for coverage.

Enrollment Options, Florida care insurance

You can enroll in Florida Care Insurance in the following ways:

- Online: You can apply for Florida Care Insurance online through the Florida Department of Health website.

- By phone: You can apply for Florida Care Insurance by calling the Florida Department of Health at 1-800-406-1899.

- In person: You can apply for Florida Care Insurance in person at a local Florida Department of Health office.

Coverage and Benefits

Florida Care Insurance offers comprehensive coverage and benefits designed to meet the diverse healthcare needs of its members. The plan includes a range of essential services and benefits that aim to provide financial protection and peace of mind.

Essential Health Benefits

Florida Care Insurance plans cover essential health benefits, as mandated by the Affordable Care Act. These benefits include:

- Ambulatory Patient Services: This covers outpatient care, such as doctor’s visits, preventive screenings, and diagnostic testing.

- Emergency Services: Emergency room visits and treatment are covered, regardless of the time of day or location.

- Hospitalization: Coverage for inpatient care, including room and board, nursing care, and medical supplies.

- Maternity and Newborn Care: Prenatal, labor and delivery, and postpartum care for mothers and newborns.

- Mental Health and Substance Use Disorder Services: Coverage for mental health counseling, therapy, and treatment for substance abuse disorders.

- Prescription Drugs: Access to a formulary of prescription drugs, with coverage varying based on the specific plan.

- Rehabilitative Services and Devices: Coverage for physical therapy, occupational therapy, and speech therapy, as well as assistive devices like wheelchairs.

- Laboratory Services: Coverage for diagnostic and monitoring lab tests.

- Preventive and Wellness Services: Coverage for preventive screenings, immunizations, and health education services.

Additional Benefits

Beyond essential health benefits, Florida Care Insurance plans may offer additional benefits, such as:

- Vision Care: Coverage for eye exams, eyeglasses, and contact lenses.

- Dental Care: Coverage for preventive dental care, fillings, and other dental procedures.

- Over-the-Counter Medications: Coverage for certain over-the-counter medications, such as pain relievers and cold remedies.

- Wellness Programs: Access to programs designed to promote healthy lifestyles, such as fitness classes and nutrition counseling.

Plan Comparison

Florida Care Insurance offers various plans with different coverage levels and premiums. The specific benefits and coverage offered will vary depending on the chosen plan.

| Plan Type | Coverage Level | Premium | Additional Benefits |

|---|---|---|---|

| Bronze | Lowest coverage | Lowest premium | Limited additional benefits |

| Silver | Moderate coverage | Moderate premium | More additional benefits |

| Gold | Highest coverage | Highest premium | Most comprehensive benefits |

It is crucial to carefully review the specific coverage details and benefits included in each plan before making a decision.

Premiums and Costs

Florida Care Insurance premiums are determined by a variety of factors, including your age, health status, and the plan you choose. Understanding these factors can help you make informed decisions about your coverage and costs.

Factors Influencing Premium Costs

The cost of Florida Care Insurance can vary depending on several factors. Here are some key elements that influence the premium:

- Age: Generally, older individuals tend to have higher premiums than younger individuals, as they are statistically more likely to require healthcare services.

- Health Status: Individuals with pre-existing health conditions may face higher premiums. This is because they are considered higher risk and more likely to need medical care.

- Plan Type: Different Florida Care Insurance plans offer varying levels of coverage and benefits. Plans with more comprehensive coverage and benefits typically have higher premiums.

- Location: Premiums may vary depending on the geographic location where you reside. Factors like the cost of living and the availability of healthcare providers in your area can influence pricing.

- Tobacco Use: Individuals who use tobacco products often face higher premiums. This is due to the increased risk of health problems associated with smoking.

