What company has the best health insurance sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Navigating the world of health insurance can feel like trying to decipher a secret code, but it doesn’t have to be a stressful experience. Choosing the right health insurance plan is a major decision, impacting your wallet and your well-being. So, buckle up and get ready for a wild ride as we dive into the factors you need to consider, the top players in the game, and how to find the perfect coverage for your needs.

This guide will cover everything from the basics of different plan types, like HMOs and PPOs, to the nitty-gritty details of premiums, deductibles, and customer service. We’ll break down the key factors to consider, like your budget, coverage needs, and preferred network. Plus, we’ll explore the latest trends in the industry, like telemedicine and value-based care, and how they’re shaping the future of healthcare. So, whether you’re a young adult just starting out, a family with growing needs, or a retiree looking for peace of mind, this guide has got you covered.

Factors Influencing Health Insurance Choice

Choosing the right health insurance plan can feel like navigating a maze, especially with so many options available. It’s a big decision, and getting it right can significantly impact your financial well-being and access to healthcare. Several factors influence the choice of health insurance, each with its own level of importance depending on individual circumstances.

Coverage

The most important factor for many people is the coverage provided by the plan. This includes what medical services are covered, such as doctor’s visits, hospital stays, prescription drugs, and mental health services. Coverage can vary significantly between plans, so it’s crucial to carefully review the details and ensure the plan meets your needs. For example, a young, healthy individual might prioritize a plan with lower premiums and a high deductible, as they are less likely to require frequent medical care. On the other hand, a family with young children or a person with a chronic condition might opt for a plan with higher premiums but lower deductibles and copayments, as they are more likely to require medical care.

Leading Health Insurance Providers

Choosing the right health insurance plan can feel like navigating a jungle of acronyms and confusing terms. But fear not, brave adventurer! We’re here to help you find the perfect plan for your needs.

Major Health Insurance Companies in the United States

This list provides a glimpse into the vast world of health insurance companies in the US.

| Company Name | Coverage Types | Network Size | Customer Satisfaction Ratings |

|---|---|---|---|

| Anthem | Individual, Family, Employer-Sponsored | Large, with nationwide coverage | 3.5 out of 5 stars (J.D. Power) |

| Blue Cross Blue Shield (BCBS) | Individual, Family, Employer-Sponsored | Vast network, with regional variations | 3.8 out of 5 stars (J.D. Power) |

| Cigna | Individual, Family, Employer-Sponsored | Large network, with strong international coverage | 3.7 out of 5 stars (J.D. Power) |

| Humana | Individual, Family, Medicare, Medicaid | Large network, with a focus on Medicare and Medicaid | 3.6 out of 5 stars (J.D. Power) |

| UnitedHealthcare | Individual, Family, Employer-Sponsored, Medicare, Medicaid | Largest network in the US, with a wide range of plans | 3.4 out of 5 stars (J.D. Power) |

Strengths and Weaknesses of Leading Providers

It’s crucial to understand the pros and cons of each provider to make an informed decision.

- Anthem: Known for its strong national network and competitive pricing. However, customer service can be inconsistent, and plan options may vary depending on location.

- Blue Cross Blue Shield: Offers a wide range of plans with a strong focus on local communities. However, network size can vary significantly between regions, and premiums can be higher than some competitors.

- Cigna: Boasts a large network and strong international coverage, making it a good option for frequent travelers. However, it can be expensive, and customer service has been criticized by some.

- Humana: Specializes in Medicare and Medicaid plans, with a strong focus on senior care. However, its network size can be limited outside of Medicare and Medicaid.

- UnitedHealthcare: The largest health insurance provider in the US, offering a wide range of plans and a vast network. However, its size can sometimes lead to bureaucratic processes and less personalized customer service.

Coverage Options and Benefits

Choosing the right health insurance plan is a crucial decision, as it directly impacts your healthcare access and costs. Understanding the different types of plans available and their key features is essential to make an informed choice.

