- Understanding Full Coverage Car Insurance

- Factors Influencing Car Insurance Costs

- Finding Affordable Full Coverage Options

- Navigating the Insurance Buying Process

- Essential Considerations for Full Coverage

- Final Thoughts: What Are The Cheapest Car Insurance Companies For Full Coverage

- Essential Questionnaire

What are the cheapest car insurance companies for full coverage? It’s a question that pops up in every driver’s mind, especially when the cost of everything else is skyrocketing. Full coverage insurance is like having a safety net, protecting you from financial ruin in case of an accident, but finding affordable options can feel like a treasure hunt. We’ll break down the factors that influence car insurance costs, show you how to compare quotes, and help you find the best deal for your driving needs.

Think of it like choosing the right team for your fantasy football league. You need players who are reliable, have good stats, and fit within your budget. With car insurance, you want a company that provides comprehensive coverage, has a good reputation, and won’t break the bank. Let’s dive into the details and find your perfect insurance match!

Understanding Full Coverage Car Insurance

Full coverage car insurance is a term often thrown around when discussing car insurance, but what does it really mean? It’s not a specific type of insurance but rather a combination of different coverages designed to protect you and your vehicle in a variety of situations. Think of it as a comprehensive safety net for your car, covering everything from accidents to theft.

Components of Full Coverage

Full coverage insurance is essentially a bundle of different coverages that work together to provide comprehensive protection for your vehicle. These coverages can be customized based on your individual needs and budget, but some common components include:

- Liability Coverage: This is the most basic type of car insurance and is legally required in most states. It covers damages and injuries you cause to others in an accident, including their vehicles, property, and medical expenses. Think of it as your protection against lawsuits from the other party.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of who’s at fault. So, even if you hit a parked car, your own insurance will cover the cost of fixing your vehicle.

- Comprehensive Coverage: This coverage protects your vehicle from damage caused by events other than accidents, such as theft, vandalism, fire, hail, and natural disasters. It’s essentially a safety net against unexpected events that could damage your car.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have enough insurance to cover your damages. It’s like an extra layer of protection when dealing with irresponsible drivers.

Benefits of Full Coverage

Having full coverage car insurance provides numerous benefits, making it a wise choice for many drivers.

- Financial Protection: Full coverage insurance acts as a financial cushion, protecting you from significant financial losses in the event of an accident, theft, or other covered events. This peace of mind can be invaluable, especially if you’re facing a large repair bill or replacement cost.

- Legal Protection: Liability coverage, a core component of full coverage, safeguards you against lawsuits from other parties involved in an accident. It covers legal fees and settlements, ensuring you’re not personally responsible for hefty financial burdens.

- Peace of Mind: Knowing you have comprehensive insurance coverage for your vehicle can provide significant peace of mind. It allows you to drive with confidence, knowing you’re protected from various risks.

Factors Influencing Car Insurance Costs

Car insurance premiums are calculated based on a variety of factors that assess the risk of you being involved in an accident. Insurance companies use a complex formula to determine your individual rate, taking into account various aspects of your driving history, vehicle, and personal circumstances.

Driving History

Your driving history plays a significant role in determining your car insurance premiums. Insurance companies analyze your driving record to evaluate your risk as a driver. A clean driving record with no accidents or violations will generally result in lower premiums. Conversely, a history of accidents, speeding tickets, or DUI convictions will significantly increase your insurance costs.

- Accidents: Each accident, regardless of fault, is a negative mark on your driving record. The severity of the accident, the number of accidents, and the time since the last accident all contribute to the premium increase.

- Traffic Violations: Speeding tickets, reckless driving citations, and other traffic violations can increase your premiums. The severity of the violation and the number of violations on your record are key factors.

- DUI/DWI: Driving under the influence of alcohol or drugs is a serious offense that carries significant consequences, including steep increases in car insurance premiums.