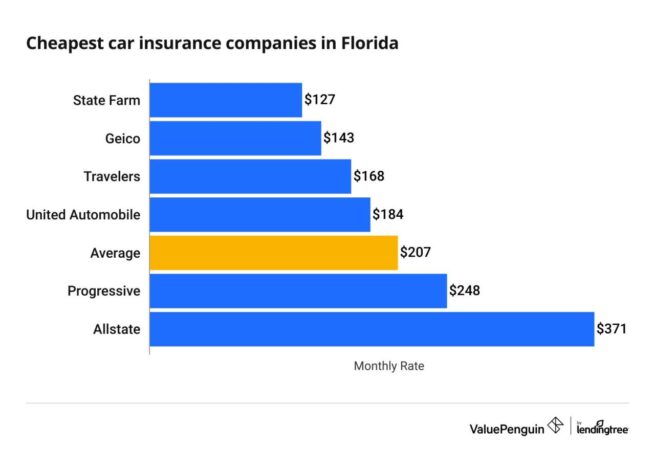

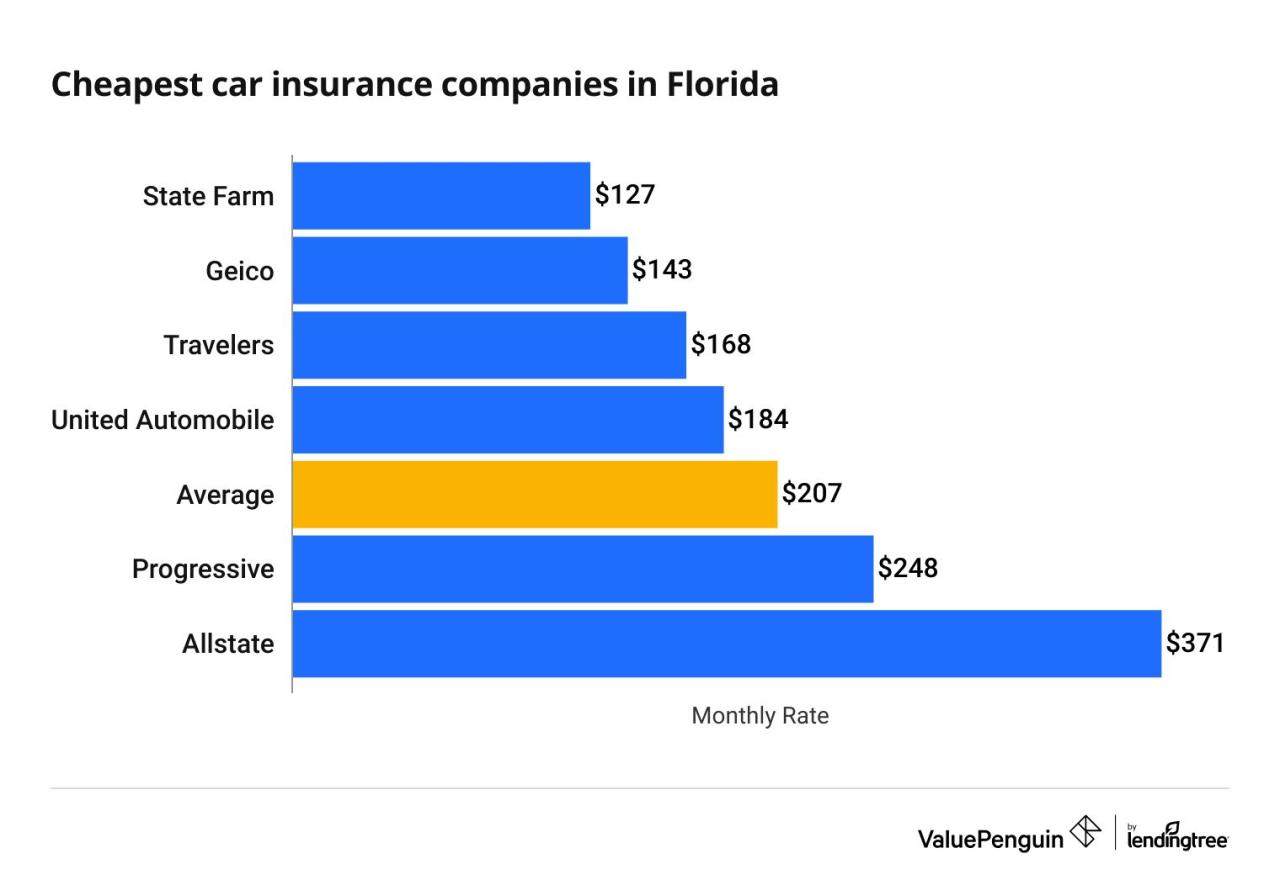

Comparing Premium Costs of Different Plans

It is crucial to compare premium costs of different Florida Care Insurance plans to find the most suitable option for your needs and budget. Here’s a breakdown of how premiums might vary across different plans:

- Basic Plans: These plans typically have lower premiums but offer limited coverage. They may cover essential healthcare services but may not include additional benefits like dental or vision care.

- Standard Plans: Standard plans provide a broader range of coverage and benefits than basic plans, resulting in higher premiums. They may include coverage for preventive care, hospitalization, and prescription drugs.

