What insurance companies offer gap coverage – Ever heard of “gap coverage”? It’s like a superhero for your car loan, saving you from financial heartache if your ride gets totaled. Think of it as a safety net that covers the difference between what your insurance pays out (based on your car’s actual value) and what you still owe on your loan. So, if your car’s worth $10,000 but you still owe $15,000, gap coverage steps in to fill that $5,000 gap.

Gap coverage is a smart move for anyone who’s financed their car, especially if you got a great deal on a new ride or have a loan with a longer term. It’s like having an extra layer of protection, just in case something happens to your car. But how do you find the right gap coverage for your needs? We’ll break down the key factors and give you the scoop on some top insurance companies that offer gap coverage.

What is Gap Coverage?: What Insurance Companies Offer Gap Coverage

Imagine you’re cruising down the highway in your brand-new ride, and BAM! A fender bender leaves your car totaled. You’re bummed, but hey, at least you have insurance, right? But here’s the kicker: your insurance payout might not cover the full amount of your car loan. That’s where gap coverage comes in, like a superhero swooping in to save the day.

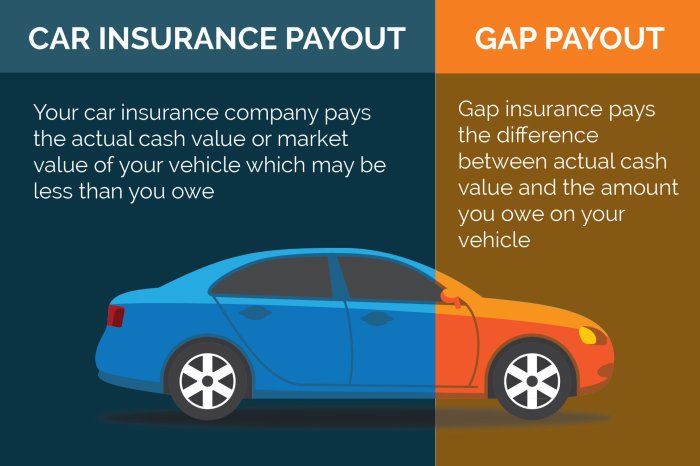

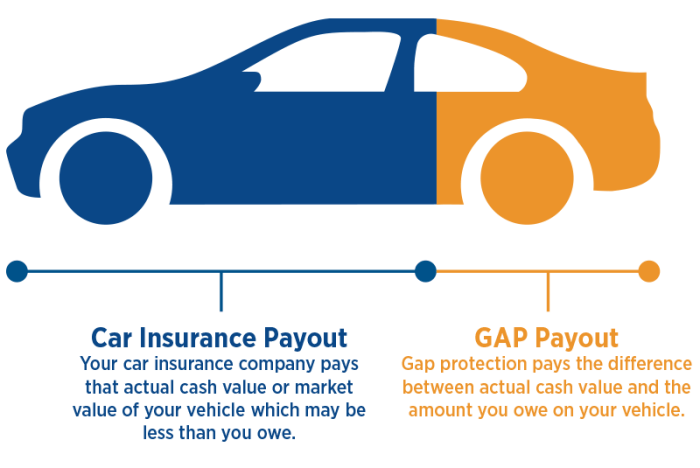

Gap coverage, or Guaranteed Auto Protection, is a type of insurance that protects you from financial losses when your car is totaled or stolen. It bridges the gap between the actual cash value (ACV) of your car and the outstanding balance on your loan.

Actual Cash Value (ACV) vs. Replacement Cost Value (RCV)

Think of it like this: ACV is what your car is worth based on its age, mileage, and condition. It’s like the value of a used car, which is usually less than the original price you paid. RCV, on the other hand, is the cost to replace your car with a brand-new one of the same make and model.

The problem is, insurance companies usually pay out the ACV, not the RCV. So, if you have a loan on your car and it’s totaled, you might end up owing more than your insurance payout. That’s where gap coverage comes in handy.

