What are the cheapest auto insurance companies sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Navigating the world of auto insurance can feel like driving through a maze of confusing terms and hidden fees. But fear not, fellow drivers, because we’re about to unlock the secrets to finding the best rates and keeping your wallet happy.

From understanding the factors that impact your premium to discovering hidden discounts, we’ll break down everything you need to know about finding the cheapest auto insurance companies. Think of this as your ultimate guide to saving money on your insurance without sacrificing the coverage you need.

Factors Influencing Auto Insurance Costs

Auto insurance premiums are not a one-size-fits-all deal. Your individual driving habits, the car you drive, and where you live all play a role in determining how much you’ll pay. It’s like a personalized pricing system based on your risk profile. Let’s break down the key factors that affect your insurance costs.

Driving History

Your driving history is a big deal in the insurance world. It’s like your driving resume, showcasing your past performance behind the wheel. A clean record, with no accidents or traffic violations, will generally result in lower premiums. It’s like getting a discount for being a responsible driver. However, if you have a history of accidents or violations, you might face higher premiums. This is because insurance companies see you as a higher risk, potentially leading to more claims in the future.

Comparing Auto Insurance Quotes

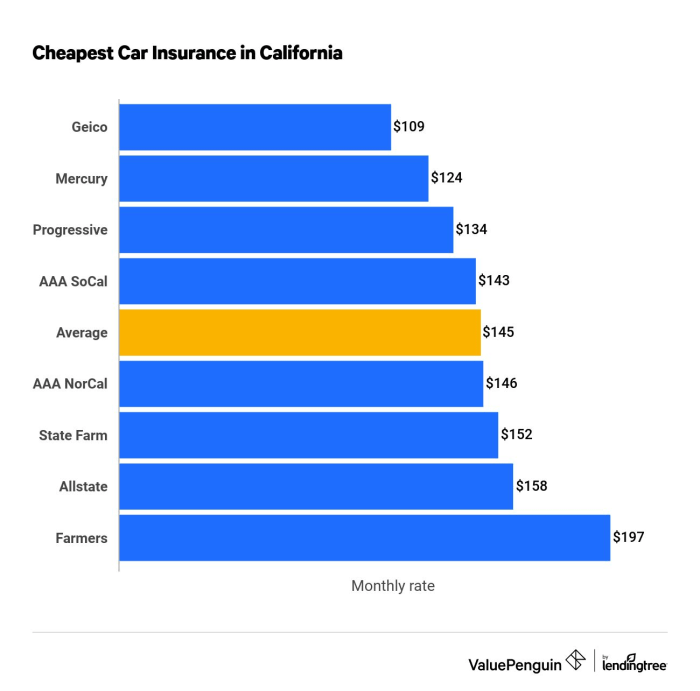

Getting the best auto insurance deal is like finding the perfect pair of jeans – it takes some effort, but it’s totally worth it. You wouldn’t buy the first pair you see, right? Same goes for insurance. Shopping around is key to getting a price that’s right for you.

Getting Quotes from Multiple Insurers

To get the best price, you need to compare apples to apples. This means getting quotes from several different insurance companies, not just the one you’ve always used. Here’s how to get started:

- Gather Your Info: Think of it like getting ready for a first date. You need to be prepared! Grab your driver’s license, vehicle registration, and any other relevant information. You’ll also need to know your driving history and any claims you’ve made.

- Choose Your Coverage: This is where you decide what kind of protection you want. Do you want basic liability coverage, or do you want comprehensive and collision coverage? Think about your budget and your risk tolerance.

- Get Quotes Online: Most insurance companies have online quote tools that make getting a quote super easy. Just fill out the form with your information and boom – you’ll get a price estimate.

- Talk to an Agent: While online quotes are great, sometimes you need to talk to a real person. This is especially true if you have a complex situation or need personalized advice. Don’t be afraid to call up an insurance agent and chat about your options.

- Compare the Quotes: Now that you have a bunch of quotes, it’s time to compare them. Look at the price, the coverage, and any discounts offered. You want to find the best value for your money.

Comparing Key Features

Once you have your quotes, it’s time to dive into the details. Here’s what to look for:

- Coverage: Make sure the coverage offered by each company meets your needs. Some companies offer more options than others, so it’s important to compare.

