Is Faye a good travel insurance company? This question pops up for anyone planning a trip and wanting to be prepared for the unexpected. Faye Travel Insurance is a relatively new player in the game, aiming to shake things up with their approach to coverage and customer experience. They’re not just about protecting your wallet; they’re about protecting your peace of mind. Let’s dive into the world of Faye Travel Insurance and see if it’s the right fit for your next adventure.

Faye offers a variety of plans, each designed to meet the specific needs of different travelers. They’ve got plans for solo adventurers, families, and even those who are just looking for basic coverage. One of the key features that sets Faye apart is their commitment to transparency. They make it easy to understand their plans and coverage, and they don’t bury you in confusing jargon. But does all this translate to a good value proposition? We’ll explore that in detail, looking at pricing, customer reviews, and the overall claims process.

Faye Travel Insurance

Faye Travel Insurance is a digital-first travel insurance company that offers a variety of plans to protect travelers from unexpected events. Faye is shaking up the travel insurance game by offering transparent and affordable plans, making it a popular choice for budget-conscious travelers.

Target Audience

Faye Travel Insurance targets a broad audience of travelers, particularly those seeking affordable and flexible coverage. The company’s digital platform and streamlined application process make it attractive to tech-savvy individuals and those who value convenience. Faye also caters to a range of travel needs, including solo travelers, families, and adventure enthusiasts.

Key Features and Benefits

Faye Travel Insurance offers several key features and benefits that set it apart from its competitors:

- Digital-First Platform: Faye’s online platform allows for quick and easy application and policy management, making it convenient for travelers to access information and manage their coverage.

- Transparent Pricing: Faye is known for its clear and straightforward pricing structure, making it easy for travelers to compare plans and find the best value for their needs.

- Flexible Coverage Options: Faye offers a range of plans to accommodate different travel styles and budgets. Travelers can choose from basic coverage for unexpected events like flight delays or lost luggage to more comprehensive plans that include medical expenses and evacuation coverage.

- 24/7 Customer Support: Faye provides round-the-clock customer support to assist travelers with any questions or concerns they may have, even while on the road.

Coverage and Plans

Faye Travel Insurance offers a variety of plans to fit different needs and budgets. Their plans are designed to provide comprehensive coverage for unexpected events that can occur while traveling, giving you peace of mind and allowing you to focus on enjoying your trip.

Faye Travel Insurance Plans

Here’s a breakdown of Faye Travel Insurance’s plans:

| Plan Name | Price | Key Coverage Features | Target Audience |

|---|---|---|---|

| Explorer | $50-$100 per trip | Basic medical coverage, emergency evacuation, baggage loss, trip cancellation/interruption | Budget-conscious travelers, short trips, domestic travel |

| Adventurer | $75-$150 per trip | Expanded medical coverage, higher limits for baggage loss, additional benefits like travel delay and rental car coverage | Active travelers, longer trips, international travel, travelers seeking more comprehensive coverage |

| Global Nomad | $100-$200 per trip | Premium medical coverage, extensive baggage protection, 24/7 emergency assistance, comprehensive travel delay and cancellation coverage | Frequent travelers, long-term trips, travelers with high-value belongings, those seeking maximum peace of mind |

Coverage Options

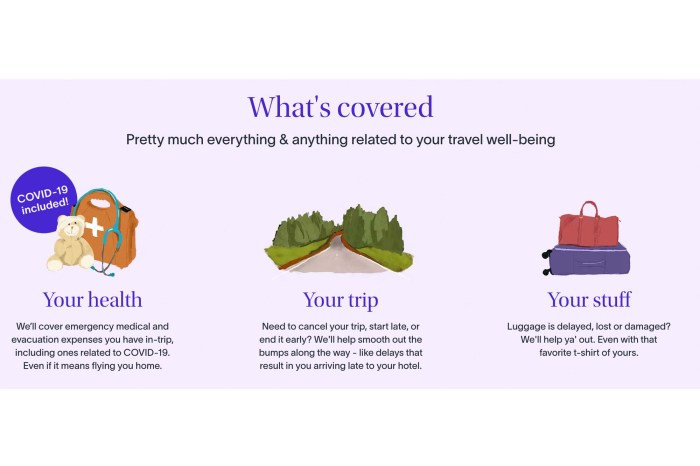

Faye Travel Insurance provides various coverage options, including:

- Medical Coverage: This covers medical expenses incurred due to illness or injury while traveling, including emergency medical evacuation and repatriation.

- Baggage Coverage: This protects against loss, theft, or damage to your belongings during your trip.

- Trip Cancellation/Interruption: This reimburses you for non-refundable trip expenses if you need to cancel or interrupt your trip due to covered reasons, such as illness, injury, or natural disasters.

- Travel Delay: This covers expenses incurred due to delays in your travel plans, such as missed connections or flight cancellations.

- Rental Car Coverage: This provides insurance for damage or theft of a rental car while on your trip.

- Emergency Assistance: Faye Travel Insurance offers 24/7 emergency assistance services, including medical assistance, legal support, and travel assistance.

