Is car insurance cheaper in Florida than New York? This is a question that many drivers ask themselves, especially when considering a move or vacation between these two states. While both states have their own unique factors that influence car insurance premiums, there are several key differences that can make one state more expensive than the other.

From population density and traffic congestion to state regulations and the prevalence of uninsured drivers, a multitude of factors contribute to the cost of car insurance. Understanding these factors is essential for drivers looking to make informed decisions about their insurance coverage.

Car Insurance Premiums in Florida and New York

Car insurance premiums can vary significantly depending on factors like the state you live in. Florida and New York are two states with distinct car insurance landscapes. This section explores the key factors that influence car insurance premiums in both states and provides a detailed comparison of average premiums.

Factors Influencing Car Insurance Premiums

Car insurance premiums are influenced by a multitude of factors, including:

- Driving History: A clean driving record with no accidents or traffic violations typically translates to lower premiums. Conversely, drivers with a history of accidents or traffic violations often face higher premiums.

- Age and Gender: Younger drivers, particularly males, are statistically more likely to be involved in accidents, leading to higher premiums. Older drivers often benefit from lower premiums due to their experience and safer driving habits.

- Vehicle Type: The type of vehicle you drive plays a crucial role in determining your insurance premiums. Luxury cars, sports cars, and high-performance vehicles are often more expensive to repair or replace, leading to higher premiums. On the other hand, compact or economy cars tend to have lower premiums.

- Coverage Levels: The level of coverage you choose impacts your premiums. Comprehensive and collision coverage, which protect you from damages caused by accidents or other incidents, typically result in higher premiums compared to liability-only coverage.

- Location: Car insurance premiums are often influenced by the location where you live. States with higher population density, more traffic congestion, and higher rates of accidents typically have higher premiums.

- Credit Score: In some states, including Florida and New York, insurers use your credit score as a factor in determining your premiums. A good credit score is generally associated with lower premiums, while a poor credit score can lead to higher premiums.

Average Car Insurance Premiums in Florida and New York

Average car insurance premiums can vary considerably based on the specific factors mentioned above. However, here is a general comparison of average premiums in Florida and New York:

| State | Average Annual Premium |

|---|---|

| Florida | $2,300 |

| New York | $2,500 |

It’s important to note that these are just average figures, and your actual premiums may vary significantly depending on your individual circumstances.

Factors Contributing to Higher Premiums in Florida

- High Number of Accidents: Florida has a high rate of car accidents, which contributes to higher insurance premiums. This is partly due to the state’s large population, heavy traffic congestion, and a high number of tourists.

- High Number of Uninsured Drivers: Florida has a significant number of uninsured drivers, which can increase premiums for insured drivers. This is because uninsured drivers are more likely to be involved in accidents, and insured drivers may be responsible for covering the costs of damages caused by uninsured drivers.

- High Cost of Auto Repair: The cost of auto repair in Florida is relatively high, which can impact insurance premiums. This is due to factors like the state’s warm climate, which can lead to more frequent repairs, and the availability of skilled mechanics.

Factors Contributing to Higher Premiums in New York

- High Population Density: New York has a high population density, leading to more traffic congestion and a higher risk of accidents. This contributes to higher insurance premiums.

- High Cost of Living: New York has a high cost of living, including high housing costs and healthcare expenses. This can impact insurance premiums, as insurers need to factor in the cost of covering potential damages and medical expenses.

- No-Fault Insurance System: New York operates a no-fault insurance system, where drivers are typically responsible for covering their own medical expenses after an accident, regardless of fault. This system can lead to higher premiums, as insurers need to cover a broader range of expenses.

Factors Affecting Car Insurance Costs

Car insurance premiums are influenced by a variety of factors, some of which are unique to each state, while others are more universal. These factors can significantly impact the cost of insurance, leading to differences in premiums between states like Florida and New York.

Population Density, Traffic Congestion, and Accident Rates

Population density, traffic congestion, and accident rates are closely interconnected and significantly influence car insurance costs.

- Higher population density often translates to more vehicles on the road, leading to increased traffic congestion and a higher likelihood of accidents. This, in turn, increases the risk for insurance companies, prompting them to charge higher premiums.

- Traffic congestion creates a more challenging driving environment, increasing the risk of accidents and claims. This can lead to higher insurance premiums as insurers factor in the increased risk associated with congested roads.

- Higher accident rates directly translate to more claims for insurance companies, which they must cover. To offset the increased risk and expenses, insurance companies may adjust their premiums upward in areas with higher accident rates.

For example, New York City, with its high population density and heavy traffic, generally experiences higher car insurance premiums than less populated areas. Conversely, Florida, with its sprawling cities and lower population density, may see lower premiums in certain areas.

State Regulations, Insurance Laws, and Availability of Insurance Companies

State regulations and insurance laws play a crucial role in shaping the car insurance landscape and influencing premiums.

- State regulations can impact the minimum coverage requirements, the types of coverage available, and the pricing structure for insurance policies. For instance, some states may mandate higher minimum liability coverage, leading to higher premiums for drivers.

