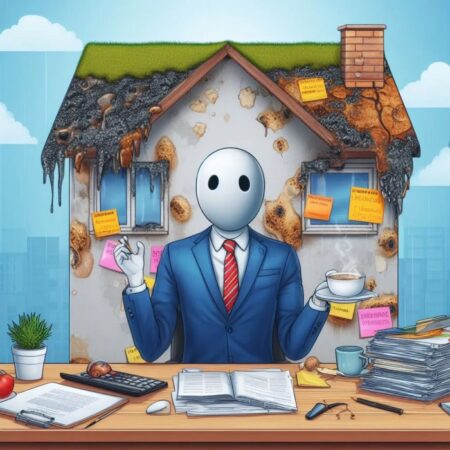

What insurance companies cover mold damage sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Mold, that sneaky, slimy, sometimes toxic, unwelcome house guest, can be a real bummer. It can turn your dream home into a nightmare, leaving you with a hefty repair bill and a serious case of the ick factor. But before you start panicking about the cost of getting rid of it, you might be wondering, “Will my insurance cover this?” Well, buckle up, because we’re about to dive into the world of mold damage and insurance, exploring the ins and outs of coverage, scenarios, and prevention.

We’ll cover everything from the basics of mold growth and the different types of insurance policies that might offer coverage to the factors that can affect your claim and how to navigate the claims process. We’ll also share tips for preventing mold in the first place and what to do if you find yourself facing a moldy situation. So grab a snack, get comfy, and let’s get this moldy business sorted out.

Mold Damage and Insurance Coverage

Mold, a type of fungus, can be a real party-pooper when it comes to your home. It thrives in damp environments, making it a common problem in areas with high humidity or after water damage. While mold might seem like just a little bit of fuzzy growth, it can cause significant damage to your home and even pose health risks. This is where insurance comes in, acting as your ultimate wingman to help you deal with the consequences of mold damage.

The Impact of Mold Damage

Mold doesn’t just look unsightly; it can also cause serious problems for your home and health. Mold spores can trigger allergies, asthma, and even respiratory infections. In extreme cases, mold can also damage the structural integrity of your home, leading to costly repairs.

Common Mold Damage Scenarios

Mold damage can be a real bummer, especially when it’s lurking in your home or business. It can be a sneaky little problem, but it’s important to know the common scenarios where mold damage can occur. Think of it like this: Mold is like the uninvited guest at a party, always finding its way into the fun.

Water Leaks

Water leaks are like the party crashers of mold damage. They can be the perfect breeding ground for mold to thrive. Imagine this: a leaky pipe in the bathroom, a dripping faucet in the kitchen, or a roof leak during a downpour. These situations can create dampness and moisture, which are mold’s best friends.

Flooding

Flooding, whether it’s from a burst pipe, a heavy rainstorm, or a natural disaster, can be a major source of mold growth. It’s like a party that got a little too wild and flooded the house. The water can soak into walls, floors, and furniture, creating a perfect environment for mold to spread like wildfire.

Humidity Issues

Humidity, that sneaky feeling of dampness in the air, can be another culprit in mold growth. Think of it like a sauna for mold. High humidity levels can make it difficult for moisture to evaporate, creating a cozy little nest for mold to settle in. It’s like a party that’s been going on for too long, and the air is thick with moisture.

Different Types of Mold and Their Health Risks

Now, let’s talk about the different types of mold and the potential health risks they can pose. Imagine mold as a group of partygoers, each with their own unique personality and quirks. Some are just annoying, while others can be downright dangerous.

Mold is classified into different types based on their appearance, growth characteristics, and potential health risks.

- Stachybotrys chartarum (Black Mold): Black mold is like the bad boy of the mold world. It’s known for its dark, velvety appearance and can cause serious health problems, including respiratory issues, allergic reactions, and even neurological damage.

- Aspergillus: Aspergillus is like the sneaky party guest, often hidden in the shadows. It can cause a range of health problems, including respiratory infections, allergies, and even fungal infections.

- Penicillium: Penicillium is like the party host, often found in damp environments. It can cause allergic reactions, respiratory problems, and skin irritation.

- Cladosporium: Cladosporium is like the party animal, often found in outdoor environments. It can cause allergic reactions, respiratory problems, and skin irritation.

Factors Affecting Coverage

Your insurance policy is your safety net, but when it comes to mold damage, it’s not always a guaranteed payout. Several factors determine whether your insurance company will cover the cost of repairs.

Think of it like this: your insurance company is like a judge in a courtroom. They’ll weigh the evidence, consider the circumstances, and decide if you deserve a payout. This means that your insurance company will examine the cause of the mold damage, the condition of your property, and your actions leading up to the damage.

