Navigating the car insurance landscape in Florida can feel like driving through a maze. “Cheapest insurance in Florida car” is a common search, but finding the best deal requires understanding the unique factors that impact premiums in the Sunshine State. From the high-risk driver population to state-specific regulations, Florida’s insurance market presents its own set of challenges.

This guide delves into the intricacies of Florida’s car insurance market, providing a comprehensive overview of the factors that influence pricing. We’ll explore key considerations like your driving history, vehicle type, and coverage options, as well as how your age, location, and credit score can affect your rates. By understanding these factors, you can make informed decisions and find affordable car insurance options that meet your needs.

Understanding Florida’s Car Insurance Market: Cheapest Insurance In Florida Car

Florida’s car insurance market is unique and complex, influenced by a combination of factors that drive insurance costs higher than in many other states. Understanding these factors is crucial for drivers seeking the most affordable coverage.

Factors Influencing Car Insurance Costs in Florida

Several factors contribute to Florida’s high car insurance rates, including:

- High Number of Accidents and Claims: Florida has a higher-than-average number of car accidents, leading to more claims and increased insurance payouts. This is partly due to the state’s large population and extensive road network, but also to factors like a high number of tourists and older drivers.

- High Litigation Rates: Florida is known for its “litigation-friendly” environment, with a high number of lawsuits related to car accidents. This increases the risk for insurers, as they face more claims and legal expenses.

- High Property Values: Florida’s coastal areas and desirable real estate contribute to high property values, which can lead to higher insurance premiums, as insurers factor in the potential cost of repairs or replacements.

- High Cost of Living: Florida’s high cost of living, including medical expenses, contributes to higher insurance costs, as insurers need to cover these costs in case of accidents.

- Natural Disasters: Florida is prone to hurricanes and other natural disasters, which can cause significant damage to vehicles. Insurers factor in these risks when setting premiums.

Key Regulations and Laws

Florida has specific regulations and laws that impact car insurance premiums, including:

- No-Fault Insurance: Florida operates under a “no-fault” insurance system, where drivers are required to carry Personal Injury Protection (PIP) coverage. This means that drivers can access benefits from their own insurance policy, regardless of who is at fault in an accident. However, PIP coverage can be expensive, contributing to higher overall premiums.

- Minimum Coverage Requirements: Florida mandates specific minimum coverage requirements for all drivers, including:

- PIP: $10,000

- Property Damage Liability: $10,000

- Bodily Injury Liability: $10,000 per person, $20,000 per accident

While these minimums are relatively low, drivers may need to purchase higher coverage limits to adequately protect themselves financially in the event of an accident.

- “Florida Statute 627.736”: This statute restricts insurers from using credit history as a factor in determining premiums. However, insurers can still use other factors, such as driving history, age, and vehicle type.

Florida’s High-Risk Driver Population

Florida has a high proportion of high-risk drivers, including:

- Older Drivers: Florida has a large population of older drivers, who are statistically more likely to be involved in accidents.

- Tourists: Tourists are often unfamiliar with Florida’s roads and traffic patterns, which can increase the risk of accidents.

- Drivers with Poor Driving Records: Florida has a significant number of drivers with poor driving records, including speeding tickets, DUI convictions, and accidents, which increases their insurance premiums.

Factors Affecting Car Insurance Prices

Understanding the factors that influence car insurance rates in Florida is crucial for finding the most affordable coverage. Insurance companies use a complex algorithm to calculate premiums, considering various aspects of your driving history, vehicle, and personal circumstances. This guide delves into the key factors that affect your car insurance price in the Sunshine State.

Driving History

Your driving record is a primary determinant of your car insurance rates. A clean driving history with no accidents, violations, or claims can significantly reduce your premiums. Conversely, a history of traffic violations, accidents, or claims can lead to higher rates. Insurance companies view these events as indicators of higher risk and, therefore, charge more for coverage.

- Accidents: A recent accident, even if you were not at fault, can increase your insurance rates. The severity of the accident and the resulting damage play a role in the premium increase.

- Traffic Violations: Speeding tickets, reckless driving citations, and other traffic violations can significantly increase your insurance rates. The severity of the violation and the number of violations you have accumulated influence the premium increase.