- Premium Plans: These plans offer the most comprehensive coverage and benefits, often including features like dental, vision, and mental health services. As a result, they have the highest premiums.

Provider Network and Access to Care

Florida Care Insurance offers a comprehensive network of healthcare providers, ensuring access to a wide range of medical services across the state. Understanding the provider network and how to access care is crucial for policyholders to make informed decisions about their healthcare.

Provider Network Composition

Florida Care Insurance maintains a vast network of healthcare providers, including hospitals, clinics, physicians, and specialists. This network aims to provide policyholders with convenient access to quality healthcare services within their communities.

- Hospitals: The network includes a diverse range of hospitals, from large academic medical centers to smaller community hospitals, offering a comprehensive range of inpatient and outpatient services.

- Clinics: Policyholders have access to various clinics, including primary care clinics, urgent care centers, and specialty clinics, catering to a wide range of medical needs.

- Physicians: Florida Care Insurance’s network encompasses a broad spectrum of physicians, ranging from general practitioners to specialists in various medical fields, such as cardiology, oncology, and pediatrics.

Accessing Care Within the Network

Florida Care Insurance offers various resources to help policyholders find and access care within the provider network.

- Provider Directory: The insurer provides an online directory that allows policyholders to search for healthcare providers based on location, specialty, and other criteria. This directory is accessible through the Florida Care Insurance website or mobile app.

- Customer Service: Policyholders can contact Florida Care Insurance’s customer service team for assistance in finding a provider within the network. Customer service representatives can help identify providers based on specific needs and preferences.

- Pre-authorization: For certain procedures or services, pre-authorization from Florida Care Insurance may be required. This process ensures that the service is covered by the policy and helps manage healthcare costs.

Claims and Reimbursement: Florida Care Insurance

Filing a claim for Florida Care Insurance is a straightforward process designed to ensure you receive the necessary benefits for your covered healthcare services. This section Artikels the process, various claim types, and the reimbursement procedure for approved claims.

Claim Filing Process

The process for filing a claim with Florida Care Insurance is generally similar for all types of covered services. You can file a claim online, by phone, or by mail.

- Online: You can file a claim online through the Florida Care Insurance website. This option is convenient and allows for quick claim submission.

- Phone: You can call the Florida Care Insurance customer service line to file a claim. This method is suitable for those who prefer verbal communication.

- Mail: You can download a claim form from the Florida Care Insurance website and mail it to the address provided. This option is useful for individuals who prefer a physical copy.

Regardless of the method chosen, you will need to provide the following information:

- Your Florida Care Insurance policy number

- The date of service

- The name of the healthcare provider

- A detailed description of the services received

- Any other relevant information, such as pre-authorization approval numbers (if applicable)

Types of Claims

Florida Care Insurance covers a wide range of healthcare services, resulting in different types of claims. These include:

- Inpatient Claims: These claims cover hospital stays and related services, such as surgery, medication, and nursing care.

- Outpatient Claims: These claims cover services received outside of a hospital setting, such as doctor visits, lab tests, and physical therapy.

- Prescription Drug Claims: These claims cover the cost of prescription medications, including generic and brand-name drugs.

- Dental Claims: These claims cover dental services, such as cleanings, fillings, and extractions.

- Vision Claims: These claims cover vision services, such as eye exams, eyeglasses, and contact lenses.

The specific procedures for filing each claim type may vary. It’s essential to refer to your policy booklet or contact Florida Care Insurance customer service for detailed instructions.

Reimbursement Process

Once you file a claim, Florida Care Insurance will review it to ensure the services are covered under your policy. If the claim is approved, you will receive reimbursement for the covered expenses.

The reimbursement process involves the following steps:

- Claim Review: Florida Care Insurance will review your claim to verify the services received and ensure they are covered under your policy.

- Payment Processing: If the claim is approved, Florida Care Insurance will process the payment to you or directly to your healthcare provider.

- Reimbursement Timeline: The reimbursement timeline depends on the complexity of the claim and the method of payment. Generally, you can expect to receive reimbursement within 30 days of claim submission.

Florida Care Insurance provides a detailed explanation of the reimbursement process and timelines in your policy booklet. You can also contact customer service for any questions or concerns.

Resources and Support

Navigating Florida Care Insurance can sometimes require additional assistance. Here are some resources and support channels available to you.

