- Health Insurance Landscape in Florida

- Cost of Health Insurance in Florida

- Health Insurance Coverage Options in Florida

- Finding Affordable Health Insurance in Florida: Health Care Insurance In Florida

- Health Insurance Regulations in Florida

- Health Insurance Trends in Florida

- Closing Summary

- Helpful Answers

Health care insurance in Florida is a complex landscape, with a wide array of options and factors to consider. From individual plans to employer-sponsored coverage, navigating this market can be challenging. Understanding the types of plans available, the costs involved, and the regulations in place is crucial for making informed decisions about your health insurance needs. This guide will delve into the intricacies of health care insurance in Florida, providing insights into the key aspects that matter most to you.

The Sunshine State boasts a diverse population, which translates into a varied health insurance market. Whether you’re a young professional, a growing family, or a retiree, finding the right health insurance plan that meets your specific requirements and budget is essential. We’ll explore the different types of health insurance plans available, including HMOs, PPOs, and high-deductible health plans (HDHPs), highlighting their unique features and costs. We’ll also discuss the impact of the Affordable Care Act (ACA) on Florida’s health insurance market and shed light on resources and strategies for finding affordable coverage.

Health Insurance Landscape in Florida

Florida’s health insurance market is diverse and dynamic, reflecting the state’s large and growing population. It is characterized by a mix of major national insurance companies and regional players, offering a wide range of plans to meet the needs of individuals, families, and employers.

Major Players and Market Share

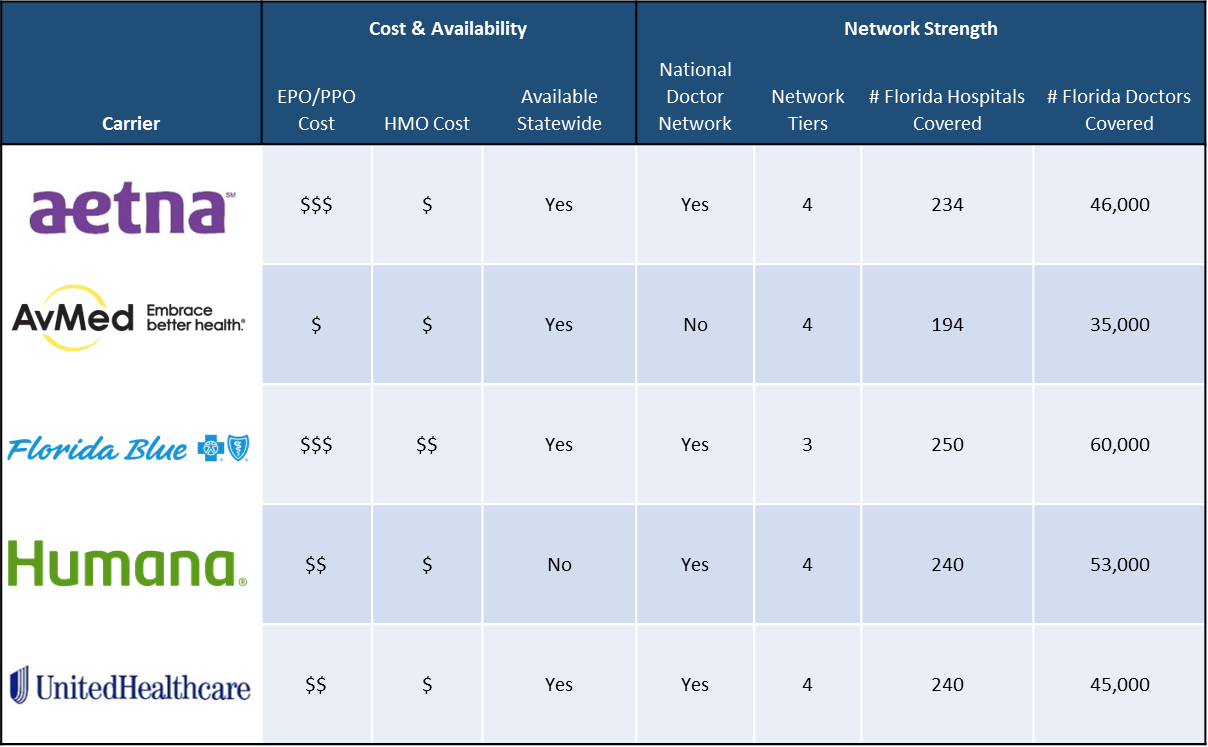

The Florida health insurance market is dominated by a few major players, including:

- UnitedHealthcare: UnitedHealthcare is the largest health insurer in Florida, holding a significant market share. It offers a comprehensive range of health insurance plans, including individual, family, and employer-sponsored plans.