Causes of Mold Damage

The first thing your insurance company will investigate is the cause of the mold damage. If the mold damage resulted from a covered peril, like a sudden and accidental water leak, your insurance company is more likely to cover the cost of repairs. However, if the mold damage is caused by something like a chronic leak or poor ventilation, your insurance company might not cover it.

- Covered Perils: Most standard homeowners’ insurance policies cover mold damage resulting from sudden and accidental events, like a burst pipe, a severe storm, or a malfunctioning appliance.

- Uncovered Perils: If the mold damage is caused by ongoing negligence, like chronic leaks, improper ventilation, or failing to address a previous water damage event, your insurance company may deny your claim.

Age of the Property

The age of your property can also affect your insurance coverage for mold damage. Older homes are more susceptible to mold growth due to factors like aging plumbing, worn-out roofing, and outdated ventilation systems. Your insurance company may scrutinize claims for mold damage in older properties, especially if the cause is attributed to the age of the structure.

- Older Homes: Insurance companies may be more cautious about covering mold damage in older homes, as the cause may be attributed to the age and condition of the property rather than a covered event.

- Newer Homes: Mold damage in newer homes is generally more likely to be covered by insurance, as it is more likely to be the result of a sudden and accidental event.

Policyholder’s Negligence

Your insurance company may deny your claim if you are found to have been negligent in preventing or addressing the mold damage. This means they will look for evidence that you failed to take reasonable steps to maintain your property and prevent mold growth. Think of it like this: If you know your roof is leaking, you can’t just ignore it and then expect your insurance company to pay for the resulting mold damage. You’re expected to be proactive and take reasonable steps to prevent damage.

- Chronic Leaks: If you knew about a leak and failed to address it, your insurance company may deny your claim.

- Poor Ventilation: If you fail to provide adequate ventilation in areas prone to moisture buildup, your insurance company may deny your claim.

- Delayed Reporting: If you delay reporting the mold damage, allowing it to worsen, your insurance company may deny your claim or reduce the amount they will pay.

Common Exclusions in Mold Damage Policies, What insurance companies cover mold damage

Insurance policies often contain specific exclusions that limit coverage for mold damage. These exclusions are designed to protect insurance companies from paying for claims that are not covered by the policy.

- Neglect: Most policies exclude coverage for mold damage that results from negligence, such as chronic leaks, improper ventilation, or failure to address a previous water damage event.

- Gradual or Continuous Damage: Policies typically exclude coverage for mold damage that occurs gradually or continuously, such as mold growth due to poor ventilation or chronic moisture problems.

- Prior Knowledge: If you were aware of a potential for mold growth and failed to take steps to prevent it, your insurance company may deny your claim.

Claim Process

You’ve got mold damage, and you’re wondering how to file a claim with your insurance company. Don’t worry, we’re here to break down the process and make it as painless as possible. Just remember, every insurance company has its own procedures, so it’s always best to check your policy or contact your insurance agent for the most accurate info.

Steps to Filing a Mold Damage Claim

It’s important to be prepared and follow the right steps to ensure your claim is processed smoothly. Here’s a breakdown of the general process:

- Contact Your Insurance Company: The first step is to call your insurance company and report the mold damage. They’ll guide you through the initial steps and provide any necessary instructions.

- File a Claim: You’ll need to file a formal claim, usually online or by phone. Make sure to provide all the necessary information, including the date of the damage, the location of the damage, and the extent of the damage.

- Inspection: Your insurance company will schedule an inspection of the damage. This is where a claims adjuster will assess the extent of the damage and determine if it’s covered by your policy.

- Negotiate Coverage: Once the inspection is complete, the insurance company will determine the coverage amount. If you disagree with their assessment, you can negotiate with them to reach a fair settlement.

- Repairs: After the claim is approved, you can start the repair process. Your insurance company may have a preferred list of contractors, or you can choose your own. Just make sure to get their approval before starting any work.

Documenting the Damage

When it comes to mold damage, documenting everything is crucial. It’s like building a case for your claim, so make sure you have solid evidence to support your request. Here are some tips:

- Take Pictures: Snap photos of the affected areas from different angles. Include close-ups of the mold growth and any visible signs of water damage.

- Keep Records: Save any receipts or invoices related to the damage. This could include receipts for repairs, cleaning supplies, or even air quality testing.

- Make a List: Create a detailed list of all the damaged items. Include the item, its value, and any relevant details about the damage.

Communicating with Your Insurance Company

Open and clear communication is key to a smooth claims process. Here’s how to make sure you’re on the same page:

- Be Prompt: Respond to your insurance company’s requests promptly. This shows you’re serious about getting your claim processed quickly.

- Be Honest: Don’t try to exaggerate or hide information. This can lead to complications later on.

- Be Professional: Maintain a professional tone in all your communications. This will help ensure a respectful and productive dialogue.

- Keep Records: Document all your communications with the insurance company. This could include emails, phone calls, and any written correspondence.

