What life insurance company is the best? That’s a question that pops up for many of us when we start thinking about protecting our loved ones. It’s a big decision, but don’t worry, it doesn’t have to be a stressful one. Think of it like choosing the right superhero for your team – you want someone reliable, strong, and ready to step up when you need them most. We’re diving into the world of life insurance to help you find the perfect fit.

From understanding different types of policies like term, whole, universal, and variable, to figuring out how much coverage you need based on your age, health, dependents, income, and financial goals, we’ll walk you through the whole process. We’ll also break down the nitty-gritty details like comparing financial stability, customer service, and policy transparency to help you make an informed decision.

Understanding Life Insurance Needs

Life insurance is an essential part of a comprehensive financial plan, providing financial security for your loved ones in the event of your untimely demise. Understanding your life insurance needs is crucial to ensure you have adequate coverage to protect your family’s future.

Types of Life Insurance Policies

Life insurance policies come in various forms, each with unique features and benefits. Understanding these differences can help you choose the policy that best aligns with your financial goals and circumstances.

- Term Life Insurance: Term life insurance is the most straightforward and affordable type. It provides coverage for a specific period, typically 10, 20, or 30 years. If you pass away within the term, your beneficiaries receive a death benefit. If you outlive the term, the policy expires, and you receive no payout. Term life insurance is ideal for temporary needs, such as covering a mortgage or supporting young children.

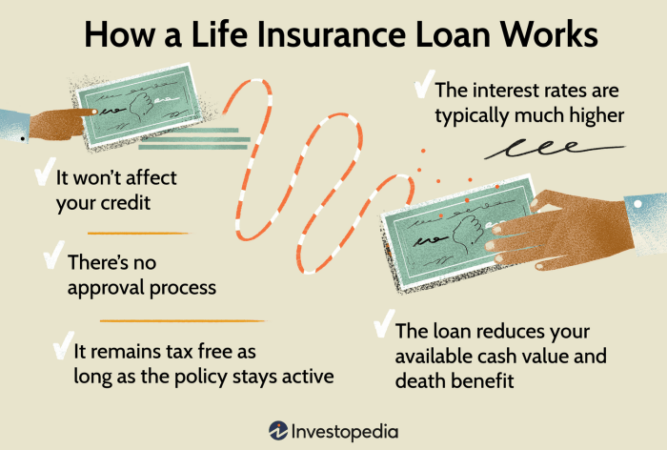

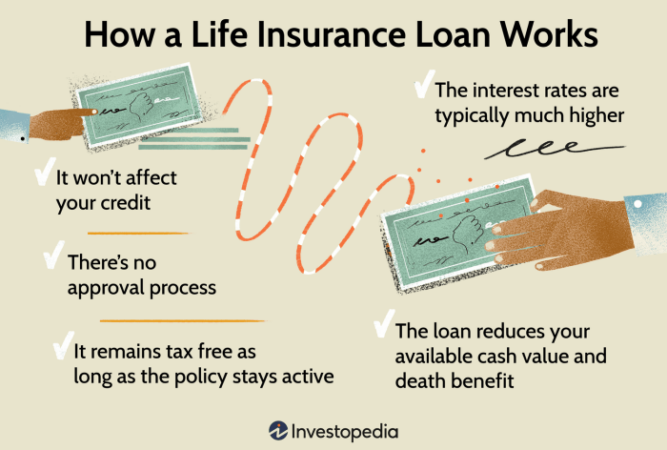

- Whole Life Insurance: Whole life insurance is a permanent policy that provides lifelong coverage. It combines a death benefit with a savings component, known as cash value. Premiums are typically higher than term life insurance, but they remain fixed throughout your life. The cash value accumulates over time and can be borrowed against or withdrawn. Whole life insurance is suitable for those seeking long-term financial security and wealth accumulation.

- Universal Life Insurance: Universal life insurance is another permanent policy that offers flexibility in premiums and death benefit. It allows you to adjust your coverage and premium payments based on your changing needs. However, it may have higher fees and a more complex structure than term life insurance. Universal life insurance is a good option for individuals who want the flexibility to adjust their coverage and investment strategy over time.

- Variable Life Insurance: Variable life insurance is a permanent policy that allows you to invest your premiums in sub-accounts that track the performance of various investment options, such as stocks or bonds. The death benefit and cash value fluctuate based on the investment performance. Variable life insurance is suitable for those seeking potential growth in their cash value but willing to accept the associated investment risks.

Factors to Consider When Determining Life Insurance Needs

Several factors play a crucial role in determining your life insurance needs. Assessing these factors will help you calculate the appropriate amount of coverage.