- Discounts: Many insurance companies offer discounts for things like good driving records, safe driving courses, and even bundling your auto and home insurance.

- Customer Service Ratings: You don’t want to get stuck with an insurance company that has terrible customer service. Check out independent ratings organizations like J.D. Power to see how companies stack up.

Flowchart for Comparing Quotes

Think of this as a visual guide to help you make the right choice:

Start

*Gather your information*

*Choose your coverage*

*Get quotes from multiple insurers*

*Compare quotes based on price, coverage, and discounts*

*Choose the best policy*

End

Understanding Insurance Terminology

Navigating the world of auto insurance can feel like trying to decipher a foreign language. But fear not, fellow driver! We’re here to break down some of the most common insurance terms and explain what they mean in plain English. Understanding these terms is crucial for making informed decisions about your coverage and ensuring you’re adequately protected.

Types of Coverage

Insurance policies can vary widely in their coverage. Here’s a breakdown of some common types of coverage:

- Liability Coverage: This is the most basic type of insurance, and it’s required by law in most states. It covers damages you cause to other people or their property in an accident. Liability coverage typically includes two components:

- Bodily Injury Liability: This covers medical expenses, lost wages, and pain and suffering for people injured in an accident that you caused.

- Property Damage Liability: This covers damages to other people’s property, such as their vehicles or buildings, that you cause in an accident.

- Collision Coverage: This covers damages to your own vehicle in an accident, regardless of who is at fault. It helps pay for repairs or replacement of your car, minus your deductible.

- Comprehensive Coverage: This covers damages to your own vehicle from non-accident events, such as theft, vandalism, fire, hail, or falling objects. It also helps pay for repairs or replacement, minus your deductible.

- Uninsured/Underinsured Motorist Coverage: This protects you if you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have enough insurance to cover your damages.

Full Coverage vs. Minimum Liability

The terms “full coverage” and “minimum liability” often confuse drivers. Here’s a simple explanation:

- Full Coverage: This generally refers to a policy that includes both collision and comprehensive coverage, along with liability coverage. It provides the most comprehensive protection for your vehicle and yourself.

- Minimum Liability: This refers to the minimum amount of liability coverage required by your state. It typically includes a basic level of bodily injury and property damage liability coverage, but does not include collision or comprehensive coverage. This type of policy is the cheapest option, but it offers limited protection.

Glossary of Essential Insurance Terms

Here’s a glossary of some common insurance terms you might encounter:

| Term | Definition |

|---|---|

| Deductible | The amount you pay out-of-pocket for repairs or replacement before your insurance coverage kicks in. |

| Premium | The amount you pay regularly (usually monthly) for your insurance coverage. |

| Claim | A request for payment from your insurance company after an accident or other covered event. |

| Policy | The written contract between you and your insurance company that Artikels the terms of your coverage. |

| Exclusions | Specific events or situations that are not covered by your insurance policy. |

| Endorsements | Additional coverage options that can be added to your policy, such as roadside assistance or rental car coverage. |

Exploring Discounts and Savings

You’re not just shopping for a car, you’re shopping for insurance too. And just like a good deal on a car, finding the right auto insurance discounts can save you serious cash. It’s like scoring a sweet deal on a pair of Jordans, but for your car!

Common Auto Insurance Discounts

These are some of the most common discounts you can snag to lower your premiums:

- Good Driver Discount: This is the MVP of discounts. Insurance companies reward safe drivers with lower rates. This is like getting a free pass to the VIP section for being a responsible driver.

- Safe Vehicle Discount: Got a car that’s safer than a bank vault? You might get a discount for driving a vehicle with advanced safety features like anti-lock brakes, airbags, and stability control.

- Multi-Policy Discount: Insurance companies love it when you bundle your policies. If you insure your car, home, and maybe even your boat with the same company, you can often get a discount for being a loyal customer. It’s like getting a combo meal, but instead of fries, you get lower premiums.

- Other Discounts: Keep your eyes peeled for other discounts like:

- Student Discount: Got a good student in the family? They might qualify for a discount for maintaining good grades.

- Military Discount: Serving your country? Some insurers offer discounts for active duty military personnel or veterans.

- Group Discount: Belong to a certain organization or club? You might be eligible for a group discount.

