- Factors Influencing Car Insurance Costs in Florida: What Is The Average Cost Of Car Insurance In Florida

- Average Car Insurance Costs in Florida

- Understanding Florida’s Unique Insurance Landscape

- Strategies for Saving on Car Insurance in Florida

- Finding the Right Car Insurance in Florida

- Wrap-Up

- Detailed FAQs

What is the average cost of car insurance in Florida? It’s a question many Floridians ask themselves, and the answer isn’t always straightforward. Florida’s unique insurance landscape, with its high-risk driver pool and specific regulations, can significantly impact car insurance premiums. Factors like driving history, age, credit score, vehicle type, location, and coverage levels all play a role in determining how much you’ll pay for car insurance in the Sunshine State.

This guide will delve into the factors influencing car insurance costs in Florida, providing a breakdown of average premiums for different coverage types and comparing them to other states. We’ll also explore strategies for saving on car insurance and offer tips for finding the right policy to fit your needs and budget.

Factors Influencing Car Insurance Costs in Florida: What Is The Average Cost Of Car Insurance In Florida

Several factors determine the cost of car insurance in Florida. These factors are used by insurance companies to assess the risk associated with insuring a particular driver and vehicle.

Driving History

Your driving history plays a significant role in determining your insurance premiums. Insurance companies carefully review your driving record, looking for any incidents that may increase your risk of future accidents. This includes:

- Traffic Violations: Speeding tickets, reckless driving citations, and DUI convictions significantly increase your insurance premiums. These violations indicate a higher likelihood of future accidents.

- Accidents: Even if you weren’t at fault, being involved in an accident can increase your insurance rates. This is because accidents suggest a higher risk of future claims.

- Insurance Lapses: If you let your car insurance lapse, it can lead to higher premiums when you renew. Insurance companies view lapses as a sign of financial instability and potential risk.