- Age: Younger individuals generally require less life insurance than older individuals, as they have less time to accumulate wealth and dependents rely on them for a shorter period. However, the age of your dependents and the time it takes to replace your income are also essential factors to consider.

- Health: Your health status can influence your life insurance premiums. Individuals with pre-existing health conditions may face higher premiums or be denied coverage altogether. It’s essential to disclose any health issues to your insurer to ensure you receive accurate pricing and coverage.

- Dependents: The number and age of your dependents are critical factors. If you have a spouse and young children, you’ll likely need more life insurance than someone without dependents. Consider the financial needs of your dependents, such as housing, education, and living expenses, when calculating your coverage.

- Income: Your income level directly impacts the amount of life insurance you need. Your dependents rely on your income to maintain their standard of living. Life insurance can help replace lost income and provide financial security for your family.

- Financial Goals: Your financial goals, such as paying off debts, funding your children’s education, or ensuring a comfortable retirement for your spouse, should be factored into your life insurance needs. Life insurance can provide the financial resources to achieve these goals even if you are no longer around.

Calculating Life Insurance Coverage

Determining the appropriate amount of life insurance coverage requires careful consideration. There are several methods to calculate your coverage needs.

- The DIME Method: The DIME method is a common approach to calculating life insurance needs. It stands for Debt, Income, Mortgage, and Education.

The DIME method considers the following:

- Debt: Outstanding debts, such as mortgages, loans, and credit card balances, should be included in your calculation. The death benefit should be sufficient to cover these debts and prevent your family from being burdened by them.

- Income: Your annual income is a crucial factor in determining your coverage needs. The death benefit should be enough to replace your income for a certain period, allowing your dependents to maintain their current lifestyle.

- Mortgage: If you have a mortgage, the death benefit should be sufficient to pay off the remaining balance, preventing your family from losing their home.

- Education: If you have children, you may want to include their future education expenses in your calculation. The death benefit should be enough to cover their college tuition and living expenses.

- The Multiple of Income Method: This method multiplies your annual income by a specific factor, typically 5 to 10, to determine the appropriate coverage amount. The multiple chosen depends on factors such as your age, dependents, and financial goals.

For example, if your annual income is $100,000 and you choose a multiple of 7, your life insurance coverage would be $700,000.

- The Needs-Based Method: This method focuses on identifying specific financial needs of your dependents, such as funeral expenses, living expenses, debt repayment, and education costs. The death benefit should be sufficient to cover these needs.

Evaluating Life Insurance Companies

Choosing the right life insurance company is a crucial decision. You want a company that’s financially stable, reliable, and offers excellent customer service. But how do you evaluate different companies and make the best choice for your needs?

Financial Stability and Ratings

Financial stability is a key factor when choosing a life insurance company. You want a company that can fulfill its financial obligations to you and your beneficiaries in the future.

One way to assess financial stability is to check the company’s ratings from independent credit rating agencies like AM Best, Moody’s, and Standard & Poor’s. These agencies evaluate the financial health of insurance companies based on factors such as their capital reserves, investment portfolio, and claims-paying ability.

A high rating from these agencies indicates that the company is financially sound and has a strong track record of meeting its obligations. Look for companies with ratings of A or higher.

Key Factors to Consider

Beyond financial stability, there are other important factors to consider when evaluating life insurance companies:

- Claims-Paying Ability: This refers to a company’s ability to pay out death benefits to beneficiaries when a policyholder dies. A company with a strong claims-paying ability has a history of honoring its commitments and paying claims promptly and efficiently. You can find information about a company’s claims-paying ability on its website or by contacting the state insurance department.

- Customer Service: Good customer service is essential, especially when dealing with a sensitive matter like life insurance. Look for a company with a reputation for responsiveness, helpfulness, and professionalism. You can research customer reviews and ratings on websites like the Better Business Bureau or Consumer Reports.

- Policy Transparency: You should be able to easily understand the terms and conditions of your policy. Look for a company that provides clear and concise policy documents and is willing to answer your questions about the policy’s coverage, exclusions, and limitations.

Reputable Resources for Research

Several reputable resources can help you research and compare life insurance companies:

- AM Best: This agency provides financial strength ratings for insurance companies based on their financial stability, operating performance, and business profile. You can access their ratings and reports on their website.

- Moody’s: Moody’s is another leading credit rating agency that provides ratings for insurance companies. Their ratings reflect the company’s financial strength, debt obligations, and overall creditworthiness.

- Standard & Poor’s: Standard & Poor’s provides financial ratings for insurance companies based on their financial performance, capital adequacy, and risk management practices. Their ratings can be found on their website.

