Who are the top 5 health insurance companies? It’s a question that pops up for millions of Americans every year, especially when open enrollment season rolls around. With so many options out there, it can feel like navigating a maze of premiums, deductibles, and coverage plans. But don’t worry, we’re here to break down the key players and help you find the right fit for your health and budget.

This guide will delve into the factors that make a health insurance company stand out from the crowd, from market share and customer satisfaction to financial stability and the breadth of coverage options. We’ll also give you a rundown of the top contenders, their strengths, and what they bring to the table.

Defining “Top” Health Insurance Companies

Determining the “top” health insurance companies requires considering various factors, and there’s no single, definitive answer. It’s like choosing the best pizza – different people have different preferences!

Criteria for Ranking Health Insurance Companies

Ranking health insurance companies involves evaluating multiple factors to determine their performance and suitability for different individuals and groups.

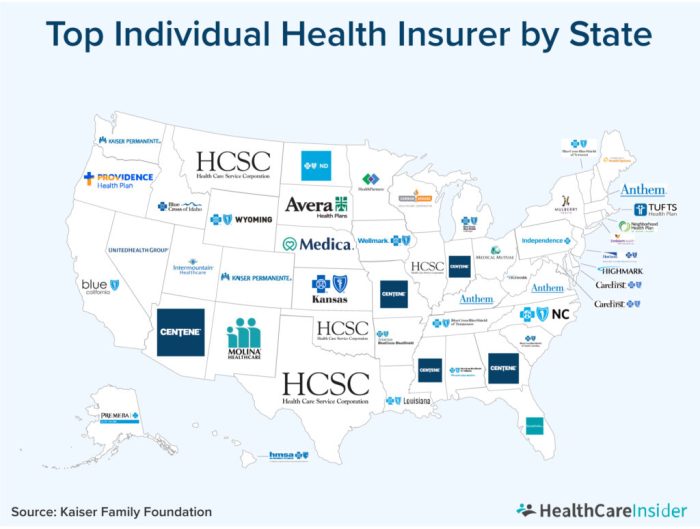

- Market Share: This reflects the company’s overall reach and popularity in the health insurance market. A large market share indicates a significant number of people trust the company, but it doesn’t necessarily guarantee superior service or coverage.

- Customer Satisfaction: Happy customers are crucial for any business, and health insurance is no exception. Companies with high customer satisfaction scores typically offer responsive customer service, clear communication, and fair claims processing.

- Financial Stability: A financially sound company is less likely to face instability or even collapse, ensuring policyholders can rely on their coverage. Strong financial ratings from agencies like AM Best or Moody’s indicate a company’s financial strength.

- Coverage Options: The variety and breadth of coverage options offered by a company are important for meeting diverse needs. Some companies might specialize in specific areas, like Medicare Advantage plans, while others offer a wider range of plans, including individual, family, and employer-sponsored plans.

- Network Size and Access: A large network of healthcare providers, including doctors, hospitals, and specialists, allows policyholders greater flexibility in choosing their healthcare providers. A broad network can be particularly important for those seeking specialized care or who live in rural areas.

- Premium Costs: While not the only factor, premium costs play a significant role in choosing health insurance. Lower premiums are generally more appealing, but it’s essential to consider the coverage offered and the potential for higher out-of-pocket costs.

Weighting Factors

The relative importance of these factors can vary depending on individual priorities. For example, someone seeking comprehensive coverage might prioritize network size and coverage options over premium costs, while someone on a tight budget might focus on affordability.

For example, a ranking might assign a higher weight to customer satisfaction and financial stability for a company focused on long-term reliability, while another ranking might prioritize market share and coverage options for a company emphasizing its reach and plan diversity.

Top 5 Health Insurance Companies

Choosing the right health insurance plan can feel like navigating a jungle of acronyms and fine print. But don’t worry, we’re here to help you find your way! We’ll break down the top five health insurance companies in the US, based on market share, customer satisfaction, and key features.

Top 5 Health Insurance Companies

Here’s a rundown of the big players in the health insurance game, along with their key stats:

| Company Name | Market Share | Customer Satisfaction Rating | Key Features |

|---|---|---|---|

| UnitedHealthcare | 29.1% | 3.5 out of 5 stars | Largest health insurer in the US, offering a wide range of plans, including Medicare Advantage and employer-sponsored plans. Known for its extensive network of providers. |

| Anthem | 13.6% | 3.7 out of 5 stars | Second-largest health insurer, offering plans through Blue Cross Blue Shield affiliates across the country. Known for its focus on preventive care and wellness programs. |

| Cigna | 7.2% | 3.8 out of 5 stars | Offers a range of health insurance plans, including individual, family, and employer-sponsored plans. Known for its strong focus on customer service and digital tools. |

| Humana | 6.5% | 3.9 out of 5 stars | Specializes in Medicare Advantage plans and offers a variety of health insurance options for individuals and families. Known for its strong focus on seniors and its commitment to providing affordable care. |

| Aetna | 5.3% | 3.6 out of 5 stars | Offers a wide range of health insurance plans, including individual, family, and employer-sponsored plans. Known for its strong focus on mental health and substance abuse services. |

