Is Transamerica a good life insurance company? It’s a question that pops up when you’re looking for the best way to protect your loved ones. Transamerica’s been around for a while, a real OG in the financial game. They offer a whole range of life insurance options, from term life to whole life and universal life. But is it the right fit for you? We’ll dive into the nitty-gritty, looking at their financial strength, customer service, and how they stack up against the competition.

We’ll break down their products, their reputation, and what you need to know before you sign on the dotted line. Whether you’re a seasoned investor or just starting out, understanding Transamerica’s strengths and weaknesses can help you make an informed decision about your life insurance needs.

Customer Experience and Service

Transamerica’s customer experience and service are crucial factors to consider when evaluating their life insurance offerings. Understanding how Transamerica interacts with its customers, including their service channels, response times, and claims processing procedures, can help potential policyholders make informed decisions.

Customer Reviews and Feedback

Customer reviews and feedback provide valuable insights into Transamerica’s customer service performance. While customer experiences can vary, analyzing online reviews and forums can offer a general understanding of common perceptions.

- Many customers appreciate Transamerica’s knowledgeable and responsive customer service representatives. They highlight the company’s willingness to answer questions and provide clear explanations.

- Some customers express frustration with lengthy wait times on the phone or difficulty reaching a representative. This suggests potential areas for improvement in customer service accessibility.

- Positive feedback often centers around Transamerica’s efficient claims processing procedures and timely payouts.

Comparison with Competitors: Is Transamerica A Good Life Insurance Company

Transamerica is a major player in the life insurance industry, competing with other well-established companies like Northwestern Mutual, Prudential, and New York Life. Evaluating Transamerica’s strengths and weaknesses against these competitors is crucial for understanding its position in the market.

Transamerica’s Life Insurance Products and Pricing Compared to Competitors

Comparing Transamerica’s life insurance products and pricing with those of major competitors involves considering factors like coverage types, policy features, and cost. Transamerica offers a variety of life insurance products, including term life, whole life, universal life, and variable life insurance. These products are comparable to those offered by other major players in the market.

Transamerica’s pricing is generally competitive, with premiums varying based on factors such as age, health, and coverage amount. For example, a 30-year-old healthy individual seeking a $250,000 term life insurance policy might find comparable premiums from Transamerica and other major insurers like Northwestern Mutual or Prudential.

Key Differentiators and Advantages or Disadvantages of Transamerica

Transamerica’s key differentiators include its focus on customer service, its wide range of financial products, and its strong financial stability. Transamerica’s customer service is often praised for its responsiveness and helpfulness. Additionally, Transamerica offers a variety of financial products beyond life insurance, such as annuities, retirement plans, and investment products, which can be beneficial for customers seeking comprehensive financial solutions. Transamerica’s strong financial stability, as evidenced by its high credit rating, can provide reassurance to customers about the company’s long-term viability.

However, Transamerica may face some disadvantages compared to competitors. For example, its life insurance products might not always offer the most competitive features or benefits compared to certain rivals. Additionally, some customers may find Transamerica’s website or online tools less user-friendly than those offered by competitors.

Strengths and Weaknesses Relative to Competitors in the Life Insurance Market

Transamerica’s strengths include its established brand recognition, its diverse product portfolio, and its strong financial performance. Transamerica has a long history in the financial services industry, which has helped build a strong brand reputation. Its diverse product portfolio allows it to cater to a wide range of customer needs, while its strong financial performance demonstrates its ability to remain competitive in the market.

However, Transamerica also faces some weaknesses. Its life insurance products might not always be the most innovative or feature-rich compared to competitors. Additionally, Transamerica’s marketing and advertising efforts could be strengthened to better attract and retain customers.

Factors to Consider When Choosing Transamerica

Choosing the right life insurance policy can be a major decision, and Transamerica is one of many providers you might consider. Before you make a choice, it’s essential to weigh several factors to ensure you get the coverage that best meets your needs and financial situation.

Your Individual Needs and Financial Circumstances

Your individual needs and financial circumstances play a crucial role in selecting the right life insurance policy. You need to consider your dependents, financial obligations, and your overall financial goals. For example, if you have a young family, you might need a larger death benefit to provide for their financial security in your absence. If you have a significant amount of debt, you might need a policy that can help pay off those obligations.

Comparing Life Insurance Options from Transamerica and Other Providers

Once you have a clear understanding of your needs, you can start comparing different life insurance options from Transamerica and other providers. Here are some key factors to consider:

- Type of Policy: Transamerica offers a variety of life insurance policies, including term life, whole life, and universal life. Each type has its own benefits and drawbacks, so it’s important to understand the differences and choose the one that best suits your needs. For instance, term life insurance provides coverage for a specific period, while whole life insurance offers lifetime coverage and cash value accumulation.

- Death Benefit: The death benefit is the amount of money your beneficiaries will receive upon your death. It’s essential to choose a death benefit that is sufficient to meet your family’s financial needs. For example, if you have a young family, you might need a larger death benefit to cover their living expenses, education costs, and other financial obligations.