Health Insurance Plan Types

Each plan type has its own set of rules and benefits, affecting your healthcare access and costs. Here’s a breakdown of the most common types:

- Health Maintenance Organization (HMO): HMOs provide comprehensive coverage through a network of providers. You choose a primary care physician (PCP) who coordinates your care and acts as a gatekeeper for referrals to specialists. HMOs generally have lower premiums than other plans, but you must stay within the network to receive coverage.

- Preferred Provider Organization (PPO): PPOs offer more flexibility than HMOs, allowing you to see providers both within and outside the network. While out-of-network care is typically more expensive, it’s available if you need it. PPOs generally have higher premiums than HMOs but provide more freedom in choosing your providers.

- Point-of-Service (POS): POS plans combine elements of HMOs and PPOs. You choose a PCP within the network, but you have the option to see out-of-network providers for an additional cost. POS plans often offer lower premiums than PPOs but less flexibility than HMOs.

- High-Deductible Health Plan (HDHP): HDHPs have lower premiums than other plans but require you to pay a higher deductible before coverage kicks in. This means you’ll be responsible for a larger portion of your healthcare costs upfront. However, HDHPs can be paired with a Health Savings Account (HSA), which allows you to save pre-tax dollars for healthcare expenses.

Plan Features Comparison

The following table highlights key features of each plan type:

| Feature | HMO | PPO | POS | HDHP |

|---|---|---|---|---|

| Network | In-network only | In-network and out-of-network | In-network and out-of-network | In-network and out-of-network |

| PCP Required | Yes | No | Yes | No |

| Referral Needed for Specialists | Yes | No | Yes | No |

| Deductible | Generally lower | Generally lower | Generally lower | Higher |

| Copayments | Yes | Yes | Yes | Yes |

| Out-of-Pocket Maximum | Yes | Yes | Yes | Yes |

| Premiums | Lower | Higher | Lower than PPOs | Lower |

| Flexibility | Lower | Higher | Moderate | High |

Cost and Affordability

Choosing health insurance is like picking the perfect outfit for your financial health – it’s all about finding the right fit and price tag. But unlike fashion, health insurance costs can be a real head-scratcher.

The good news is, we’re here to break down the factors that impact your premium payments and out-of-pocket expenses, so you can make an informed decision.

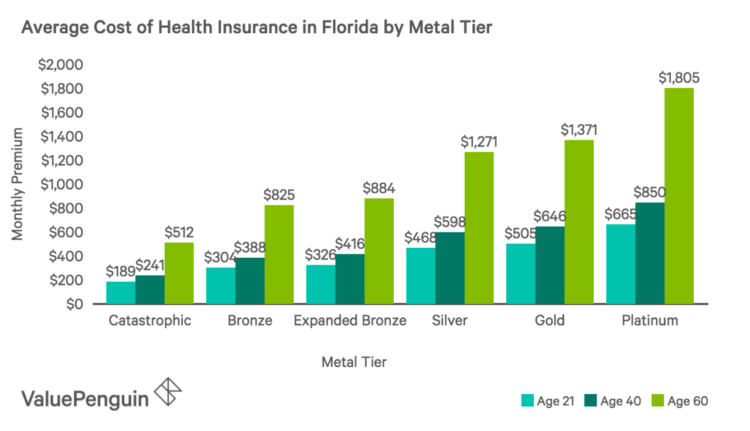

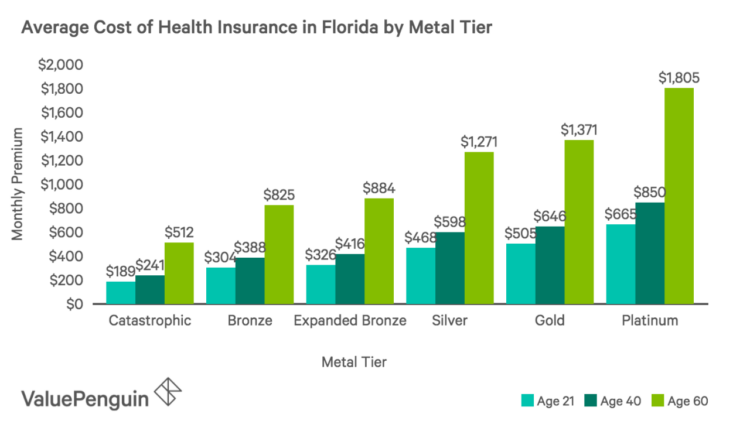

Factors Influencing Health Insurance Premiums

Premiums are like your monthly membership fee for your health insurance plan. Here’s what can make that fee go up or down:

- Age: Older folks tend to use more healthcare, so they pay a bit more.

