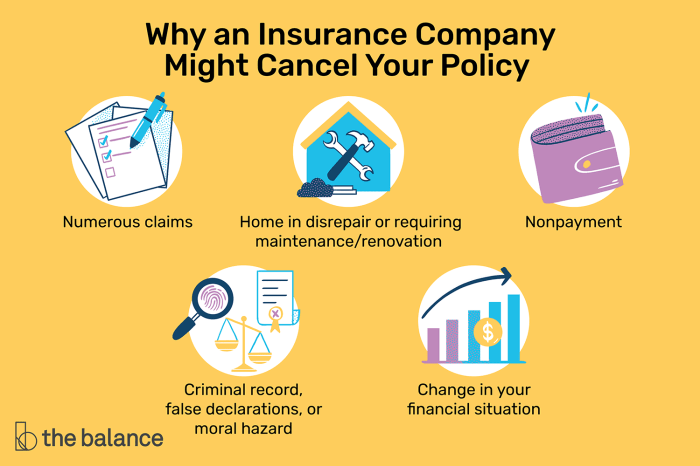

Why do insurance companies drop you? It’s a question that might pop into your head if you’ve ever been hit with a cancellation notice or a hefty premium increase. Insurance companies are in the business of managing risk, and they’re constantly evaluating whether you’re a good bet. From missed payments to risky hobbies, there are plenty of reasons why your policy could be on the chopping block.

Let’s break down the common reasons insurance companies might drop you and how to avoid finding yourself in a sticky situation.

Reasons for Insurance Policy Cancellation

It’s a common misconception that insurance companies are always happy to have your business. While they want to provide coverage, they also need to protect their bottom line. This means they may choose to drop clients for various reasons, from policy violations to changes in risk assessment. Let’s dive into the most common reasons why insurance companies might cancel your policy.

Policy Violations

Policy violations are the most common reason for insurance policy cancellation. These violations can range from minor infractions to serious breaches of contract. When you sign an insurance policy, you agree to abide by certain terms and conditions. Failure to do so can result in your policy being canceled.

Here are some common examples of policy violations that can lead to cancellation:

- Failure to pay premiums: This is perhaps the most common reason for policy cancellation. Insurance premiums are the cost of your coverage, and if you fail to pay them on time, the insurance company may cancel your policy.

- Providing false or misleading information: When you apply for insurance, you are required to provide accurate information about yourself and your situation. If you provide false or misleading information, your policy could be canceled.

- Engaging in risky behavior: Certain activities, such as driving under the influence or participating in dangerous hobbies, can increase your risk of filing a claim. If you engage in these activities, your insurance company may cancel your policy.

- Making fraudulent claims: Filing a false insurance claim is a serious offense that can lead to criminal charges. If you are caught making a fraudulent claim, your policy will likely be canceled.

Risk Assessment

Insurance companies constantly assess their clients’ risk profiles to determine whether they are good candidates for coverage. This assessment involves a variety of factors, including your age, driving history, credit score, and even your occupation.

“Insurance companies are in the business of predicting risk. They use a variety of factors to assess your likelihood of filing a claim, and they may cancel your policy if they believe you are too risky.”

If your risk profile changes significantly, your insurance company may decide to cancel your policy. This could happen if you move to a high-risk area, develop a pre-existing medical condition, or change your occupation to a more dangerous one.

Non-Payment of Premiums

Let’s face it, life throws curveballs, and sometimes, paying your insurance premiums can fall by the wayside. But just like missing a rent payment, failing to pay your insurance premiums on time can have some serious consequences, from temporary coverage lapses to full-blown policy cancellation.

If you’re struggling to keep up with your insurance payments, it’s important to understand the ins and outs of grace periods and the cancellation process. It’s not always a total disaster, but you’ll need to be proactive to keep your coverage intact.

Grace Periods

Grace periods are your lifesavers, offering a bit of breathing room when you miss a premium payment. Most insurance companies provide a grace period of 10 to 30 days after your due date. During this time, your coverage remains active, but if you don’t catch up by the end of the grace period, your policy could be canceled.

Think of it like a “get out of jail free” card, but with a time limit. The exact grace period length can vary depending on your insurer and the type of insurance policy.

Policy Cancellation Due to Non-Payment

If you miss your premium payment and don’t make it up within the grace period, your insurance company has the right to cancel your policy. It’s like a “you’re out” call in a game, except in this case, you’re out of coverage.

The cancellation process usually involves a notice from the insurance company. This notice will Artikel the reason for cancellation and your options for reinstatement. You’ll have a chance to appeal the decision or pay the overdue premium, but if you don’t act, you’ll be left without insurance.