- Driving Record: Insurance companies often access your driving record through a national database. This record includes details about your driving history, such as accidents, violations, and driving experience.

Vehicle Type

The type of vehicle you drive is another crucial factor influencing your car insurance rates. Insurance companies assess the risk associated with different vehicles based on factors like safety features, theft risk, and repair costs.

- Make and Model: Certain car makes and models are statistically more prone to accidents or theft. Insurance companies factor this into their rate calculations, with higher-risk vehicles typically attracting higher premiums.

- Safety Features: Vehicles equipped with advanced safety features, such as anti-lock brakes, airbags, and electronic stability control, are generally considered safer and may qualify for lower insurance rates.

- Value and Repair Costs: The cost of repairing or replacing a vehicle significantly impacts insurance premiums. Vehicles with higher repair costs, like luxury or sports cars, often have higher insurance rates.

Coverage Options

The amount and type of coverage you choose directly affect your insurance premiums. Higher coverage levels generally mean higher premiums. Understanding the different coverage options and their impact on your budget is essential.

| Coverage Type | Description | Impact on Premiums |

|---|---|---|

| Liability Coverage | Covers damages to other people’s property or injuries to others in an accident you cause. | Higher liability limits result in higher premiums. |

| Collision Coverage | Covers damage to your vehicle in an accident, regardless of fault. | Optional coverage; higher deductibles result in lower premiums. |

| Comprehensive Coverage | Covers damage to your vehicle from non-accident events, such as theft, vandalism, or natural disasters. | Optional coverage; higher deductibles result in lower premiums. |

| Uninsured/Underinsured Motorist Coverage | Protects you if you are involved in an accident with a driver who has no or insufficient insurance. | Optional coverage; can be expensive but provides essential protection. |

Age

Your age plays a significant role in determining your car insurance rates. Younger drivers, particularly those under 25, are statistically more likely to be involved in accidents. Insurance companies consider this higher risk and charge higher premiums for younger drivers. However, as drivers gain experience and reach their mid-20s, their premiums tend to decrease. Older drivers, especially those over 65, may also face higher premiums due to potential health concerns that could affect their driving abilities.

Location

Your location in Florida significantly impacts your car insurance rates. Insurance companies consider the accident frequency and severity in different areas. Areas with higher accident rates, denser populations, and more traffic congestion generally have higher car insurance premiums. Additionally, factors like the cost of living and the availability of repair services in your area can also influence your rates.

Credit Score

In many states, including Florida, insurance companies can use your credit score as a factor in determining your car insurance rates. This practice is controversial, but insurers argue that credit score is a good predictor of risk. Individuals with lower credit scores are statistically more likely to file insurance claims, leading to higher premiums. Improving your credit score can potentially lower your car insurance premiums.

Finding Affordable Car Insurance Options

Navigating the world of Florida car insurance can feel like a maze, especially when you’re seeking the most affordable option. With so many providers and varying coverage plans, finding the right fit for your budget can be a challenge. This section will guide you through the process of comparing insurance providers, exploring available discounts, and leveraging reliable comparison websites to secure the best deals.