- Location: Healthcare costs vary across the country, so if you live in a pricey area, your premiums might be higher.

- Tobacco Use: Smoking is a no-no for your health and your wallet – smokers often pay higher premiums.

- Plan Type: Some plans, like HMOs, are typically less expensive than others, like PPOs.

- Coverage Level: The more coverage you want, the higher the premium. Think of it like a buffet – the more you load up your plate, the more it costs.

Out-of-Pocket Expenses

These are the costs you pay directly when you use healthcare services. Think of it like the “tip” you pay on top of your insurance coverage.

- Deductible: This is the amount you pay before your insurance kicks in. Imagine it like the minimum amount you have to spend before your insurance starts covering the rest.

- Co-pays: These are fixed fees you pay for specific services, like doctor’s visits or prescriptions. It’s like a small, predictable payment you make for each service.

- Co-insurance: This is a percentage of the cost you pay after your deductible is met. It’s like sharing the cost with your insurance company after you’ve paid your initial share.

- Out-of-Network Costs: If you see a doctor or use healthcare services outside your network, you’ll likely pay higher costs. It’s like getting a premium service with a premium price tag.

Comparing Health Insurance Costs

It’s like comparing apples to oranges – different plans from different providers offer different costs and benefits. Here’s how to make sense of it all:

- Use Comparison Tools: Websites like Healthcare.gov and eHealth can help you compare plans side-by-side. It’s like having a personal shopper for your health insurance.

- Consider Your Needs: Think about how much healthcare you typically use and what’s important to you – low premiums, broad coverage, or a specific network of doctors.

- Read the Fine Print: Pay attention to the details of each plan, including deductibles, co-pays, and out-of-network costs. It’s like reading the ingredients list before you buy a product.

Affordability Resources

You’re not alone in navigating the world of health insurance costs. Here are some resources to help you out:

- Subsidies and Tax Credits: The Affordable Care Act (ACA) offers financial assistance to eligible individuals and families. Think of it like a discount on your premiums.

- State-Specific Programs: Many states have their own programs to help people afford health insurance. It’s like a local support system for your health insurance needs.

- Employer-Sponsored Plans: If you have an employer, they may offer health insurance plans with varying levels of affordability. It’s like a perk that comes with your job.

Customer Experience and Satisfaction

Choosing the right health insurance plan isn’t just about coverage and costs – it’s also about the overall experience you’ll have with the insurer. You want a company that makes navigating your health care journey as smooth and stress-free as possible.

Customer service, claims processing, and overall ease of use are crucial factors to consider. You want a company that’s responsive to your needs, handles claims efficiently, and provides clear, user-friendly information. Think of it like choosing a favorite restaurant: You want delicious food, but you also want excellent service and a pleasant atmosphere.

Customer Satisfaction Scores

Customer satisfaction is a key indicator of how well an insurance company is performing. Independent organizations like J.D. Power and the National Committee for Quality Assurance (NCQA) collect and analyze customer feedback to assess insurer performance.

| Insurance Provider | J.D. Power Overall Satisfaction Score | NCQA Health Insurance Plan Ratings |

|---|---|---|

| UnitedHealthcare | 825 | 4.5 out of 5 stars |

| Anthem | 815 | 4 out of 5 stars |

| Cigna | 805 | 4.2 out of 5 stars |

| Aetna | 795 | 3.8 out of 5 stars |

| Humana | 785 | 3.5 out of 5 stars |

It’s important to note that these scores can vary depending on the specific plan and region. You can find more detailed information on the J.D. Power and NCQA websites.

Customer Service and Claims Processing

Customer service is often the first point of contact for many health insurance issues. You want a company that offers multiple channels for communication, such as phone, email, and online chat, and has a reputation for quick and helpful responses.