Consequences of Policy Cancellation

Being dropped by your insurance company can leave you in a tough spot, especially if you need coverage for a car accident, a house fire, or a medical emergency. Here are some potential consequences:

- No coverage for future events: If you’re involved in an accident or face a covered event after your policy is canceled, you’ll be responsible for all costs out of pocket.

- Difficulty getting new insurance: Insurance companies often look at your past insurance history, and a cancellation due to non-payment can make it harder to get new coverage or result in higher premiums.

- Financial hardship: Without insurance, you’re on the hook for all expenses related to covered events. This could lead to significant financial strain, especially if you’re dealing with a major accident or medical issue.

Fraudulent Claims

Insurance companies are in the business of managing risk, and fraudulent claims are a major risk they have to contend with. When someone tries to deceive an insurance company to get a payout, it affects everyone. Premiums go up, and honest policyholders end up footing the bill.

Types of Fraudulent Claims

Insurance companies have sophisticated systems in place to identify and investigate suspicious claims. Here are some common types of fraudulent claims that could lead to policy cancellation:

- Staged Accidents: Think of a car crash where someone deliberately causes an accident to collect insurance money. It’s like a scene straight out of a bad action movie, except it’s real life, and it’s illegal.

- Exaggerated Injuries: This involves claiming more serious injuries than you actually have to get a bigger payout. It’s like trying to win an Oscar for your “performance” of being hurt, but in reality, you’re just trying to cheat the system.

- False Claims: This involves making up an entire claim, like saying your car was stolen when it wasn’t, or pretending your house burned down when it didn’t. It’s like playing a game of pretend, but with serious consequences.

- Duplicate Claims: This is when someone tries to file multiple claims for the same incident. It’s like trying to pull a fast one on the insurance company, but they’re not easily fooled.

- Ghost Claims: This involves filing a claim for someone who doesn’t actually exist. It’s like trying to create a phantom claimant to collect money, but it’s a recipe for disaster.

Insurance Company Investigations

Insurance companies have a team of specialists who investigate suspicious claims. They might use various methods, including:

- Reviewing medical records: They’ll check if your medical records match the injuries you’ve claimed. It’s like comparing your story to the evidence, and if they don’t match, you’re in trouble.

- Investigating the scene: They’ll examine the scene of the accident or incident to see if it matches your story. It’s like putting the pieces of a puzzle together, and if they don’t fit, you’re busted.

- Interviewing witnesses: They’ll talk to anyone who might have seen the accident or incident to get their perspective. It’s like a detective trying to gather information, and if the witnesses don’t support your story, you’re caught red-handed.

- Using surveillance: They might use surveillance cameras or private investigators to gather evidence. It’s like having a secret camera crew following you, but they’re not filming for a reality show; they’re gathering evidence to catch you in a lie.

Consequences of Filing a Fraudulent Claim, Why do insurance companies drop you

If you’re caught filing a fraudulent claim, you’ll face serious consequences. It’s like playing a game of Russian roulette, but instead of a gun, you’re playing with your reputation and your freedom. Here’s a breakdown of what could happen:

| Consequence | Description |

|---|---|

| Policy Cancellation | You’ll lose your insurance policy, and you’ll be left high and dry if you need coverage in the future. |

| Denial of Future Claims | You might not be able to get insurance in the future, making it difficult to protect yourself and your assets. |

| Criminal Charges | You could face criminal charges, including fines and jail time. It’s like playing a game of Monopoly, but instead of losing money, you’re losing your freedom. |

| Civil Lawsuits | The insurance company could sue you to recover the money they paid out, and you could end up owing a lot more than you originally claimed. It’s like a game of poker, but instead of winning money, you’re losing your shirt. |

High-Risk Activities

Insurance companies assess risk when determining your premiums. Engaging in high-risk activities can lead to higher premiums or even policy cancellation. These activities are often associated with a greater chance of accidents, injuries, or property damage, making them a concern for insurance providers.

Impact of High-Risk Activities on Insurance Policies

Certain activities can significantly influence your insurance premiums or even lead to policy cancellation.

