- Understanding Florida Car Insurance Requirements

- Factors Influencing Car Insurance Premiums in Florida

- Key Considerations for Choosing Car Insurance in Florida

- Finding the Best Car Insurance Deals in Florida: Car Insurance Florida Compare

- Understanding Florida’s No-Fault Insurance System

- Additional Considerations for Car Insurance in Florida

- Last Word

- Essential FAQs

Car insurance Florida compare is a crucial step for any driver in the Sunshine State. Navigating Florida’s unique insurance landscape can be complex, with its no-fault system and mandatory coverages. This guide provides a comprehensive overview of car insurance in Florida, helping you understand your requirements, factors influencing premiums, and strategies for finding the best deals.

From understanding the minimum liability limits to exploring different coverage options, we’ll delve into key considerations for choosing car insurance in Florida. We’ll also equip you with tips for comparing quotes, negotiating lower premiums, and ensuring you’re adequately protected on the road.

Understanding Florida Car Insurance Requirements

Driving in Florida requires you to comply with specific insurance requirements to protect yourself and others on the road. The state mandates that all drivers carry a minimum level of car insurance coverage to ensure financial responsibility in case of an accident.

Mandatory Coverage Requirements

Florida law requires all drivers to have the following minimum insurance coverage:

- Personal Injury Protection (PIP): This coverage pays for medical expenses, lost wages, and other related costs for the insured and passengers in their vehicle, regardless of who is at fault.

- Property Damage Liability (PDL): This coverage pays for damages to another person’s property, such as their vehicle, if you are at fault in an accident.

- Bodily Injury Liability (BIL): This coverage pays for medical expenses, lost wages, and other related costs for injuries to other people if you are at fault in an accident.

Minimum Liability Limits

Florida law sets minimum liability limits for bodily injury and property damage coverage:

- Bodily Injury Liability (BIL): $10,000 per person/$20,000 per accident. This means that your insurance company will pay up to $10,000 for injuries to one person in an accident and up to $20,000 for all injuries in a single accident.

- Property Damage Liability (PDL): $10,000. This means your insurance company will pay up to $10,000 for damages to another person’s property in an accident.

Personal Injury Protection (PIP)

PIP coverage is mandatory in Florida and plays a crucial role in covering medical expenses following an accident. It is a no-fault coverage, meaning that it pays for your medical expenses regardless of who is at fault in the accident.

- Medical Expenses: PIP covers reasonable and necessary medical expenses, including doctor visits, hospital stays, surgeries, and rehabilitation.

- Lost Wages: PIP can also cover lost wages if you are unable to work due to injuries sustained in an accident.

- Other Expenses: PIP may cover other expenses related to your injuries, such as funeral expenses, transportation costs, and home health care.

Important Note: Florida’s PIP coverage is limited to $10,000 per person. If your medical expenses exceed this limit, you may be responsible for the remaining costs.

Factors Influencing Car Insurance Premiums in Florida

Your driving history and traffic violations play a significant role in determining your car insurance premiums in Florida. Insurance companies assess your risk based on your driving record, and a history of accidents or violations can lead to higher premiums.

Driving History and Traffic Violations

Your driving record is a crucial factor in determining your car insurance premiums in Florida. Insurance companies use your driving history to assess your risk as a driver. A clean driving record with no accidents or violations will generally result in lower premiums. Conversely, a history of accidents or traffic violations can significantly increase your insurance costs.

- Accidents: Each accident you’ve been involved in, regardless of fault, is recorded on your driving record. Insurance companies consider the severity of the accident, the number of accidents, and the time elapsed since the last accident. The more accidents you have, the higher your premiums are likely to be.

- Traffic Violations: Traffic violations, such as speeding tickets, running red lights, or driving under the influence, also impact your insurance premiums. These violations demonstrate a higher risk of future accidents, leading to increased insurance costs. The severity of the violation and the number of violations will affect the premium increase.

- Points on Your License: In Florida, traffic violations can result in points being added to your driving record. These points can lead to higher insurance premiums, and a certain number of points can even result in the suspension of your driver’s license.

Age, Gender, and Credit Score

Besides your driving record, other factors also influence your car insurance premiums in Florida. These factors include your age, gender, and credit score.

- Age: Younger drivers, particularly those under 25, are statistically more likely to be involved in accidents. Insurance companies often charge higher premiums for younger drivers due to their higher risk profile. As you age and gain more driving experience, your premiums typically decrease.