- Insurance laws, such as those related to no-fault insurance or the ability to sue for pain and suffering, can also affect insurance costs. States with more restrictive insurance laws may see lower premiums compared to states with more lenient laws.

- The availability of insurance companies in a particular state can also influence premiums. A competitive market with many insurance companies vying for customers may lead to lower premiums due to increased competition and the need to attract customers with competitive rates.

For instance, Florida’s no-fault insurance system, where drivers are typically required to file claims with their own insurer regardless of fault, can impact the cost of insurance compared to states with traditional fault-based systems.

Other Factors Influencing Car Insurance Costs, Is car insurance cheaper in florida than new york

Several other factors can contribute to the variation in car insurance premiums.

- Weather conditions can significantly influence insurance costs. States prone to hurricanes, tornadoes, or severe weather events may see higher premiums as insurers account for the increased risk of damage and claims. Florida, with its susceptibility to hurricanes, is an example of this.

- Theft rates can also affect insurance premiums. Areas with high car theft rates may see higher premiums as insurers factor in the increased risk of vehicle theft and associated claims.

- The prevalence of uninsured drivers can also impact premiums. When there is a high proportion of uninsured drivers, insurers may charge higher premiums to compensate for the increased risk of having to cover claims from accidents involving uninsured drivers.

For instance, states with a high number of uninsured drivers may see higher premiums as insurers factor in the risk of having to cover claims from accidents involving uninsured drivers.

Driving Habits and Insurance Premiums

Driving habits play a significant role in determining car insurance premiums. Insurance companies assess driving records, including speeding violations, accidents, and DUI convictions, to determine the risk associated with each driver. This analysis influences the cost of insurance, with drivers with a history of risky behavior facing higher premiums.

Driving Habits in Florida and New York

The driving habits of residents in Florida and New York differ significantly. Florida, known for its warm climate and extensive coastline, experiences higher annual mileage compared to New York. This is primarily due to longer commutes, frequent road trips, and increased leisure driving. In contrast, New York, with its dense urban environment and extensive public transportation network, tends to have lower annual mileage.

- Annual Mileage: Florida residents drive an average of 13,000 miles annually, while New York residents drive an average of 10,000 miles annually.

- Commuting Distances: Commuting distances are generally longer in Florida, with many residents driving for over an hour each day. New York City, with its dense population and extensive public transportation system, tends to have shorter commuting distances.

- Driving Experience: The average driving experience in Florida is slightly lower than in New York. This is attributed to a larger population of new drivers and retirees in Florida, who may have less experience behind the wheel.

Impact of Driving Habits on Insurance Premiums

Driving habits significantly impact insurance premiums in both Florida and New York. Drivers with a history of risky behavior, such as speeding violations, accidents, and DUI convictions, face higher premiums. This is because insurance companies perceive these drivers as posing a higher risk of future claims.

- Speeding Violations: A speeding ticket can increase insurance premiums by 15-25% in both states. This is because speeding is a strong indicator of risky driving behavior.

- Accidents: Drivers involved in accidents, regardless of fault, are likely to see their insurance premiums increase. This is because accidents demonstrate a higher risk of future claims.

- DUI Convictions: A DUI conviction can lead to a significant increase in insurance premiums, sometimes doubling or tripling the cost. This is because DUI convictions are considered a serious safety concern.

Note: Insurance companies use a complex algorithm to determine insurance premiums based on a variety of factors, including driving habits, vehicle type, age, and location. The specific impact of driving habits on premiums can vary depending on the individual driver and the insurance company.

Insurance Coverage Options and Costs: Is Car Insurance Cheaper In Florida Than New York

Car insurance coverage options are crucial to consider when comparing insurance costs in Florida and New York. Understanding the different types of coverage, their availability, and costs can help you make informed decisions about your insurance needs.

Coverage Options and Availability

- Liability Coverage: This is the most basic type of car insurance and is required in both Florida and New York. It covers damages to other people’s property or injuries to other people in an accident caused by you.

- Florida requires a minimum of $10,000 per person and $20,000 per accident for bodily injury liability and $10,000 for property damage liability.

- New York requires a minimum of $25,000 per person and $50,000 per accident for bodily injury liability and $10,000 for property damage liability.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of fault. It’s usually optional, but it’s recommended if you have a financed or leased vehicle.

- Both Florida and New York offer collision coverage, and the cost varies depending on factors like your vehicle’s make, model, and year.

- Comprehensive Coverage: This coverage pays for damages to your vehicle caused by events other than accidents, such as theft, vandalism, natural disasters, or falling objects. It’s also typically optional.

- Both Florida and New York offer comprehensive coverage, and the cost is influenced by factors like your vehicle’s value and the risk of these events in your area.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have enough insurance to cover your damages. It’s typically optional but highly recommended.

- Both Florida and New York offer uninsured/underinsured motorist coverage, and the cost varies based on your coverage limits and the state’s minimum requirements.

Impact of Coverage Levels and Optional Add-ons

- Coverage Levels: The higher your coverage limits for liability, collision, and comprehensive coverage, the more expensive your insurance will be. However, higher limits provide greater financial protection in the event of a serious accident or significant damage to your vehicle.

