Best Florida car insurance rates are crucial for navigating the Sunshine State’s unique insurance landscape. Florida’s no-fault system, with its emphasis on personal injury protection (PIP) coverage, creates a distinct set of considerations for drivers seeking affordable and comprehensive insurance. Understanding the factors that influence rates, from driving history to vehicle type and coverage options, is essential for securing the best value.

Finding the best car insurance rates in Florida involves a multi-faceted approach. Comparing quotes from multiple insurance providers is a must, but it’s equally important to understand the intricacies of Florida’s insurance regulations. The Florida Office of Insurance Regulation (OIR) plays a key role in ensuring fair and transparent pricing practices, while drivers must carefully consider their specific needs and risk profiles when selecting coverage.

Understanding Florida Car Insurance Rates

Florida’s car insurance market is unique and complex, influenced by various factors that determine the cost of coverage. Understanding these factors can help you find the best rates and ensure you have adequate protection.

Factors Influencing Florida Car Insurance Rates, Best florida car insurance rates

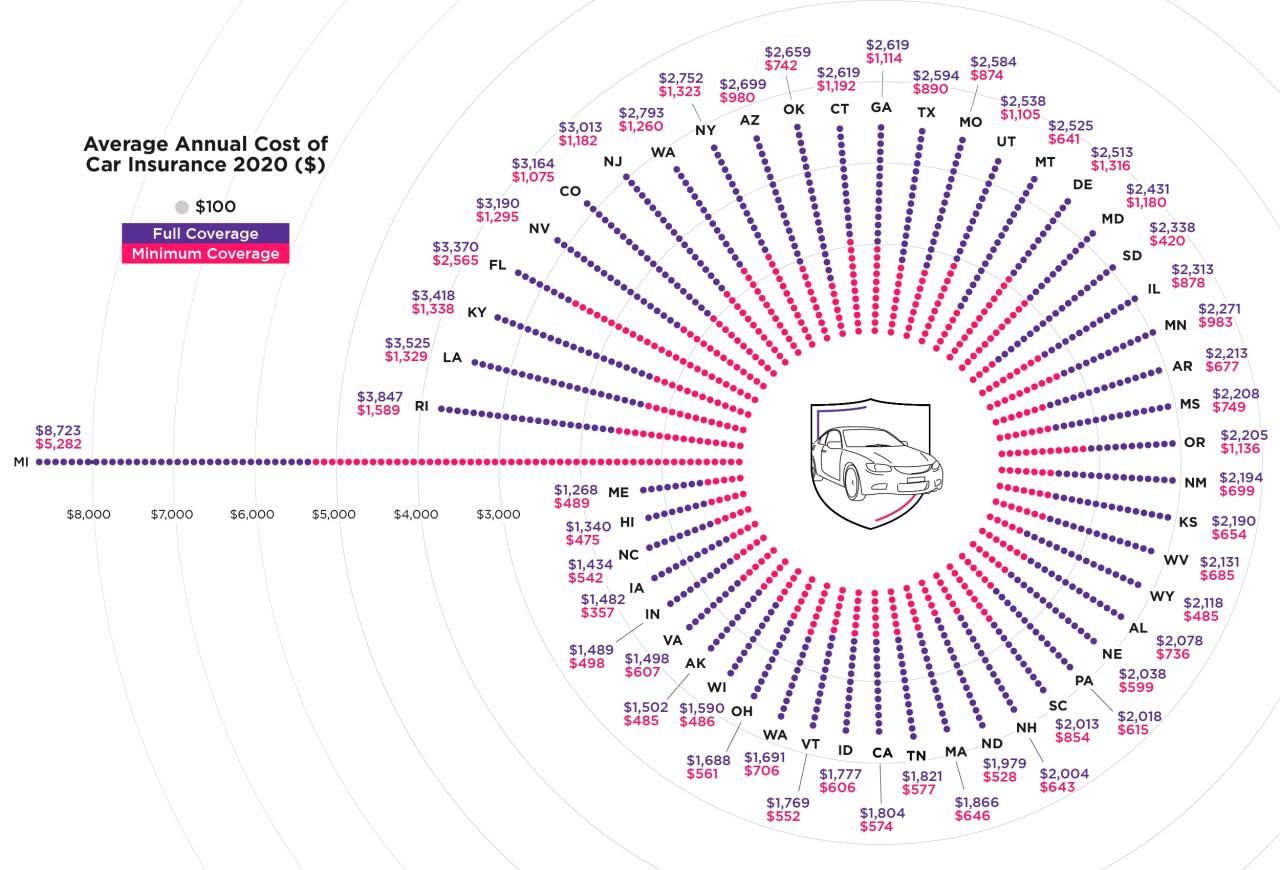

Several factors contribute to the cost of car insurance in Florida. These factors can be broadly categorized into demographics, driving history, vehicle type, and coverage options.

- Demographics: Your age, gender, and location can affect your insurance rates. Younger drivers and those living in urban areas with higher accident rates often pay more.