Comparing Faye Travel Insurance to Competitors

Faye Travel Insurance is a competitive player in the travel insurance market. Compared to other prominent providers like World Nomads, Allianz Travel Insurance, and Travel Guard, Faye offers:

- Competitive Pricing: Faye Travel Insurance is generally priced competitively with other providers, offering affordable options for different budgets.

- Comprehensive Coverage: Faye Travel Insurance offers a wide range of coverage options, including medical, baggage, cancellation, and travel delay, ensuring comprehensive protection for your trip.

- User-Friendly Platform: Faye’s website and app are user-friendly, making it easy to compare plans, get quotes, and purchase insurance.

- Excellent Customer Service: Faye is known for its responsive and helpful customer service, providing assistance whenever needed.

Customer Experience and Reviews

Faye Travel Insurance has garnered a mix of customer feedback, with some praising its straightforward policies and prompt claims processing, while others express concerns about customer support responsiveness and limited coverage options.

Customer Reviews and Ratings

To understand the overall customer sentiment, it’s essential to examine reviews from various platforms.

- Trustpilot: Faye Travel Insurance holds a respectable 4.0 out of 5 stars on Trustpilot, based on over 1,000 reviews. While a majority of customers express satisfaction with the company’s services, particularly its clear and transparent policies, some highlight issues with claims processing delays and communication challenges.

- Google Reviews: Faye Travel Insurance receives a 3.8 out of 5 stars on Google Reviews, with over 500 reviews. Many customers appreciate the ease of purchasing policies online and the company’s responsiveness to inquiries. However, some reviewers point to limited coverage options and difficulties in reaching customer support.

- Facebook: Faye Travel Insurance has a 4.2 out of 5 stars rating on Facebook, with over 200 reviews. Positive reviews often mention the user-friendly website and the company’s commitment to providing affordable insurance. However, a few negative reviews express dissatisfaction with the claims process and the lack of flexibility in policy modifications.

Ease of Claiming and Customer Support

Faye Travel Insurance aims to streamline the claims process. However, customer feedback suggests inconsistencies in the experience.

- Positive Experiences: Many customers report a smooth and straightforward claims process, with quick processing times and helpful customer support representatives.

- Challenges: Some customers have encountered delays in claim processing, particularly during peak travel seasons. Additionally, some reviewers express frustration with the difficulty in reaching customer support via phone or email, leading to prolonged wait times for assistance.

Strengths and Weaknesses

Customer feedback highlights key strengths and weaknesses of Faye Travel Insurance.

- Strengths:

- Clear and Transparent Policies: Customers consistently praise Faye Travel Insurance for its easy-to-understand policies, which they find clear and straightforward.

- User-Friendly Website: The company’s website is generally well-received for its intuitive design and ease of navigation, making it simple to purchase policies and access information.

- Competitive Pricing: Faye Travel Insurance offers competitive prices compared to other travel insurance providers, attracting budget-conscious travelers.

- Weaknesses:

- Limited Coverage Options: Some customers find the coverage options offered by Faye Travel Insurance to be limited, particularly for specific travel needs or pre-existing conditions.

- Customer Support Responsiveness: While many customers report positive experiences with customer support, others have encountered challenges in reaching representatives, leading to delays in receiving assistance.

- Claims Processing Delays: While Faye Travel Insurance aims for efficient claim processing, some customers have experienced delays, particularly during peak travel seasons.

Pricing and Value

Faye Travel Insurance offers various plans, each with different coverage levels and premiums. To determine if Faye’s pricing aligns with your travel needs and budget, it’s crucial to analyze its pricing structure and compare it to competitors.

Understanding Faye’s pricing structure and value proposition is crucial for discerning whether it’s a good fit for your travel insurance needs. This section will examine Faye’s pricing, compare it to competitors, and explore potential cost-saving strategies.

Pricing Structure and Comparison, Is faye a good travel insurance company

Faye’s pricing structure is based on factors such as trip duration, destination, age, and coverage level. The company offers several plan options, each catering to different traveler profiles and risk appetites. To ensure a comprehensive evaluation, comparing Faye’s pricing to its competitors is essential. This comparison should encompass factors like coverage, benefits, and overall value.

- Faye’s pricing is generally competitive, with premiums comparable to other well-known travel insurance providers. However, it’s important to compare specific plans and coverage levels to ensure you’re getting the best value for your money.

- For example, if you’re looking for comprehensive coverage, Faye’s premium might be higher than a basic plan from a competitor. Conversely, if you only require minimal coverage, Faye might offer a more affordable option.

- To make an informed decision, carefully analyze the coverage details and benefits of each plan and compare them across different providers.

Value Proposition

Faye Travel Insurance aims to provide comprehensive coverage and peace of mind for travelers. The company’s value proposition revolves around its commitment to offering comprehensive benefits, including medical expenses, trip cancellation, and baggage loss. The value proposition is further enhanced by Faye’s customer service, claims processing efficiency, and focus on providing a positive travel experience. However, it’s important to evaluate if Faye’s pricing aligns with the value it delivers, considering factors like coverage levels, benefits, and customer service quality.

