- Defining Limited Power of Attorney for Motor Vehicle Transactions

- Eligibility Requirements for Granting and Accepting the Power of Attorney

- Legal and Practical Considerations for Using a Limited Power of Attorney

- Best Practices for Using a Limited Power of Attorney in Motor Vehicle Transactions

- Closing Notes: Limited Power Of Attorney For Eligible Motor Vehicle Transactions

- Helpful Answers

Limited power of attorney for eligible motor vehicle transactions provides a way for individuals to delegate the authority to handle specific vehicle-related matters to another person. This legal tool grants the designated agent the power to act on behalf of the principal in transactions such as buying, selling, registering, or titling a vehicle, while the principal retains control over other aspects of their affairs.

Understanding the legal requirements, eligibility criteria, and potential risks associated with this type of power of attorney is crucial for both the principal and the agent. It’s essential to ensure that the document is properly drafted and executed to avoid legal complications and protect the interests of all parties involved.

Defining Limited Power of Attorney for Motor Vehicle Transactions

A limited power of attorney (POA) for motor vehicle transactions is a legal document that grants an individual, known as the attorney-in-fact, the authority to act on behalf of another person, known as the principal, for specific motor vehicle transactions. This type of POA is designed to be narrower in scope than a general POA, focusing solely on motor vehicle-related matters.

Purpose of a Limited Power of Attorney for Motor Vehicle Transactions

A limited POA for motor vehicle transactions serves several purposes, primarily to provide convenience and flexibility when the principal is unable or unwilling to personally handle motor vehicle transactions.

- Convenience: It allows the principal to delegate tasks such as buying, selling, registering, or titling a vehicle to someone they trust, especially if they are unable to do so themselves due to travel, illness, or other reasons.

- Flexibility: It enables the principal to handle motor vehicle transactions even when they are not physically present. For instance, if a principal is relocating or temporarily residing outside of the state, they can appoint an attorney-in-fact to manage their vehicle-related affairs.

Types of Motor Vehicle Transactions Covered

A limited POA for motor vehicle transactions typically covers a range of activities, including:

- Buying and Selling Vehicles: The attorney-in-fact can act on the principal’s behalf to purchase or sell a vehicle, including negotiating the terms of the sale, signing contracts, and handling the transfer of ownership.

- Registering Vehicles: The attorney-in-fact can register a vehicle in the principal’s name, obtaining license plates, and paying registration fees.

- Titling Vehicles: The attorney-in-fact can handle the titling process, including applying for a title, transferring ownership, and updating the title information.

- Other Transactions: The POA may also authorize the attorney-in-fact to handle other motor vehicle-related transactions, such as obtaining vehicle inspections, paying fines, or dealing with insurance matters.

Comparison with a General Power of Attorney

While a limited POA for motor vehicle transactions grants specific authority related to vehicles, a general POA provides broader authority to the attorney-in-fact, covering a wide range of financial and legal matters.

- Scope: A general POA empowers the attorney-in-fact to act on the principal’s behalf in various situations, including managing finances, making medical decisions, and handling real estate transactions. In contrast, a limited POA is restricted to motor vehicle transactions only.

- Specificity: A limited POA clearly defines the attorney-in-fact’s authority, limiting their actions to the specific motor vehicle transactions Artikeld in the document. This ensures that the attorney-in-fact cannot exceed their granted authority.

- Duration: A general POA can be either durable (lasting even if the principal becomes incapacitated) or non-durable (terminating if the principal becomes incapacitated). A limited POA for motor vehicle transactions is typically non-durable, meaning it terminates if the principal becomes incapacitated.

Eligibility Requirements for Granting and Accepting the Power of Attorney

Granting and accepting a limited power of attorney for motor vehicle transactions is a legal process that requires specific eligibility criteria to ensure the validity and legitimacy of the power of attorney. These criteria aim to safeguard the interests of all parties involved and prevent potential misuse or fraud.

Grantor Eligibility

The individual granting the power of attorney, known as the grantor, must meet certain legal requirements. The grantor must be of legal age and sound mind, capable of understanding the nature and consequences of granting such authority. This implies that the grantor should be free from any mental incapacities or impairments that might hinder their ability to make informed decisions. Additionally, the grantor must be legally competent to own and transact with motor vehicles.

Grantee Eligibility

The individual accepting the power of attorney, known as the grantee, must also meet specific eligibility requirements. The grantee must be of legal age and have the legal capacity to enter into contracts. They should be trustworthy and capable of responsibly handling the motor vehicle transactions on behalf of the grantor. The grantee should not have any criminal record that could disqualify them from dealing with motor vehicles.

Legal Implications of Ineligibility

Granting or accepting a power of attorney from someone who does not meet the eligibility criteria can have serious legal consequences. The power of attorney may be deemed invalid and unenforceable, potentially leading to disputes and legal challenges. The grantor may face difficulties in recovering their motor vehicle or completing transactions, while the grantee may be held liable for any actions taken without proper authorization.

