- Understanding Driving Records

- Insurance Company Access to Driving Records

- The Impact of Driving Records on Insurance Premiums

- Maintaining a Clean Driving Record

- Dispute or Correct Errors in Your Driving Record

- Last Point

- Question & Answer Hub: Can Your Driving Record Be Checked By Your Insurance Company

Can Your Driving Record Be Checked by Your Insurance Company? It’s a question that pops up for many of us, especially when we’re trying to get the best car insurance rates. Imagine you’re cruising down the highway, jamming out to your favorite tunes, and suddenly a cop pulls you over for speeding. That ticket might not just be a dent in your wallet – it could also mean a higher insurance premium. But how does your insurance company even know about your driving record? Let’s dive into the world of driving records and insurance companies, and see how they’re connected.

Your driving record is like a personal report card for your time on the road. It keeps track of everything from speeding tickets to accidents, and even things like license suspensions. Insurance companies use this information to assess your risk as a driver. Think of it like a game of “risk vs. reward” – if you’ve got a clean record, you’re considered a low-risk driver, which often means lower premiums. But if you’ve got a few bumps on your driving record, you might be considered a higher risk, leading to higher premiums.

Understanding Driving Records

Your driving record is a detailed account of your driving history, and it plays a crucial role in determining your car insurance premiums. It’s essentially a report card for your driving habits, and insurance companies use it to assess your risk as a driver.

Driving Record Components

Your driving record is a compilation of various information that reflects your driving behavior. This information is used by insurance companies to determine your risk level and calculate your insurance premiums.

- Personal Information: Your driving record includes basic information about you, such as your name, date of birth, address, and driver’s license number.

- Driving History: This section details your driving history, including the date you obtained your driver’s license, any driving violations, accidents, and other incidents that may have occurred while driving.

- Traffic Violations: This part of the record lists any traffic violations you have received, such as speeding tickets, running red lights, or driving under the influence. Each violation is assigned a specific code, and the severity of the violation is reflected in the code.

- Accidents: Any accidents you have been involved in, whether you were at fault or not, are recorded in your driving record. The record includes details about the accident, such as the date, location, and severity of the accident.

- License Suspensions or Revocations: If your driver’s license has been suspended or revoked for any reason, this information is included in your driving record.

Examples of Common Driving Record Entries

It’s essential to understand the types of information that are typically included in a driving record and how they can affect your insurance premiums. Here are some common examples of driving record entries:

- Speeding Tickets: A speeding ticket is a common example of a traffic violation that is recorded in your driving record. The severity of the ticket, such as the speed you were exceeding the limit by, can impact your insurance premiums.

- Accidents: If you have been involved in an accident, even if you were not at fault, it will be recorded in your driving record. The severity of the accident, such as the number of vehicles involved or the extent of damage, can affect your insurance premiums.

- License Suspensions: If your driver’s license has been suspended, this information will be included in your driving record. License suspensions can occur for various reasons, such as driving under the influence or accumulating too many traffic violations. A license suspension can significantly impact your insurance premiums.

Insurance Company Access to Driving Records

It’s a common concern: can your insurance company peek into your driving history? The short answer is yes, but there are rules in place to make sure it’s done fairly.

Legal Framework for Accessing Driving Records

The legal framework surrounding insurance companies’ access to your driving records is primarily governed by the Fair Credit Reporting Act (FCRA). This federal law sets the rules for how companies can collect, use, and share your personal information, including your driving history.

Fair Credit Reporting Act (FCRA)

The FCRA is a powerful tool for protecting your privacy and ensuring that your credit information is used responsibly. The FCRA applies to consumer reporting agencies (CRAs) like Experian, Equifax, and TransUnion.

How Insurance Companies Obtain Driving Records

Insurance companies usually obtain your driving record through third-party reporting agencies, which are authorized by the FCRA to collect and provide driving records. These agencies typically have access to state motor vehicle records and compile information on your driving history, including:

- Traffic violations

- Accidents

- Driving license status

The Impact of Driving Records on Insurance Premiums

Your driving record is like a report card for your driving skills. It’s a compilation of your driving history, and it plays a crucial role in determining your car insurance premium. Insurance companies use this information to assess your risk as a driver, and they adjust your premium accordingly.

