- Understanding Illinois Financial Power of Attorney

- Types of Financial Power of Attorney in Illinois

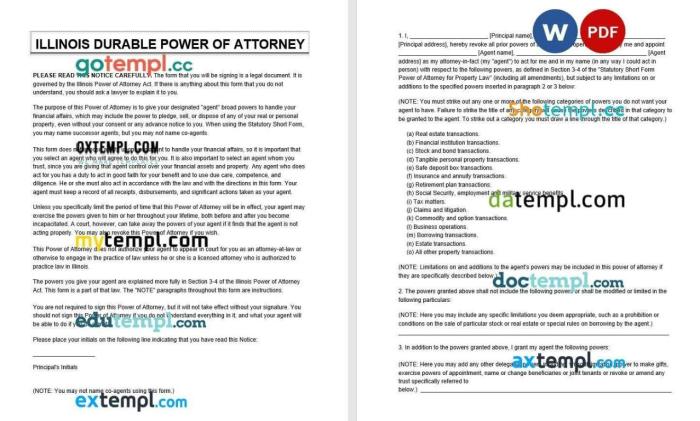

- Creating a Financial Power of Attorney in Illinois

- Powers Granted by a Financial Power of Attorney in Illinois

- Responsibilities of the Agent

- Termination and Revocation of a Financial Power of Attorney

- Legal Considerations and Potential Issues

- Resources and Additional Information

- Last Recap

- Popular Questions: Financial Power Of Attorney Illinois Pdf

Financial Power of Attorney Illinois PDF is a crucial legal document that empowers individuals to designate someone they trust to manage their financial affairs. It provides a framework for handling finances, assets, and investments should you become incapacitated or unable to manage your own affairs. This comprehensive guide delves into the intricacies of Illinois financial power of attorney, outlining its purpose, types, creation, and legal implications.

From understanding the different types of financial power of attorney to navigating the legal complexities, this guide provides valuable insights for individuals seeking to establish financial control and ensure their financial well-being. Whether you’re planning for the future or seeking to understand your rights and responsibilities, this information will equip you with the knowledge necessary to make informed decisions.

Understanding Illinois Financial Power of Attorney

A financial power of attorney (POA) in Illinois is a legal document that grants another person (the agent) the authority to make financial decisions on your behalf. It’s crucial for individuals who wish to ensure their financial affairs are managed in case of incapacitation or if they simply need assistance with financial matters.

Purpose and Legal Significance

The primary purpose of a financial power of attorney in Illinois is to empower an agent to handle your financial affairs. This document serves as a legal authorization for your agent to act on your behalf in various financial situations, such as:

* Paying bills: Your agent can pay your bills, including utilities, rent, and credit card payments.

* Managing bank accounts: Your agent can access your bank accounts, deposit funds, and withdraw money.

* Investing: Your agent can make investment decisions on your behalf, such as buying and selling stocks, bonds, or real estate.

* Collecting debts: Your agent can collect debts owed to you.

* Selling property: Your agent can sell your property, including your home, car, or other assets.

The legal significance of a financial POA lies in its ability to grant broad authority to your agent. In the eyes of the law, your agent’s actions are considered to be your own, even if you are unable to make decisions yourself. This document can be a valuable tool for protecting your financial interests and ensuring your affairs are handled responsibly.

Key Elements of a Valid Financial Power of Attorney

A valid financial power of attorney document in Illinois must meet specific requirements to be legally binding. Here are the key elements:

* Signature of the Principal: The document must be signed by the principal (the person granting the power of attorney).

* Witness Signature: The principal’s signature must be witnessed by two credible witnesses, who are not beneficiaries of the power of attorney.

* Capacity of the Principal: The principal must be of sound mind and capable of understanding the nature and effect of the document when signing it.

* Clear and Specific Grant of Authority: The document must clearly state the specific powers granted to the agent, such as the ability to access bank accounts, manage investments, or sell property.

* Durable Power of Attorney: In Illinois, a durable power of attorney remains in effect even if the principal becomes incapacitated.

Legal Authority Granted by a Financial Power of Attorney

The legal authority granted by a financial power of attorney in Illinois is extensive and encompasses a wide range of financial transactions. This authority is typically divided into two categories:

* General Power of Attorney: This grants the agent broad authority to handle all of the principal’s financial affairs.

