- Understanding Insurance Policy Cancellation

- Cancellation Due to Non-Payment of Premiums

- Cancellation Due to Fraud or Misrepresentation

- Cancellation Due to Changes in Risk

- Consumer Rights and Options After Cancellation

- Preventing Policy Cancellation

- Final Thoughts: Can An Insurance Company Cancel Your Policy

- Question Bank

Can an insurance company cancel your policy? It’s a question that might make you sweat, especially if you’re already dealing with a tough situation. The truth is, insurance companies do have the right to cancel your policy, but it’s not always a sudden, unexpected bombshell. There are specific reasons and procedures they must follow. Understanding those reasons and your rights is crucial, so you can be prepared and take action if needed.

This guide will break down the common scenarios where an insurance company might pull the plug on your policy, explaining the rules of the game, your options, and how to stay in control. Think of it like a playbook for navigating the world of insurance cancellation, so you can avoid getting blindsided.

Understanding Insurance Policy Cancellation

It’s not a fun thought, but insurance companies can cancel your policy. This can happen for a variety of reasons, some of which you might not even realize are against the terms of your policy. Let’s break down the reasons why your insurance company might cancel your policy, the things you need to know about policy violations, and the legal implications of policy cancellation.

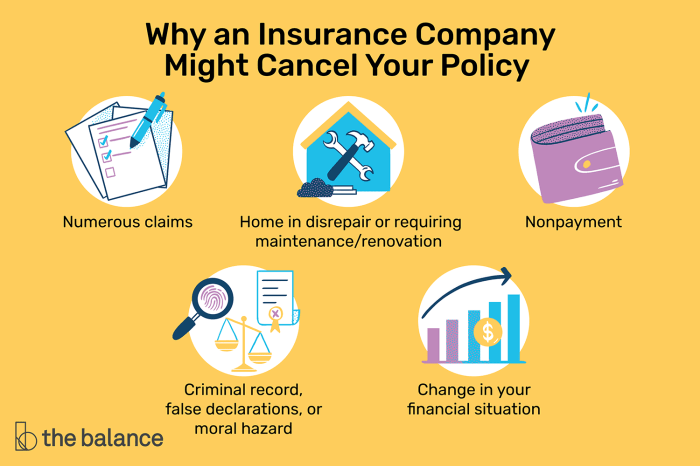

Reasons for Policy Cancellation

Insurance companies have the right to cancel your policy if you violate the terms of your contract. Here are some of the most common reasons why this might happen:

- Non-Payment of Premiums: This is the most common reason for policy cancellation. If you don’t pay your premiums on time, your insurance company can cancel your policy. Remember, insurance is a contract, and you’re obligated to pay your premiums in exchange for coverage.

- Fraudulent Claims: If you try to make a false claim, your insurance company will likely cancel your policy. This includes lying about the circumstances of an accident or exaggerating the extent of your damages.

- Material Misrepresentation: When you apply for insurance, you’re required to provide accurate information about yourself and your situation. If you intentionally lie or omit important details, your policy could be canceled. For example, if you fail to disclose a pre-existing medical condition on a health insurance application, your policy might be canceled if you file a claim related to that condition.

- Changes in Risk: Sometimes, your insurance company might cancel your policy if your risk profile changes significantly. For example, if you move to a high-crime area or start a dangerous hobby, your insurance company might decide that you’re too risky to insure.

- Failure to Meet Policy Conditions: Every insurance policy has specific conditions that you must meet to maintain coverage. These conditions can vary depending on the type of insurance. For example, a homeowner’s insurance policy might require you to maintain a certain level of security on your property. If you fail to meet these conditions, your insurance company can cancel your policy.

Policy Violations

Here are some common examples of policy violations that could lead to cancellation:

- Driving Under the Influence: If you’re caught driving under the influence of alcohol or drugs, your auto insurance policy could be canceled. Insurance companies view this as a significant risk, and they’re not willing to cover drivers who are likely to cause accidents.

- Driving Without a License: Driving without a valid driver’s license is a violation of the law, and it can also be a violation of your auto insurance policy. Insurance companies might cancel your policy if they find out you’ve been driving without a license.

- Failure to Disclose a Pre-Existing Condition: As mentioned earlier, failing to disclose a pre-existing medical condition on a health insurance application can lead to policy cancellation.

- Making False Statements on an Insurance Application: Any misrepresentation or omission of important information on an insurance application can lead to policy cancellation.