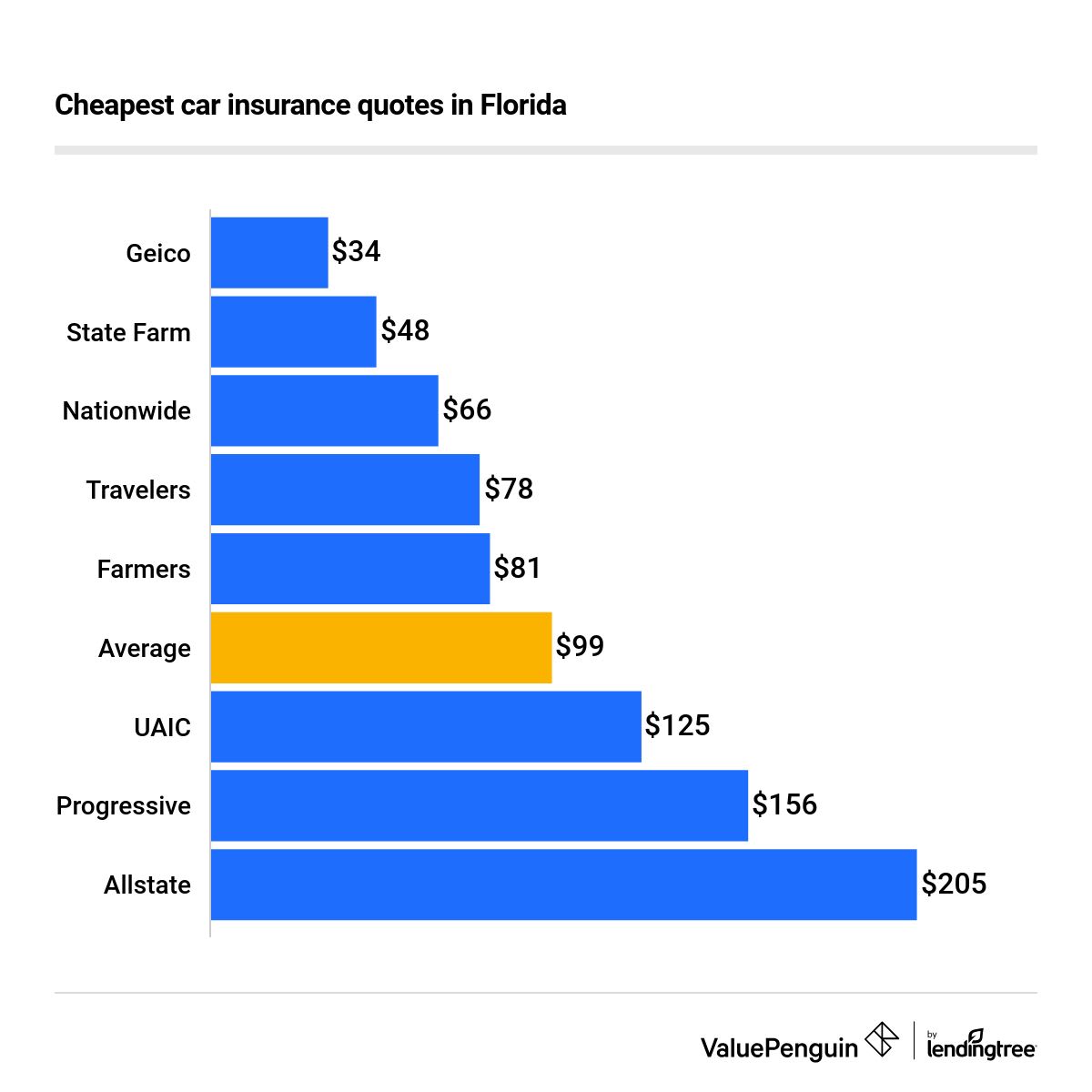

Comparing Insurance Providers

Understanding the differences in pricing and coverage offered by various insurance companies is crucial for finding the best deal. It’s essential to compare quotes from multiple providers to identify the most competitive options.

- Geico: Known for its competitive rates and extensive online tools, Geico offers a wide range of coverage options. It’s often considered a top choice for drivers with good driving records.

- State Farm: A well-established and reputable insurer, State Farm provides comprehensive coverage and a strong customer service network. It offers various discounts, including good driver and multi-policy discounts.

- Progressive: Progressive stands out for its personalized coverage options and innovative features, such as its “Name Your Price” tool that allows you to customize your policy based on your budget.

- USAA: Exclusively available to military personnel and their families, USAA consistently receives high marks for its exceptional customer service and competitive rates.

- Florida Peninsula: As a Florida-based insurer, Florida Peninsula specializes in providing affordable coverage for drivers in the state. It offers a variety of discounts and specialized programs for specific demographics.

Discount Programs and Special Offers

Many insurance companies offer discount programs and special offers to reduce your premiums. These discounts can vary based on your individual circumstances and the insurer’s policies.

- Good Driver Discounts: Maintaining a clean driving record with no accidents or violations can significantly reduce your premiums.

- Multi-Policy Discounts: Bundling your car insurance with other policies, such as homeowners or renters insurance, can lead to substantial savings.

- Safety Features Discounts: Installing safety features in your vehicle, such as anti-theft devices or airbags, can qualify you for discounts.

- Student Discounts: Good student discounts are often available to students who maintain a certain GPA.

- Senior Discounts: Drivers over a certain age may qualify for discounts based on their experience and driving habits.

