- Factors Influencing Florida Car Insurance Costs

- Understanding Florida’s Insurance Market

- Comparing Car Insurance Rates in Florida

- Strategies for Lowering Car Insurance Costs in Florida

- Understanding Florida’s No-Fault Insurance System

- Common Car Insurance Coverage Options in Florida

- Florida’s Unique Insurance Challenges: Florida Car Insurance Cost

- Closure

- Top FAQs

Florida car insurance cost is a significant expense for many residents, often influenced by a unique blend of factors. The Sunshine State’s high population density, susceptibility to hurricanes, and complex insurance regulations contribute to a higher cost of coverage compared to other states. Understanding the intricacies of Florida’s insurance market is crucial for finding the best rates and securing the protection you need.

This comprehensive guide delves into the key factors affecting Florida car insurance costs, providing insights into how your driving history, vehicle type, coverage levels, and even your credit score can impact your premiums. We’ll explore strategies for lowering your costs, compare rates across different regions, and guide you through the complexities of Florida’s no-fault insurance system.

Factors Influencing Florida Car Insurance Costs

Florida’s car insurance market is unique and often more expensive than other states. This is due to a combination of factors, including a high population density, a large number of tourists, and a high frequency of natural disasters.

Demographics

Demographics play a significant role in determining car insurance premiums. Insurers consider factors like age, gender, and marital status to assess risk.

- Age: Younger drivers are statistically more likely to be involved in accidents, resulting in higher premiums. As drivers age and gain experience, their premiums tend to decrease.

- Gender: Historically, men have been found to have higher accident rates than women, leading to higher premiums for male drivers. However, this gap is narrowing in recent years.

- Marital Status: Married individuals often have lower insurance premiums than single individuals. This is attributed to the assumption that married individuals are more responsible and have a lower risk of accidents.

Driving History

Driving history is a major factor in determining car insurance costs. A clean driving record with no accidents or violations will result in lower premiums.

- Accidents: Any accidents, even minor ones, can significantly increase insurance premiums. The severity of the accident, fault, and the number of accidents will impact the increase.

- Traffic Violations: Speeding tickets, DUI convictions, and other traffic violations can result in higher premiums. The severity of the violation and the number of violations will influence the impact on premiums.

- Driving Record: A clean driving record with no accidents or violations will result in lower premiums. The longer a driver has a clean record, the lower their premiums are likely to be.

Vehicle Type

The type of vehicle you drive significantly impacts your insurance costs.

- Vehicle Value: More expensive vehicles, like luxury cars or sports cars, are more costly to repair or replace, leading to higher premiums.

- Safety Features: Vehicles with advanced safety features, such as anti-lock brakes, airbags, and stability control, are generally considered safer and can lead to lower premiums.

- Vehicle Age: Newer vehicles are generally safer and have lower repair costs than older vehicles, resulting in lower premiums.

Coverage Levels

The level of coverage you choose impacts your insurance premiums.

- Liability Coverage: This coverage protects you financially if you are at fault in an accident. Higher liability limits will result in higher premiums, but provide greater financial protection.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if you are involved in an accident, regardless of fault. Choosing a higher deductible can lower your premiums but increase your out-of-pocket expenses in the event of an accident.

- Comprehensive Coverage: This coverage protects you from damage to your vehicle caused by events other than accidents, such as theft, vandalism, or natural disasters. Higher deductibles can lower your premiums but increase your out-of-pocket expenses in the event of a covered incident.

Florida’s Unique Insurance Market

Florida’s car insurance market is unique and presents challenges that contribute to higher costs.

- High Population Density: Florida’s high population density leads to increased traffic congestion and a higher likelihood of accidents, contributing to higher insurance premiums.

- Tourist Traffic: The state’s large number of tourists can contribute to higher accident rates, as visitors may be unfamiliar with local roads and driving conditions.

- Susceptibility to Natural Disasters: Florida’s vulnerability to hurricanes, floods, and other natural disasters can increase insurance costs, as insurers factor in the potential for catastrophic claims.