Legal and Practical Considerations for Using a Limited Power of Attorney

Using a limited power of attorney for motor vehicle transactions can streamline processes, but it’s crucial to understand the legal implications and potential risks involved. This section delves into the legal framework, practical tips, and potential liabilities associated with using a limited power of attorney in this context.

Legal Implications of Using a Limited Power of Attorney, Limited power of attorney for eligible motor vehicle transactions

The legal implications of using a limited power of attorney for motor vehicle transactions are significant and must be carefully considered. This section explores the legal framework surrounding the use of limited power of attorney in motor vehicle transactions.

- Grantor’s Capacity and Consent: The grantor, the person granting the power of attorney, must be of sound mind and have the legal capacity to execute the document. The grantor’s consent must be freely given, without undue influence or coercion.

- Specific Scope of Authority: The power of attorney document must clearly define the specific scope of authority granted to the attorney-in-fact. This means outlining the specific motor vehicle transactions the attorney-in-fact is authorized to perform. The scope of authority should be limited to the specific transactions needed and should not grant broad or unlimited powers.

- Compliance with State Laws: The power of attorney must comply with the specific requirements of the state where the motor vehicle transaction is taking place. Each state has its own laws regarding the form and content of power of attorney documents, including requirements for witnesses and notarization.

- Legal Consequences of Misuse: If the attorney-in-fact exceeds the scope of authority granted in the power of attorney document or acts in a way that is not in the grantor’s best interests, they could face legal consequences, including civil liability and potential criminal charges.

Practical Tips for Drafting and Executing a Limited Power of Attorney

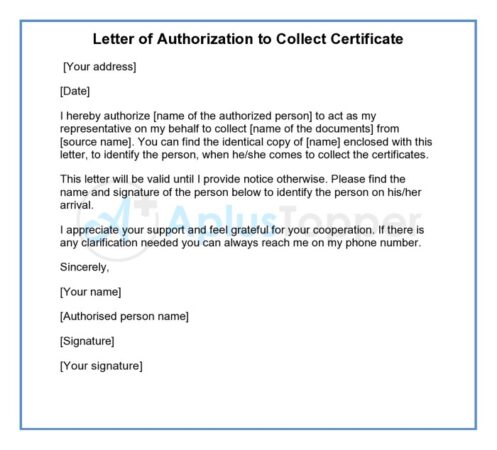

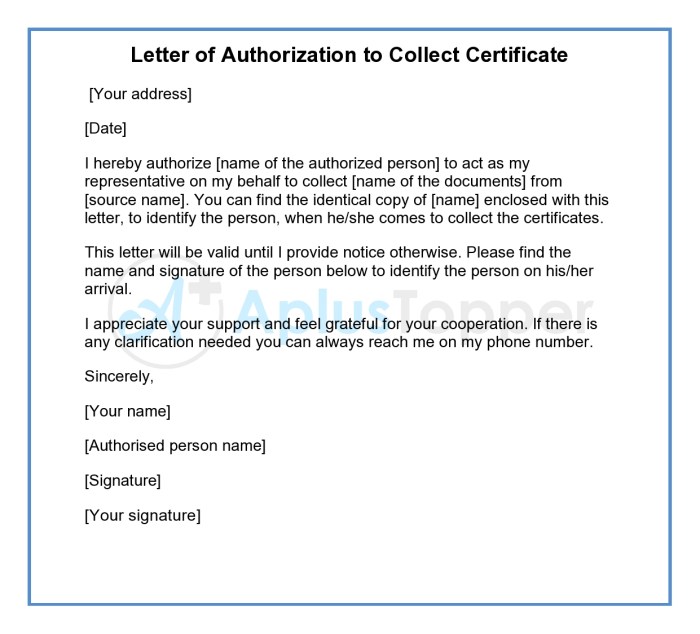

Drafting and executing a limited power of attorney document requires careful attention to detail and adherence to legal requirements. The following practical tips can help ensure the document is legally sound and protects the interests of both the grantor and the attorney-in-fact.

- Seek Legal Counsel: Consulting with an attorney experienced in estate planning and power of attorney law is highly recommended. An attorney can help ensure the document complies with state laws and accurately reflects the grantor’s intentions.

- Use Clear and Concise Language: The power of attorney document should be written in clear and concise language, avoiding technical jargon or ambiguous terms. The specific transactions the attorney-in-fact is authorized to perform should be explicitly stated.

- Specify Time Limits: If desired, the power of attorney document can include time limits for the attorney-in-fact’s authority. For example, the document could state that the attorney-in-fact’s authority expires on a specific date or upon the occurrence of a particular event.

- Include a Revocation Clause: The document should include a revocation clause, allowing the grantor to revoke the power of attorney at any time. This clause ensures the grantor retains control over their affairs and can terminate the attorney-in-fact’s authority if necessary.

- Proper Execution and Witnessing: The power of attorney document must be properly executed and witnessed according to state law requirements. This typically involves the grantor signing the document in the presence of witnesses and having the document notarized.