- Florida Blue: As a major health insurer in the state, Florida Blue offers a variety of health insurance plans, including individual, family, and employer-sponsored plans.

- Cigna: Cigna is another major player in the Florida health insurance market, offering a range of health insurance plans, including individual, family, and employer-sponsored plans.

- Aetna: Aetna, a national health insurance company, offers a range of health insurance plans in Florida, including individual, family, and employer-sponsored plans.

These major players compete fiercely in the Florida health insurance market, offering a variety of plans and pricing options to attract customers.

Types of Health Insurance Plans in Florida

Florida offers a wide range of health insurance plans to meet the diverse needs of its residents. These plans can be categorized into several types:

- Individual Health Insurance Plans: These plans are purchased by individuals or families directly from insurance companies. They provide coverage for medical expenses and are typically offered through the Health Insurance Marketplace or directly from insurance companies.

- Family Health Insurance Plans: Family health insurance plans are designed to cover the medical expenses of multiple family members. They are typically offered through employers or purchased directly from insurance companies.

- Employer-Sponsored Health Insurance Plans: These plans are offered by employers to their employees. They are typically more affordable than individual plans and offer a wider range of coverage options.

Impact of the Affordable Care Act (ACA) on Health Insurance in Florida

The Affordable Care Act (ACA), also known as Obamacare, has had a significant impact on health insurance in Florida. The ACA has expanded health insurance coverage to millions of Americans, including those in Florida, by providing subsidies to help individuals and families afford health insurance. It has also established health insurance marketplaces where individuals and families can compare and purchase health insurance plans.

The ACA has also introduced several key provisions that have impacted health insurance in Florida, such as:

- Essential Health Benefits: The ACA requires health insurance plans to cover essential health benefits, including preventive care, hospitalization, and prescription drugs.

- Pre-existing Conditions: The ACA prohibits insurance companies from denying coverage or charging higher premiums based on pre-existing conditions.

- Individual Mandate: The ACA required individuals to have health insurance or pay a penalty. This provision was repealed in 2019.

Cost of Health Insurance in Florida

Florida residents face a significant financial burden when it comes to health insurance premiums. The state’s average premium cost often exceeds the national average, making it crucial to understand the factors influencing these costs.