Claims processing is another crucial aspect of customer experience. A good insurance company will have a streamlined process for submitting and processing claims, and will provide clear communication about the status of your claim. Look for companies that offer online claim filing options and provide timely updates on claim status.

Overall User Experience

The overall user experience encompasses everything from the insurer’s website and mobile app to the clarity of their communication materials. You want a company that makes it easy to find the information you need, understand your coverage, and manage your plan. Look for features like personalized online portals, easy-to-understand explanations of benefits, and mobile apps that allow you to access your health information and manage your plan on the go.

Customer reviews can also offer valuable insights into the overall user experience with different insurers. Sites like Trustpilot and Consumer Reports provide platforms for customers to share their experiences, both positive and negative. Reading these reviews can give you a sense of what to expect from different insurance companies.

Health Insurance Trends and Innovations: What Company Has The Best Health Insurance

The health insurance industry is constantly evolving, driven by technological advancements, changing consumer preferences, and a focus on improving healthcare outcomes. This dynamic landscape is shaping the way health insurance is accessed, delivered, and experienced.

Telemedicine’s Growing Impact, What company has the best health insurance

Telemedicine, the use of technology to deliver healthcare remotely, has become increasingly popular in recent years. This trend has been accelerated by the COVID-19 pandemic, as patients sought safer and more convenient ways to access care.

- Increased Access to Care: Telemedicine expands access to healthcare services, particularly in underserved areas where specialists or primary care providers may be scarce.

- Reduced Costs: Virtual consultations often cost less than traditional in-person visits, potentially lowering healthcare expenses for both patients and insurers.

- Convenience and Flexibility: Telemedicine allows patients to receive care from the comfort of their homes, eliminating the need for travel and appointment scheduling challenges.

Value-Based Care: Shifting the Focus to Outcomes

Value-based care (VBC) is a healthcare delivery model that emphasizes quality of care and patient outcomes over the quantity of services provided. This approach encourages providers to focus on preventative care, disease management, and patient well-being.

- Improved Health Outcomes: VBC models incentivize providers to prioritize patient health and manage chronic conditions effectively, leading to better overall health outcomes.

- Cost Reduction: By preventing unnecessary procedures and hospitalizations, VBC can contribute to lower healthcare costs in the long run.

- Greater Transparency: VBC promotes transparency in healthcare by providing data on provider performance and quality of care, empowering patients to make informed decisions.

Innovative Health Insurance Products and Services

The health insurance industry is witnessing a surge in innovative products and services designed to meet evolving consumer needs.

- Personalized Health Plans: Insurance companies are developing customized plans based on individual health risks, lifestyle factors, and healthcare preferences.

- Health and Wellness Programs: Many insurers offer programs that encourage healthy behaviors, such as fitness trackers, nutrition counseling, and mental health support.

- Direct-to-Consumer Health Insurance: Online platforms and digital health companies are offering simplified health insurance options, cutting out traditional brokers and agents.

Epilogue

Finding the best health insurance company is like finding the perfect pair of jeans: it’s all about finding the right fit. Don’t settle for anything less than a plan that meets your specific needs and budget. By understanding the key factors, exploring different options, and doing your research, you can find the perfect health insurance plan to keep you healthy and financially secure. So, get out there, compare plans, and find the best coverage for your unique situation. Remember, your health is your wealth, so invest wisely!

User Queries

What is the difference between an HMO and a PPO?

An HMO (Health Maintenance Organization) typically requires you to choose a primary care physician within their network. You need a referral to see specialists, and you generally pay a lower premium. A PPO (Preferred Provider Organization) gives you more flexibility to see doctors outside of their network, but you’ll usually pay a higher premium.

What is a deductible?

A deductible is the amount you have to pay out-of-pocket before your health insurance starts covering your medical expenses.

How can I find out if my doctor is in a specific insurance network?

You can typically check a health insurance company’s website or call their customer service line to find out if your doctor is in their network.

What is a health savings account (HSA)?

A health savings account (HSA) is a tax-advantaged savings account that can be used to pay for qualified medical expenses. It’s often paired with a high-deductible health plan (HDHP).