Understanding Florida’s Insurance Market

Florida’s car insurance market is unique and complex, influenced by factors like the state’s high population density, frequent weather events, and a history of litigation. Understanding the dynamics of this market is crucial for consumers to make informed decisions about their insurance coverage.

The Role of the Florida Office of Insurance Regulation (OIR)

The Florida Office of Insurance Regulation (OIR) plays a vital role in overseeing the state’s insurance market, ensuring fairness and stability for both consumers and insurers. It has broad regulatory powers, including:

- Setting rates and approving insurance policies

- Monitoring the financial solvency of insurance companies

- Investigating complaints against insurance companies

- Promoting consumer education and awareness

The OIR works to strike a balance between protecting consumers and ensuring the financial viability of insurance companies. It regularly reviews insurance rates and policies, ensuring they are fair and reasonable. The OIR also actively monitors the financial health of insurance companies, intervening if necessary to protect policyholders’ interests.

Types of Car Insurance Providers in Florida

Florida’s car insurance market is diverse, with a range of providers offering different types of coverage. These providers can be broadly categorized as:

- Private Companies: These are the most common type of insurance providers, offering a wide range of coverage options and services. Some examples include State Farm, Geico, and Progressive.

- State-Run Programs: Florida offers a few state-run programs, such as the Florida Automobile Joint Underwriting Association (FAJUA), which provides coverage to drivers who are unable to obtain insurance through private companies. This program is often used as a last resort for high-risk drivers.

- Mutual Insurers: These are insurance companies owned by their policyholders. They often offer lower premiums and greater control over their operations. Examples include USAA and Nationwide.

The type of provider you choose will depend on your individual needs and preferences. Private companies often offer a wider range of coverage options and services, while state-run programs can provide a safety net for high-risk drivers. Mutual insurers can be a good option for drivers seeking lower premiums and greater control over their insurance.

Impact of Insurance Reforms and Legislation

Florida’s car insurance market has been subject to numerous reforms and legislative changes over the years, often driven by concerns about rising insurance costs and the state’s high number of lawsuits. These changes have had a significant impact on car insurance costs in the state. For example, the passage of the Personal Injury Protection (PIP) reforms in 2012 significantly reduced the amount of PIP benefits available to accident victims, which in turn led to lower insurance premiums for many drivers.

“The Florida Legislature has attempted to balance the interests of consumers and insurance companies through a series of reforms. These reforms have aimed to reduce fraud, litigation, and overall costs.”

However, the impact of these reforms has been complex and multifaceted, with some arguing that they have led to a decline in the quality of healthcare available to accident victims. The ongoing debate over insurance reforms in Florida highlights the delicate balance between ensuring affordability and providing adequate coverage for consumers.