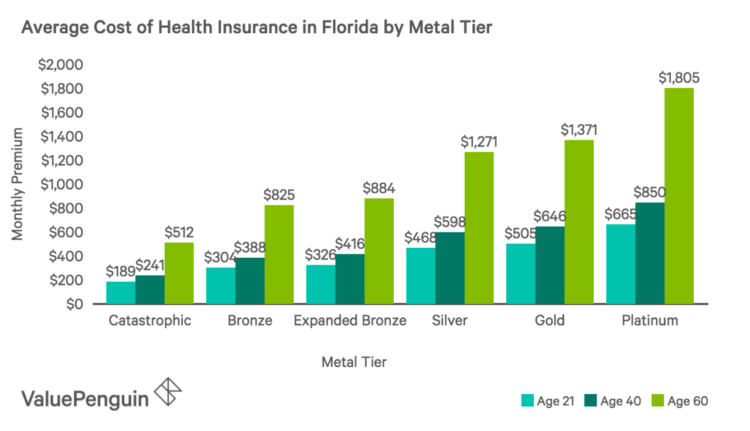

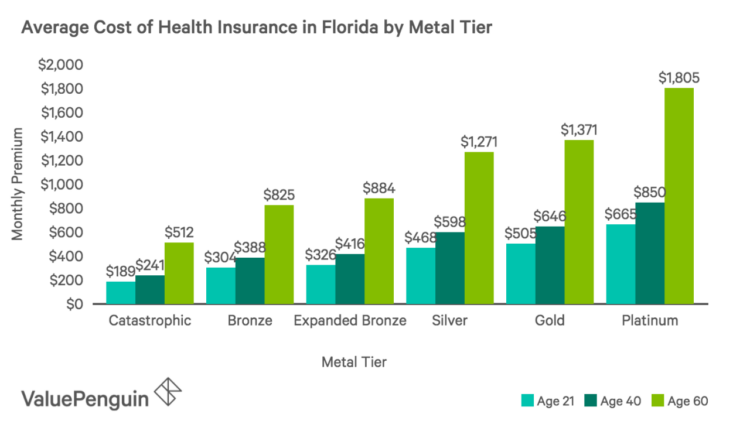

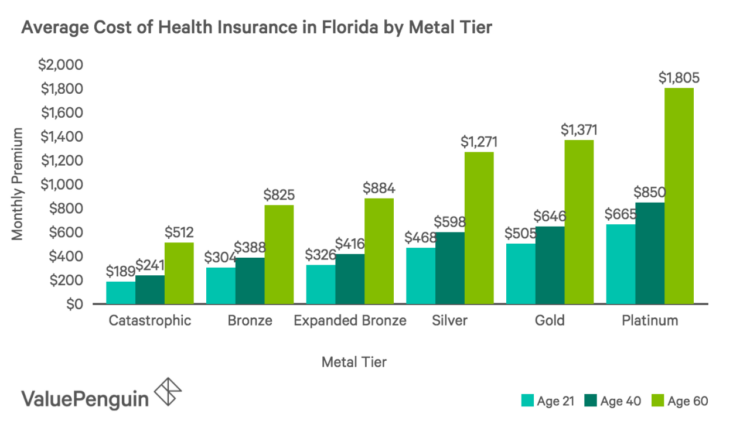

Average Premium Costs in Florida

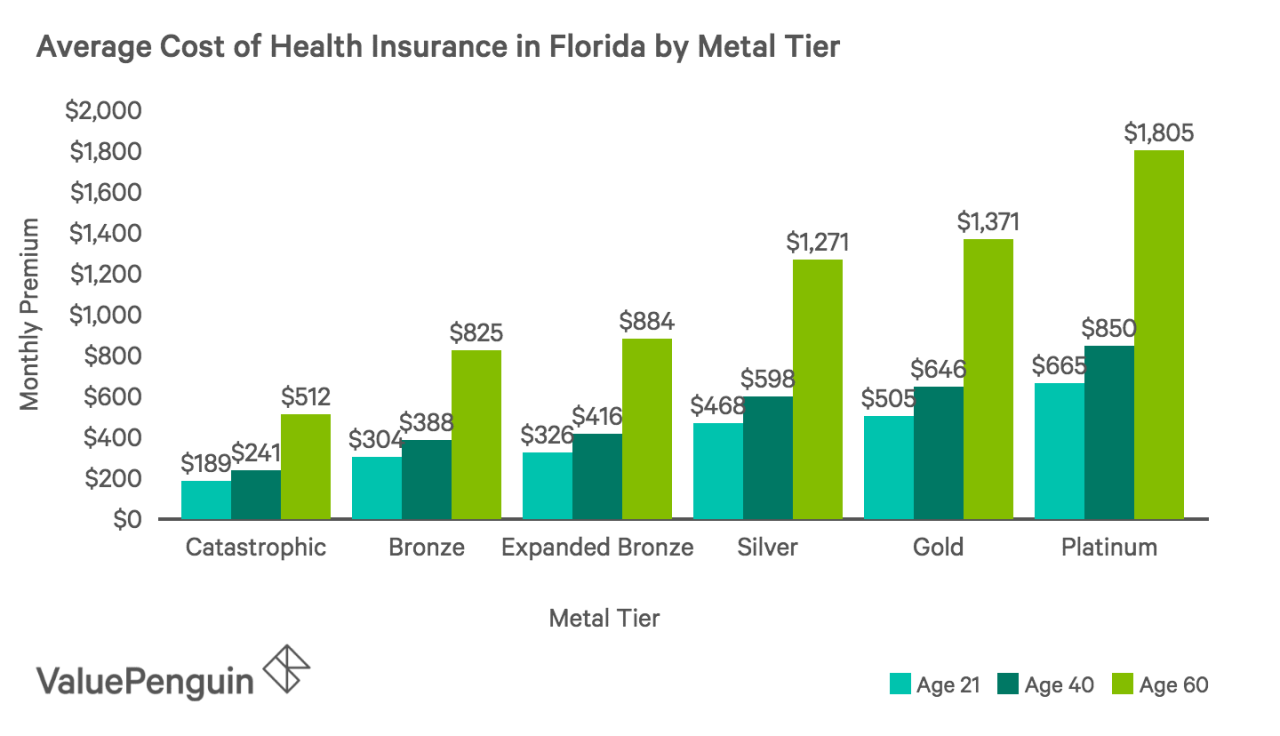

The average monthly premium for individual health insurance plans in Florida is higher than the national average. According to the Kaiser Family Foundation, the average monthly premium for a single adult in Florida was $539 in 2023, compared to the national average of $489. This higher cost is attributed to several factors, including the state’s large population of seniors and individuals with pre-existing conditions.