- Driving History: Your driving record is a significant factor. A clean driving record with no accidents or traffic violations will result in lower premiums. Conversely, accidents, DUI convictions, and other violations will increase your rates.

- Vehicle Type: The type of vehicle you drive also plays a role. Luxury vehicles, high-performance cars, and vehicles with safety features are often associated with higher premiums.

- Coverage Options: The amount of coverage you choose impacts your premium. Higher coverage limits for liability, collision, and comprehensive insurance will result in higher premiums.

Florida’s No-Fault System

Florida operates under a no-fault insurance system. This means that after an accident, each driver files a claim with their own insurance company, regardless of who caused the accident. This system is designed to reduce lawsuits and expedite claims processing.

The Role of the Florida Office of Insurance Regulation (OIR)

The Florida Office of Insurance Regulation (OIR) is the state agency responsible for overseeing the insurance industry. The OIR sets rates, regulates insurance companies, and investigates consumer complaints. It plays a crucial role in ensuring fair and competitive insurance rates for Florida residents.

Finding the Best Car Insurance Rates in Florida

Finding the best car insurance rates in Florida is crucial for managing your finances effectively. Car insurance is a necessity, but with so many providers offering different rates, it can be challenging to find the most competitive price. This is where the importance of comparing quotes from multiple insurance providers comes into play.