* Specific Power of Attorney: This grants the agent limited authority to handle specific financial transactions, such as managing a particular bank account or selling a specific piece of property.

The agent’s authority is only limited to the powers specifically granted in the financial power of attorney document.

It is essential to carefully consider the scope of authority you wish to grant to your agent and ensure that the document clearly reflects your intentions.

Types of Financial Power of Attorney in Illinois

Illinois law provides several types of financial power of attorney documents, each offering different levels of authority and flexibility. Understanding these distinctions is crucial for choosing the right type of power of attorney for your specific needs.

Durable Power of Attorney

A durable power of attorney grants someone you trust, known as your agent, the authority to manage your financial affairs. This type of power of attorney remains effective even if you become incapacitated, making it a crucial document for ensuring your financial well-being in case of unforeseen circumstances.

- Powers Granted: Durable power of attorney documents typically grant broad authority to your agent, allowing them to handle a wide range of financial transactions, including:

- Managing bank accounts and investments

- Paying bills and taxes

- Selling or buying property

- Making healthcare decisions

- Limitations: While durable power of attorney grants broad authority, it may not cover every aspect of your financial affairs. For instance, it may not allow your agent to make gifts or create trusts.

- Situations: A durable power of attorney is generally appropriate for individuals who wish to provide a trusted person with comprehensive authority over their financial affairs, particularly if they are concerned about potential incapacity.

Springing Power of Attorney

A springing power of attorney becomes effective only upon the occurrence of a specific event, such as the principal’s incapacitation. This type of power of attorney offers greater control over when your agent gains authority.

- Powers Granted: A springing power of attorney grants your agent authority over your financial affairs only after a specific event, such as:

- A medical diagnosis of incapacity

- A determination by a court that you are incapacitated

- A specific date

- Limitations: Springing power of attorney grants limited authority, only becoming effective when the triggering event occurs. This means your agent may not have access to your financial affairs until the specified event takes place.

- Situations: A springing power of attorney may be appropriate for individuals who wish to maintain control over their finances until they are incapacitated. It can also be useful for individuals who want to ensure their agent has authority only when they are unable to manage their affairs.

Limited Power of Attorney

A limited power of attorney grants your agent authority over specific aspects of your financial affairs. This type of power of attorney offers greater control over the scope of your agent’s authority.

- Powers Granted: A limited power of attorney can be tailored to grant your agent authority over specific tasks, such as:

- Managing a particular bank account

- Paying a specific bill

- Selling a specific piece of property

- Limitations: A limited power of attorney only grants authority over the specific tasks Artikeld in the document. Your agent will not have authority over other aspects of your financial affairs.

- Situations: A limited power of attorney may be appropriate for individuals who wish to grant limited authority to their agent, such as for a specific transaction or period of time.

Power of Attorney for Healthcare

A power of attorney for healthcare grants your agent the authority to make healthcare decisions on your behalf if you are unable to do so. This type of power of attorney is distinct from financial power of attorney and focuses solely on healthcare decisions.

- Powers Granted: A power of attorney for healthcare grants your agent the authority to make decisions regarding your healthcare, such as:

- Consent to medical treatment

- Access to medical records

- Decisions regarding end-of-life care

- Limitations: A power of attorney for healthcare does not grant authority over your financial affairs. It is specifically focused on healthcare decisions.

- Situations: A power of attorney for healthcare is crucial for ensuring your healthcare wishes are respected if you are unable to communicate them yourself.

Creating a Financial Power of Attorney in Illinois

Creating a valid financial power of attorney document in Illinois requires careful attention to detail and adherence to specific legal requirements. It’s crucial to understand the process and seek professional legal advice to ensure the document is properly drafted and legally binding.

Steps Involved in Creating a Financial Power of Attorney

To create a valid financial power of attorney in Illinois, follow these steps:

- Choose an Agent: Select a trustworthy individual you want to grant authority to manage your finances. This person is known as your “agent.”

- Select a Form: Illinois offers several forms for financial power of attorney, including durable power of attorney, springing power of attorney, and limited power of attorney. Choose the form that best suits your needs and the scope of authority you wish to grant.

- Complete the Form: Fill out the chosen form accurately and completely, providing all necessary information, including your name, address, the name of your agent, and the scope of authority you wish to grant.

- Witness and Notarize: The document must be witnessed by two credible individuals who are not beneficiaries of the power of attorney. It must also be notarized by a notary public.