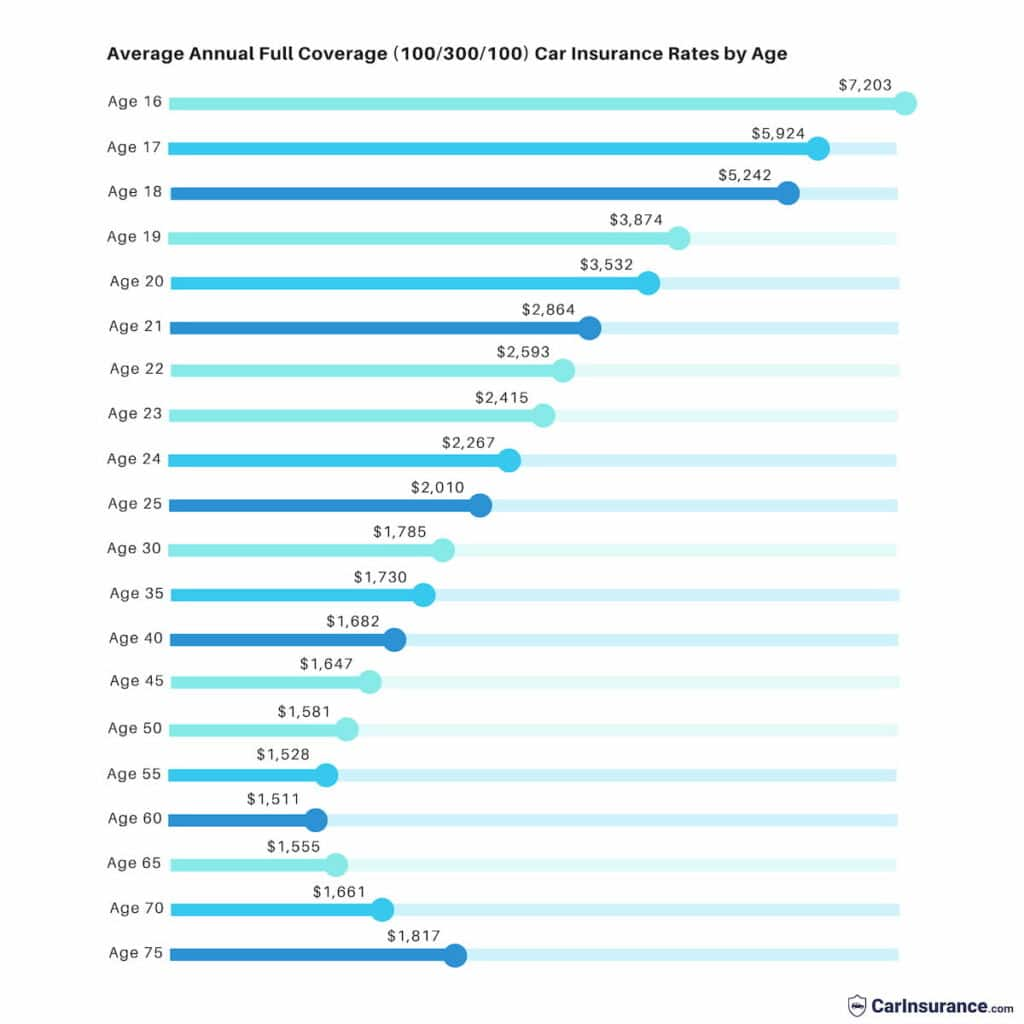

Age

Age is another crucial factor in car insurance pricing. Young drivers, particularly those under 25, generally have higher premiums. This is because they have less experience behind the wheel and are statistically more likely to be involved in accidents. As drivers gain experience and age, their premiums typically decrease.

Credit Score

Surprisingly, your credit score can also influence your car insurance premiums in Florida. This is because insurance companies use credit scores as a proxy for financial responsibility. Drivers with good credit scores are considered less risky and may receive lower premiums.

Vehicle Type

The type of vehicle you drive also impacts your insurance cost. Certain vehicles are more expensive to repair or replace, while others are considered safer and less prone to accidents. For instance, luxury cars or high-performance vehicles generally have higher insurance premiums than basic sedans.

Location

Your location in Florida can influence your insurance premiums. Areas with higher crime rates or a greater number of accidents tend to have higher insurance costs.

Coverage Levels

The amount of coverage you choose significantly affects your premiums. Higher coverage levels, such as comprehensive and collision coverage, provide greater financial protection but come with higher premiums.

Average Car Insurance Costs in Florida

The cost of car insurance in Florida can vary significantly depending on a number of factors, including the type of coverage, the driver’s driving record, the vehicle’s make and model, and the location of the driver. However, understanding the average cost of car insurance in Florida can help drivers budget for this essential expense.

Average Car Insurance Costs in Florida by Coverage Type

The average annual cost of car insurance in Florida for different types of coverage is shown in the table below. This information is based on data from the Insurance Information Institute (III).

| Coverage Type | Average Annual Cost | Minimum Coverage Requirements | Factors Influencing Cost |

|---|---|---|---|

| Liability | $700 | $10,000 per person/$20,000 per accident for bodily injury liability; $10,000 for property damage liability | Driving record, age, location, vehicle type |

| Collision | $500 | Not required | Vehicle value, driving record, location |

| Comprehensive | $300 | Not required | Vehicle value, location, driving record |

| Personal Injury Protection (PIP) | $400 | $10,000 per person | Driving record, age, location, vehicle type |

| Uninsured Motorist (UM) | $200 | $10,000 per person/$20,000 per accident | Driving record, age, location |