How Gap Coverage Works

Let’s say you bought a car for $25,000 and financed $20,000. After a year, your car is totaled, and the insurance company offers you $15,000 in ACV. You still owe $18,000 on the loan. That’s where gap coverage kicks in. It pays the difference between the ACV and the outstanding loan balance, leaving you debt-free.

In this case, gap coverage would pay $3,000 ($18,000 loan balance – $15,000 ACV).

Who Needs Gap Coverage?

Gap coverage is like a safety net for your car loan, especially if you’re driving a fancy whip. It’s a good idea to consider it if you’re financing a newer car, but it’s not a one-size-fits-all solution.

Who Benefits Most from Gap Coverage

Let’s break down who might be most interested in gap coverage:

- New Car Owners: If you’re driving a shiny new car, especially if you financed it, gap coverage can be a lifesaver. Cars depreciate like crazy, so if your car gets totaled in an accident, your insurance payout might not cover the full amount you still owe on the loan. Gap coverage fills that gap, helping you avoid being stuck with a hefty debt.

- Drivers with Long Loan Terms: The longer your loan term, the more your car depreciates. If you’re paying off your car over five years or more, gap coverage might be worth considering.

- Drivers with Large Down Payments: Even if you put down a big chunk of change, you could still be upside down on your loan if your car is totaled. Gap coverage can protect you from this situation.

Scenarios Where Gap Coverage is Valuable

Imagine these scenarios:

- Totaled Car: You’re cruising in your sweet ride when BAM! A fender bender turns into a total loss. Your insurance payout is based on the car’s actual cash value (ACV), which is way lower than what you still owe on your loan. Gap coverage steps in to cover the difference, saving you from being stuck with a huge debt.

- Theft: Your ride gets stolen, and you’re left with nothing but a big ol’ loan. Gap coverage can help you get back on your feet by covering the difference between the insurance payout and your loan balance.

- Natural Disaster: A hurricane, flood, or earthquake hits, and your car is a write-off. Gap coverage can make sure you’re not left holding the bag for the remaining loan amount.

Comparing Cost and Benefits

Gap coverage isn’t free, but it’s a small price to pay for the peace of mind it offers. The cost of gap coverage varies depending on your car, your loan amount, and your insurance company. It’s usually a few dollars per month, but it can potentially save you thousands of dollars in the event of a total loss.

- Cost: The average cost of gap coverage is around $10-$20 per month. It’s a small investment that can potentially save you thousands of dollars in the event of a total loss.

- Benefits: The potential benefits of gap coverage can be huge. It can save you from being stuck with a significant debt if your car is totaled, stolen, or damaged beyond repair.

Factors Affecting Gap Coverage Cost

Just like your favorite pizza toppings, the price of gap coverage isn’t a one-size-fits-all deal. Several factors come into play, influencing how much you’ll pay for that extra layer of financial protection.

Think of it like this: you’re building a custom pizza, and each ingredient (factor) adds to the final cost.

Vehicle Age, Model, and Loan Amount, What insurance companies offer gap coverage

The age, make, and model of your vehicle, along with the amount you borrowed to buy it, are major factors that influence the cost of gap coverage.

Imagine you’re buying a brand-new, shiny sports car. You’re borrowing a lot of money to get it. Since it’s new, it’s likely to depreciate quickly, meaning its value will drop fast. If you get into an accident, your insurance might not cover the entire amount you owe on the loan, leaving you with a hefty gap. This scenario would likely result in a higher gap coverage cost.

Now, let’s say you’re driving a reliable, older car with a smaller loan. You’re less likely to owe more than the car is worth. The risk of needing gap coverage is lower, so the cost would likely be less.

Essentially, the higher the loan amount and the faster the vehicle depreciates, the more likely you are to need gap coverage, and the more you’ll likely pay for it.

Credit History and Driving Record

Just like a good credit score can help you snag a lower interest rate on a loan, a good driving record can also save you money on gap coverage. Insurance companies use your driving history to assess your risk.

If you’ve got a clean driving record, you’re considered a lower risk. This means you’ll likely pay less for gap coverage. But if you have a history of accidents or violations, your insurance company might see you as a higher risk, potentially leading to higher premiums.