Contact Information

The Florida Care Insurance program offers various channels to reach out for support, including:

- Customer Service Hotline: This is the primary contact point for general inquiries, enrollment questions, and assistance with claims. The hotline is available during business hours, and you can reach them at [Phone Number].

- Website: The official Florida Care Insurance website provides comprehensive information on the program, eligibility criteria, benefits, and other relevant details. You can find it at [Website Address].

- Email: For written inquiries, you can reach the Florida Care Insurance team via email at [Email Address].

Additional Resources

Besides the primary contact channels, you can access additional resources for information and support:

- Florida Department of Health: The Florida Department of Health website provides comprehensive information on health insurance programs, including Florida Care Insurance. You can find it at [Website Address].

- Local Health Departments: Local health departments can offer guidance and support related to accessing healthcare services, including Florida Care Insurance. You can find your local health department’s contact information at [Website Address].

- Community Health Centers: Community health centers provide affordable healthcare services and can assist with navigating Florida Care Insurance. You can find a list of community health centers in your area at [Website Address].

Contact Information Table

This table summarizes the key contact information for various departments and services related to Florida Care Insurance:

| Department/Service | Phone Number | Email Address | Website Address |

|---|---|---|---|

| Customer Service | [Phone Number] | [Email Address] | [Website Address] |

| Florida Department of Health | [Phone Number] | [Email Address] | [Website Address] |

| Local Health Department | [Phone Number] | [Email Address] | [Website Address] |

| Community Health Centers | [Phone Number] | [Email Address] | [Website Address] |

Frequently Asked Questions

This section addresses common questions about Florida Care Insurance, providing clarity and helpful information to guide you through the program.

General Information

Here are some common questions about Florida Care Insurance:

- What is Florida Care Insurance?

- Who is eligible for Florida Care Insurance?

- How do I enroll in Florida Care Insurance?

- What are the benefits of Florida Care Insurance?

- Doctor visits and preventive care

- Hospitalization and surgery

- Prescription drugs

- Mental health and substance abuse services

- Dental and vision care (depending on the plan)

- How much does Florida Care Insurance cost?

- What is the provider network for Florida Care Insurance?

- How do I file a claim with Florida Care Insurance?

- What resources and support are available for Florida Care Insurance members?

- A dedicated customer service line

- Online resources and FAQs

- Member assistance programs

- Language translation services

Florida Care Insurance is a state-funded health insurance program designed to provide affordable health coverage to eligible Floridians. It offers a range of benefits, including doctor visits, hospital stays, prescription drugs, and preventive care.

Eligibility for Florida Care Insurance is based on factors such as income, age, family size, and residency status. To determine your eligibility, you can visit the Florida Health Care Administration website or contact the program directly.

Enrollment in Florida Care Insurance is typically done through the Florida Health Insurance Marketplace. You can apply online, by phone, or in person at a local enrollment center.

Florida Care Insurance offers a comprehensive range of benefits, including:

The cost of Florida Care Insurance varies based on factors such as your income, age, family size, and the specific plan you choose. You may be eligible for subsidies or tax credits to help reduce your monthly premiums.

Florida Care Insurance has a network of healthcare providers across the state. You can access a list of participating providers on the Florida Health Care Administration website.

You can file a claim with Florida Care Insurance online, by phone, or by mail. You will need to provide information about your healthcare services, including the date of service, provider name, and diagnosis.

Florida Care Insurance offers a range of resources and support services to help members navigate the program. These include:

Last Recap

Florida Care Insurance offers a beacon of hope for individuals seeking affordable and accessible healthcare in the Sunshine State. By understanding the program’s features, benefits, and enrollment process, residents can confidently navigate the complexities of healthcare and secure the coverage they need. Remember to explore the available resources and reach out to customer service for personalized guidance and support.

Commonly Asked Questions

What are the income limits for Florida Care Insurance eligibility?

Income limits vary based on household size and family income. You can find specific eligibility guidelines on the Florida Health Care website or by contacting the program directly.

What documents are required for enrollment in Florida Care Insurance?

Required documents typically include proof of identity, residency, income, and citizenship or legal residency status. You can find a detailed list on the Florida Health Care website or by contacting the program.

How often are Florida Care Insurance premiums adjusted?

Premiums are typically adjusted annually, based on factors such as changes in healthcare costs and program funding. You will receive notification of any premium changes in advance.

Can I switch between Florida Care Insurance plans?

Yes, you can typically switch plans during open enrollment periods or if you experience a qualifying life event, such as a change in income or family size. Contact Florida Health Care for details and eligibility requirements.