Finding Affordable Full Coverage Options

Okay, so you’ve decided full coverage is the way to go, but how do you find the best deal without breaking the bank? Don’t worry, you’re not alone! We’ve got you covered.

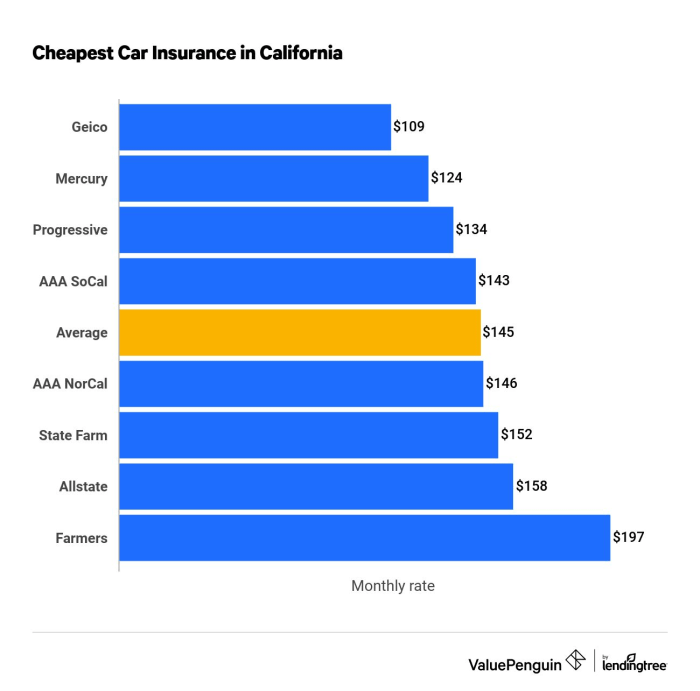

Comparing Top 5 Cheapest Car Insurance Companies

It’s like shopping for the best pizza in town, you gotta compare the deals! Here’s a rundown of some of the top contenders for affordable full coverage car insurance. Remember, prices can vary based on your location, driving record, and the car you drive.

| Company Name | Average Premium | Coverage Options | Discounts Offered | Customer Reviews |

|—|—|—|—|—|

| Geico | $1,428 | Comprehensive, Collision, Liability, Uninsured/Underinsured Motorist | Good Student, Safe Driver, Multi-Car, Multi-Policy | 4.5 stars |

| State Farm | $1,500 | Comprehensive, Collision, Liability, Uninsured/Underinsured Motorist | Good Driver, Safe Driver, Multi-Car, Multi-Policy | 4.3 stars |

| Progressive | $1,550 | Comprehensive, Collision, Liability, Uninsured/Underinsured Motorist | Good Student, Safe Driver, Multi-Car, Multi-Policy | 4.2 stars |

| USAA | $1,380 | Comprehensive, Collision, Liability, Uninsured/Underinsured Motorist | Military Discounts, Good Driver, Safe Driver | 4.8 stars |

| Liberty Mutual | $1,600 | Comprehensive, Collision, Liability, Uninsured/Underinsured Motorist | Good Student, Safe Driver, Multi-Car, Multi-Policy | 4.0 stars |

Tips for Finding the Most Affordable Full Coverage Insurance

It’s like finding the perfect pair of jeans, gotta shop around and know your size! Here are some tips to help you find the most affordable full coverage insurance:

- Compare Quotes from Multiple Providers: Don’t settle for the first offer! Use online comparison tools or contact insurers directly to get multiple quotes. It’s like trying on different pairs of jeans to find the perfect fit.

- Bundle Your Policies: Combine your car insurance with homeowners or renters insurance to get a discount. Think of it like buying a combo meal, you get more for less.

- Increase Your Deductible: A higher deductible means lower premiums. It’s like saving money on your pizza by choosing a smaller size, but you’ll have to pay more out of pocket if you have an accident.

- Improve Your Driving Record: A clean driving record can significantly lower your premiums. Think of it like getting a discount for being a good customer, the better your record, the better the deal.