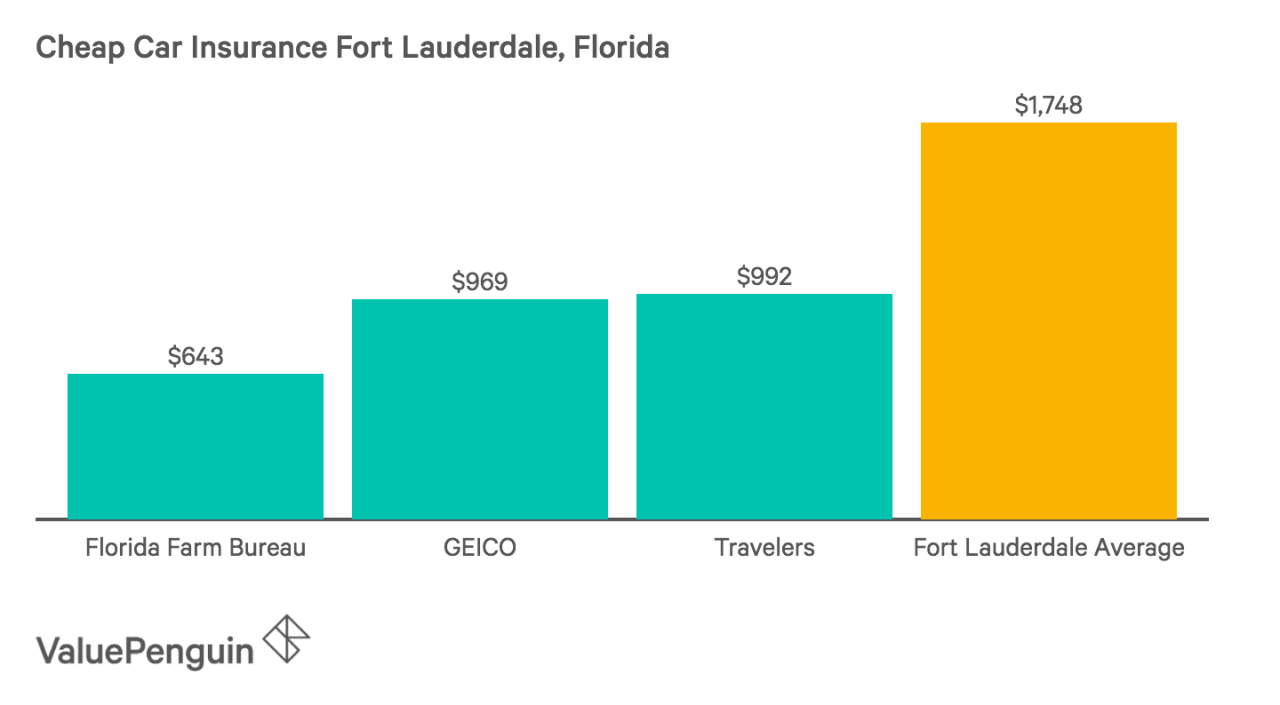

Comparing Car Insurance Rates in Florida

Florida’s car insurance market is highly competitive, with numerous insurers offering a wide range of coverage options and prices. Understanding the factors influencing car insurance costs in Florida is crucial for drivers seeking the best deals. This section compares average car insurance rates across different cities and regions in Florida, highlighting any significant variations and exploring the factors contributing to these regional differences.

Average Car Insurance Rates by City and Region

Car insurance rates in Florida vary significantly depending on the city and region. The following table presents average car insurance rates for different cities and regions in Florida:

| City/Region | Average Annual Premium |

|---|---|

| Miami | $2,500 |

| Tampa | $2,200 |

| Orlando | $2,000 |

| Jacksonville | $1,800 |

| South Florida (Miami-Dade, Broward, Palm Beach counties) | $2,400 |

| Central Florida (Orange, Seminole, Osceola counties) | $2,100 |

| North Florida (Jacksonville, Duval, Clay counties) | $1,900 |

These figures represent average premiums for a standard car insurance policy with liability coverage, collision coverage, comprehensive coverage, and uninsured motorist coverage.

Factors Contributing to Regional Rate Variations

Several factors contribute to the variations in car insurance rates across different cities and regions in Florida. These factors include:

- Population density and traffic congestion: Cities with high population density and traffic congestion often have higher car insurance rates due to an increased risk of accidents. Miami, for example, has a high population density and a significant amount of traffic congestion, leading to higher average car insurance rates compared to other regions in Florida.

- Crime rates: Regions with higher crime rates, particularly car theft and vandalism, tend to have higher car insurance rates. South Florida, known for its high crime rates, generally has higher average car insurance rates than other regions in Florida.

- Weather conditions: Florida’s hurricane season and frequent thunderstorms can increase the risk of car damage, leading to higher car insurance rates. Coastal regions in Florida, particularly those exposed to hurricanes, often have higher average car insurance rates than inland regions.

- Cost of living: Regions with higher costs of living, including healthcare and vehicle repair costs, tend to have higher car insurance rates. South Florida, with its high cost of living, generally has higher average car insurance rates than other regions in Florida.

- Competition among insurers: Regions with a higher number of insurance companies offering competitive rates tend to have lower average car insurance rates. Central Florida, with a large number of insurance companies operating in the region, generally has lower average car insurance rates than other regions in Florida.