- File the Document: In Illinois, there is no requirement to file the financial power of attorney with any government agency. However, you may choose to file it with your financial institutions or other relevant parties for their records.

Importance of Legal Advice and Proper Forms

Seeking legal advice from an experienced attorney is highly recommended when creating a financial power of attorney. An attorney can help you understand the different types of power of attorney available, ensure the document is properly drafted, and address any specific needs or concerns you may have.

Using the correct forms and procedures is crucial for creating a valid financial power of attorney. Illinois provides specific forms that must be used, and any deviation from these forms could invalidate the document.

Selecting a Suitable Agent and Defining Scope of Authority

Choosing a suitable agent is a critical step in creating a financial power of attorney. The agent should be a trustworthy individual who understands your financial situation and is capable of managing your finances responsibly.

Clearly defining the scope of your agent’s authority is essential. The power of attorney document should explicitly state what actions your agent is authorized to take on your behalf. This may include:

- Managing bank accounts and investments

- Paying bills and taxes

- Selling or purchasing property

- Making healthcare decisions

It’s important to carefully consider the scope of authority you grant to your agent and to avoid granting broad or unlimited powers.

Powers Granted by a Financial Power of Attorney in Illinois

A financial power of attorney in Illinois grants the agent broad authority to manage the principal’s financial affairs. This authority can encompass a wide range of financial transactions and decisions, enabling the agent to act on the principal’s behalf in various situations.

The scope of these powers can be defined and limited within the document itself. This allows the principal to tailor the power of attorney to their specific needs and preferences. The document can specify the types of transactions the agent is authorized to perform, the assets covered, and any limitations on the agent’s authority.

Defining the Scope of Powers

The financial power of attorney document allows for the principal to clearly define the extent of the agent’s authority. This can be achieved through various methods, including:

- Specific Powers: The document can explicitly list the specific financial powers the agent is authorized to exercise. For instance, the principal may grant the agent the power to manage bank accounts, pay bills, invest funds, or sell real estate. This method ensures clarity and minimizes potential misunderstandings regarding the agent’s authority.

- General Powers: Alternatively, the document may grant the agent general powers, such as the authority to handle all financial matters related to the principal. This approach provides greater flexibility but may require careful consideration to ensure the agent understands and complies with the principal’s wishes.

- Limitations: The document can also include limitations on the agent’s authority. These limitations can be specific, such as restricting the agent’s ability to sell certain assets or make investments exceeding a particular amount. Alternatively, they can be more general, such as requiring the agent to obtain the principal’s consent for specific transactions.

Common Financial Transactions Authorized

A financial power of attorney can authorize the agent to engage in a wide range of financial transactions, including:

- Managing Bank Accounts: The agent can be authorized to deposit, withdraw, and transfer funds from the principal’s bank accounts.

- Paying Bills: The agent can pay the principal’s bills, such as utilities, rent, and credit card payments.

- Investing Funds: The agent can invest the principal’s funds in various assets, such as stocks, bonds, and mutual funds. However, the agent’s authority to invest may be limited by the document.

- Selling Real Estate: The agent can be authorized to sell the principal’s real estate properties, subject to any limitations specified in the document.

- Collecting Debts: The agent can collect debts owed to the principal.

- Making Gifts: The agent can make gifts on behalf of the principal, subject to any restrictions Artikeld in the document.

- Filing Taxes: The agent can file the principal’s income tax returns.

Responsibilities of the Agent

An agent appointed under a financial power of attorney has significant legal and ethical responsibilities. They must act with integrity, prioritize the principal’s best interests, and manage their finances responsibly.

Acting in the Best Interests of the Principal

The agent’s primary responsibility is to act in the best interests of the principal. This means making financial decisions that are beneficial to the principal, even if they are not personally advantageous to the agent. The agent must prioritize the principal’s needs and well-being over their own. For example, if the principal has a limited income, the agent should avoid making extravagant purchases or investments that could deplete their resources.

Managing Finances Responsibly

The agent must manage the principal’s finances responsibly and in accordance with their instructions. This includes:

- Keeping accurate records of all financial transactions.

- Paying bills on time.

- Making wise investment decisions.

- Avoiding unnecessary spending.

- Protecting the principal’s assets from fraud and abuse.

The agent must be mindful of the principal’s financial goals and limitations, and they must be transparent in their actions.