Coverage Options and Plans

Choosing the right health insurance plan can be a bit like picking the perfect outfit for a big event – you want something that fits your needs, looks good, and doesn’t break the bank. There are different types of plans available, each with its own unique features and price tag. Understanding the basics of these plans can help you find the one that best suits your individual situation.

Health Maintenance Organization (HMO)

HMO plans are known for their lower premiums, but they come with stricter rules. They require you to choose a primary care physician (PCP) within their network, and you need a referral from your PCP to see specialists. This means you have a more limited choice of doctors, but it can also mean lower out-of-pocket costs.

Think of an HMO plan as a “one-stop shop” for your healthcare needs. You have a designated PCP who acts as your guide within the network, and you generally pay a fixed monthly premium, regardless of how much care you use.

Preferred Provider Organization (PPO)

PPO plans offer more flexibility than HMOs. You don’t need a referral to see specialists, and you can choose doctors outside of the network, although you’ll pay higher out-of-pocket costs.

Imagine a PPO plan as a “choose your own adventure” for your healthcare. You have more freedom to choose your doctors and specialists, but you’ll pay a higher premium and potentially higher out-of-pocket costs for services outside the network.

Point of Service (POS)

POS plans combine features of both HMOs and PPOs. You choose a PCP within the network, but you have the option to see specialists outside of the network, though you’ll pay higher out-of-pocket costs.

Think of a POS plan as a “hybrid” approach, offering a balance between cost savings and flexibility. You have a PCP within the network, but you can also choose to go outside the network for specialist care, with the understanding that you’ll pay more for those services.

Customer Experience and Reviews

Choosing a health insurance company is a big decision, and it’s essential to understand how customers feel about their experiences. Customer reviews and testimonials can provide valuable insights into the strengths and weaknesses of different companies. This section delves into the world of customer feedback, exploring the common themes and trends that emerge from reviews about the top 5 health insurance companies.

Customer Feedback Analysis, Who are the top 5 health insurance companies

Customer feedback on health insurance companies often centers around three key areas: claims processing, customer service, and overall satisfaction. By analyzing reviews, we can identify patterns and insights that highlight both positive and negative experiences.

- Claims Processing: Customers often comment on the speed, efficiency, and ease of filing claims. Positive reviews highlight companies with streamlined online claim submission processes, prompt reimbursements, and clear communication throughout the process. Conversely, negative reviews may point to difficulties in navigating the claims process, long wait times for approvals, or confusing paperwork.

- Customer Service: Responsive and helpful customer service is crucial for a positive experience. Reviews often mention the availability of knowledgeable representatives, quick response times, and personalized support. Negative experiences might involve long hold times, unhelpful staff, or difficulties in reaching a representative.

- Overall Satisfaction: Customers often share their overall satisfaction with the company, encompassing factors like plan coverage, pricing, and customer service. Positive reviews may express satisfaction with the value of the plan, the ease of using the company’s website or mobile app, and the overall peace of mind they feel with their coverage. Negative reviews might reflect dissatisfaction with the plan’s limitations, unexpected costs, or a lack of trust in the company’s commitment to their well-being.

Choosing the Right Health Insurance

Navigating the world of health insurance can feel like trying to decipher a secret code. It’s a jungle out there, filled with confusing terms, endless options, and a whole lot of paperwork. But don’t worry, you don’t need to be a healthcare expert to find the right plan for your needs. Just like picking the perfect outfit for a night out, choosing health insurance is about knowing your style, your budget, and what you’re looking for. Let’s break it down and make this process a breeze.

Factors to Consider

Choosing the right health insurance plan involves a lot of factors, and you’ll need to consider them carefully. Think of it like a recipe for success – you need the right ingredients to make it work.