Reputable Insurance Comparison Websites

Using insurance comparison websites can streamline the process of finding the best deals. These websites gather quotes from multiple insurers, allowing you to compare options side-by-side and make informed decisions.

- Policygenius: Policygenius is a popular platform that offers a user-friendly interface for comparing quotes from various insurance companies. It provides detailed information about each provider and coverage plan, making it easier to choose the right option.

- The Zebra: The Zebra is another well-regarded website that simplifies the insurance comparison process. It allows you to filter quotes based on your specific needs and preferences, making it easy to find the most suitable policy.

- Insurify: Insurify is known for its comprehensive coverage options and ability to compare quotes from a wide range of insurers. It also offers personalized recommendations based on your driving history and other factors.

Tips for Saving on Car Insurance

Finding affordable car insurance in Florida is crucial, but it’s also possible to save money on your premiums by implementing smart strategies. By understanding the factors influencing your rates and taking proactive steps, you can significantly reduce your insurance costs.

Improving Driving Habits and Maintaining a Clean Driving Record

A clean driving record is one of the most significant factors affecting your insurance premiums. Insurance companies consider drivers with a history of accidents, traffic violations, or DUI convictions to be higher risk and charge higher premiums.

- Drive Safely and Defensively: Practice safe driving habits by obeying traffic laws, avoiding distractions, and maintaining a safe following distance.

- Avoid Traffic Violations: Every speeding ticket, reckless driving citation, or parking violation can lead to increased insurance premiums.

- Take Defensive Driving Courses: Many insurance companies offer discounts for completing defensive driving courses. These courses teach safe driving techniques and can help you improve your driving skills, potentially leading to fewer accidents and lower premiums.

Bundling Insurance Policies and Exploring Discounts, Cheapest insurance in florida car

Bundling multiple insurance policies, such as car insurance, homeowners insurance, and renters insurance, with the same company can often result in significant discounts. Insurance companies offer these discounts because they view bundled customers as less risky and more likely to remain loyal.

- Compare Bundled Rates: Contact your current insurance company and inquire about bundling discounts. You can also compare quotes from other insurance providers to see if bundling offers a better deal.

- Explore Discounts for Safety Features: Many insurance companies offer discounts for vehicles equipped with safety features such as anti-theft devices, airbags, anti-lock brakes, and daytime running lights.

- Consider Discounts for Good Students: If you have a teenager driving your car, inquire about discounts for good students. Some insurance companies offer lower premiums to students who maintain a certain GPA.

Negotiating with Insurance Companies

While insurance companies have set rates, you can still negotiate for lower premiums.

- Shop Around for Quotes: Get quotes from multiple insurance providers to compare rates and find the best deal. Don’t hesitate to negotiate with your current insurer to match or beat a lower quote from another company.

- Be Prepared to Switch Companies: If your current insurer is unwilling to negotiate, be prepared to switch to a different company offering a lower rate. The threat of losing a customer can often incentivize insurance companies to offer better deals.

- Highlight Your Positive Driving Record: Emphasize your clean driving history and lack of accidents or violations. This can strengthen your position during negotiations.

Essential Coverage for Florida Drivers

In Florida, having the right car insurance coverage is crucial, not just to comply with the law but also to protect yourself financially in case of an accident. Understanding the different types of coverage and their importance is key to making informed decisions about your insurance policy.

Minimum Liability Coverage in Florida

Florida law requires all drivers to carry a minimum amount of liability insurance. This coverage protects you financially if you cause an accident that results in injuries or property damage to others. The minimum requirements are:

* $10,000 per person for bodily injury liability

* $20,000 per accident for bodily injury liability

* $10,000 per accident for property damage liability

It’s important to note that these minimum limits may not be sufficient to cover the costs of a serious accident. If you are found liable for significant damages, you could be personally responsible for paying the difference.

Benefits of Additional Coverage Options

While minimum liability coverage is required, it’s highly advisable to consider additional coverage options to provide comprehensive protection:

* Collision Coverage: This coverage pays for repairs to your vehicle if you are involved in an accident, regardless of who is at fault.

* Comprehensive Coverage: This coverage protects your vehicle against damages from events other than collisions, such as theft, vandalism, or natural disasters.