- Pay-in-Full Discount: Some insurers offer discounts if you pay your premium in full upfront.

Qualifying for Discounts

Here’s the deal: you gotta meet the requirements to score these discounts. It’s like unlocking a secret level in a video game. You might need to:

- Maintain a Clean Driving Record: No speeding tickets, no accidents, no DUIs. Keep your record clean and you’ll be rewarded with lower premiums.

- Complete a Defensive Driving Course: Taking a defensive driving course can demonstrate that you’re a responsible driver. This is like getting a badge of honor for being a safe driver.

- Install Safety Features: If your car doesn’t already have them, installing safety features like anti-theft devices or anti-lock brakes can earn you a discount.

- Meet Age Requirements: Some discounts might be age-specific, like the good student discount or the senior citizen discount.

Comparing Discount Programs, What are the cheapest auto insurance companies

Insurance companies have different discount programs, so it’s like comparing apples and oranges. You gotta shop around to find the best deals. Here are some things to consider:

- Types of Discounts Offered: Some companies might offer a wider range of discounts than others.

- Discount Amounts: Don’t just look at the discounts, check the actual amount you’ll save.

- Eligibility Requirements: Make sure you meet the requirements to qualify for the discounts.

Tips for Finding the Best Deal

Finding the best auto insurance deal involves more than just comparing quotes. It’s about understanding your options, knowing your rights, and leveraging strategies to secure the most favorable rates. By following these tips, you can navigate the insurance landscape and get the coverage you need at a price that fits your budget.

Negotiating Lower Premiums

Negotiating lower premiums can feel like a daunting task, but it’s worth exploring. Here are some strategies to try:

- Bundle your policies: Combining your auto insurance with homeowners or renters insurance can lead to significant savings. Insurance companies often offer discounts for bundling multiple policies.

- Improve your credit score: Your credit score plays a role in determining your insurance premiums. By improving your credit score, you can potentially lower your rates.

- Ask about discounts: Many insurance companies offer discounts for various factors, such as good driving records, safety features in your car, and even being a member of certain organizations. Be sure to inquire about all potential discounts you might qualify for.

- Shop around: Don’t settle for the first quote you receive. Compare quotes from multiple insurance companies to find the best rates.

- Consider increasing your deductible: Raising your deductible can lower your premium, but it means you’ll pay more out of pocket if you need to file a claim. Carefully weigh the pros and cons before making this decision.

- Be a loyal customer: Some insurance companies offer loyalty discounts to long-term policyholders. Staying with the same insurer can potentially lead to lower premiums over time.

- Negotiate during renewal: When your policy is up for renewal, take the opportunity to negotiate a better rate. Insurance companies are often more willing to offer discounts to retain existing customers.

Bundling Insurance Policies

Bundling insurance policies is a smart strategy for saving money. Combining your auto insurance with other policies, such as homeowners, renters, or life insurance, can result in significant discounts.

- Reduced premiums: Insurance companies offer discounts for bundling policies because it’s more profitable for them to insure multiple policies for the same customer.

- Convenience: Bundling simplifies your insurance management by having all your policies under one roof. You’ll have a single point of contact for claims and customer service.

- Potential for loyalty discounts: Bundling can also increase your loyalty with an insurance company, making you eligible for additional discounts.

Resources and Tools for Finding Affordable Auto Insurance

Numerous resources and tools can help you find affordable auto insurance. Here are some to consider:

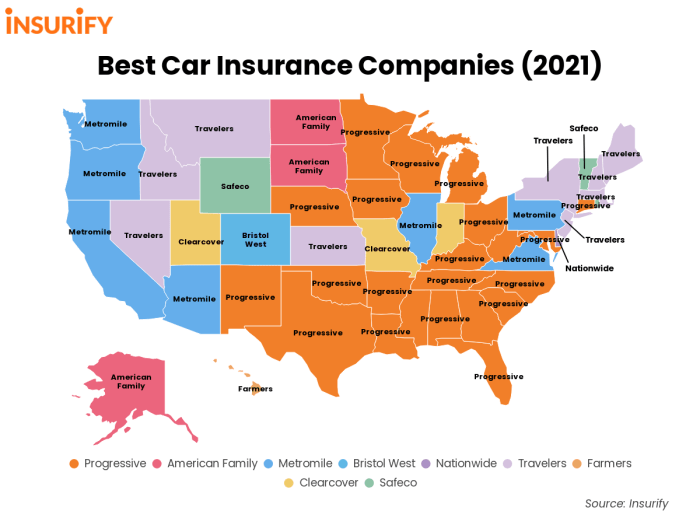

- Online comparison websites: Websites like Policygenius, The Zebra, and Insurance.com allow you to compare quotes from multiple insurance companies simultaneously. This saves you time and effort in your search.