- Gender: In some states, insurance companies may charge different premiums based on gender. However, this practice is becoming increasingly uncommon due to regulations and concerns about gender discrimination. In Florida, insurance companies are prohibited from using gender as a factor in determining premiums.

- Credit Score: Your credit score may seem unrelated to driving, but insurance companies in Florida can use it as a factor in determining your premiums. A lower credit score can indicate a higher risk of financial instability, which can translate to higher insurance costs.

Vehicle Type and Model

The type and model of your vehicle can also influence your car insurance premiums in Florida. Insurance companies consider factors like the vehicle’s safety features, repair costs, and theft risk when determining premiums.

- Safety Features: Vehicles with advanced safety features, such as anti-lock brakes, airbags, and stability control, are generally considered safer and may qualify for lower insurance premiums.

- Repair Costs: Vehicles with high repair costs, such as luxury cars or sports cars, can result in higher insurance premiums. Insurance companies factor in the cost of repairs in case of an accident.

- Theft Risk: Vehicles that are more prone to theft, such as expensive models or popular car models, may have higher insurance premiums. Insurance companies consider the risk of theft when setting premiums.

Key Considerations for Choosing Car Insurance in Florida

Choosing the right car insurance in Florida is crucial to protect yourself financially in case of an accident. Several factors influence your premium, and understanding the different coverage options available can help you make an informed decision.

Understanding Different Coverage Options, Car insurance florida compare

Car insurance policies in Florida offer various coverage options, each with its own benefits and drawbacks. Here’s a breakdown of some key coverage types:

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if you’re involved in an accident, regardless of who is at fault. Collision coverage is optional, but it’s generally recommended for newer vehicles or those with significant loan balances. The benefit of collision coverage is that it provides financial protection for your vehicle in case of an accident, allowing you to repair or replace it. However, the drawback is that it can increase your premium.

- Comprehensive Coverage: This coverage protects your vehicle against damage caused by events other than collisions, such as theft, vandalism, natural disasters, and falling objects. Like collision coverage, comprehensive coverage is optional, but it’s generally recommended for newer or more expensive vehicles. The benefit of comprehensive coverage is that it provides financial protection for your vehicle against a wide range of risks. The drawback is that it can increase your premium.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you and your passengers if you’re involved in an accident with a driver who is uninsured or underinsured. This coverage is mandatory in Florida, but you can choose your coverage limits. The benefit of uninsured/underinsured motorist coverage is that it provides financial protection if you’re involved in an accident with a driver who doesn’t have sufficient insurance. The drawback is that it can increase your premium.

- Personal Injury Protection (PIP): This coverage pays for medical expenses and lost wages for you and your passengers, regardless of who is at fault in an accident. PIP coverage is mandatory in Florida, with a minimum coverage limit of $10,000. The benefit of PIP coverage is that it provides financial protection for your medical expenses and lost wages in case of an accident. The drawback is that it can increase your premium.

- Liability Coverage: This coverage protects you financially if you cause an accident that injures another person or damages their property. Liability coverage is mandatory in Florida, with minimum limits of $10,000 for bodily injury per person, $20,000 for bodily injury per accident, and $10,000 for property damage. The benefit of liability coverage is that it provides financial protection for the other party’s injuries and property damage if you cause an accident. The drawback is that it can increase your premium if you choose higher limits.

Comparing Car Insurance Providers in Florida

Several car insurance providers operate in Florida, each offering varying coverage options and premiums. Comparing quotes from multiple providers can help you find the best value for your needs. Here’s a table comparing the features and pricing of some popular insurance providers in Florida:

| Insurance Provider | Average Annual Premium | Coverage Options | Discounts | Customer Service Rating |

|---|---|---|---|---|

| State Farm | $1,500 | Collision, Comprehensive, Uninsured/Underinsured Motorist, PIP, Liability | Safe Driver, Good Student, Multi-Car, Multi-Policy | 4.5/5 |

| Geico | $1,400 | Collision, Comprehensive, Uninsured/Underinsured Motorist, PIP, Liability | Safe Driver, Good Student, Multi-Car, Multi-Policy | 4.0/5 |

| Progressive | $1,300 | Collision, Comprehensive, Uninsured/Underinsured Motorist, PIP, Liability | Safe Driver, Good Student, Multi-Car, Multi-Policy | 3.5/5 |

| Allstate | $1,600 | Collision, Comprehensive, Uninsured/Underinsured Motorist, PIP, Liability | Safe Driver, Good Student, Multi-Car, Multi-Policy | 4.0/5 |

Note: The average annual premium figures are estimates and may vary based on individual factors such as driving history, vehicle type, and location. It’s essential to obtain personalized quotes from multiple providers to compare prices accurately.