- Optional Add-ons: Optional add-ons, such as roadside assistance, rental car reimbursement, or gap insurance, can increase your premium. It’s essential to consider the value of these add-ons and weigh them against the potential costs.

Tips for Lowering Car Insurance Premiums

Lowering your car insurance premiums in Florida and New York can save you significant money over time. By implementing smart strategies and making informed decisions, you can reduce your insurance costs without compromising your coverage.

Improving Driving Habits

Maintaining a safe driving record is crucial for lowering your insurance premiums. Insurance companies often offer discounts to drivers with clean records.

- Avoid traffic violations: Speeding tickets, reckless driving, and DUI offenses can significantly increase your insurance rates.

- Drive defensively: Defensive driving courses teach you techniques to anticipate potential hazards and avoid accidents, which can lead to lower insurance premiums.

- Maintain a safe driving record: A clean driving record with no accidents or violations is a major factor in determining your insurance rates.

Increasing Deductibles

A higher deductible means you pay more out of pocket in case of an accident, but it can also lower your premium.

- Consider a higher deductible: If you can afford to pay a higher deductible in case of an accident, it can significantly reduce your premium.

- Evaluate your risk tolerance: Carefully consider your financial situation and risk tolerance before increasing your deductible.

Bundling Insurance Policies

Bundling your car insurance with other insurance policies, such as homeowners or renters insurance, can often result in significant discounts.

- Bundle with other policies: Check with your insurance provider to see if they offer discounts for bundling multiple policies.

- Compare quotes: Shop around for quotes from different insurance companies to see who offers the best rates for bundled policies.

Shopping for Competitive Rates

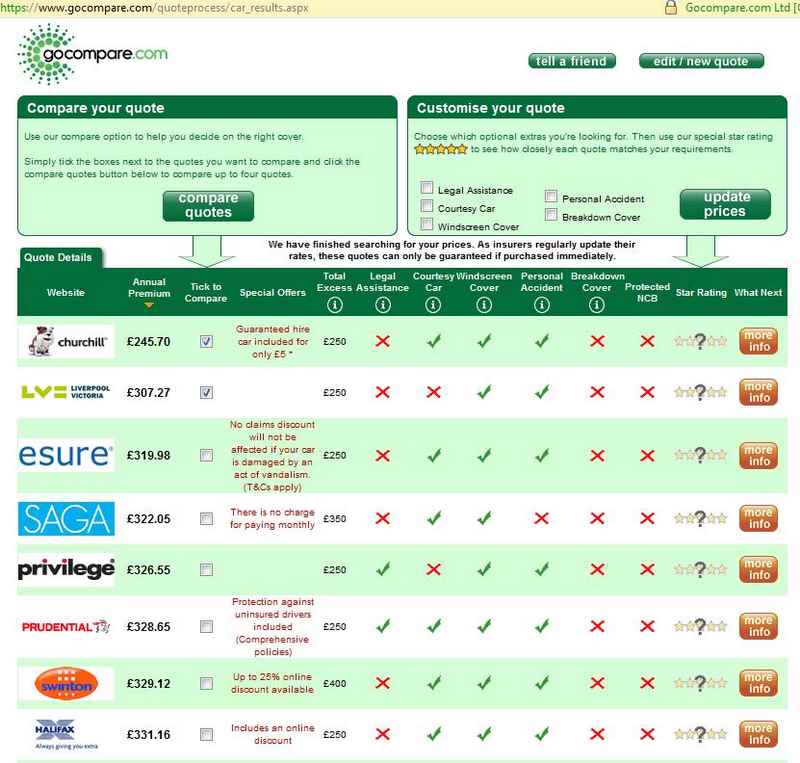

Regularly comparing quotes from different insurance companies can help you find the best rates for your specific needs.

- Compare quotes online: Many insurance comparison websites allow you to enter your information and receive quotes from multiple companies.

- Contact insurance companies directly: Call insurance companies directly to discuss your specific needs and get personalized quotes.

Maintaining a Good Credit Score

Your credit score can influence your car insurance premiums.

- Improve your credit score: A higher credit score can lead to lower insurance rates.

- Monitor your credit report: Check your credit report regularly for any errors that could be affecting your score.

Last Point

Ultimately, the cost of car insurance in Florida and New York depends on a complex interplay of factors, including individual driving habits, vehicle type, and the specific insurance company chosen. By understanding the key factors that influence premiums, drivers can make informed decisions about their insurance coverage and potentially save money. Remember, comparing quotes from multiple insurers is always a good practice to ensure you are getting the best possible rate.

Expert Answers

What are some common reasons for higher car insurance premiums in Florida?

Florida has a higher rate of car accidents and uninsured drivers, which can lead to increased insurance costs. Additionally, the state’s warm climate and high population density can contribute to more frequent claims.

How does driving experience impact car insurance rates?

Drivers with a longer and safer driving history generally receive lower insurance premiums. This is because they are statistically less likely to be involved in accidents.

What are some tips for lowering car insurance premiums in both Florida and New York?

Consider increasing your deductible, bundling your insurance policies, and taking a defensive driving course. Maintaining a good credit score can also help lower your premiums.