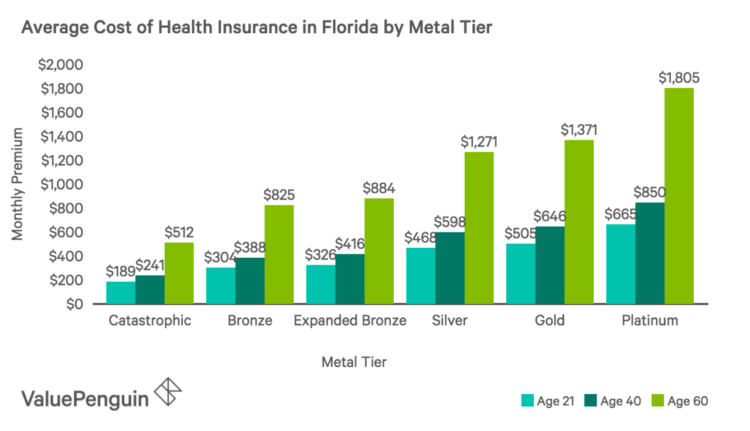

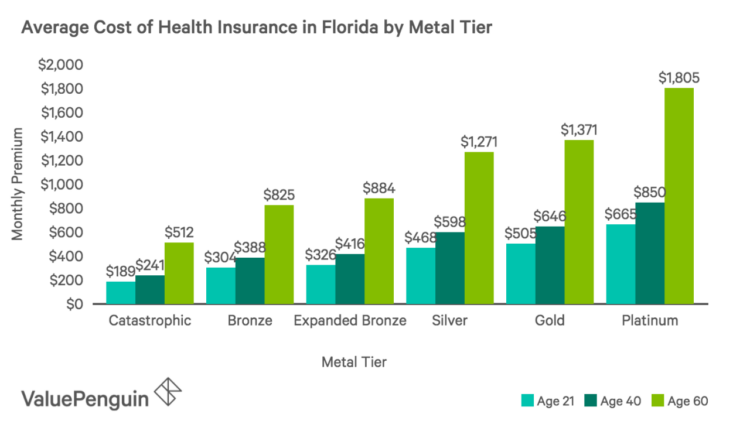

- Age: Younger folks might not need as much coverage, while older adults may want a plan with more comprehensive benefits. Think of it like picking the right shoes for a marathon – you need the right support for your age group.

- Health Status: If you’re healthy and rarely see a doctor, a basic plan might be all you need. But if you have pre-existing conditions, you’ll want a plan with robust coverage. Imagine it like picking the right car – if you drive on rough terrain, you’ll need a rugged vehicle.

- Budget: Health insurance premiums can vary wildly, so it’s important to know how much you can afford to pay. Think of it like planning a vacation – you need to set a budget to make sure you don’t overspend.

- Desired Coverage: What kind of coverage do you want? Do you need a plan that covers everything, or are you looking for something more basic? Think of it like ordering a meal – do you want a full course, or just a simple snack?

Navigating the Market

The health insurance market can be a bit overwhelming, but there are some strategies you can use to find the right plan for you. Think of it like a treasure hunt – you need the right tools and strategies to find the gold.

- Start with the basics: First, figure out what kind of coverage you need and what your budget is. This will help you narrow down your options and make the search easier. It’s like planning a road trip – you need to know your destination before you hit the road.

- Compare plans: Once you have a good idea of what you’re looking for, start comparing plans from different insurance companies. Use online comparison tools to see what’s available in your area. Think of it like shopping for clothes online – you can browse different options and compare prices.

- Talk to a broker: If you’re still feeling lost, consider talking to a health insurance broker. They can help you understand your options and find a plan that meets your needs. Think of it like having a personal shopper – they know the best deals and can help you find what you’re looking for.

- Read the fine print: Before you sign up for a plan, make sure you read the fine print carefully. Pay attention to the deductible, co-pays, and other important details. Think of it like reading the instructions before assembling a new toy – you don’t want to be surprised later on.

Final Wrap-Up: Who Are The Top 5 Health Insurance Companies

So, there you have it – a peek into the world of top health insurance companies. Remember, choosing the right plan is a personal decision, and it’s crucial to consider your individual needs and priorities. Whether you’re a young and healthy individual or part of a growing family, the right health insurance plan can be your safety net, providing peace of mind and financial security. By understanding the key players, exploring their offerings, and carefully comparing plans, you can confidently choose the best fit for your health journey.

Questions and Answers

What are the main types of health insurance plans?

The most common types of health insurance plans include HMOs (Health Maintenance Organizations), PPOs (Preferred Provider Organizations), and POS (Point-of-Service plans). Each plan offers different levels of coverage, network restrictions, and cost-sharing arrangements.

How do I find out if a health insurance company is reputable?

You can check a company’s reputation by looking at its ratings from independent organizations like the National Committee for Quality Assurance (NCQA) and the Better Business Bureau. You can also read customer reviews and testimonials online.

What should I consider when choosing a health insurance plan?

When choosing a plan, consider your age, health status, budget, desired coverage, and whether you need prescription drug coverage or mental health services. It’s also essential to factor in the provider network and whether your doctors are in-network.