Average Car Insurance Rates by Vehicle Type and Coverage Level

The average car insurance rate in Florida also varies depending on the type of vehicle and the level of coverage selected. The following table presents average car insurance rates for different vehicle types and coverage levels in Florida:

| Vehicle Type | Coverage Level | Average Annual Premium |

|---|---|---|

| Sedan | Liability Only | $800 |

| Sedan | Liability + Collision + Comprehensive | $1,500 |

| SUV | Liability Only | $900 |

| SUV | Liability + Collision + Comprehensive | $1,700 |

| Truck | Liability Only | $1,000 |

| Truck | Liability + Collision + Comprehensive | $1,900 |

These figures represent average premiums for a standard car insurance policy with liability coverage, collision coverage, comprehensive coverage, and uninsured motorist coverage.

Strategies for Lowering Car Insurance Costs in Florida

Navigating the high cost of car insurance in Florida can be daunting, but there are strategies you can employ to reduce your premiums. Understanding the factors that influence your rates, coupled with proactive measures, can significantly impact your overall cost. This section will explore practical tips and strategies to help you lower your car insurance costs in Florida.

Improving Driving Habits

One of the most significant factors impacting your car insurance premiums is your driving record. A clean driving history translates into lower rates. Insurers assess your risk based on past driving behavior, and a history of accidents or violations increases your premiums. Here are some tips to improve your driving habits and potentially lower your rates:

- Defensive Driving Courses: Completing a defensive driving course can help you learn safer driving techniques and potentially earn a discount on your insurance premiums. These courses are often offered online or in person and cover topics like defensive driving strategies, traffic laws, and accident prevention. Florida law mandates that insurers offer a discount to drivers who complete a state-approved defensive driving course.

- Avoid Distracted Driving: Distracted driving is a major contributor to accidents. Avoid using your phone, eating, or engaging in other activities while driving. Focus on the road ahead and be fully present while driving.

- Maintain a Safe Speed: Speeding tickets can significantly increase your insurance premiums. Adhere to posted speed limits and avoid aggressive driving behaviors.

- Avoid Driving Under the Influence: Driving under the influence of alcohol or drugs is extremely dangerous and can lead to severe consequences, including hefty insurance premiums. Always designate a sober driver or utilize alternative transportation if you plan to consume alcohol.

Maintaining a Good Credit Score

In Florida, insurers can use your credit score as a factor in determining your car insurance rates. A good credit score often indicates financial responsibility, which can translate into lower premiums. Here are some strategies to improve your credit score:

- Pay Bills on Time: Make sure to pay all your bills, including credit card bills, utility bills, and loans, on time. Late payments can negatively impact your credit score.

- Keep Credit Utilization Low: Credit utilization is the amount of credit you are using compared to your total available credit. Aim to keep your credit utilization below 30% to maintain a good credit score.

- Monitor Your Credit Report: Regularly review your credit report for errors or inaccuracies. You can obtain a free credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) annually.

Bundling Insurance Policies

Bundling your car insurance with other insurance policies, such as homeowners or renters insurance, can often result in significant discounts. Insurers reward customers who consolidate their policies, as it simplifies their administration and reduces the risk of losing customers. Here’s how bundling works:

- Multiple Policies, One Provider: When you bundle your insurance policies, you purchase them from the same insurance company. This allows the insurer to offer you a discounted rate on your combined policies.

- Discounts Vary: The amount of discount you receive for bundling can vary depending on the insurer and the specific policies you bundle. It’s essential to compare quotes from different insurers to see what kind of discounts are available.

- Convenience and Savings: Bundling your insurance policies offers convenience and savings. You have a single point of contact for all your insurance needs, and you can potentially save money on your premiums.

Discount Programs

Many insurers in Florida offer discount programs to reward good drivers and responsible policyholders. These programs can help you save money on your car insurance premiums. Here are some common discount programs available:

- Good Student Discount: This discount is typically available to students who maintain a certain GPA.

- Safe Driver Discount: Insurers reward drivers with a clean driving record by offering a safe driver discount.

- Multi-Car Discount: If you have multiple vehicles insured with the same insurer, you may qualify for a multi-car discount.