Similar to your credit history, a strong credit score can also work in your favor. A good credit score indicates you’re financially responsible, which insurance companies consider a positive factor. This could potentially result in lower gap coverage costs.

How to Find Gap Coverage

Finding gap coverage is like finding the perfect pair of jeans: you want something that fits your needs and budget. You can get gap coverage from different places, each with its own perks and drawbacks. Let’s break down the options and see which one fits your style.

Obtaining Gap Coverage Through a Dealership

You can usually get gap coverage when you purchase a new car from a dealership. It’s often presented as an add-on, just like a fancy car wash or a lifetime oil change. This option is convenient, as you can wrap everything up in one go. However, it might not be the most budget-friendly. Dealership gap coverage is often bundled with other extras, which can inflate the price.

Examples of Insurance Companies Offering Gap Coverage

You’re ready to find gap coverage, but you might be wondering, “Who even offers this stuff?” Don’t worry, it’s not some secret insurance society. Many major insurance companies offer gap coverage, so you’ve got options!

Insurance Companies Offering Gap Coverage

Here’s a rundown of some popular insurance companies that offer gap coverage. Keep in mind that coverage details and pricing can vary based on your car, location, and other factors. It’s always best to contact the insurance company directly for the most up-to-date information.

| Company Name | Website | Key Features | Contact Information |

|---|---|---|---|

| Geico | https://www.geico.com/ | Offers gap coverage as an add-on to their auto insurance policies. Provides coverage for the difference between your car’s actual cash value and the amount you owe on your loan or lease. | 1-800-434-2426 |

| Progressive | https://www.progressive.com/ | Offers gap coverage as an optional add-on to their auto insurance policies. Helps cover the difference between the actual cash value of your vehicle and the amount you owe on your loan or lease. | 1-800-PROGRESSIVE (1-800-776-4737) |

| State Farm | https://www.statefarm.com/ | Offers gap coverage as an add-on to their auto insurance policies. Provides coverage for the difference between the actual cash value of your car and the amount you owe on your loan or lease. | 1-800-STATE FARM (1-800-782-8332) |

| Allstate | https://www.allstate.com/ | Offers gap coverage as an add-on to their auto insurance policies. Helps cover the difference between the actual cash value of your vehicle and the amount you owe on your loan or lease. | 1-800-ALLSTATE (1-800-255-7828) |

Benefits of Gap Coverage

Imagine this: your brand new car, only a year old, gets totaled in an accident. You’re heartbroken, but you also know you’re covered by insurance. However, the insurance payout might not be enough to cover the full amount you owe on the loan, leaving you with a significant financial gap. This is where gap coverage comes in, acting as a safety net to protect you from financial burdens in such situations.

Financial Protection in Total Loss

Gap coverage bridges the financial gap between your car’s actual cash value (ACV) and the outstanding loan balance. ACV is the market value of your car at the time of the accident, which depreciates over time. In contrast, your loan balance represents the amount you still owe on your car loan. When your car is totaled, the insurance payout based on ACV might be significantly less than your outstanding loan balance, leaving you responsible for the difference. Gap coverage steps in to cover this financial gap, ensuring you’re not left with a substantial debt.

Avoiding Financial Burdens After an Accident

Without gap coverage, you might find yourself in a difficult financial position after an accident. The insurance payout might not be enough to cover your loan balance, forcing you to make up the difference out of pocket. This could lead to financial stress, impacting your credit score and overall financial well-being. Gap coverage acts as a shield against these potential financial burdens, ensuring you’re not left with a substantial debt after an accident.

Real-Life Scenarios

Imagine a young professional who recently bought a brand new car for $30,000, taking out a loan for the full amount. After a year, the car’s ACV drops to $20,000 due to depreciation. Unfortunately, the car is totaled in an accident. Without gap coverage, the insurance payout would only be $20,000, leaving the driver with a $10,000 debt. However, with gap coverage, the insurance company would pay the remaining $10,000, covering the difference between the ACV and the loan balance.