Finding the Best Car Insurance Deals in Florida: Car Insurance Florida Compare

Securing the most favorable car insurance rates in Florida requires a proactive approach. By understanding the process of comparing quotes, carefully evaluating insurance providers, and implementing negotiation strategies, you can significantly reduce your insurance premiums and find the best deal.

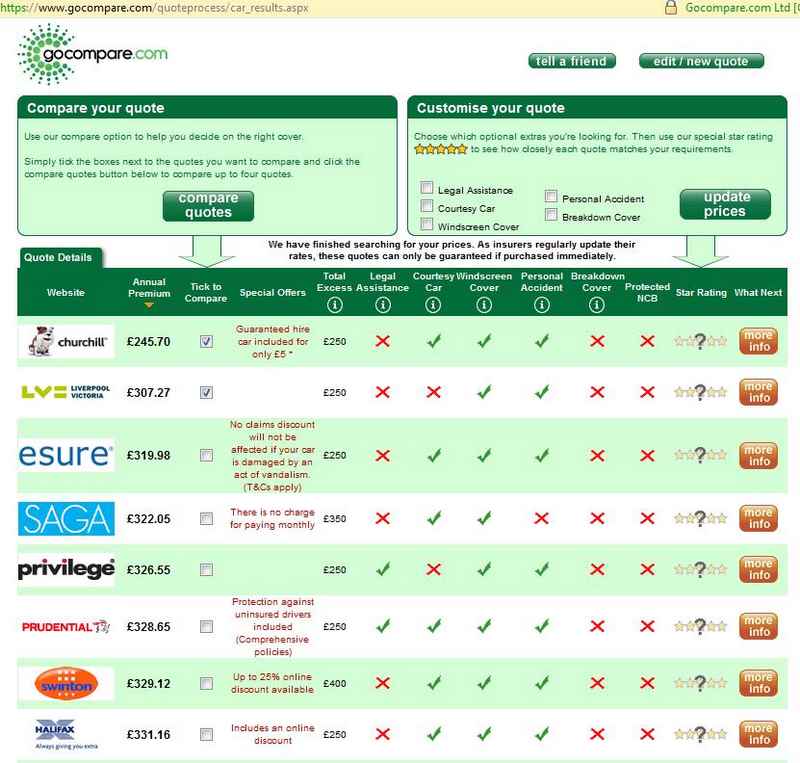

Comparing Quotes from Different Insurance Companies

To find the best car insurance deal, it’s crucial to compare quotes from multiple insurance companies. This allows you to assess the range of available coverage options and premiums, ensuring you choose the most suitable plan for your needs.

- Utilize Online Comparison Tools: Websites like Policygenius, Insurance.com, and NerdWallet offer comprehensive comparison tools. These platforms allow you to enter your personal information and vehicle details, and they will generate quotes from various insurance companies in real-time.

- Contact Insurance Companies Directly: Don’t solely rely on online comparison tools. Contact insurance companies directly to obtain personalized quotes. This gives you the opportunity to discuss specific coverage needs and ask questions about their policies.

- Request Quotes from Local Agents: Local insurance agents can provide valuable insights into the insurance market in your area. They can offer personalized recommendations based on your individual circumstances.

Factors to Consider When Choosing a Provider

Beyond price, it’s essential to evaluate other factors when selecting an insurance provider. This ensures you choose a company that provides reliable coverage, excellent customer service, and financial stability.

- Customer Service: Consider the company’s reputation for customer service. Research online reviews and ratings to gauge their responsiveness, friendliness, and ability to resolve issues promptly.

- Claims Handling Process: A smooth and efficient claims handling process is crucial. Research the company’s track record in processing claims quickly and fairly. Look for companies with high customer satisfaction ratings for claims handling.

- Financial Stability: Ensure the insurance company has a strong financial standing. You can check the company’s financial ratings from organizations like AM Best and Standard & Poor’s.

- Coverage Options: Compare the coverage options offered by different insurance companies. Consider factors like liability limits, comprehensive and collision coverage, and uninsured/underinsured motorist coverage.

