What’s the best insurance company? It’s a question we all ask ourselves, especially when life throws us a curveball. Whether you’re a first-time homeowner, a growing family, or just looking for the best deal, finding the right insurance can feel like navigating a maze. But don’t worry, you’re not alone. This guide will help you decode the world of insurance and find the perfect fit for your needs.

From understanding your insurance needs to comparing quotes and managing your policies, we’ll break down everything you need to know to make an informed decision. Think of it like your own personal insurance playbook, equipped with all the tools you need to score a winning policy.

Understanding Insurance Needs

Insurance is like a safety net, protecting you and your loved ones from unexpected life events. Understanding your insurance needs is crucial to ensure you have the right coverage to safeguard your financial well-being. Let’s dive into the world of insurance and figure out what’s essential for you.

Common Insurance Needs, What’s the best insurance company

Insurance protects you from various risks, and different types of insurance address specific needs. Here are some common insurance needs for individuals and families:

- Health Insurance: This covers medical expenses, including doctor visits, hospital stays, and prescription drugs. It’s essential for safeguarding your health and financial security in case of illness or injury.

- Auto Insurance: This protects you against financial losses resulting from accidents, theft, or damage to your vehicle. It’s legally required in most states and helps cover repairs, medical bills, and liability claims.

- Homeowners or Renters Insurance: This protects your property and belongings against damage or loss due to fire, theft, or natural disasters. It also provides liability coverage for injuries that occur on your property.

- Life Insurance: This provides financial support to your loved ones in the event of your death. It can help cover funeral expenses, outstanding debts, and ongoing living expenses for your dependents.

Assessing Risk Factors

Before you start shopping for insurance, it’s important to understand your individual risk factors. These factors influence the types and amount of coverage you need. Here’s a breakdown:

- Age: Older individuals may require more health insurance coverage, while younger individuals might prioritize life insurance to protect their families.

- Health: Individuals with pre-existing conditions may need more comprehensive health insurance plans.

- Location: Your location can impact your insurance needs. For example, those living in areas prone to natural disasters might need additional coverage.

- Lifestyle: Your lifestyle can also influence your insurance needs. For example, drivers who frequently commute long distances might need higher auto insurance limits.

Different Insurance Types

The insurance world offers a variety of options to cater to your specific needs. Here’s a comprehensive list of different insurance types:

- Health Insurance: This covers medical expenses, including doctor visits, hospital stays, and prescription drugs.

- Auto Insurance: This protects you against financial losses resulting from accidents, theft, or damage to your vehicle.

- Homeowners Insurance: This protects your home and belongings against damage or loss due to fire, theft, or natural disasters.

- Renters Insurance: This protects your personal belongings against damage or loss while renting an apartment or house.

- Life Insurance: This provides financial support to your loved ones in the event of your death.

- Disability Insurance: This provides income replacement if you become disabled and unable to work.

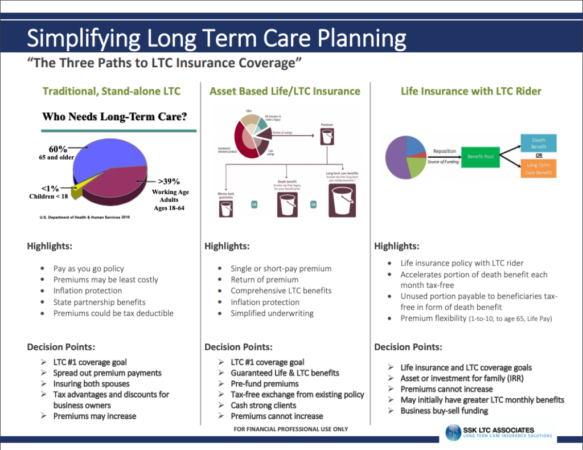

- Long-Term Care Insurance: This covers the costs of long-term care services, such as assisted living or nursing home care.

- Umbrella Insurance: This provides additional liability coverage beyond your existing policies, protecting you from major financial losses.

- Business Insurance: This protects businesses from various risks, including property damage, liability claims, and employee injuries.

Last Recap

So, what’s the best insurance company for you? Ultimately, the answer depends on your individual circumstances and priorities. But with the right information and a little bit of research, you can find a policy that protects you and your loved ones without breaking the bank. Remember, insurance is a game of strategy, and with this guide, you’ll be ready to play and win.

Query Resolution: What’s The Best Insurance Company

What is the difference between a deductible and a premium?

A deductible is the amount you pay out of pocket before your insurance coverage kicks in, while a premium is the regular payment you make for your insurance policy.

How often should I review my insurance policies?

It’s a good idea to review your insurance policies at least once a year, or whenever there’s a significant change in your life, such as getting married, having a child, or buying a new home.

What are some tips for negotiating insurance rates?

You can often negotiate lower rates by comparing quotes from different companies, bundling multiple policies, and asking about discounts for safety features, good driving records, or being a loyal customer.