Another scenario involves a family who purchased a used car for $15,000 with a loan of $12,000. After a few years, the car’s ACV drops to $8,000 due to depreciation. If the car is totaled in an accident, the insurance payout would be $8,000. Without gap coverage, the family would be left with a $4,000 debt. But with gap coverage, the insurance company would cover the $4,000 difference, ensuring the family doesn’t face a financial burden.

Limitations of Gap Coverage

Gap coverage is a helpful tool, but it’s not a magic bullet. Like any insurance policy, it has its limits. Understanding these limitations is crucial before you commit to purchasing it. It’s important to weigh the potential benefits against the potential drawbacks to ensure it’s the right choice for your specific situation.

Scenarios Where Gap Coverage Might Not Be Applicable

Gap coverage isn’t a one-size-fits-all solution. It’s not designed to cover every possible situation. Here are some scenarios where gap coverage might not apply:

- Total Loss Due to an Accident: Gap coverage is designed to bridge the gap between what your insurance pays and what you owe on your loan. If your car is totaled in an accident, gap coverage will only cover the difference if you owe more on the loan than the insurance payout. For example, if you owe $25,000 on your car loan and your insurance only pays $20,000, gap coverage would cover the remaining $5,000. However, if you have a newer car with a lower loan balance, you may not need gap coverage.

- Total Loss Due to Other Causes: Gap coverage might not apply to situations where your car is totaled due to causes other than accidents. For example, if your car is stolen and not recovered, or if it’s damaged beyond repair due to a natural disaster, gap coverage might not cover the entire difference between your loan balance and the insurance payout. It’s important to check the specific terms of your gap coverage policy to understand the circumstances under which it applies.

- Used Cars: Gap coverage is typically offered on newer cars, as the loan balance is often higher than the car’s value. If you purchase a used car, you might not be able to get gap coverage, or the coverage might be limited. The reason for this is that the car’s value depreciates quickly, and the loan balance might be less than the car’s actual value after a short period of time.

- Cars With Low Loan Balances: If you have a lower loan balance on your car, you may not need gap coverage. This is because the insurance payout might be enough to cover your loan balance, even if your car is totaled. You should consider your loan balance and the estimated value of your car to determine if gap coverage is necessary.

Considerations Before Purchasing Gap Coverage

Before you decide to purchase gap coverage, there are a few key factors to consider:

- Loan Balance: The higher your loan balance, the more likely you are to benefit from gap coverage. If you have a large loan balance and your car is totaled, gap coverage can help you avoid a significant financial burden.

- Car’s Value: The value of your car is another important factor. If your car is worth less than what you owe on it, gap coverage can help make up the difference. You can estimate the value of your car using online tools or by contacting a local car dealership.

- Your Financial Situation: Consider your overall financial situation before purchasing gap coverage. If you have a limited budget, gap coverage might not be a priority. However, if you can afford it and you’re concerned about the potential financial impact of a totaled car, gap coverage can provide peace of mind.

Ending Remarks

Gap coverage can be a lifesaver if your car gets totaled, especially if you’re still paying off a hefty loan. It’s like having a safety net that catches you when you need it most. While it’s not a requirement, it’s definitely worth considering if you want to protect yourself from financial hardship in the event of an accident. Before you make a decision, do your research, compare prices, and find the gap coverage that fits your budget and needs. And remember, a little bit of protection goes a long way.

FAQ Section

How much does gap coverage cost?

The cost of gap coverage varies depending on your car, loan amount, and insurance company. It’s usually a small extra premium on top of your regular car insurance.

Can I get gap coverage after I’ve already financed my car?

You might be able to, but it depends on the insurance company. Some insurers offer gap coverage as an add-on to your existing policy, while others may only offer it when you first finance your car.

Do I need gap coverage if I have full coverage insurance?

Full coverage insurance protects you from damage to your car, but it doesn’t necessarily cover the entire loan balance if your car is totaled. Gap coverage fills that gap, ensuring you’re not left with a hefty debt.