- Failing to Maintain a Safe Property: Homeowners insurance policies often require you to maintain a certain level of security on your property. This might include things like installing smoke detectors or having a working alarm system. If you fail to meet these requirements, your insurance company could cancel your policy.

Legal Implications of Policy Cancellation

It’s important to understand the legal implications of policy cancellation. Both the insurer and the insured have certain rights and responsibilities:

- Insurer’s Rights: Insurance companies have the right to cancel your policy for legitimate reasons. They must follow specific procedures for cancellation, which vary by state. Typically, they’re required to provide you with written notice of cancellation and give you a certain amount of time to find new coverage.

- Insured’s Rights: You have the right to appeal a cancellation decision. You also have the right to receive a full refund of any unearned premiums. This means that if your policy is canceled before the end of your coverage period, you’re entitled to a refund for the portion of the policy you didn’t use.

- Cancellation Notice: Insurance companies are required to provide you with written notice of cancellation. This notice must include the reason for cancellation and the date on which the policy will be canceled. You should carefully review this notice and make sure you understand the reason for cancellation.

- Appeal Process: If you disagree with the reason for cancellation, you have the right to appeal the decision. The appeal process will vary depending on the state and the type of insurance. You should contact your insurance company or the state insurance department for information on how to appeal.

Cancellation Due to Non-Payment of Premiums

It’s a classic scenario: you forget to pay your insurance premium. Don’t worry, it happens to the best of us. But it’s important to understand what happens next, because if you don’t pay up, your policy could be canceled.

Insurance companies understand that life throws curveballs, so they usually give you a grace period to make your payment. This is like a “do-over” period, giving you a little extra time to catch up before any serious consequences kick in.

Grace Period and Consequences

Insurance companies typically offer a grace period of 10 to 30 days after the due date of your premium payment. During this time, your policy remains active. However, if you miss the grace period, your policy could be canceled. Think of it like a movie ticket that expires – you miss the deadline, you miss the show. The consequences of missing your grace period vary depending on the type of insurance and the insurance company. For example, if you have a car insurance policy and your policy is canceled due to non-payment, you could face higher premiums when you try to get new coverage, or even have your license suspended.

Policy Lapse

A policy lapse is different from cancellation. When your policy lapses, it means that your coverage has stopped, but it doesn’t necessarily mean your policy is canceled. It’s like pressing the pause button on your coverage. The insurance company may still be willing to reinstate your policy if you pay the missed premium, but you might have to pay a late fee or a penalty.

Cancellation vs. Lapse

| Cancellation | Lapse | |

|---|---|---|

| Coverage | Coverage is terminated permanently | Coverage is temporarily suspended |

| Reinstatement | Not possible unless the insurer agrees | Usually possible by paying missed premiums and fees |

| Consequences | Higher premiums, license suspension, etc. | Late fees, penalties, potential denial of future coverage |

Cancellation Due to Fraud or Misrepresentation

Insurance companies are pretty serious about honesty. If you try to pull a fast one, they’ll be ready to cancel your policy. It’s all about protecting themselves and making sure everyone pays their fair share. Think of it as a big game of trust, and if you break the rules, you’re out.

Investigating Suspected Fraud

When an insurance company suspects fraud, they’re like detectives on the case. They’ll start digging into the details to see if something’s fishy. Think of it like a puzzle, and they’re trying to put all the pieces together. Here’s what they might do:

- Review your application: They’ll go back and check if you told the truth on your application. Did you leave out any important details or fudge the facts?

- Investigate the claim: They’ll take a close look at your claim to see if it adds up. Did you really have an accident, or are you making it up? They might even call witnesses or check surveillance footage.

- Check your history: They might look into your past claims and see if you have a history of making fraudulent claims. This could be a red flag for them.

- Consult with experts: If the case is complex, they might bring in experts to help them investigate. This could be a fraud investigator, an accident reconstruction specialist, or even a medical professional.

Consequences of Insurance Fraud

Getting caught for insurance fraud is like getting caught with your hand in the cookie jar. The consequences can be pretty serious, and they might include:

- Policy cancellation: This is the first and most likely consequence. They’ll cancel your policy, and you’ll be left without coverage.

- Denial of future claims: Even if you get a new policy with a different company, they might deny your claims based on your past fraud.

- Fines and penalties: Depending on the severity of the fraud, you could face hefty fines and penalties. It’s like a double whammy: you lose your coverage, and you have to pay extra on top of that.