- Discounts: Explore available discounts. Many insurance companies offer discounts for safe driving records, good grades, multiple car insurance policies, and safety features in your vehicle.

Negotiating Lower Premiums

Negotiating with insurance companies can help you secure lower premiums. By leveraging your knowledge of the market and employing effective negotiation strategies, you can potentially save money on your car insurance.

- Shop Around Regularly: Don’t assume your current insurance provider is offering the best rates. Regularly compare quotes from other companies to ensure you’re getting the most competitive prices.

- Bundle Your Policies: Consider bundling your car insurance with other policies, such as homeowners or renters insurance. Many insurance companies offer discounts for bundling multiple policies.

- Increase Your Deductible: A higher deductible means you pay more out of pocket in case of an accident, but it can lower your premium. Carefully assess your financial situation and determine the deductible amount you’re comfortable with.

- Improve Your Driving Record: A clean driving record is a significant factor in determining your insurance premium. By avoiding accidents and traffic violations, you can qualify for lower rates.

- Ask for Discounts: Don’t hesitate to inquire about available discounts. Many insurance companies offer discounts for various factors, such as safety features in your vehicle, good student status, and membership in certain organizations.

Understanding Florida’s No-Fault Insurance System

Florida operates under a no-fault insurance system, which means that after an accident, drivers are primarily responsible for covering their own medical expenses and lost wages, regardless of who caused the accident. This system aims to streamline the claims process and reduce litigation.

The Concept of No-Fault Insurance

No-fault insurance requires drivers to carry Personal Injury Protection (PIP) coverage, which pays for medical expenses and lost wages for the insured and their passengers, regardless of fault. The PIP coverage limit is $10,000, and the insured can choose a lower limit, but it’s generally recommended to carry the full amount. This system simplifies the claims process, as you file a claim with your own insurer rather than the insurer of the other driver.

Filing a Claim Under Florida’s No-Fault System

To file a claim under Florida’s no-fault system, you must first contact your insurance company and provide them with the necessary information about the accident, such as the date, time, location, and the names of the parties involved. Your insurer will then process your claim and begin paying for your medical expenses and lost wages.

Limitations and Exceptions to No-Fault Coverage

While Florida’s no-fault system is designed to simplify the claims process, there are certain limitations and exceptions to consider:

- If your injuries are severe, you may be able to file a claim against the other driver, regardless of whether they were at fault. This is called a “serious injury” threshold, and it includes injuries like permanent disability, significant scarring, or death.

- You may also be able to file a claim against the other driver if you were injured by an uninsured or underinsured motorist.

- You can also file a claim for property damage, even if the damage is minor, as Florida’s no-fault system does not cover property damage.

Additional Considerations for Car Insurance in Florida

Florida’s unique climate, driving culture, and susceptibility to natural disasters present specific challenges for car insurance. This section explores these challenges and offers guidance on protecting yourself against fraudulent claims.

Driving Risks in Florida

Florida’s high population density and tourist influx lead to increased traffic congestion and accidents. The state also has a significant number of elderly drivers, who are statistically more likely to be involved in accidents. Additionally, Florida’s warm weather and open roads encourage speeding, which contributes to the high number of traffic fatalities.

Last Word

By understanding your needs, exploring various insurance providers, and utilizing comparison tools, you can secure the most comprehensive and affordable car insurance in Florida. Remember, being informed and proactive can save you time, money, and potential headaches in the long run.

Essential FAQs

What are the minimum car insurance requirements in Florida?

Florida requires drivers to have a minimum of $10,000 in Personal Injury Protection (PIP), $10,000 in Property Damage Liability (PDL), and $10,000 in Bodily Injury Liability (BIL) per person and $20,000 per accident.

What are the best car insurance companies in Florida?

The best car insurance company for you depends on your individual needs and budget. Consider factors like coverage options, customer service, claims handling, and financial stability when making your decision. It’s always a good idea to compare quotes from multiple insurers.

How can I get discounts on car insurance in Florida?

Many insurance companies offer discounts for factors like good driving history, safety features in your car, bundling insurance policies, and being a member of certain organizations.

What are the implications of Florida’s no-fault insurance system?

Florida’s no-fault system means you must file a claim with your own insurance company, regardless of who caused the accident. This can expedite the claims process but also limits your ability to sue the other driver for pain and suffering.