Factors Influencing Health Insurance Costs

Several factors contribute to the cost of health insurance premiums in Florida, including:

- Age: Older individuals generally pay higher premiums than younger individuals due to their higher risk of needing healthcare services.

- Location: Premiums can vary significantly depending on the geographic location within Florida. Urban areas with higher healthcare costs tend to have higher premiums.

- Health Status: Individuals with pre-existing conditions, such as diabetes or heart disease, may face higher premiums.

- Plan Type: The type of health insurance plan chosen significantly impacts the premium cost. Plans with lower deductibles and copayments generally have higher premiums.

- Tobacco Use: Smokers typically pay higher premiums than non-smokers due to their increased risk of health issues.

Examples of Health Insurance Plans in Florida

Here are some examples of health insurance plans available in Florida and their corresponding premiums:

| Plan Type | Average Monthly Premium (Single Adult) |

|---|---|

| Bronze | $400 – $500 |

| Silver | $500 – $600 |

| Gold | $600 – $700 |

| Platinum | $700 – $800 |

Note: These are just estimates, and actual premiums may vary based on individual circumstances. It is crucial to compare quotes from multiple insurers to find the best plan for your needs and budget.

Health Insurance Coverage Options in Florida

Florida offers a variety of health insurance plans to meet the diverse needs of its residents. Understanding the different plan types and their features is crucial for making an informed decision that aligns with your individual circumstances.

Health Maintenance Organizations (HMOs)

HMOs provide comprehensive health coverage through a network of doctors and hospitals. They typically have lower premiums compared to other plans but require you to choose a primary care physician (PCP) within the network.

- Benefits: HMOs often have lower premiums and copayments, and they emphasize preventive care.

- Drawbacks: You need to select a PCP within the network and obtain referrals for specialist care. Out-of-network services are generally not covered.

Preferred Provider Organizations (PPOs)

PPOs offer more flexibility than HMOs, allowing you to choose doctors and hospitals both within and outside the network.

- Benefits: PPOs provide greater freedom in choosing healthcare providers and generally have wider networks. They offer coverage for out-of-network services, although at a higher cost.

- Drawbacks: PPOs typically have higher premiums and copayments compared to HMOs. You may face higher out-of-pocket expenses for out-of-network services.

Point-of-Service (POS) Plans

POS plans combine elements of HMOs and PPOs. They offer a network of providers but allow you to access out-of-network care at a higher cost.

- Benefits: POS plans offer a balance between network restrictions and flexibility. They provide some coverage for out-of-network services.

- Drawbacks: POS plans may have higher premiums and copayments compared to HMOs. Out-of-network services are subject to higher costs.

High-Deductible Health Plans (HDHPs)

HDHPs have lower premiums but higher deductibles than traditional plans. They are often paired with a health savings account (HSA), allowing you to save pre-tax dollars for healthcare expenses.

- Benefits: HDHPs offer lower premiums and the ability to save pre-tax money for healthcare expenses through an HSA.

- Drawbacks: HDHPs require you to pay a high deductible before insurance coverage kicks in. They may not be suitable for individuals with frequent healthcare needs.

Comparing Health Insurance Plans in Florida

The following table summarizes the key features, premiums, and deductibles of different health insurance plans available in Florida:

| Plan Type | Key Features | Average Premium (Monthly) | Average Deductible |

|---|---|---|---|

| HMO | Network-based, PCP required, lower premiums, emphasizes preventive care | $350 | $1,000 |

| PPO | More flexibility, wider network, higher premiums, coverage for out-of-network services | $450 | $1,500 |

| POS | Combines HMO and PPO features, balance between network restrictions and flexibility | $400 | $1,200 |

| HDHP | Lower premiums, higher deductibles, HSA-compatible | $300 | $2,500 |

Note: The average premiums and deductibles presented are for illustrative purposes only and may vary depending on factors such as age, location, and health status.