Here’s a table outlining specific activities and their impact on various insurance policies:

| Activity | Impact on Auto Insurance | Impact on Home Insurance | Impact on Life Insurance |

|—|—|—|—|

| Motorcycle Riding | Increased premiums due to higher risk of accidents | No direct impact | No direct impact |

| Scuba Diving | Increased premiums due to potential underwater hazards | No direct impact | Increased premiums if diving is a hobby |

| Skydiving | Increased premiums due to high-risk nature | No direct impact | Increased premiums if skydiving is a hobby |

| Mountain Climbing | Increased premiums due to potential falls and injuries | No direct impact | Increased premiums if mountain climbing is a hobby |

| Competitive Sports | Increased premiums due to risk of injuries | No direct impact | Increased premiums if competitive sports are a hobby |

| Owning a High-Performance Vehicle | Increased premiums due to higher risk of accidents | No direct impact | No direct impact |

| Driving with a DUI | Increased premiums or policy cancellation due to risky behavior | No direct impact | No direct impact |

| Dangerous Hobbies | Increased premiums due to potential for accidents and injuries | No direct impact | Increased premiums if dangerous hobbies are a significant part of life |

It’s crucial to be transparent with your insurance company about your activities, as failure to do so could result in policy cancellation or denial of claims.

Changes in Circumstances

Life is a wild ride, and sometimes, your personal circumstances can throw you a curveball. These changes can impact your insurance coverage, and it’s crucial to keep your insurance company in the loop.

Changes in personal circumstances can affect your insurance coverage because insurance companies need to assess your risk profile and make sure your policy aligns with your current situation. If your risk profile changes, your premiums might go up, or your policy might be canceled.

Changes that May Require Policy Adjustments

Changes in personal circumstances can be significant, and some changes may require you to adjust your insurance policies. For example, getting married, buying a new house, or having a baby might necessitate a policy change.

- Marriage: If you get hitched, your insurance company might need to adjust your coverage. This could include adding your spouse to your health insurance or adjusting your auto insurance to cover a new car.

- Homeownership: Moving into a new house often means updating your homeowner’s insurance. The cost of rebuilding your home, the location, and other factors can affect your premiums.

- New Baby: Welcoming a little one means updating your health insurance to cover the new addition. You might also want to consider adding life insurance to protect your family.

- Changes in Employment: If you lose your job, you might need to update your health insurance to get coverage through COBRA or find a new plan on the individual market.

- Moving to a New State: Insurance regulations vary from state to state. When you move, you might need to adjust your policies to meet the new requirements.

- Changes in Driving Habits: If you start driving less or stop driving altogether, you might be eligible for a discount on your auto insurance.

How to Notify Insurance Companies

It’s crucial to keep your insurance company in the loop about any significant changes in your life. This ensures you have the right coverage and avoid any surprises later on.

- Contact Your Insurance Agent: The easiest way to notify your insurance company is to contact your agent. They can help you understand how the changes might affect your coverage and make any necessary adjustments.

- Update Your Policy Online: Many insurance companies allow you to update your policy information online. This is a convenient way to make changes, but be sure to double-check your information for accuracy.

- Send a Written Notice: If you’re not sure how to update your policy online or through your agent, you can always send a written notice to your insurance company. This is a good option if you need to provide documentation to support your changes.

Policy Lapse: Why Do Insurance Companies Drop You

You know how sometimes you forget to pay your bills? Well, insurance policies are no different. If you miss a payment, your policy can lapse. And trust me, it’s not like forgetting to pay your Netflix subscription.

Policy lapse is when your insurance coverage ends because you haven’t paid your premiums. Think of it like forgetting to renew your driver’s license – you’re not covered anymore. And that’s a major bummer, especially if you need to file a claim.

Reactivating a Lapsed Policy

Once your policy lapses, you’ll need to jump through some hoops to get it back. First, you’ll have to pay all the missed premiums. But here’s the catch: your insurance company might also require you to pay a reinstatement fee. It’s like a penalty for forgetting to pay. And if your policy has been lapsed for a while, you might even have to undergo a new underwriting process, which could affect your premium. Think of it as a mini-interview to prove you’re still a good insurance risk.

Examples of Policy Lapse Scenarios

Life throws you curveballs, and sometimes those curveballs can lead to policy lapse. Here are a few scenarios:

- Financial Troubles: Let’s be real, sometimes bills pile up, and you might have to prioritize your rent or mortgage over your insurance.

- Job Loss: If you lose your job, paying premiums might become a real struggle, especially if you’re already dealing with other financial challenges.

- Forgetting to Pay: Sometimes, life gets busy, and you might simply forget to pay your premium. We’ve all been there.

- Moving or Changing Circumstances: If you move to a new state or have a significant change in your life, like getting married or having a baby, you might forget to update your insurance policy, leading to a lapse.