Factors Affecting Insurance Premiums

Your driving record holds a significant weight in calculating your insurance premium. Here are the specific factors that influence your rate:

- Traffic Violations: A speeding ticket, running a red light, or even a parking violation can raise your premium. The severity of the violation determines the impact. A DUI, for example, will result in a significantly higher premium than a parking ticket.

- Accidents: Being at fault in an accident can significantly increase your insurance premium. The severity of the accident, including the amount of damage and injuries, will affect the increase.

- Driving History: The length of your driving history matters. A clean driving record with no violations or accidents for a long period can earn you a discount. Conversely, a recent history of accidents or violations will result in a higher premium.

Impact of Different Driving Record Entries

Each entry on your driving record has a different impact on your premium.

- Minor Violations: A minor violation, such as a parking ticket or a speeding ticket under 10 mph over the limit, will typically result in a small increase in your premium.

- Serious Violations: Serious violations, such as a DUI or reckless driving, can lead to a significant increase in your premium. Some insurers may even refuse to cover you if you have a DUI on your record.

- Accidents: An accident, especially if you are at fault, will result in a significant increase in your premium. The severity of the accident, including the amount of damage and injuries, will affect the increase.

Maintaining a Clean Driving Record

Keeping a clean driving record is like having a superpower: it can save you a ton of cash on your insurance premiums. Think of it as a way to level up your financial game, and it’s way easier than trying to unlock a new level in your favorite video game.

Practical Tips for Avoiding Traffic Violations and Accidents

Let’s be real, getting pulled over or having an accident can be a real buzzkill. It’s like a sudden drop in your Netflix queue—you’re just not happy about it. But, you can avoid this drama by following some simple tips:

- Be mindful of speed limits: Don’t be that person who’s always pushing the limits. It’s not cool, and it’s definitely not safe. Just stick to the speed limit, and you’ll be good to go.

- Buckle up: It’s like your car’s safety hug. Always wear your seatbelt, even for short trips. Think of it as a commitment to your own safety, and your insurance company will thank you for it.

- Avoid distractions: We’ve all been there—scrolling through Instagram, checking texts, or trying to grab that dropped french fry. But these distractions can be super dangerous. Put your phone down, and focus on the road. Your life (and your driving record) will thank you.

- Don’t drink and drive: This one is a no-brainer. If you’re going to be drinking, find a designated driver, call a ride-sharing service, or just stay put. It’s not worth the risk. Think of it as a real-life “Choose Your Own Adventure” story, and make the smart choice.

Defensive Driving Techniques and Safe Driving Habits

Think of defensive driving as a superpower that helps you avoid getting into a fender bender. It’s like having a shield that protects you from the chaos of the road. Here’s how to level up your driving skills:

- Stay alert: Pay attention to your surroundings. It’s like being the main character in an action movie, but instead of dodging bullets, you’re dodging distracted drivers and unexpected road hazards.

- Maintain a safe distance: Don’t tailgate. It’s like playing a real-life game of “chicken,” and you’re not going to win. Leave plenty of space between you and the car in front of you, so you have time to react if needed.

- Signal your intentions: Let other drivers know what you’re going to do. It’s like giving them a heads-up, so they can avoid a collision. Signal your turns and lane changes, and make sure you’re doing it early enough.

- Be predictable: Drive smoothly and consistently. It’s like being the ultimate chill vibes master. Avoid sudden stops, swerving, or other erratic maneuvers. This will help other drivers anticipate your moves and avoid accidents.

Potential Benefits of Taking Defensive Driving Courses, Can your driving record be checked by your insurance company

Think of defensive driving courses as a cheat code for your driving skills. They can teach you how to avoid traffic violations and accidents, which can save you money on insurance and even prevent you from getting points on your license.

- Reduced Insurance Premiums: Many insurance companies offer discounts to drivers who complete defensive driving courses. It’s like getting a free upgrade on your insurance plan.

- Point Reduction: In some states, you can get points removed from your license by completing a defensive driving course. It’s like hitting a reset button on your driving record.

- Improved Driving Skills: These courses can teach you valuable techniques and strategies that can help you become a safer and more confident driver. It’s like getting a crash course in driving mastery.

Dispute or Correct Errors in Your Driving Record

Think of your driving record as your driving resume. It’s a snapshot of your driving history, and just like a resume, it needs to be accurate. But what happens when you spot a mistake on your driving record? You wouldn’t want a wrong address on your resume, right? The same principle applies to your driving record. Let’s dive into how to correct those errors and keep your record squeaky clean.