- Insurance brokers: Insurance brokers can provide personalized guidance and help you find the best coverage at the most competitive rates. They work with multiple insurance companies and can navigate the complexities of the insurance market on your behalf.

- Consumer Reports: Consumer Reports provides independent ratings and reviews of insurance companies, helping you make informed decisions based on their financial stability, customer satisfaction, and claims handling practices.

- Your state insurance department: Your state insurance department can provide information on consumer protection laws and help resolve disputes with insurance companies.

The Importance of Coverage

Think of auto insurance as your safety net, protecting you and your ride from the unexpected. It’s not just about covering repairs after an accident, it’s about peace of mind knowing you’re financially secure if something goes wrong.

It’s crucial to have adequate coverage because it can shield you from substantial financial burdens in the event of an accident. Without sufficient insurance, you could face hefty medical bills, repair costs, or even legal battles, putting your financial stability at risk.

The Potential Consequences of Underinsurance

Underinsurance, like wearing a half-sized helmet, can leave you exposed. It’s when your insurance policy doesn’t provide enough coverage to fully cover the damages or losses you incur in an accident. This can lead to a range of consequences:

- Out-of-Pocket Expenses: You might have to pay for repairs or medical bills exceeding your policy limits, leaving you with a significant financial burden.

- Legal Troubles: If you’re found liable for an accident, underinsurance can expose you to lawsuits and hefty legal fees.

- Financial Strain: The costs associated with an accident can strain your finances, potentially leading to debt or even bankruptcy.

Considering Future Needs

Think ahead! Your insurance needs can change as your life evolves.

- New Vehicle: A new car usually means a higher value, so you’ll need to adjust your coverage accordingly.

- Family Growth: Adding a new member to your family increases your responsibility and the potential for accidents, making it crucial to review your coverage.

- Increased Assets: As you acquire more assets, you’ll need to ensure your insurance protects your financial well-being.

Real-World Examples of Insurance Coverage

Insurance coverage has been a lifesaver for many individuals facing difficult situations.

- Medical Coverage: A driver involved in a serious accident was able to access comprehensive medical treatment without worrying about the cost thanks to their health insurance coverage.

- Liability Coverage: A driver who accidentally backed into another car was able to avoid a costly lawsuit due to their liability coverage, which covered the damages to the other vehicle.

- Collision Coverage: A driver whose car was totaled in a collision received a fair payout from their collision coverage, allowing them to purchase a new vehicle.

Last Point

So buckle up, because finding the cheapest auto insurance companies doesn’t have to be a wild ride. With a little research and a sprinkle of savvy, you can navigate the insurance landscape and find the perfect policy that fits your needs and your budget. Remember, knowing your options and asking the right questions are key to getting the best deal. You’ve got this!

Question & Answer Hub: What Are The Cheapest Auto Insurance Companies

What are the most common factors that influence auto insurance premiums?

Your driving record, the type of car you drive, your location, and the coverage you choose all play a big role in determining your insurance premiums. Things like your age, credit score, and even your marital status can also impact your rates.

What are some common discounts offered by auto insurance companies?

Many companies offer discounts for good drivers, safe vehicles, bundling multiple policies, and even completing driver safety courses. Make sure to ask your insurer about all the discounts you might qualify for!

How can I get the most accurate auto insurance quotes?

To get the best quotes, it’s important to provide accurate information about yourself and your vehicle. You should also compare quotes from multiple insurance companies to ensure you’re getting the best deal.

What are some resources for finding affordable auto insurance?

You can use online comparison websites, speak with an independent insurance broker, or consult with your state’s insurance department for help finding affordable options. Remember, it’s always good to shop around and compare!