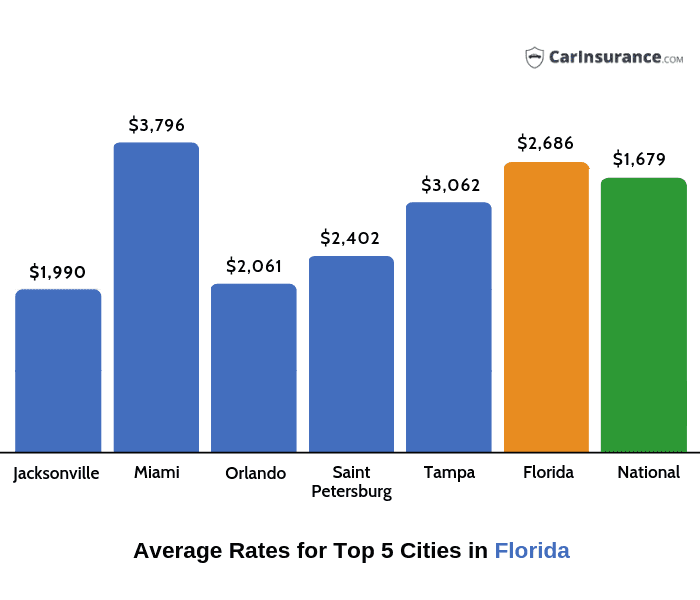

Comparison of Car Insurance Costs in Florida to Other States

Florida has the second-highest average annual car insurance premium in the United States, according to the III. The average annual premium in Florida is $2,246, compared to the national average of $1,771. This is likely due to a number of factors, including the state’s high population density, the prevalence of uninsured drivers, and the high number of accidents. However, it’s important to note that the average cost of car insurance can vary significantly from one state to another, even within the same state. For example, drivers in Miami-Dade County may pay significantly more for car insurance than drivers in rural areas of the state.

Understanding Florida’s Unique Insurance Landscape

Florida’s car insurance landscape is distinct due to a confluence of factors, including a high-risk driver pool, unique regulations, and the presence of a state-run insurance program. These elements contribute to the state’s higher-than-average car insurance premiums.

The Impact of Florida’s High-Risk Driver Pool

Florida’s high-risk driver pool significantly impacts car insurance costs. This is attributed to several factors, including:

- High Population Density: Florida’s dense population leads to increased traffic congestion, raising the likelihood of accidents.

- Tourist Presence: The state’s large tourist population contributes to a higher number of unfamiliar drivers on the roads, potentially increasing the risk of accidents.

- High Number of Uninsured Drivers: Florida has a relatively high number of uninsured drivers, which can lead to financial hardship for those involved in accidents with uninsured motorists.

- Fraudulent Claims: Florida has a history of insurance fraud, which drives up insurance costs for all drivers.

These factors contribute to a higher frequency and severity of accidents, leading insurance companies to charge higher premiums to cover the increased risk.

The Role of the Florida Automobile Joint Underwriting Association (FAJUA)

The Florida Automobile Joint Underwriting Association (FAJUA) plays a crucial role in providing coverage to high-risk drivers who have been denied insurance by private insurers. FAJUA is a state-run program that acts as a safety net for drivers who cannot obtain coverage in the private market. This program helps to ensure that all drivers in Florida have access to basic auto insurance, even if they have a history of accidents or traffic violations. However, FAJUA policies typically have higher premiums than private insurance policies due to the higher risk associated with the drivers they insure.

Key Regulations and Laws Specific to Florida

Florida has a number of unique regulations and laws that affect car insurance:

- No-Fault Insurance: Florida is a no-fault insurance state, meaning that drivers are required to file claims with their own insurance company, regardless of who is at fault in an accident. This system aims to expedite claims processing and reduce litigation. However, it can lead to higher premiums due to the increased number of claims.

- Personal Injury Protection (PIP): Florida requires all drivers to carry Personal Injury Protection (PIP) coverage, which covers medical expenses and lost wages for the policyholder and their passengers, regardless of fault. PIP coverage is mandatory, but drivers can choose the amount of coverage they want to purchase.

- Limits on Tort Claims: Florida has limits on tort claims, which are lawsuits filed against another driver for damages caused by an accident. This law restricts the amount of compensation a driver can receive for pain and suffering in a car accident.

These regulations and laws, along with the factors discussed above, contribute to the unique insurance landscape in Florida, leading to higher car insurance premiums than in many other states.

Strategies for Saving on Car Insurance in Florida

Car insurance premiums in Florida can be expensive, but there are several strategies you can employ to lower your costs. By taking proactive steps and understanding your options, you can significantly reduce your insurance bills and save money in the long run.

Maintaining a Good Driving Record

A clean driving record is one of the most significant factors influencing your car insurance premiums. By avoiding traffic violations, accidents, and other driving-related offenses, you can demonstrate to insurance companies that you are a responsible driver.

A good driving record can lead to substantial discounts on your insurance premiums, sometimes even exceeding 50% in some cases.

- Avoid traffic violations: Every ticket, from speeding to running a red light, can increase your premiums.

- Maintain a safe driving history: A clean accident record is crucial. Even a minor accident can significantly impact your rates.

- Complete a defensive driving course: Many insurance companies offer discounts for completing a certified defensive driving course, which can enhance your driving skills and lower your premiums.

Choosing a Safe Vehicle

The type of vehicle you drive plays a significant role in determining your insurance costs. Insurance companies consider factors like safety ratings, theft risk, and repair costs when setting premiums.