Avoiding Conflicts of Interest

A conflict of interest arises when the agent’s personal interests conflict with the principal’s best interests. For example, an agent should not use the principal’s funds for their own personal gain or invest in a business in which they have a financial stake. To avoid conflicts of interest, the agent should:

- Disclose any potential conflicts of interest to the principal.

- Avoid situations where their personal interests could influence their decisions.

- Seek independent advice from a qualified professional if necessary.

Termination and Revocation of a Financial Power of Attorney

A financial power of attorney can be terminated or revoked in several ways, either by the principal or through specific circumstances. Understanding these methods and their implications is crucial for ensuring the smooth functioning of your financial affairs.

Revocation by the Principal

A principal can revoke their financial power of attorney at any time, even if the document states it’s irrevocable. The principal can revoke the power of attorney by:

- Creating a new power of attorney document that specifically revokes the previous one.

- Signing a written statement explicitly revoking the power of attorney.

- Communicating their intent to revoke the power of attorney in writing to the agent, the parties holding the power of attorney, or any relevant financial institutions.

It is important to note that the revocation is only effective when it is communicated to the agent and any relevant parties. The principal should keep a copy of the revocation document for their records.

Automatic Termination

A financial power of attorney can also be terminated automatically under specific circumstances, including:

- Death of the Principal: Upon the principal’s death, the power of attorney automatically terminates, as the principal can no longer give instructions. The agent must cease acting under the power of attorney and may be required to provide an accounting of their actions to the principal’s estate.

- Incapacity of the Principal: If the principal becomes incapacitated and is deemed unable to manage their own affairs, the power of attorney may be terminated. The determination of incapacity is typically made by a court or through a formal legal process. However, if the power of attorney document specifically addresses incapacity, it may continue to be valid even after the principal becomes incapacitated.

- Expiration of the Power of Attorney: If the power of attorney document specifies a duration or expiration date, it will automatically terminate upon the expiration of that period. It’s essential to ensure that the power of attorney document has a clear expiration date or is worded to reflect the intended duration of the agent’s authority.

Consequences of Revocation

Revoking a financial power of attorney can have various consequences. It’s important to consider these implications before taking action.

- Loss of Authority: Upon revocation, the agent immediately loses the authority to act on the principal’s behalf. They can no longer access the principal’s financial accounts or make decisions about their finances.

- Potential Liability: The agent may be held liable for any actions they took after the revocation but before they received notice of it. This could include financial transactions, withdrawals, or other actions that may have been detrimental to the principal’s interests.

- Legal Disputes: If there are disputes regarding the revocation of the power of attorney, the principal or the agent may need to seek legal counsel to resolve the matter. This could involve legal proceedings, such as a court hearing or a formal mediation process.

Legal Considerations and Potential Issues

While a financial power of attorney can be a valuable tool for managing your finances, it’s crucial to understand the legal complexities and potential challenges associated with it in Illinois. This section will explore common legal issues, the impact on estate planning, and situations where a financial power of attorney might be contested.

Potential Legal Issues and Challenges

Understanding the potential legal issues and challenges associated with a financial power of attorney in Illinois is crucial to avoid complications.

- Agent’s Misconduct: The agent’s misuse of the power of attorney can lead to legal repercussions. If the agent acts improperly, such as using the power of attorney for personal gain or making decisions that are not in the principal’s best interest, the principal or their heirs can take legal action.

- Lack of Capacity: If the principal lacked mental capacity when signing the power of attorney, it might be deemed invalid. The burden of proof lies with the agent to demonstrate the principal’s mental competency at the time of signing. This can become a significant issue, especially if the principal’s mental state deteriorates after granting the power of attorney.

- Conflicting Interests: When the agent has a financial interest in the principal’s assets, a conflict of interest arises. This can create a legal challenge, as the agent’s actions might be seen as benefiting themselves rather than the principal.

- Undue Influence: If the principal was coerced or pressured into granting the power of attorney, it could be challenged. This can be particularly relevant if the agent has a close relationship with the principal, such as a family member or caregiver.

Impact on Estate Planning and Inheritance

A financial power of attorney can significantly impact estate planning and inheritance.

- Changes to Assets: The agent can make decisions that alter the principal’s assets, potentially affecting the distribution of inheritance. For instance, the agent might sell assets, invest funds, or make charitable donations, all of which can impact the final inheritance received by beneficiaries.