Prevention and Mitigation

Mold growth is a common issue that can cause significant damage to homes and pose health risks. However, with proactive measures and proper mitigation techniques, you can prevent and control mold growth, protecting your property and well-being.

Preventive Measures

Taking preventative measures is key to avoiding mold growth in the first place. Here are some practical steps you can take:

- Maintain Proper Ventilation: Ensure adequate ventilation in your home, especially in areas prone to moisture buildup, such as bathrooms, kitchens, and basements. Use exhaust fans during showers and cooking, and open windows whenever possible to allow fresh air circulation.

- Control Humidity Levels: Mold thrives in humid environments. Use a dehumidifier, especially in basements and crawl spaces, to keep humidity levels below 60%.

- Address Water Leaks Promptly: Fix leaky pipes, faucets, and appliances immediately. Promptly dry any spills or water damage to prevent mold growth.

- Maintain Proper Drainage: Ensure proper drainage around your home, including gutters, downspouts, and landscaping. Redirect water away from the foundation to prevent water infiltration.

- Inspect for Moisture: Regularly inspect your home for signs of moisture, such as dampness, musty odors, or visible water damage. Pay attention to areas prone to leaks or condensation.

Mold Mitigation

If mold growth occurs, prompt mitigation is essential to prevent further damage and health risks. Here are the steps involved:

- Professional Remediation: For extensive mold growth, it’s crucial to contact a professional mold remediation company. They have the expertise and equipment to safely and effectively remove mold.

- Identify the Source: Before remediation, it’s important to identify and address the source of moisture that caused the mold growth. This may involve fixing leaky pipes, repairing roof damage, or improving ventilation.

- Clean and Dry Affected Areas: Clean and dry affected areas thoroughly using appropriate cleaning solutions and techniques. For large-scale remediation, professional assistance is recommended.

- Remove Moldy Materials: Moldy materials that cannot be effectively cleaned should be removed and disposed of properly. This may include drywall, insulation, or carpeting.

- Prevent Future Growth: After remediation, take steps to prevent future mold growth by addressing the source of moisture, improving ventilation, and maintaining proper humidity levels.

Resources and Further Information

Okay, so you’ve got the lowdown on mold and insurance, but you’re probably wondering where to go for more info, right? Don’t worry, we’ve got you covered!

This section is all about pointing you to the right resources for all your moldy questions. We’ll cover websites, organizations, and even some hot tips on how to keep your home mold-free.

Websites with Information on Mold and Insurance

- The Environmental Protection Agency (EPA): This is your go-to for all things mold, from prevention tips to remediation advice. Check out their website for a comprehensive guide to mold in your home: https://www.epa.gov/mold

- The Centers for Disease Control and Prevention (CDC): The CDC provides valuable information about health risks associated with mold exposure and offers guidance on preventing mold growth: https://www.cdc.gov/mold/index.htm

- The Insurance Information Institute (III): This organization is your one-stop shop for insurance-related information, including details on mold coverage: https://www.iii.org/

Organizations Offering Mold-Related Guidance and Support

- The National Mold Remediation Association (NMRA): The NMRA is a professional organization that provides certification and training for mold remediation professionals. They also offer resources for homeowners dealing with mold issues: https://www.nmra.org/

- The American Academy of Allergy, Asthma & Immunology (AAAAI): The AAAAI provides information on mold allergies and the health effects of mold exposure: https://www.aaaai.org/

- Your Local Health Department: Contact your local health department for information about mold regulations and resources in your area.

Outcome Summary

So there you have it! Mold damage can be a real headache, but understanding your insurance coverage and taking preventative measures can make a world of difference. Remember, it’s always a good idea to consult with your insurance agent to review your policy and make sure you have the right coverage for your specific needs. And if you do find yourself dealing with mold, don’t panic! Stay calm, document the damage, and follow the steps Artikeld in your insurance policy to file a claim. With a little knowledge and a proactive approach, you can keep mold at bay and protect your home and your health.

Top FAQs: What Insurance Companies Cover Mold Damage

What if the mold damage is caused by a pre-existing condition that wasn’t disclosed to the insurance company?

Insurance companies often exclude coverage for pre-existing conditions that weren’t disclosed during the policy application. This can be tricky, so it’s crucial to be transparent with your insurer about any known issues.

What are some common exclusions for mold damage in insurance policies?

Common exclusions include mold damage caused by neglect, lack of maintenance, or from a natural disaster that wasn’t covered by the policy. It’s always best to read your policy carefully and talk to your insurance agent to understand what’s covered and what’s not.

What are some tips for preventing mold growth in my home?

Here are some tips to keep mold at bay: Fix leaks promptly, ventilate your home properly, keep humidity levels low, and clean up spills and messes right away. You can also use a dehumidifier in damp areas, and consider having your home inspected for moisture problems.