Process for Disputing Errors

It’s crucial to take action if you find an inaccuracy on your driving record. The good news is that most states have a process in place for challenging these errors. Here’s the general approach:

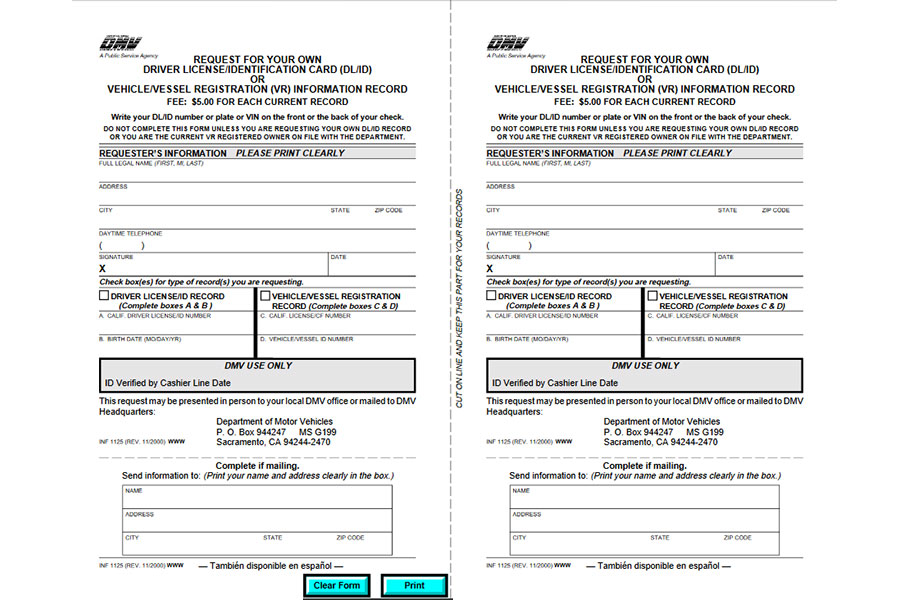

- Obtain a copy of your driving record: Start by getting a copy of your driving record. This will give you a clear picture of what’s being reported and help you identify any discrepancies. You can typically obtain this record from your state’s Department of Motor Vehicles (DMV) website or by visiting a local office.

- File a formal dispute: Once you’ve identified an error, you’ll need to file a formal dispute with the appropriate agency. This is usually the DMV in your state. They’ll provide a form or instructions for filing a dispute.

- Provide evidence: To support your claim, gather any relevant evidence that proves the error. This might include:

- Police reports: If the error involves a traffic violation, a police report that contradicts the information on your record can be crucial.

- Witness statements: If you have witnesses who can confirm the error, their statements can be helpful.

- Photos or videos: Visual evidence, like photos or videos, can strengthen your case.

- Wait for a response: The DMV will review your dispute and the evidence you’ve provided. It may take some time to process your request.

Consequences of Ignoring Errors

Don’t let those inaccuracies slide! Ignoring errors in your driving record can have serious consequences. Here’s why it’s important to address them:

- Higher insurance premiums: Insurance companies rely on driving records to assess risk. If your record contains inaccurate information, it could lead to higher premiums.

- License suspension or revocation: In some cases, an inaccurate record could lead to the suspension or revocation of your driver’s license.

- Difficulty obtaining car insurance: Insurance companies may be hesitant to provide coverage if your driving record shows inaccurate information.

Last Point

So, next time you’re behind the wheel, remember that your driving record is more than just a list of traffic violations. It’s a reflection of your driving habits and can have a big impact on your insurance premiums. Drive safe, keep your record clean, and you’ll be on your way to saving some serious cash on your car insurance. And hey, maybe even a little less stress on the road! Just don’t forget to crank up the tunes – that’s a safe driving tip, right?

Question & Answer Hub: Can Your Driving Record Be Checked By Your Insurance Company

What happens if I have an error on my driving record?

If you spot an error, you can usually dispute it with the agency that issued the record. It’s like a game of “catch me if you can” for your driving record!

How often does my insurance company check my driving record?

Insurance companies usually check your driving record when you first apply for insurance and then periodically throughout your policy. It’s like a surprise check-up for your driving history!

Can I get a discount on my insurance if I take a defensive driving course?

Absolutely! Many insurance companies offer discounts for taking defensive driving courses. It’s like a reward for being a responsible driver.