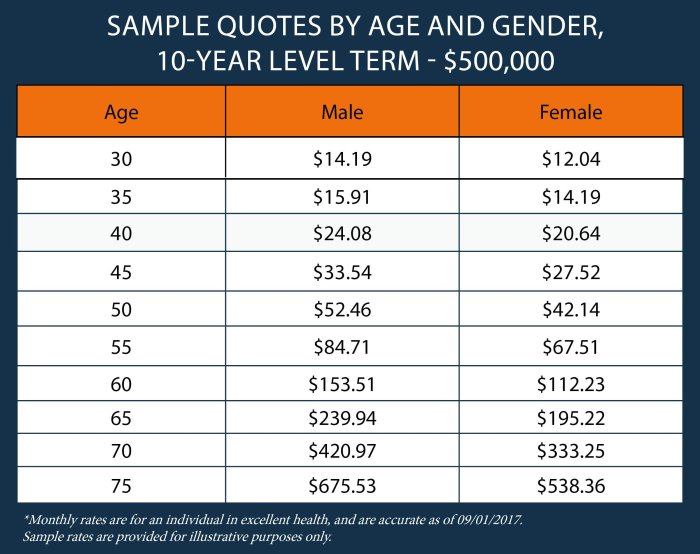

- Premiums: Premiums are the monthly payments you make for your life insurance policy. The cost of premiums can vary depending on several factors, including your age, health, and the type of policy you choose. When comparing policies, it’s important to consider the total cost of premiums over the life of the policy.

- Riders: Riders are additional features that can be added to your life insurance policy to provide extra coverage or benefits. For example, you might consider adding a waiver of premium rider, which would waive your premium payments if you become disabled. Consider which riders are important to you and factor them into your comparison.

- Financial Stability: It’s essential to choose a life insurance provider that is financially stable and has a strong track record. You can research the financial health of Transamerica and other providers by checking their ratings from independent agencies like A.M. Best and Moody’s.

- Customer Service: Good customer service is essential, especially when dealing with a complex financial product like life insurance. Research Transamerica’s customer service reputation by reading online reviews and testimonials. Consider reaching out to the company directly to ask questions and get a feel for their responsiveness and helpfulness.

Potential Risks and Considerations

Like any financial product, life insurance policies come with potential risks and considerations. It’s crucial to understand these aspects before committing to a policy, especially when dealing with a significant financial decision like life insurance. While Transamerica offers a range of life insurance products, there are some potential drawbacks and limitations that you should be aware of.

Limitations and Exclusions

Transamerica’s life insurance policies, like those of many other companies, have specific limitations and exclusions. These restrictions are Artikeld in the policy documents and are designed to protect the insurer against unnecessary claims or fraudulent activities.

- Pre-existing Conditions: Transamerica may exclude coverage for pre-existing conditions or illnesses that you had before purchasing the policy. This means that if you develop a condition covered by the policy, but it’s related to a pre-existing condition, the claim might be denied or limited.

- Dangerous Activities: Certain activities, such as skydiving, scuba diving, or participating in extreme sports, might be excluded or require additional premiums. This is because these activities increase the risk of death or disability, impacting the insurer’s financial obligations.

- Suicide Clause: Most life insurance policies include a suicide clause, which typically states that if the insured person dies by suicide within a specified period (usually one or two years) after purchasing the policy, the beneficiary will receive a limited payout, often the premiums paid, instead of the full death benefit.

Potential Risks, Is transamerica a good life insurance company

While Transamerica strives to provide quality life insurance products, there are potential risks associated with any insurance policy, including:

- Financial Stability of the Insurer: The financial stability of the insurance company issuing the policy is crucial. If Transamerica experiences financial difficulties or becomes insolvent, it might not be able to fulfill its obligations under the policy, leaving your beneficiaries without the promised death benefit.

- Policy Changes: Transamerica, like any insurance company, has the right to modify or change its policies over time. These changes could affect the premiums, coverage, or benefits of your existing policy. It’s essential to stay informed about any policy updates and review your policy periodically to ensure it still meets your needs.

- Misrepresentation or Fraud: Providing false or misleading information during the application process can lead to policy cancellation or denial of claims. It’s crucial to be truthful and accurate when completing the application and disclose any relevant information.

Final Thoughts

When it comes to life insurance, choosing the right company is a big deal. Transamerica has a long history and offers a variety of products. But remember, every situation is different. Before you commit, do your research, compare options, and make sure the policy aligns with your personal needs and financial goals. It’s your future, and you deserve the best protection possible.

Common Queries

What are Transamerica’s financial ratings?

Transamerica has solid financial ratings from reputable agencies like A.M. Best, Moody’s, and Standard & Poor’s. These ratings reflect their financial strength and ability to pay claims.

Does Transamerica offer different types of life insurance policies?

Yes, Transamerica offers a range of life insurance products, including term life, whole life, and universal life insurance. Each policy type has different features, premiums, and coverage options.

How do I get a quote from Transamerica?

You can get a quote online, over the phone, or by working with a Transamerica insurance agent. Be sure to provide accurate information about your health, age, and desired coverage amount.

Is it better to buy life insurance through a broker or directly from Transamerica?

That depends on your preferences. A broker can help you compare options from multiple companies, while buying directly from Transamerica might offer more personalized service.

What are some alternatives to Transamerica life insurance?

There are many other life insurance companies out there, such as Northwestern Mutual, New York Life, and Prudential. It’s important to shop around and compare different options to find the best fit for your needs.