- Jail time: In some cases, insurance fraud can be a criminal offense, and you could end up behind bars.

Cancellation Due to Changes in Risk

Insurance companies assess risk when they issue a policy. This risk assessment is based on the information you provide, such as your driving record, health history, and property details. If your circumstances change, it can impact the risk associated with your policy. If the risk becomes significantly higher, your insurance company may choose to cancel your policy.

Think of it like this: if you were a really safe driver with a clean record, but then started driving recklessly and got into multiple accidents, your insurance company might be like, “Whoa, this person is a risk now!” They might decide to cancel your policy or raise your premiums because you’re not the same safe driver they initially insured.

Situations That Can Lead to Policy Cancellation Due to Increased Risk

There are several situations that can increase the risk associated with your policy and potentially lead to cancellation. These situations vary depending on the type of insurance policy.

- Auto Insurance:

- Getting multiple traffic violations or a DUI.

- Adding a high-risk driver to your policy, such as a teenager or someone with a poor driving record.

- Making significant changes to your vehicle, such as adding modifications that increase its performance or value.

- Moving to a high-risk area with a higher rate of accidents or crime.

- Health Insurance:

- Developing a pre-existing condition that significantly increases your healthcare costs.

- Changing your employment status, which may affect your eligibility for employer-sponsored health insurance.

- Moving to a different state, which may have different health insurance regulations.

- Life Insurance:

- Engaging in high-risk activities, such as skydiving or extreme sports.

- Developing a serious health condition that significantly shortens your life expectancy.

- Making significant changes to your financial situation, such as taking on substantial debt.

Cancellation Process for Different Insurance Policies, Can an insurance company cancel your policy

The cancellation process can vary depending on the type of insurance policy and the specific circumstances.

- Auto Insurance:

- Insurance companies typically provide a grace period for non-payment of premiums, but if you continue to miss payments, your policy may be canceled.

- If your policy is canceled due to a change in risk, such as getting multiple traffic violations, the insurance company may send you a notice explaining the reason for cancellation and your options.

- You may be able to appeal the cancellation decision or find a new insurance policy with a different company.

- Health Insurance:

- Health insurance policies are generally less likely to be canceled due to changes in risk, especially if you are covered under an employer-sponsored plan.

- However, if you have an individual health insurance policy and develop a pre-existing condition, the insurance company may raise your premiums or decline to renew your policy.

- In some cases, you may be able to appeal the insurance company’s decision or find a different health insurance plan.

- Life Insurance:

- Life insurance policies are typically more stable and less likely to be canceled due to changes in risk, but they can be canceled if you fail to pay your premiums.

- If you develop a serious health condition that significantly shortens your life expectancy, the insurance company may offer to reduce your death benefit or adjust your policy to reflect the increased risk.

- In some cases, the insurance company may decline to renew your policy if the risk has become too high.

Consumer Rights and Options After Cancellation

It can be super frustrating to have your insurance policy cancelled, but you’re not completely out of luck! There are certain rights you have as a policyholder, and there are steps you can take to get back on your feet.

Knowing your rights is key to navigating this situation. You’re not powerless. Whether it’s a car insurance policy, health insurance, or even homeowners insurance, you have the right to understand why your policy was cancelled and what your options are.

Rights After Cancellation

If your insurance policy is cancelled, you have certain rights, including the right to be notified in advance, the right to appeal the cancellation, and the right to file a complaint with the relevant regulatory body.

- Right to Notice: Insurance companies are generally required to give you advance notice before cancelling your policy. This notice period varies depending on the state and the reason for cancellation.

- Right to Appeal: You have the right to appeal the cancellation decision. This means you can challenge the reason for cancellation and try to get your policy reinstated.

- Right to File a Complaint: If you believe your insurance company has unfairly cancelled your policy, you have the right to file a complaint with the state insurance department or other relevant regulatory body.

Filing a Complaint with a Regulatory Body

If you’re unhappy with the way your insurance company handled the cancellation, you can file a complaint with the state insurance department.

- Gather Your Information: Before you file a complaint, gather all the relevant information, such as your policy number, the date of cancellation, and any correspondence you’ve had with the insurance company.

- Contact Your State Insurance Department: You can find contact information for your state insurance department online or by calling the insurance commissioner’s office.

- File Your Complaint: You can usually file a complaint online, by mail, or by phone.

Finding a New Insurer

Once your policy is cancelled, you’ll need to find a new insurance company.