Comparing Quotes from Multiple Providers

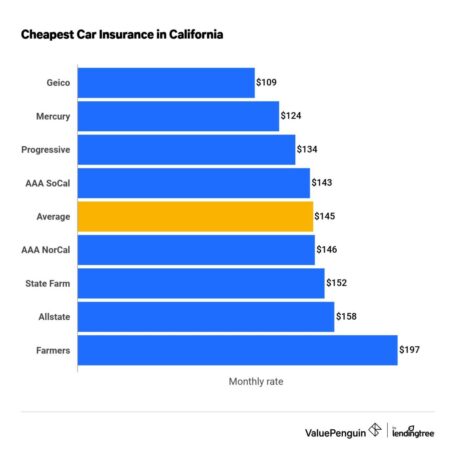

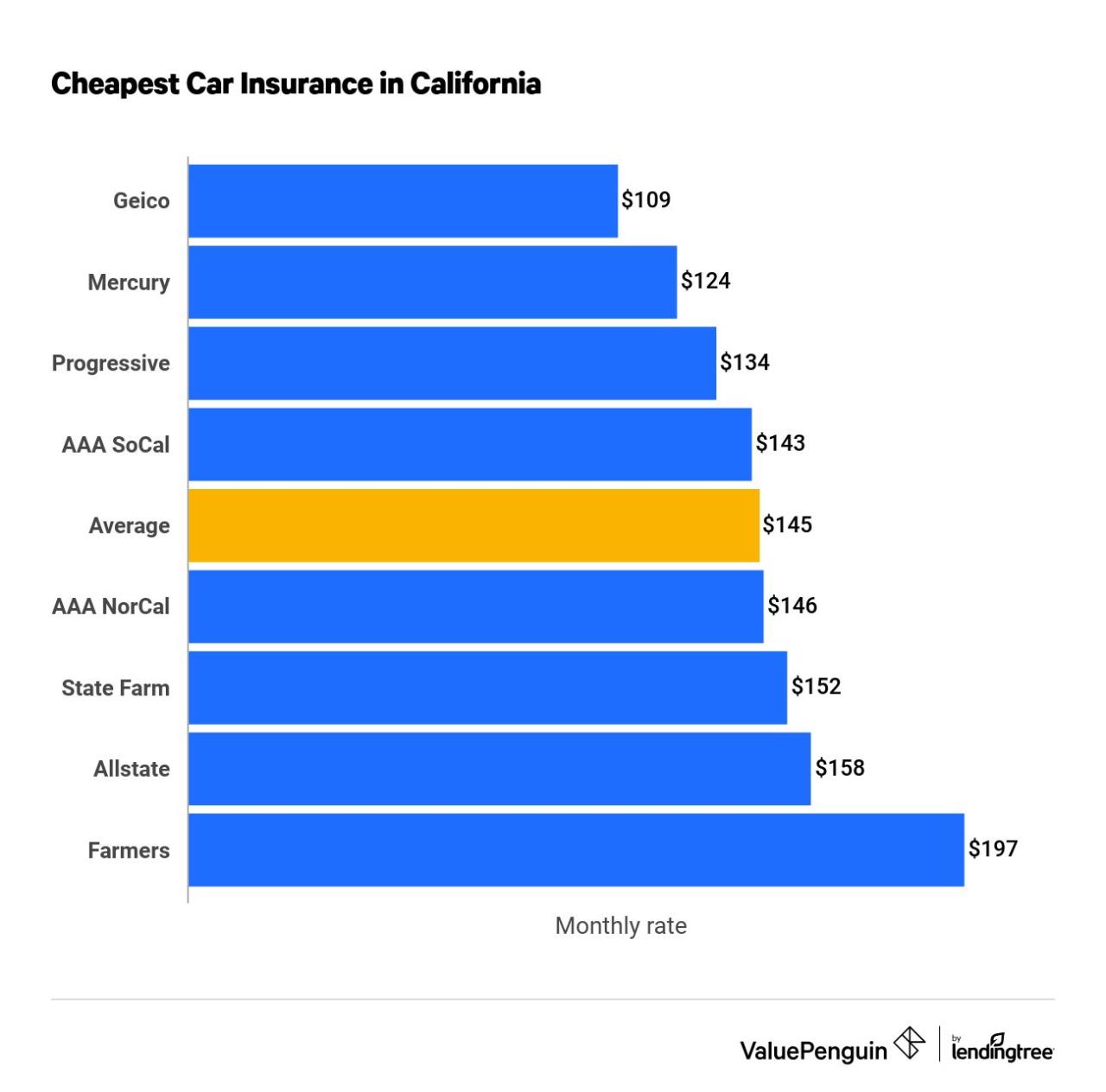

Comparing quotes from multiple insurance providers is essential to find the best car insurance rates in Florida. Each provider has its own pricing structure, and their rates can vary significantly. By comparing quotes, you can ensure that you’re getting the most competitive price for the coverage you need.

- Avoid settling for the first quote you receive. Many people make the mistake of accepting the first car insurance quote they get. However, this could lead to overpaying for your coverage. Instead, take the time to compare quotes from at least three different providers.

- Use online comparison tools. Several online comparison tools allow you to enter your information once and receive quotes from multiple providers. These tools can save you time and effort. However, it’s important to note that these tools may not always provide quotes from all providers in your area.