Potential Risks and Liabilities Associated with Using a Limited Power of Attorney

While using a limited power of attorney can be beneficial, it’s essential to be aware of the potential risks and liabilities associated with this legal instrument.

- Fraud or Misuse: There is always a risk that the attorney-in-fact could misuse their authority or engage in fraudulent activities. This risk can be mitigated by carefully selecting a trustworthy attorney-in-fact and clearly defining the scope of their authority in the power of attorney document.

- Liability for Attorney-in-Fact’s Actions: The grantor may be held liable for the actions of the attorney-in-fact, particularly if the attorney-in-fact exceeds the scope of authority granted in the power of attorney document. To minimize this risk, the grantor should carefully monitor the attorney-in-fact’s activities and ensure they are acting within the bounds of their authority.

- Potential for Disputes: Disputes can arise between the grantor and the attorney-in-fact, particularly if the attorney-in-fact’s actions are perceived as being contrary to the grantor’s interests. To minimize the likelihood of disputes, it is crucial to have open communication between the grantor and the attorney-in-fact and to clearly define their roles and responsibilities in the power of attorney document.

Best Practices for Using a Limited Power of Attorney in Motor Vehicle Transactions

A limited power of attorney (POA) for motor vehicle transactions can be a valuable tool, allowing an authorized individual to handle specific tasks on your behalf. However, it’s crucial to understand and follow best practices to ensure both your legal protection and the smooth execution of the transaction.

Drafting and Executing the Limited Power of Attorney

It’s essential to create a well-defined and comprehensive limited POA for motor vehicle transactions. This document should clearly Artikel the specific powers granted to the attorney-in-fact and the scope of their authority.

- Clearly Define the Scope of Authority: The POA should explicitly state the specific motor vehicle transactions the attorney-in-fact is authorized to perform. This could include buying, selling, registering, or titling a vehicle. Avoid using broad or ambiguous language that could lead to misunderstandings.

- Identify the Specific Vehicle: The POA should clearly identify the vehicle(s) covered by the document. This can be done by providing the vehicle identification number (VIN) or a detailed description of the vehicle.

- Set an Expiration Date: Include a specific expiration date for the POA. This helps prevent the document from being used indefinitely and ensures that the grantor retains control over their vehicle transactions.

- Consider a Revocation Clause: Include a provision allowing the grantor to revoke the POA at any time. This gives the grantor the flexibility to terminate the attorney-in-fact’s authority if necessary.

- Use Proper Legal Language: It’s recommended to consult with an attorney to ensure the POA is drafted using accurate and legally binding language. This minimizes the risk of disputes or legal challenges.

- Proper Witnessing and Notarization: Ensure the POA is properly witnessed and notarized according to the requirements of your state. This adds legitimacy and legal weight to the document.

Storing and Managing the Power of Attorney Document

Safeguarding your POA document is crucial to prevent misuse or unauthorized access.

- Secure Storage: Store the original POA in a safe and secure location, such as a fireproof safe or a bank safe deposit box. Avoid keeping it in an easily accessible place.

- Make Copies: Create copies of the POA for the attorney-in-fact and yourself. This ensures both parties have a readily available copy of the document.

- Keep Records: Maintain a record of all POA transactions, including dates, parties involved, and transaction details. This can help with recordkeeping and accountability.

Seeking Legal Advice

Consulting with an attorney before using a limited POA for motor vehicle transactions is highly recommended.

- Understanding Legal Requirements: An attorney can provide guidance on the specific legal requirements for executing and using a POA in your state. They can ensure the POA complies with all applicable laws and regulations.

- Addressing Potential Issues: An attorney can help identify and address potential legal issues or complexities related to the POA. This can help prevent misunderstandings or disputes down the line.

- Protecting Your Interests: An attorney can help you understand your rights and responsibilities as the grantor of the POA. They can ensure the POA is drafted in a way that protects your interests and minimizes your liability.

Closing Notes: Limited Power Of Attorney For Eligible Motor Vehicle Transactions

Using a limited power of attorney for vehicle transactions can streamline processes and provide convenience, but it’s crucial to approach it with careful consideration and legal guidance. By understanding the implications, eligibility requirements, and best practices, individuals can utilize this tool effectively while safeguarding their legal rights and interests.

Helpful Answers

What happens if the principal dies while the power of attorney is in effect?

The power of attorney automatically terminates upon the principal’s death. The agent no longer has the authority to act on behalf of the deceased principal.

Can a limited power of attorney be revoked?

Yes, a limited power of attorney can be revoked by the principal at any time, as long as they are of sound mind and not under duress. The revocation should be in writing and signed by the principal.

What if the agent misuses the power of attorney?

If the agent acts outside the scope of the power of attorney or misuses the authority granted, the principal may be able to take legal action to rectify the situation. It’s essential to choose a trusted and responsible agent.

Is a limited power of attorney required for all vehicle transactions?

No, a limited power of attorney is not always required for vehicle transactions. However, it may be necessary in certain situations, such as when the principal is unable to handle the transaction themselves due to illness, travel, or other reasons.