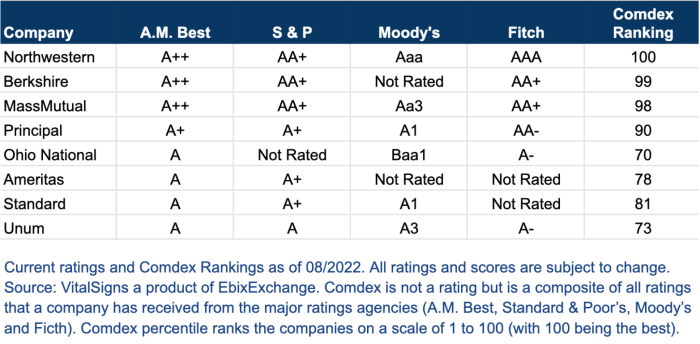

Am best ratings insurance company – AM Best ratings are like the Oscars of the insurance world, giving you the inside scoop on which companies are the real deal and which ones might leave you hanging. These ratings are a big deal because they tell you how financially stable an insurance company is and how likely they are to pay out your claims when you need them most.

Think of it this way: you wouldn’t buy a car without checking out the reviews, right? Same goes for insurance. AM Best ratings are like those reviews, helping you make sure you’re not getting ripped off. They analyze a company’s financial performance, claims experience, and overall stability to give you a clear picture of their trustworthiness.

Consumer Impact of Ratings

Insurance company ratings play a crucial role in shaping consumer choices and influencing their decisions about which insurance provider to trust. These ratings provide valuable insights into the financial stability, customer service, and claims-handling practices of insurance companies, empowering consumers to make informed decisions.

The Influence of Ratings on Consumer Choices

Insurance company ratings act as a guide for consumers, helping them navigate the complex world of insurance and make informed decisions. Ratings provide a standardized measure of an insurance company’s performance, allowing consumers to compare different providers based on objective criteria. Consumers can use these ratings to identify companies with a strong track record of financial stability, excellent customer service, and fair claims handling practices.

The Role of Ratings in Building Trust and Confidence

Ratings play a vital role in building trust and confidence among consumers. When a company receives a high rating from a reputable organization, it signals to consumers that the company is reliable, trustworthy, and committed to providing quality service. Consumers are more likely to choose an insurance company with a strong rating, as it demonstrates a commitment to ethical business practices and customer satisfaction.

Examples of Consumer Use of Ratings

Consumers utilize insurance company ratings in various ways to compare and select insurance providers. For instance, they may use ratings to:

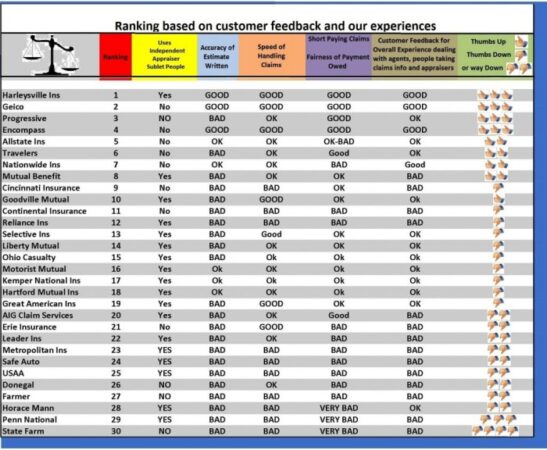

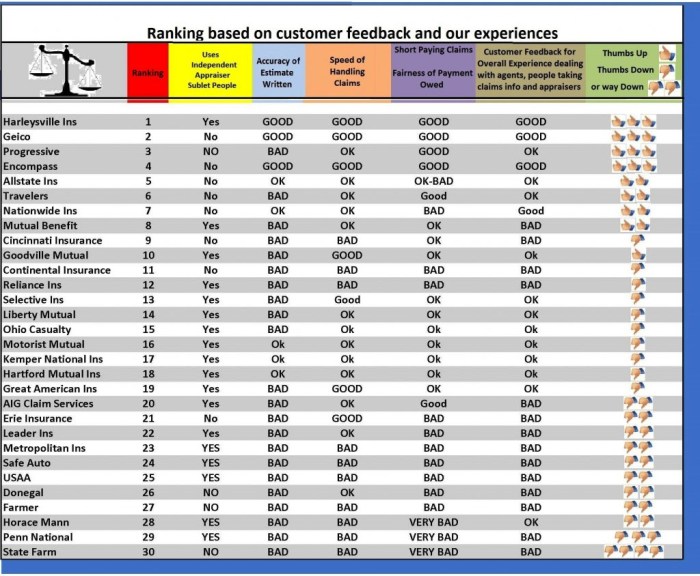

- Identify financially stable companies: Ratings from organizations like AM Best or Standard & Poor’s provide insights into an insurance company’s financial health, helping consumers choose companies less likely to face financial difficulties.

- Compare customer service experiences: Ratings from organizations like J.D. Power or Consumer Reports offer insights into customer satisfaction levels, helping consumers choose companies known for their excellent customer service.