Understanding Policy Terms

You know how you have a contract with your best friend? Like, you agree to share a pizza and they agree to let you borrow their cool hat? Well, insurance policies are like contracts too, but with way more fine print. And just like you wouldn’t just blindly agree to anything your friend says, you gotta be on top of your insurance policy terms. It’s not just about paying your premiums; it’s about understanding what’s covered, what’s not, and what could cause your policy to go kaput.

Key Terms and Conditions Impacting Policy Cancellation

Understanding the terms and conditions of your insurance policy is like knowing the rules of the game. If you don’t know the rules, you could get a penalty, or even get kicked out of the game! Here are some key terms you need to know to avoid getting kicked out of your insurance game:

- Renewal Period: This is the time frame when your insurance company will let you renew your policy. Think of it as the “window of opportunity” to stay covered. If you miss this window, your coverage might go poof!

- Cancellation Clause: This part of the policy Artikels reasons why your insurance company can cancel your policy. Think of it as the “no-no” list. If you break any of these rules, your insurance company might be like, “You’re out of here!”

- Notice Period: This is the time frame your insurance company needs to give you before they cancel your policy. It’s like a heads-up to get your act together before they pull the plug. This period can vary depending on the reason for cancellation.

- Grace Period: This is a little bit of extra time they give you to pay your premium after it’s due. It’s like a “second chance” to avoid getting cancelled. But don’t get too comfortable; this grace period is usually short.

Importance of Reviewing Policy Documents Carefully

It’s like when you’re about to order a burger, you don’t just assume it’s going to have all your favorite toppings. You gotta check the menu! Same thing with your insurance policy. Don’t just assume you know what’s covered. Read the whole thing, like, really read it! Look for those little details that could save you a lot of trouble later.

Common Policy Terms and Definitions

It’s like learning a new language, but instead of “bonjour” and “guten tag,” you’re learning “deductible” and “premium.” Here’s a quick cheat sheet:

| Term | Definition |

|---|---|

| Deductible | The amount you pay out of pocket before your insurance kicks in. Think of it as your “personal contribution” to the cost of repairs. |

| Premium | The regular payment you make to keep your insurance policy active. It’s like your “membership fee” to the insurance club. |

| Coverage | What your insurance policy covers. Think of it as the “safety net” that protects you from financial ruin. |

| Exclusions | Things that are not covered by your insurance policy. Think of it as the “don’t even try it” list. |

| Limits | The maximum amount your insurance will pay for a claim. Think of it as the “ceiling” on how much they’ll cover. |

Protecting Yourself from Cancellation

It’s a bummer when your insurance company decides to ditch you, right? But fear not, you can take steps to avoid getting the boot. Knowing the rules of the game and playing by them can keep your coverage in place.

Maintaining a Good Insurance Record

A squeaky clean insurance record is your ticket to staying in the good graces of your insurer. It’s like having a golden star on your forehead, making you a super-attractive customer.

- Pay Your Premiums On Time: Think of your insurance premiums like rent for your coverage. If you’re late with the rent, your landlord might not be so happy, and your insurance company is no different. Set up automatic payments to ensure you’re always on top of things.

- Avoid Making Claims Unless Absolutely Necessary: Each claim you make is like a strike against you. While you need to use your insurance when you have a legitimate need, think twice before filing a claim for something minor. Every claim can potentially increase your future premiums.

- Be Honest and Transparent: Don’t try to pull a fast one on your insurer by fudging the truth. Being honest about your situation, even if it seems embarrassing, will help you in the long run. It’s like telling your mom you ate the cookies – she’ll be mad at first, but you’ll get it over with and avoid bigger trouble later.

Ending Remarks

Navigating the world of insurance can be a bit of a wild ride, but understanding the rules of the game can help you keep your coverage in place. By being aware of potential risks and taking steps to manage them, you can stay on the good side of your insurance company and ensure you’re protected when you need it most.

Question Bank

What happens if I miss a premium payment?

Most insurance companies have a grace period for missed payments, but if you don’t catch up within that timeframe, your policy could be canceled. It’s best to contact your insurer as soon as you realize you’ll be late to avoid any potential issues.

Can I get my insurance back after it’s been canceled?

It depends on the reason for cancellation. If it was due to non-payment, you might be able to reinstate your policy, but you’ll likely have to pay back any missed premiums plus a reinstatement fee. If it was due to a violation of policy terms, it might be harder to get your coverage back.

How can I dispute a cancellation decision?

If you believe your policy was canceled unfairly, you have the right to appeal the decision. Contact your insurance company and request a review of your case. Be prepared to provide evidence to support your claim.