Finding Affordable Health Insurance in Florida: Health Care Insurance In Florida

Navigating the world of health insurance in Florida can feel overwhelming, especially when affordability is a top concern. Fortunately, several resources and strategies can help you find a plan that fits your budget and needs. This section explores key avenues for finding affordable health insurance in Florida, along with tips for navigating the application process and maximizing your coverage.

Florida Health Insurance Marketplace (FHIX)

The Florida Health Insurance Marketplace (FHIX) is a government-run platform that allows Floridians to compare and enroll in various health insurance plans. This platform offers a range of plans from different insurance companies, providing you with multiple options to choose from.

The FHIX simplifies the process of finding affordable health insurance by:

- Comparing plans: The platform allows you to compare plans based on your individual needs, such as coverage, cost, and deductibles.

- Estimating costs: The FHIX provides an online tool that estimates your monthly premium based on your income and family size. This helps you get an idea of what you can expect to pay.

- Financial assistance: The FHIX offers financial assistance to eligible individuals and families to help reduce the cost of their premiums. This assistance is available through tax credits and subsidies, making health insurance more accessible.

Other Government Programs

Besides the FHIX, other government programs can provide affordable health insurance options in Florida.

- Medicaid: Medicaid is a federal and state program that offers health coverage to low-income individuals and families. In Florida, the program is known as “Florida Healthy Kids.” You can apply for Medicaid online, by phone, or through local community organizations.

- Children’s Health Insurance Program (CHIP): CHIP provides health insurance to children from families who earn too much to qualify for Medicaid but can’t afford private health insurance. Florida’s CHIP program is known as “Florida Healthy Kids.”

Navigating the Application Process

The application process for health insurance through the FHIX or other government programs can seem daunting, but it’s generally straightforward. Here’s a breakdown of the steps:

- Create an account: You’ll need to create an account on the FHIX website to access the marketplace. This account will store your personal information and application details.

- Provide personal information: You’ll be asked to provide personal information, including your income, family size, and citizenship status. This information is used to determine your eligibility for financial assistance and to calculate your premium.

- Compare plans: The FHIX will display a list of plans based on your needs and location. You can compare plans based on coverage, cost, and other factors.

- Enroll in a plan: Once you’ve chosen a plan, you can enroll online or by phone. The enrollment period typically runs from November 1st to January 15th, but you may be able to enroll outside of this period if you experience a qualifying life event, such as losing your job or getting married.

Tips for Negotiating with Insurance Companies

Even after finding an affordable plan, there are ways to further reduce your costs and optimize your coverage.

- Shop around: Don’t settle for the first plan you find. Compare quotes from multiple insurance companies to ensure you’re getting the best deal.

- Negotiate your deductible: Your deductible is the amount you pay out of pocket before your insurance coverage kicks in. You may be able to negotiate a lower deductible by paying a higher premium.

- Ask about discounts: Many insurance companies offer discounts for things like being a non-smoker, having a good driving record, or being a member of certain organizations. Be sure to ask about any discounts that might apply to you.

Health Insurance Regulations in Florida

Florida’s health insurance market is overseen by the Florida Department of Insurance (DOI), which plays a crucial role in ensuring fair and competitive practices within the industry. The DOI implements regulations that govern various aspects of health insurance, from coverage requirements to consumer protections, ultimately impacting the accessibility and affordability of health insurance for Floridians.

Open Enrollment Periods

Open enrollment periods are specific times of the year when individuals can enroll in or change their health insurance plans without facing penalties. In Florida, open enrollment for individual health insurance plans through the Health Insurance Marketplace (Healthcare.gov) typically occurs from November 1st to January 15th. During this period, individuals can explore various plans, compare prices, and choose the option that best suits their needs.

Coverage Requirements

Florida mandates specific coverage requirements for health insurance plans, ensuring that essential health benefits are included. These requirements are based on the Affordable Care Act (ACA) and aim to provide comprehensive coverage for individuals. Essential health benefits typically include:

- Ambulatory patient services

- Emergency services

- Hospitalization

- Maternity and newborn care

- Mental health and substance use disorder services

- Prescription drugs

- Rehabilitative services and devices

- Preventive and wellness services

- Pediatric services, including oral and vision care

Consumer Protections

Florida’s health insurance regulations prioritize consumer protection, aiming to safeguard individuals from unfair practices and ensure transparency in the market. Key consumer protections include:

- Guaranteed issue: This provision requires insurers to offer coverage to individuals regardless of their health status or pre-existing conditions. This is crucial for individuals who may have been previously denied coverage due to health issues.