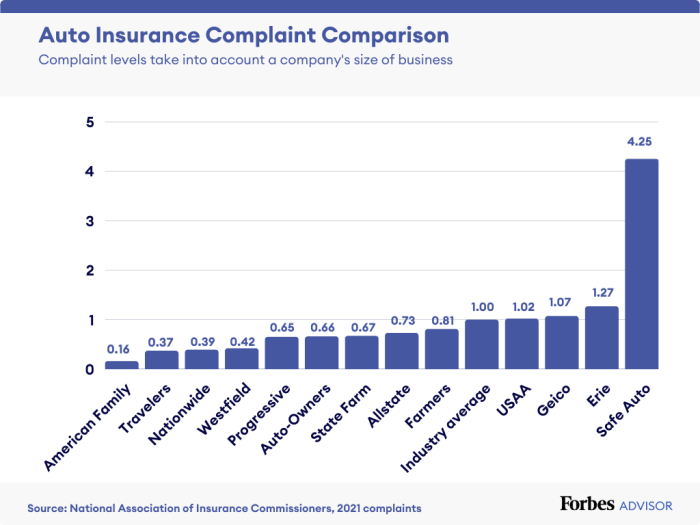

- Evaluate claims-handling practices: Ratings from organizations like the National Association of Insurance Commissioners (NAIC) provide information on an insurance company’s claims-handling practices, helping consumers choose companies known for their fairness and efficiency.

The Role of Transparency: Am Best Ratings Insurance Company

Transparency is a key ingredient in the recipe for trust, and in the world of insurance ratings, trust is everything. When consumers understand how ratings are calculated and what factors are considered, they can make informed decisions about their insurance coverage.

Ensuring Accuracy and Objectivity

Rating agencies employ rigorous methodologies to ensure the accuracy and objectivity of their assessments. These methodologies are often based on a combination of quantitative and qualitative factors. Quantitative factors include financial performance, claims history, and regulatory compliance. Qualitative factors include corporate governance, risk management practices, and customer service.

- Data Collection: Rating agencies rely on extensive data collection from insurance companies. This data includes financial statements, regulatory filings, and claims information. The agencies then verify the accuracy of this data through independent audits and reviews.

- Analyst Expertise: Rating agencies employ analysts with deep expertise in the insurance industry. These analysts evaluate the data collected and apply their knowledge to assess the financial strength and operating performance of insurance companies.

- Peer Review: To ensure objectivity, rating agencies subject their assessments to peer review by other analysts. This process helps to identify potential biases and ensure that ratings are based on a sound and consistent methodology.

Improving Transparency

Insurance companies can enhance their ratings by increasing their transparency. This can be achieved through a variety of measures, including:

- Publicly disclosing their financial statements and regulatory filings: This allows investors and consumers to gain a better understanding of the company’s financial health and operating performance.

- Providing detailed information about their risk management practices: This helps to demonstrate the company’s commitment to managing risks effectively.

- Being transparent about their claims handling processes: This builds trust with customers and demonstrates the company’s commitment to fair and efficient claims handling.

- Publishing customer satisfaction surveys: This provides valuable insights into the company’s customer service performance.

Beyond Ratings

While insurance ratings provide a valuable starting point, they shouldn’t be the sole factor in your decision. A comprehensive approach involves considering additional factors that align with your individual needs and preferences.

Customer Service, Am best ratings insurance company

Customer service is paramount, especially when you need to file a claim or have a question about your policy. A company with a reputation for excellent customer service can make a significant difference in your overall experience.

- Read online reviews: Websites like Yelp, Google Reviews, and Trustpilot offer insights into customer experiences with different insurance companies. Look for patterns in positive and negative reviews to gauge the company’s overall customer service quality.

- Check the company’s complaint history: The National Association of Insurance Commissioners (NAIC) maintains a database of consumer complaints against insurance companies. This information can provide valuable insights into a company’s responsiveness to customer concerns.

- Contact the company directly: Before committing to a policy, reach out to the insurance company’s customer service department with a simple question or request. This allows you to assess their responsiveness, professionalism, and communication skills firsthand.

Policy Coverage

The coverage offered by an insurance company is a crucial factor to consider. Make sure the policy meets your specific needs and provides adequate protection against potential risks.

- Compare coverage options: Different insurance companies offer various coverage options and limits. Take the time to compare policies and ensure you understand the scope of protection provided.

- Review exclusions and limitations: Pay close attention to any exclusions or limitations in the policy. These can significantly impact your coverage in the event of a claim.

- Seek professional advice: Consult with an insurance broker or agent to discuss your specific needs and obtain expert guidance on selecting the right policy coverage.

Pricing

Pricing is an important consideration, but it shouldn’t be the only factor driving your decision. While finding a competitive price is essential, it’s equally important to ensure you’re getting adequate coverage for your needs.

- Obtain multiple quotes: Contact several insurance companies to obtain quotes for similar coverage. This allows you to compare prices and identify the best value.

- Consider discounts: Many insurance companies offer discounts for various factors, such as good driving records, safety features, and bundling multiple policies. Inquire about available discounts to potentially reduce your premium.

- Evaluate the overall value: Don’t solely focus on the lowest price. Consider the coverage offered, customer service reputation, and financial stability of the company when evaluating the overall value of a policy.

Ultimate Conclusion

Knowing how to read the tea leaves of AM Best ratings is a game-changer when it comes to insurance. You’ll be able to choose a company that’s financially solid, has a good track record, and will be there for you when you need them. So ditch the guesswork and make sure you’re getting the best protection possible.

Query Resolution

What does an A++ rating mean?

An A++ rating from AM Best means the insurance company is considered to be in excellent financial condition and has a very strong ability to meet its obligations.

How often are AM Best ratings updated?

AM Best ratings are typically updated on a quarterly basis, although they can be changed more frequently if there are significant changes in a company’s financial performance or operations.

Are AM Best ratings the only thing I should consider when choosing an insurance company?

While AM Best ratings are a good starting point, it’s also important to consider other factors like customer service, policy coverage, and pricing when choosing an insurance company.