Cost and Affordability

Life insurance, like any other financial product, comes with a price tag. The cost of your policy will depend on several factors, including your age, health, coverage amount, and the type of policy you choose. Understanding these factors and how they impact the cost of your policy is crucial to finding the best and most affordable life insurance option for you.

Factors Affecting Life Insurance Costs

The cost of life insurance is determined by a complex set of factors, with some being more influential than others. It’s important to understand how these factors play a role in calculating your premiums.

- Age: Younger people generally pay lower premiums than older people. This is because younger individuals have a longer life expectancy, meaning the insurance company is less likely to have to pay out a death benefit sooner. As you age, the risk of death increases, so premiums rise.

- Health: Your health plays a significant role in determining your life insurance premium. Individuals with pre-existing conditions or unhealthy habits, like smoking, may face higher premiums. This is because insurance companies consider these factors as increased risks of early death.

- Coverage Amount: The amount of death benefit you choose will also affect the cost of your premium. The higher the coverage amount, the more expensive the policy will be. This is because you’re essentially paying for a larger financial guarantee from the insurance company.

- Policy Term: The length of your policy, known as the term, also impacts the premium. Shorter-term policies generally have lower premiums than longer-term policies. This is because the insurance company is obligated to cover your death benefit for a shorter period.

Finding Affordable Life Insurance Options

Finding affordable life insurance can be challenging, but there are strategies you can implement to reduce your premiums and get the coverage you need.

- Shop Around: Compare quotes from multiple insurance companies to find the best rates. Don’t just settle for the first quote you get; take the time to explore your options. You can use online comparison tools or contact insurance agents directly to gather quotes.

- Consider a Term Life Policy: Term life insurance is generally the most affordable type of life insurance. It provides coverage for a specific period, such as 10, 20, or 30 years. After the term expires, you can renew the policy, but the premiums will likely be higher. Term life insurance is an excellent option for people who need coverage for a specific period, such as while raising young children or paying off a mortgage.

- Improve Your Health: Taking steps to improve your health can lower your premiums. This includes quitting smoking, maintaining a healthy weight, and managing any existing health conditions. By demonstrating a commitment to your health, you can reduce the risk you present to insurance companies and potentially secure lower rates.

- Consider a Smaller Coverage Amount: If you’re on a tight budget, you can lower your premiums by reducing the coverage amount. While you’ll receive a smaller death benefit, you’ll also pay less for your policy. Evaluate your financial needs and determine the minimum coverage amount that will provide adequate protection for your family.

- Bundle Your Policies: Some insurance companies offer discounts if you bundle your life insurance policy with other insurance products, such as car insurance or homeowners insurance. Ask your insurance agent if they offer any bundling discounts.

Customer Experience and Reviews

Choosing the right life insurance company is a big decision, and it’s not just about the price tag. You want to feel confident that the company you choose will be there for you when you need them, especially during a difficult time. That’s where customer experience and reviews come in.

Customer Reviews and Testimonials

Customer reviews and testimonials can provide valuable insights into the experiences of others with different life insurance companies. These reviews often cover a range of factors, including claims processing, customer service, and policy administration. By reading these reviews, you can get a sense of how responsive and helpful a company is, how efficiently they handle claims, and how easy it is to manage your policy.

Claims Processing

Claims processing is a critical aspect of life insurance, and it’s essential to choose a company that has a reputation for handling claims fairly and efficiently. Here’s what to look for in reviews:

- Speed and Efficiency: Reviews often highlight how quickly claims are processed and whether the company provides regular updates throughout the process.

- Transparency and Communication: Look for reviews that mention clear communication from the company, with detailed explanations of the claims process and any decisions made.

- Fairness and Accuracy: Reviews should mention whether the company paid out the full amount of the claim, whether there were any unexpected deductions, and if the process was handled fairly.

Customer Service

Customer service is another important factor to consider when choosing a life insurance company. Here’s what to look for in reviews:

- Responsiveness and Availability: Reviews should highlight how easy it is to get in touch with the company and how quickly they respond to inquiries.

- Friendliness and Professionalism: Reviews often mention the level of courtesy and professionalism exhibited by customer service representatives.

- Problem Resolution: Reviews should discuss how well the company handles complaints and whether they offer solutions to address any issues.

Policy Administration

Managing your life insurance policy should be a straightforward process. Reviews can shed light on how easy it is to manage your policy with different companies.

- Online Access and Tools: Reviews should mention the availability of online portals and tools for managing your policy, paying premiums, and accessing important documents.