Cost-Saving Strategies

Faye offers several cost-saving strategies to help travelers optimize their travel insurance premiums. These strategies can help you save money without compromising on essential coverage.

- Bundle your insurance: Faye often provides discounts when you bundle your travel insurance with other products, such as car rental insurance or medical insurance. Bundling can significantly reduce your overall premium, making Faye a more attractive option.

- Purchase early: Purchasing travel insurance early in the planning stages can often lead to lower premiums. This is because insurers typically offer discounts for early bookings, as it allows them to better manage their risk.

- Take advantage of discounts: Faye may offer discounts for specific groups, such as seniors, students, or members of certain organizations. It’s worthwhile to inquire about any available discounts to potentially lower your premium.

- Consider a higher deductible: Opting for a higher deductible can significantly reduce your premium. However, remember that a higher deductible means you’ll be responsible for a larger portion of any covered expenses.

Claims Process and Procedures

Faye Travel Insurance aims to make the claims process as smooth and hassle-free as possible. Whether you’re dealing with a medical emergency, lost luggage, or a travel delay, Faye has a streamlined system in place to help you get back on track.

Filing a Claim

The first step in the claims process is to notify Faye Travel Insurance as soon as possible after the incident. You can do this by calling their customer service line or submitting a claim online through their website.

Here’s a breakdown of the steps involved:

- Report the Incident: Contact Faye Travel Insurance as soon as possible, either by phone or online. Provide details about the incident, including the date, time, location, and nature of the event.

- Gather Documentation: Collect all relevant documentation, such as medical bills, police reports, airline confirmations, or receipts for lost or damaged items. The more information you can provide, the faster your claim will be processed.

- Submit Your Claim: Once you have gathered all the necessary documentation, you can submit your claim online or by mail. Faye will provide you with a claim form to complete.

- Claim Review: Faye will review your claim and the supporting documentation. They will contact you if they require any additional information.

- Claim Decision: Once Faye has reviewed your claim, they will make a decision and notify you in writing. If your claim is approved, you will receive payment for your covered expenses.

Required Documentation

Faye Travel Insurance requires specific documentation to process your claim efficiently. These documents vary depending on the nature of your claim, but generally include:

- Claim Form: This form provides details about the incident and your policy information.

- Proof of Coverage: Your insurance policy or a copy of your policy number.

- Medical Bills: If your claim involves medical expenses, you will need to provide copies of your medical bills.

- Police Report: For claims related to theft or lost luggage, you will need a copy of the police report filed at the time of the incident.

- Airline Confirmations: For travel delays or cancellations, you will need copies of your airline confirmations and any relevant correspondence.

- Receipts: For claims involving lost or damaged items, you will need to provide receipts for the items.

Timelines for Claim Processing

The time it takes to process a claim varies depending on the complexity of the claim and the availability of documentation. However, Faye Travel Insurance strives to process claims within a reasonable timeframe.

Faye generally aims to process claims within 30 days of receiving all necessary documentation.

Real-World Claim Scenarios

Here are some real-world claim scenarios and how Faye Travel Insurance handled them:

- Medical Emergency: A traveler experienced a medical emergency while on vacation in Europe. Faye Travel Insurance covered the cost of medical treatment and transportation back to the United States.

- Lost Luggage: A traveler’s luggage was lost during a flight. Faye Travel Insurance reimbursed the traveler for the cost of replacing their lost items.

- Travel Delay: A traveler’s flight was delayed due to bad weather. Faye Travel Insurance covered the cost of accommodation and meals while the traveler waited for their rescheduled flight.

Faye Travel Insurance in Context

Faye Travel Insurance operates in a dynamic and competitive travel insurance market, navigating a landscape shaped by evolving travel trends, regulatory changes, and the ever-present risk of unexpected events.

Faye Travel Insurance’s Position in the Market

Faye Travel Insurance is a relatively new player in the travel insurance market, competing against established players like Allianz Global Assistance, Travel Guard, and World Nomads. Faye’s success hinges on its ability to differentiate itself through its digital-first approach, streamlined claims process, and competitive pricing.

Last Point: Is Faye A Good Travel Insurance Company

Ultimately, deciding whether Faye is the right travel insurance company for you depends on your individual needs and preferences. If you’re looking for a company with transparent plans, a user-friendly claims process, and a focus on customer satisfaction, Faye is definitely worth considering. However, it’s important to weigh the pros and cons and compare Faye to other providers to make sure you’re getting the best deal for your money. So, before you book that next trip, take a closer look at Faye Travel Insurance and see if it’s the perfect travel companion for you.

FAQ Overview

What types of coverage does Faye offer?

Faye offers a variety of coverage options, including medical expenses, trip cancellation, baggage loss, and emergency evacuation. They also have specialized plans for specific types of travel, such as adventure travel or cruises.

How do Faye’s prices compare to other travel insurance companies?

Faye’s prices are generally competitive with other travel insurance companies. However, it’s important to compare plans and coverage carefully to ensure you’re getting the best value for your money.

What is Faye’s claims process like?

Faye has a streamlined claims process that is designed to be easy and hassle-free. You can file a claim online or by phone, and their customer support team is available 24/7 to assist you.