* Uninsured Motorist Protection: This coverage protects you if you are injured in an accident caused by an uninsured or underinsured driver.

Coverage Options and Costs

| Coverage Option | Description | Typical Cost (Annual) |

|—|—|—|

| Minimum Liability | Meets Florida’s minimum insurance requirements | $400 – $600 |

| Collision | Covers repairs to your vehicle in an accident | $200 – $400 |

| Comprehensive | Covers damage to your vehicle from non-collision events | $100 – $200 |

| Uninsured Motorist Protection | Protects you from uninsured or underinsured drivers | $50 – $100 |

The actual cost of car insurance will vary depending on factors such as your driving record, age, vehicle type, and location.

Navigating the Insurance Claims Process

Filing a car insurance claim in Florida can be a stressful experience, but understanding the process can make it smoother. This guide will walk you through the steps involved, explain different claim types, and provide tips for a positive outcome.

Filing a Car Insurance Claim

Knowing how to file a claim is essential. Here’s a step-by-step guide:

- Contact Your Insurance Company: Immediately report the accident to your insurance company, providing details like the date, time, location, and involved parties. Most companies offer 24/7 claim reporting through phone, online portals, or mobile apps.

- Gather Information: Collect as much information as possible, including police reports, witness statements, photos of the damage, and contact details of all parties involved.

- Submit Your Claim: Follow your insurance company’s instructions for submitting your claim, which may involve completing forms, providing documentation, and scheduling an inspection.

- Work with the Adjuster: An insurance adjuster will assess the damage and determine the amount of coverage. Be transparent and cooperative, providing all necessary information.

- Negotiate a Settlement: If you disagree with the adjuster’s initial assessment, you have the right to negotiate a settlement. It’s advisable to seek legal advice if you need help with the negotiation process.

- Receive Payment: Once the settlement is finalized, your insurance company will issue payment for repairs, medical expenses, or other covered losses.

Types of Car Insurance Claims

Florida insurance claims fall into various categories:

- Property Damage Claims: These involve damage to your vehicle or another person’s property, such as a parked car or a fence. Your insurance company will cover repairs or replacement costs, subject to your coverage limits.

- Bodily Injury Claims: These arise from injuries sustained in an accident, including medical expenses, lost wages, and pain and suffering. Your insurance company will cover these expenses, subject to your coverage limits.

- Uninsured/Underinsured Motorist Claims: These are filed when you are involved in an accident with a driver who lacks insurance or has insufficient coverage. Your own insurance policy will cover your losses, subject to your uninsured/underinsured motorist coverage limits.

Tips for a Smooth Claims Experience

Following these tips can make the claims process more efficient:

- Document Everything: Keep detailed records of the accident, including dates, times, locations, and witness information. Take photos or videos of the damage and injuries.

- Be Honest and Cooperative: Provide accurate information to your insurance company and cooperate with the adjuster’s investigation. Avoid making false statements or exaggerating your claims.

- Understand Your Policy: Review your insurance policy carefully to understand your coverage limits, deductibles, and exclusions. This will help you navigate the claims process effectively.

- Seek Legal Advice: If you are unsure about your rights or if you are having difficulty with your insurance company, it’s advisable to seek legal advice from an experienced attorney.

Conclusion

Finding the cheapest car insurance in Florida doesn’t have to be a daunting task. By understanding the key factors that influence pricing, comparing quotes from different insurers, and taking advantage of available discounts, you can secure affordable coverage that protects you and your vehicle. Remember to prioritize comprehensive coverage, shop around, and don’t hesitate to negotiate with insurance companies to find the best possible deal.

Q&A

What is the minimum car insurance coverage required in Florida?

Florida requires drivers to have a minimum amount of liability coverage, which includes $10,000 for bodily injury per person, $20,000 for bodily injury per accident, and $10,000 for property damage per accident.

What are some common discounts offered by car insurance companies in Florida?

Common discounts include good driver discounts, safe driver discounts, multi-car discounts, and discounts for bundling insurance policies.

How often should I review my car insurance policy?

It’s recommended to review your car insurance policy at least annually to ensure you’re still getting the best rates and coverage for your needs.

What are the consequences of driving without car insurance in Florida?

Driving without car insurance in Florida is illegal and can result in fines, license suspension, and even jail time.