- Contact insurance providers directly. You can also contact insurance providers directly to request a quote. This can be a good option if you have specific questions about their coverage or pricing. Be prepared to provide your personal information and details about your vehicle when you contact them.

Obtaining Accurate Quotes

Obtaining accurate quotes is crucial to ensure you’re getting the best possible price. To receive accurate quotes, it’s essential to provide complete and truthful information about yourself and your vehicle.

- Provide accurate personal information. This includes your name, address, date of birth, and driving history. Any inaccuracies can lead to inaccurate quotes or even coverage issues later on.

- Provide accurate vehicle information. This includes your vehicle’s make, model, year, and mileage. Also, be sure to disclose any modifications or customizations you’ve made to your vehicle.

- Be honest about your driving history. Disclosing any accidents, traffic violations, or other incidents you’ve been involved in is crucial. Failing to do so can result in higher premiums or even coverage denial later.

Key Factors to Consider When Comparing Quotes

When comparing quotes, it’s important to consider various factors beyond just the price. These factors can affect your overall insurance costs and the level of coverage you receive.

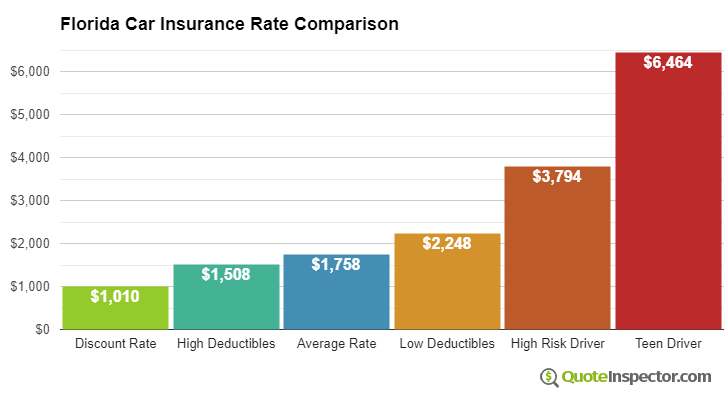

- Coverage Levels. Different insurance providers offer different levels of coverage. You’ll need to choose the level of coverage that best suits your needs and budget. Basic coverage options include liability, collision, and comprehensive coverage. However, you may also want to consider additional coverage options such as uninsured/underinsured motorist coverage, personal injury protection (PIP), and rental car reimbursement.

- Deductibles. Your deductible is the amount you’ll pay out-of-pocket for a covered claim. A higher deductible typically results in lower premiums. However, you’ll have to pay more out-of-pocket if you need to file a claim. Consider your risk tolerance and financial situation when choosing your deductible.

- Discounts. Insurance providers offer various discounts to their policyholders. These discounts can help lower your premiums. Common discounts include good driver discounts, safe driver discounts, multi-car discounts, and bundling discounts. Ask your insurance provider about the discounts they offer and ensure you qualify for all applicable discounts.

Final Review

Navigating the complexities of Florida car insurance can be challenging, but armed with the right information and strategies, drivers can secure affordable and reliable coverage. By understanding the factors influencing rates, comparing quotes diligently, and leveraging available discounts, Floridians can find the best car insurance rates that meet their individual needs and protect them on the road.

Essential Questionnaire: Best Florida Car Insurance Rates

What are the main factors that influence car insurance rates in Florida?

Several factors contribute to car insurance rates in Florida, including your driving history, vehicle type, coverage options, demographics, and even your credit score.

How can I get the most accurate car insurance quotes?

To receive accurate quotes, be truthful and comprehensive when providing information about your driving history, vehicle, and desired coverage. Avoid omitting details or providing false information, as this can lead to higher rates or even policy cancellation.

What are some common discounts offered by car insurance companies in Florida?

Many insurance companies offer discounts for good drivers, safe drivers, good students, multi-car policies, and even for installing safety features in your vehicle.