- Ease of Communication: Reviews should discuss the ease of communication with the company, whether it’s through email, phone, or online chat.

- Policy Changes and Updates: Reviews should highlight how easy it is to make changes to your policy, such as increasing coverage or updating your beneficiary information.

Importance of Customer Satisfaction, What life insurance company is the best

Customer satisfaction is a key indicator of a company’s commitment to providing a positive experience. When you choose a life insurance company, you’re not just buying a product; you’re establishing a relationship. It’s important to choose a company that values its customers and strives to deliver a high level of service.

Choosing the Right Company

You’ve done your homework, figured out how much coverage you need, and now you’re ready to pick a life insurance company. But with so many options out there, how do you choose the right one? Don’t worry, we’re here to help you navigate this process like a pro.

Essential Factors to Consider

Picking the right life insurance company is like choosing the right team for your life’s biggest play. You want a company that’s reliable, trustworthy, and has your back, no matter what. To find your perfect match, consider these key factors:

- Financial Strength: Look for a company with a solid track record of paying claims on time. You can check ratings from organizations like A.M. Best, Moody’s, and Standard & Poor’s to see how financially sound a company is.

- Reputation: Do your research and see what others are saying about the company. Look for reviews online, check with the Better Business Bureau, and see if they’ve been involved in any major lawsuits or scandals.

- Policy Options: Make sure the company offers the type of policy you need, whether it’s term life, whole life, or universal life. Consider your budget and how much flexibility you want in your policy.

- Customer Service: You want to work with a company that’s responsive and helpful. Look for companies with good customer service ratings and check if they offer 24/7 support.

- Transparency and Clarity: Make sure you understand the terms and conditions of the policy before you sign anything. Look for a company that provides clear and concise information about their policies.

Navigating the Process

Choosing a life insurance company doesn’t have to be a complicated process. Think of it like shopping for a new pair of sneakers – you want to find the right fit, the right style, and the right price. Here’s a step-by-step guide to help you find the perfect life insurance company:

- Get Quotes: Start by getting quotes from multiple companies. You can use online comparison tools or contact companies directly. This will give you a good idea of what different companies are offering and how their prices compare.

- Compare Policies: Once you have a few quotes, compare the policies side-by-side. Pay attention to the coverage amount, the premium, the length of the term, and any riders or options included.

- Check Company Ratings: Don’t just rely on price. Research the financial strength and reputation of each company. Look for ratings from organizations like A.M. Best, Moody’s, and Standard & Poor’s.

- Read Reviews: See what other customers are saying about the company. Look for reviews online, check with the Better Business Bureau, and see if they’ve been involved in any major lawsuits or scandals.

- Ask Questions: Don’t hesitate to ask questions. Contact the company directly and speak with a representative. Ask about their policies, their claims process, and their customer service.

- Make Your Decision: Once you’ve gathered all the information you need, make your decision. Choose a company that you feel comfortable with and that offers a policy that meets your needs and budget.

Finding a Reputable Company

Finding a reputable life insurance company is like finding a trusted friend – you want someone you can rely on. Here are some tips to help you find a company that’s right for you:

- Start with Recommendations: Ask your friends, family, and colleagues for recommendations. They may have had positive experiences with certain companies.

- Check Online Resources: There are many online resources that can help you find reputable life insurance companies. Websites like NerdWallet, Bankrate, and Policygenius provide reviews, ratings, and comparisons of different companies.

- Look for Awards and Recognition: See if the company has won any awards or received any recognition for its financial strength, customer service, or product innovation.

- Consider Your Needs: Ultimately, the best life insurance company for you will depend on your individual needs and circumstances. Consider your budget, your coverage needs, and your risk tolerance when making your decision.

Last Point

Finding the right life insurance company is like finding the right pair of jeans – it’s all about finding the perfect fit for your needs and lifestyle. With the right information, you can feel confident that you’ve got the best coverage to protect your loved ones and secure their future. So, buckle up, let’s get started on this journey to find the life insurance company that’s truly the best for you!

Questions Often Asked: What Life Insurance Company Is The Best

How much life insurance do I really need?

The amount of life insurance you need depends on your individual circumstances. Consider your income, debts, dependents, and financial goals. A financial advisor can help you calculate the right amount of coverage.

What if I’m not sure what type of life insurance is right for me?

Don’t worry, it’s a common question! Each type of life insurance has its own pros and cons. Talking to a financial advisor can help you understand the different options and choose the one that best fits your needs.

Can I change my life insurance policy later on?

You can often adjust your policy later on, but it might involve some adjustments to your premiums or coverage. It’s best to review your policy regularly to make sure it’s still meeting your needs.