- Anti-theft Device Discount: Installing anti-theft devices in your vehicle can help reduce your insurance premiums.

- Loyalty Discount: Some insurers offer loyalty discounts to customers who have been with them for a certain period.

- Pay-in-Full Discount: Paying your car insurance premium in full upfront can often earn you a discount.

- Telematics Program: Some insurers offer telematics programs that use technology to track your driving habits. If you drive safely, you may qualify for a discount.

Shopping Around for Car Insurance Rates

The most effective way to find the best car insurance rates in Florida is to shop around and compare quotes from multiple insurers. Here’s a step-by-step guide:

- Gather Your Information: Before you start comparing quotes, gather all the necessary information, including your driver’s license number, vehicle identification number (VIN), and details about your driving history and coverage needs.

- Use Online Comparison Tools: Several online comparison tools allow you to enter your information and receive quotes from multiple insurers simultaneously. This can save you time and effort.

- Contact Insurers Directly: After using online comparison tools, consider contacting insurers directly to discuss your specific needs and get personalized quotes.

- Review Quotes Carefully: Once you receive quotes from multiple insurers, carefully review them to compare coverage, premiums, and discounts. Pay attention to the deductibles and limits of each policy.

- Consider Your Needs: Choose the insurer that offers the best combination of coverage, price, and customer service that aligns with your needs and budget.

Understanding Florida’s No-Fault Insurance System

Florida’s no-fault insurance system is a unique aspect of the state’s car insurance landscape. It operates on the principle that drivers are responsible for covering their own medical expenses and lost wages following a car accident, regardless of who is at fault. This system aims to reduce the number of lawsuits and expedite the claims process.

The Concept of No-Fault Insurance

No-fault insurance is a type of auto insurance where drivers are primarily responsible for covering their own losses after an accident, regardless of fault. In Florida, this means that you are required to have Personal Injury Protection (PIP) coverage, which covers your medical expenses and lost wages.

The Role of Personal Injury Protection (PIP) Coverage

PIP coverage is a mandatory component of Florida’s no-fault system. It pays for medical expenses, lost wages, and other related costs for the policyholder and passengers in their vehicle, regardless of who caused the accident. The amount of PIP coverage you are required to have is $10,000, but you can choose to purchase more.

Filing a Car Insurance Claim Under Florida’s No-Fault System

The process for filing a car insurance claim under Florida’s no-fault system is relatively straightforward.

- Report the accident to your insurance company. This should be done as soon as possible after the accident.

- Seek medical attention. It is important to seek medical attention for any injuries you sustained in the accident, even if they seem minor.

- Submit your claim to your insurance company. Your insurance company will review your claim and process your PIP benefits.

Common Car Insurance Coverage Options in Florida

Understanding the different types of car insurance coverage available in Florida is crucial for ensuring adequate protection in case of an accident. This section explores the key coverage options, outlining their benefits and drawbacks, and providing examples of situations where each coverage may be necessary.

Liability Coverage

Liability coverage is a fundamental component of car insurance in Florida. It protects you financially if you cause an accident that results in injuries or damage to another person’s property. Liability coverage typically includes:

* Bodily Injury Liability: Covers medical expenses, lost wages, and pain and suffering for injuries caused to others in an accident.

* Property Damage Liability: Covers damage to another person’s vehicle or property in an accident.

The minimum liability coverage required in Florida is 10/20/10, meaning $10,000 per person for bodily injury, $20,000 per accident for bodily injury, and $10,000 for property damage. However, it is generally advisable to carry higher limits, especially considering the potential for significant medical expenses and property damage in serious accidents.

Collision Coverage

Collision coverage pays for repairs or replacement of your vehicle if it is damaged in an accident, regardless of who is at fault. This coverage is optional, but it can be essential if you want to ensure that your vehicle is repaired or replaced after a collision.

Collision coverage is typically required if you have a loan or lease on your vehicle.