- Shop Around Regularly: Don’t be afraid to switch insurers if you find a better deal. It’s like checking out other pizza places to see if they have a better offer.

- Ask About Discounts: Many insurers offer discounts for things like good students, safe drivers, and multi-car policies. Don’t be shy to ask about these savings, it’s like getting a free topping on your pizza!

Resources for Obtaining Free Car Insurance Quotes

Finding the right car insurance is like finding the right outfit for a special occasion, you gotta look good and feel good! Here are some resources to help you get started:

- Online Comparison Tools: Websites like [Insert Website Names] allow you to compare quotes from multiple insurers in one place. Think of it like a virtual shopping mall for car insurance.

- Insurance Company Websites: Most insurance companies have online quote tools available on their websites. It’s like browsing their store and picking out the best deal.

- Insurance Agents: Local insurance agents can provide personalized advice and help you find the best policy for your needs. Think of it like having a personal stylist for your insurance needs.

Navigating the Insurance Buying Process

Getting the best car insurance deal isn’t just about finding the cheapest option; it’s about finding the right coverage at the right price. Navigating the insurance buying process can feel like a maze, but with a little know-how, you can find the perfect fit for your needs and budget.

Obtaining Car Insurance Quotes

Obtaining car insurance quotes is the first step in finding the best deal. It’s a straightforward process that involves providing some basic information about yourself and your vehicle.

- Gather Your Information: Before you start, gather the essential information needed for a quote. This includes your driver’s license number, vehicle identification number (VIN), details about your driving history (including any accidents or violations), and your desired coverage levels.

- Contact Multiple Insurers: Don’t settle for just one quote. Contact several insurance companies, both online and offline. This allows you to compare prices, coverage options, and customer service.

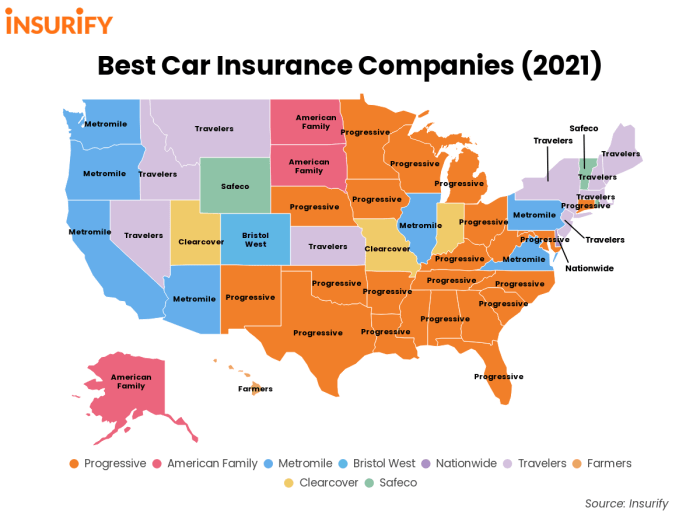

- Use Online Comparison Tools: Online comparison websites like Compare.com, The Zebra, and Insurify are fantastic resources. These platforms allow you to enter your information once and receive quotes from multiple insurers simultaneously.

- Get Quotes Directly from Insurers: Don’t rely solely on comparison websites. Contact insurance companies directly to get personalized quotes and discuss specific coverage options.

Comparing Multiple Quotes

Comparing multiple quotes is crucial to finding the best deal. It allows you to see the full spectrum of prices and coverage options available.

- Compare Coverage: Make sure you’re comparing apples to apples. Ensure all quotes include the same coverage levels, such as liability, collision, comprehensive, and uninsured/underinsured motorist coverage.

- Consider Deductibles: A higher deductible usually translates to a lower premium. Weigh the trade-off between the amount you’d pay out-of-pocket in the event of an accident and the potential savings on your monthly premium.

- Evaluate Discounts: Take advantage of discounts offered by insurers. These can include discounts for good driving records, safety features, bundling multiple policies, or being a member of certain organizations.