- Impact on Estate Planning Documents: A financial power of attorney can impact existing estate planning documents like wills and trusts. The agent’s actions might inadvertently alter the intended distribution of assets, creating legal challenges and potential disputes among beneficiaries.

- Contesting the Power of Attorney: Beneficiaries or heirs might contest the validity of the power of attorney if they believe the agent has acted improperly or that the principal lacked capacity when granting the power of attorney. This can lead to legal battles over the distribution of assets.

Situations Where a Financial Power of Attorney Might Be Contested

Several situations can lead to a financial power of attorney being contested.

- Suspicion of Agent’s Misconduct: If beneficiaries or heirs suspect the agent has misused the power of attorney, they might challenge its validity. This can involve allegations of misappropriation of funds, unauthorized transactions, or actions that were not in the principal’s best interest.

- Concerns About Principal’s Capacity: If the principal’s mental capacity was questionable at the time of granting the power of attorney, beneficiaries or heirs might challenge its validity. They might argue that the principal was not mentally competent to understand the consequences of granting the power of attorney or that the agent exerted undue influence.

- Disputes Among Beneficiaries: Disputes among beneficiaries over the distribution of assets can lead to challenges regarding the validity of the power of attorney. If beneficiaries believe the agent has acted unfairly or has not followed the principal’s wishes, they might challenge the power of attorney to ensure a fair distribution of assets.

Resources and Additional Information

This section provides you with valuable resources and information to help you navigate the complexities of financial power of attorney in Illinois. You can find links to websites, organizations, and legal professionals who specialize in estate planning and power of attorney in Illinois.

Illinois Bar Association

The Illinois Bar Association is a valuable resource for information on financial power of attorney in Illinois. The website provides access to articles, publications, and other resources that can help you understand your legal rights and obligations. You can also find a directory of attorneys who specialize in estate planning and power of attorney.

Illinois Attorney General’s Office, Financial power of attorney illinois pdf

The Illinois Attorney General’s Office offers consumer protection resources and information on various legal matters, including power of attorney. You can find information on the website about common scams and fraud related to power of attorney, as well as tips on how to protect yourself.

Illinois Department of Aging

The Illinois Department of Aging offers a range of resources and services for older adults, including information on power of attorney. The website provides information on how to create a power of attorney, as well as resources for finding legal assistance.

Legal Aid Organizations

Legal aid organizations provide free or low-cost legal assistance to low-income individuals and families. These organizations can help you understand your legal rights and obligations related to financial power of attorney and can provide guidance on creating a power of attorney.

Legal Resources and Publications

Here are some legal resources and publications that can offer further guidance and insights on financial power of attorney in Illinois:

- Illinois Power of Attorney Act (755 ILCS 45/1 et seq.) – This act Artikels the legal requirements for creating and using a power of attorney in Illinois. It covers topics such as the types of powers that can be granted, the requirements for valid execution, and the duties of the agent.

- Illinois Estate Planning Guide – This guide published by the Illinois Bar Association provides comprehensive information on estate planning, including power of attorney. It covers topics such as choosing the right type of power of attorney, drafting a power of attorney, and managing assets under a power of attorney.

- Illinois Probate Code – This code governs the administration of estates in Illinois, including the use of power of attorney. It Artikels the legal requirements for using a power of attorney in probate proceedings.

Last Recap

In conclusion, a financial power of attorney in Illinois serves as a vital tool for safeguarding your financial future. By carefully considering the different types, legal requirements, and potential issues, you can create a document that empowers your chosen agent to act in your best interests. Remember to consult with an experienced legal professional to ensure your financial power of attorney is properly executed and meets your individual needs.

Popular Questions: Financial Power Of Attorney Illinois Pdf

What happens if I don’t have a financial power of attorney?

Without a financial power of attorney, your family members or loved ones may need to go through a lengthy and costly legal process to gain access to your financial accounts and manage your affairs. This can lead to delays and potential complications.

Can I revoke my financial power of attorney?

Yes, you can revoke your financial power of attorney at any time. You must do so in writing and notify your agent and any relevant financial institutions.

What are the consequences of violating a financial power of attorney?

Violating a financial power of attorney can have serious legal consequences, including criminal charges. It’s crucial to act responsibly and in accordance with the terms of the document.