- Select vehicles with high safety ratings: Cars with advanced safety features, such as anti-lock brakes, airbags, and electronic stability control, are generally associated with lower insurance premiums.

- Opt for vehicles with lower theft risk: Vehicles that are more susceptible to theft tend to have higher insurance premiums.

- Consider vehicles with lower repair costs: Cars with cheaper parts and easier repairs often translate to lower insurance premiums.

Bundling Insurance Policies

Bundling your car insurance with other policies, such as homeowners or renters insurance, can often lead to substantial discounts.

- Contact your current insurance provider: Inquire about their bundling options and potential discounts.

- Compare quotes from multiple insurers: Get quotes from different insurance companies to find the best bundling deals.

- Consider bundling other policies: Explore bundling opportunities for additional policies, such as life insurance or health insurance, to maximize savings.

Discounts Offered by Insurance Companies

Florida insurance companies offer a variety of discounts to reduce premiums for eligible policyholders.

- Good student discount: This discount is typically available for students with high GPAs or good academic standing.

- Safe driver discount: Insurance companies reward drivers with a clean driving record by offering discounts for maintaining a safe driving history.

- Multi-car discount: If you insure multiple vehicles with the same insurance company, you may be eligible for a multi-car discount.

- Loyalty discount: Some insurance companies offer discounts to policyholders who have been with them for a certain period.

- Anti-theft device discount: Installing anti-theft devices, such as alarms or tracking systems, can lower your insurance premiums.

Finding the Right Car Insurance in Florida

Navigating the world of car insurance in Florida can feel overwhelming, but finding the right policy doesn’t have to be a stressful experience. By following a structured approach and understanding your needs, you can secure a policy that offers comprehensive coverage at a competitive price.

Comparing Quotes from Multiple Insurers

Obtaining quotes from multiple insurance companies is a crucial step in finding the best car insurance deal. This allows you to compare prices, coverage options, and discounts, ensuring you get the most value for your money.

- Utilize online comparison websites: These platforms streamline the quote process by allowing you to enter your information once and receive quotes from various insurers. Popular options include Insurance.com, The Zebra, and Policygenius.

- Contact insurance companies directly: While online comparison websites are convenient, contacting insurance companies directly can provide more personalized attention and allow you to discuss specific needs.

- Consider local and regional insurers: In addition to national insurance giants, exploring local and regional insurers can often yield competitive rates and better customer service.

Factors to Consider When Choosing an Insurance Company, What is the average cost of car insurance in florida

Beyond price, several factors play a vital role in selecting the right insurance company for your needs.

- Financial stability: Assessing an insurance company’s financial strength is crucial, as it ensures they can fulfill their obligations in case of a claim. You can evaluate their financial stability by checking their ratings from organizations like A.M. Best, Moody’s, and Standard & Poor’s.

- Customer service: Excellent customer service is essential, especially during stressful situations like accidents or claims. Consider reading online reviews and seeking recommendations from friends and family to gauge a company’s customer service reputation.

- Coverage options: Ensure the insurer offers the coverage you need, including liability, collision, comprehensive, and uninsured/underinsured motorist coverage.

- Discounts: Many insurers offer discounts for various factors, such as safe driving records, good credit scores, and bundling insurance policies.

Wrap-Up

Navigating Florida’s car insurance market can be complex, but with the right information and strategies, you can find a policy that provides adequate coverage at a price that fits your budget. By understanding the factors that influence car insurance costs, comparing quotes from multiple insurers, and taking advantage of available discounts, you can ensure you’re getting the best value for your car insurance in Florida.

Detailed FAQs

What are the minimum car insurance requirements in Florida?

Florida requires drivers to have a minimum of $10,000 in Personal Injury Protection (PIP), $10,000 in Property Damage Liability (PDL), and $10,000 in Bodily Injury Liability (BI) per person and $20,000 per accident.

How can I lower my car insurance premiums in Florida?

You can lower your premiums by maintaining a good driving record, choosing a safe vehicle, bundling insurance policies, and taking advantage of discounts offered by insurance companies.

What is the Florida Automobile Joint Underwriting Association (FAJUA)?

The FAJUA is a state-run organization that provides car insurance to high-risk drivers who have been denied coverage by private insurers.