- Shop Around: Get quotes from multiple insurance companies to compare rates and coverage.

- Consider Your Needs: Think about what kind of coverage you need and what your budget is.

- Read the Fine Print: Carefully review the policy documents before you sign up to make sure you understand the terms and conditions.

Preventing Policy Cancellation

So, you’ve learned about all the reasons why your insurance policy might get canceled. But don’t fret! You’re not powerless against the insurance gods. There are things you can do to stay in good standing and avoid getting kicked to the curb. Think of it as your insurance survival guide, and trust me, it’s way less dramatic than the “Hunger Games.”

Steps to Minimize the Risk of Cancellation

Here’s the deal: Insurance companies want to keep you as a customer. They’re not in the business of cancelling policies willy-nilly. But they do need to protect themselves from risky situations. By following these steps, you can show them you’re a responsible policyholder and keep your coverage in good shape.

- Pay your premiums on time. This is the number one way to avoid cancellation. Set up automatic payments or reminders to make sure you don’t miss a deadline. Think of it like paying rent – you wouldn’t want to get evicted, right?

- Update your contact information. Make sure your insurance company has your current address, phone number, and email address. You don’t want to miss important notices about your policy, like changes in premiums or deadlines. It’s like keeping your social media profiles up-to-date – you want to stay connected!

- Review your policy regularly. Make sure your coverage still meets your needs and that you understand all the terms and conditions. It’s like getting a yearly check-up for your insurance.

- Be honest and accurate. When you apply for insurance or report a claim, be truthful and provide all the necessary information. Lying or withholding information can lead to cancellation. Remember, honesty is always the best policy, even when it comes to insurance.

- Communicate with your insurance company. If you’re having trouble paying your premiums, contact your insurance company as soon as possible. They may be able to work with you to create a payment plan or find other solutions. Communication is key, just like in any relationship.

Important Policy Documents and Information

Think of these as your insurance essentials. Keep them organized and accessible so you can easily find them when you need them.

- Policy Declarations Page: This document summarizes your coverage, including the policy number, insured parties, coverage amounts, and premiums. It’s like the “About Me” section of your insurance profile.

- Policy Contract: This document contains the full terms and conditions of your insurance policy. It’s like the official rulebook of your insurance.

- Payment Records: Keep track of your payment history, including dates and amounts paid. This can be helpful if you ever need to dispute a claim or verify your coverage. It’s like your insurance diary.

- Claim Information: If you’ve filed a claim, keep all related documents, including the claim number, date of claim, and any correspondence with your insurance company. This is your insurance evidence file.

Maintaining Open Communication with Your Insurance Company

Communication is the key to a happy and healthy insurance relationship. Don’t be afraid to reach out to your insurance company if you have any questions or concerns. They’re there to help you, and they want you to understand your policy. Think of it like talking to your insurance bestie.

- Contact your insurance company immediately if you have any questions or concerns about your policy. Don’t let things fester or assume you know everything. It’s always better to be safe than sorry.

- Keep your insurance company updated on any changes to your situation, such as a change in address, a new car, or a new driver in your household. This ensures your policy is accurate and reflects your current needs. It’s like updating your insurance profile.

- If you are experiencing financial difficulties, contact your insurance company to discuss possible payment arrangements. They may be able to work with you to avoid cancellation. It’s like asking for a little insurance help from your insurance friend.

Final Thoughts: Can An Insurance Company Cancel Your Policy

Remember, being informed is your best defense. By understanding the reasons for policy cancellation, your rights, and the steps you can take to prevent it, you can keep your coverage secure and avoid any nasty surprises. So, stay proactive, keep your policy documents organized, and keep the lines of communication open with your insurance company. It’s all about being a savvy insurance consumer, and that’s how you win the game.

Question Bank

What happens if I miss a premium payment?

Most insurance companies offer a grace period for late payments. If you miss a payment within the grace period, your policy won’t be immediately canceled. However, exceeding the grace period can lead to policy lapse or cancellation.

Can I appeal the cancellation of my insurance policy?

Yes, you usually have the right to appeal the cancellation of your policy. You can submit a written appeal to your insurance company, outlining your reasons for disagreeing with their decision.

What are the consequences of insurance fraud?

Insurance fraud can result in serious consequences, including policy cancellation, fines, and even criminal charges.

How can I find a new insurance company after my policy is cancelled?

You can start by contacting insurance brokers or comparing quotes online. Be sure to disclose any past policy cancellations or claims to ensure you get accurate quotes.