- Read the Fine Print: Before you commit, carefully review the policy documents, including the terms and conditions. Pay attention to exclusions, limitations, and any hidden fees.

Consulting with an Insurance Broker

While online comparison tools and direct quotes are valuable, consulting with an insurance broker can provide a personalized approach.

- Expert Guidance: Insurance brokers act as your advocate, helping you understand complex insurance terms and finding the best policy for your specific needs. They have access to a wide range of insurers and can negotiate on your behalf.

- Personalized Advice: Brokers can provide tailored recommendations based on your individual circumstances, driving history, and financial situation.

- Time-Saving: Brokers can handle the tedious task of contacting multiple insurers and comparing quotes, saving you time and effort.

Essential Considerations for Full Coverage

Full coverage car insurance, while providing peace of mind, requires careful consideration to ensure it truly meets your needs and financial situation. Understanding the intricacies of coverage limits, deductibles, and common exclusions is crucial to make informed decisions.

Coverage Limits and Deductibles, What are the cheapest car insurance companies for full coverage

Coverage limits define the maximum amount your insurance company will pay for a covered event. For instance, a liability limit of $100,000 means your insurer will pay up to $100,000 for injuries or property damage caused to others in an accident. Deductibles, on the other hand, are the amount you pay out-of-pocket before your insurance kicks in. A higher deductible generally leads to lower premiums, while a lower deductible results in higher premiums.

Common Exclusions and Limitations

While full coverage insurance provides broad protection, certain events or circumstances may not be covered. Common exclusions include:

- Wear and Tear: Normal wear and tear on your vehicle, such as tire punctures or brake pad replacements, are typically not covered.

- Acts of God: Natural disasters like earthquakes or floods may not be covered, especially if you live in a high-risk area.

- Mechanical Failures: Engine breakdowns or transmission issues are generally not covered unless they are caused by an accident.

- Driving Under the Influence: If you are driving under the influence of alcohol or drugs and cause an accident, your insurance coverage may be limited or even denied.

Ensuring Policy Meets Your Needs

To ensure your full coverage insurance policy meets your specific needs, consider the following tips:

- Review Your Coverage Limits: Carefully review your policy to understand the maximum amounts your insurance company will pay for various types of claims, such as liability, collision, and comprehensive coverage. Ensure these limits are sufficient to cover potential financial liabilities.

- Choose the Right Deductible: Balance your deductible with your budget and risk tolerance. A higher deductible may save you money on premiums but will require you to pay more out-of-pocket in case of an accident.

- Consider Additional Coverage: Depending on your individual needs, you may want to consider additional coverage options such as rental car reimbursement, roadside assistance, or gap insurance.

- Read the Fine Print: Carefully review your policy documents to understand all the terms and conditions, including exclusions and limitations.

- Shop Around for Quotes: Get quotes from multiple insurance companies to compare rates and coverage options. You can use online comparison tools or contact insurance agents directly.

Final Thoughts: What Are The Cheapest Car Insurance Companies For Full Coverage

Finding the cheapest full coverage car insurance doesn’t have to be a stressful endeavor. By understanding the key factors that influence pricing, comparing quotes, and taking advantage of discounts, you can secure a policy that fits your budget without compromising on protection. Remember, a little research goes a long way, and you can drive with confidence knowing you’re covered.

Essential Questionnaire

What is full coverage car insurance?

Full coverage car insurance combines several types of coverage, including liability, collision, and comprehensive, offering protection against a wide range of incidents like accidents, theft, and vandalism.

Do I really need full coverage car insurance?

Whether you need full coverage depends on your financial situation and the value of your car. If you have a loan on your vehicle, the lender might require it. It’s also recommended if your car is relatively new or has a high value.

What are some common discounts for car insurance?

Many insurance companies offer discounts for good driving records, safety features, multiple policies, and bundling with other insurance products.