Comprehensive Coverage

Comprehensive coverage protects your vehicle from damage caused by events other than collisions, such as:

* Theft

* Vandalism

* Hail

* Fire

* Natural disasters

Like collision coverage, comprehensive coverage is optional. However, it can be beneficial if you want to protect your vehicle from unforeseen events.

Comprehensive coverage is typically required if you have a loan or lease on your vehicle.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist (UM/UIM) coverage protects you if you are injured in an accident caused by a driver who does not have insurance or has insufficient insurance to cover your damages. This coverage is optional but highly recommended, as it can help to cover your medical expenses, lost wages, and pain and suffering if you are involved in an accident with an uninsured or underinsured driver.

UM/UIM coverage is often included in your car insurance policy at no additional cost. However, it is essential to check your policy to ensure that you have adequate coverage.

Comparing Car Insurance Policies in Florida

| Policy | Liability Coverage | Collision Coverage | Comprehensive Coverage | UM/UIM Coverage |

|---|---|---|---|---|

| Basic Liability | 10/20/10 | No | No | No |

| Full Coverage | 25/50/25 | Yes | Yes | Yes |

| Limited Coverage | 10/20/10 | Yes | No | Yes |

| Customizable Policy | Variable | Variable | Variable | Variable |

The table above provides a general overview of common car insurance policy options in Florida. The specific coverage options and costs will vary depending on your individual needs and the insurance company you choose.

Florida’s Unique Insurance Challenges: Florida Car Insurance Cost

Florida’s car insurance market faces a unique set of challenges that significantly impact the cost of coverage for residents. These challenges stem from the state’s susceptibility to hurricanes, a history of insurance fraud, and a litigious environment. These factors combine to create a complex landscape that drives up premiums for Floridians.

The Impact of Hurricanes

Hurricanes pose a significant threat to Florida, leading to widespread property damage and substantial insurance claims. The frequency and intensity of hurricanes in recent years have resulted in significant losses for insurance companies, forcing them to raise premiums to offset their risk. For example, Hurricane Andrew in 1992 caused an estimated $26.5 billion in damages, leading to a substantial increase in insurance rates across the state.

Insurance Fraud, Florida car insurance cost

Florida has a history of insurance fraud, which further contributes to higher car insurance costs. Fraudulent claims, such as staged accidents and exaggerated injury claims, increase insurance company expenses and ultimately lead to higher premiums for all policyholders.

Litigious Environment

Florida’s legal system is known for its high volume of lawsuits, including those related to car accidents. This litigious environment encourages more claims and increases legal costs for insurance companies. These costs are then passed on to policyholders in the form of higher premiums.

Strategies for Addressing Challenges

Addressing these challenges requires a multi-pronged approach.

- Strengthening hurricane preparedness and mitigation strategies: Implementing stricter building codes, promoting community-wide preparedness programs, and investing in infrastructure improvements can help reduce hurricane-related damages and insurance claims.

- Combating insurance fraud: Strengthening fraud detection mechanisms, increasing penalties for fraudsters, and fostering public awareness about insurance fraud can help deter fraudulent activities and protect consumers.

- Reforming the legal system: Implementing measures to reduce frivolous lawsuits, promoting alternative dispute resolution methods, and streamlining the claims process can help reduce litigation costs and ultimately lower premiums.

Closure

Navigating Florida’s car insurance landscape can feel like a complex maze, but by understanding the factors influencing your rates and utilizing available strategies, you can secure affordable and comprehensive coverage. Remember to shop around, compare quotes, and explore discounts to find the best value for your specific needs. By taking a proactive approach, you can navigate the complexities of Florida’s insurance market and ensure you’re adequately protected on the road.

Top FAQs

What are the main factors influencing Florida car insurance costs?

Factors like your driving history, vehicle type, coverage levels, age, gender, credit score, and location all play a role in determining your Florida car insurance costs.

Is car insurance mandatory in Florida?

Yes, Florida requires all drivers to carry at least a minimum amount of liability insurance. This coverage protects you financially if you cause an accident and injure or damage another person or their property.

How can I find the best car insurance rates in Florida?

Compare quotes from multiple insurers, explore discounts, and consider bundling your insurance policies to potentially save money.