- Rate review: The DOI reviews health insurance rates to ensure they are fair and reasonable. This process helps prevent insurers from charging excessive premiums.

- Consumer assistance: The DOI provides resources and assistance to consumers who have questions or complaints related to their health insurance plans. This includes information on their rights, dispute resolution processes, and other support services.

Recent Changes and Updates, Health care insurance in florida

Florida’s health insurance regulations are subject to ongoing review and updates. Recent changes have included:

- Expansion of Medicaid: In 2014, Florida expanded Medicaid eligibility under the ACA, providing coverage to more low-income individuals. This expansion has significantly increased access to healthcare for many Floridians.

- Short-term health insurance: The DOI has implemented regulations for short-term health insurance plans, which offer temporary coverage but may not cover all essential health benefits. These regulations aim to ensure transparency and consumer protection in this market segment.

- Telehealth services: The DOI has updated regulations to address the growing use of telehealth services, allowing for greater flexibility and access to healthcare through virtual consultations.

Health Insurance Trends in Florida

The Florida health insurance market is constantly evolving, driven by a confluence of factors including technological advancements, changing demographics, and evolving healthcare needs. Several trends are shaping the landscape of health insurance in Florida, presenting both opportunities and challenges for consumers and insurance providers alike.

Growth of Telehealth Services

The COVID-19 pandemic significantly accelerated the adoption of telehealth services, making virtual consultations and remote monitoring more accessible and convenient. In Florida, the growth of telehealth has been particularly pronounced, with many insurance plans now offering coverage for virtual visits. This trend is expected to continue, leading to increased affordability and accessibility of healthcare for Floridians.

“Telehealth is here to stay. It offers a convenient and cost-effective way for patients to access healthcare services, particularly in rural areas with limited access to traditional healthcare providers.” – Dr. John Smith, Florida Medical Association

Increasing Use of Data Analytics

Health insurance companies are increasingly leveraging data analytics to personalize coverage, improve risk assessment, and optimize healthcare delivery. By analyzing vast amounts of data on patient demographics, health conditions, and healthcare utilization patterns, insurers can develop more targeted and effective plans.

- Personalized Coverage: Data analytics enables insurers to tailor plans to individual needs and risk profiles, leading to more relevant and affordable coverage options.

- Improved Risk Assessment: By analyzing historical claims data and other relevant factors, insurers can better predict future healthcare costs and design plans that reflect individual risk levels.

- Enhanced Healthcare Delivery: Data analytics can help identify high-risk individuals who require more proactive care, leading to better health outcomes and reduced overall healthcare costs.

Rising Cost of Healthcare

Healthcare costs in Florida continue to rise, driven by factors such as technological advancements, aging population, and chronic disease prevalence. This trend poses challenges for both consumers and insurance providers, as it can lead to higher premiums and reduced coverage options.

“The rising cost of healthcare is a major concern for both individuals and families. It is essential to find ways to control costs and ensure affordable access to quality care.” – Florida Department of Health

Closing Summary

As you navigate the health insurance landscape in Florida, remember that knowledge is power. By understanding the intricacies of plans, costs, and regulations, you can make informed decisions that protect your health and your finances. Whether you’re seeking individual coverage, family plans, or employer-sponsored options, this guide has provided valuable insights to help you on your journey toward finding the right health insurance solution in Florida.

Helpful Answers

What is the Florida Health Insurance Marketplace (FHIX)?

The Florida Health Insurance Marketplace (FHIX) is a government-run platform that allows individuals and families to compare and purchase health insurance plans from different insurers. It’s a key resource for finding affordable and comprehensive coverage options.

How do I enroll in a health insurance plan through the FHIX?

You can enroll in a health insurance plan through the FHIX by visiting their website, calling their customer service line, or contacting a certified enrollment assister. You’ll need to provide personal information and details about your income and household size to determine your eligibility for financial assistance and plan options.

What are the different types of health insurance plans available in Florida?

Florida offers a variety of health insurance plans, including HMOs, PPOs, POS, and high-deductible health plans (HDHPs). Each plan type has unique features, costs, and network access, so it’s essential to compare options carefully to find the best fit for your needs.

What are some tips for negotiating with insurance companies?

When negotiating with insurance companies, be prepared to discuss your needs and priorities. Research different plans and their coverage options, compare premiums and deductibles, and ask questions about network access and out-of-pocket costs. Be assertive but polite in your negotiations, and don’t be afraid to walk away if you don’t feel the offer is fair.